Regarding the legitimacy of 91PME.COM forex brokers, it provides HKGX and WikiBit, (also has a graphic survey regarding security).

Is 91PME.COM safe?

Software Index

Risk Control

Is 91PME.COM markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

RegulatedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

鑫匯寶貴金屬有限公司

Effective Date: Change Record

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.91pme.comExpiration Time:

--Address of Licensed Institution:

九龍紅磡都會道10號都會大廈22樓2207-09室Phone Number of Licensed Institution:

38920688Licensed Institution Certified Documents:

Is Xinhuibao Safe or Scam?

Introduction

Xinhuibao is a forex broker that positions itself in the competitive landscape of online trading, primarily focusing on precious metals and forex markets. As with any broker, it is crucial for traders to assess the credibility and safety of their trading platform. With the rise of online trading, the forex market has unfortunately seen a surge in fraudulent schemes, making it imperative for investors to conduct thorough due diligence before committing their funds. This article aims to investigate whether Xinhuibao is a safe trading option or a potential scam by evaluating its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical indicator of its legitimacy and safety. A well-regulated broker is subject to stringent oversight, ensuring that it adheres to industry standards and protects its clients' interests. In the case of Xinhuibao, there are significant concerns regarding its regulatory compliance. According to various sources, including WikiFX and ForexBrokers.com, Xinhuibao is suspected of operating under a clone license, which raises red flags about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| HK GX | 106 | Hong Kong | Suspicious Clone |

The above table highlights the dubious nature of Xinhuibao's licensing. The fact that it operates under a "suspicious clone" license suggests that it may not be properly regulated, putting traders at risk. The importance of regulatory oversight cannot be overstated, as it ensures that brokers are held accountable and that clients have recourse in the event of disputes. In light of this information, it is crucial for potential clients to exercise caution when considering whether is Xinhuibao safe.

Company Background Investigation

A comprehensive understanding of a broker's history, ownership structure, and management team can provide valuable insights into its reliability. Xinhuibao claims to have been established for several years, focusing on precious metals trading. However, details about its ownership and management remain opaque, leading to concerns about transparency. A lack of clear information regarding the company's history and its key personnel can be a significant red flag.

The background of the management team is particularly important; experienced leaders with a solid track record in the financial industry can enhance a broker's credibility. Unfortunately, Xinhuibao does not provide sufficient information about its management team, which further exacerbates concerns regarding its legitimacy. The absence of transparency and information disclosure raises questions about the broker's accountability and commitment to ethical practices. Therefore, when assessing whether is Xinhuibao safe, potential clients should consider the lack of transparency as a significant risk factor.

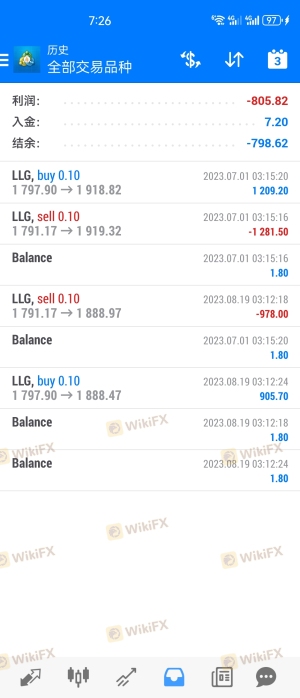

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience and profitability. Xinhuibao's fee structure has been a subject of scrutiny, with reports indicating that it may have hidden fees or unfavorable trading conditions. Understanding the costs associated with trading on a platform is essential for traders to make informed decisions.

| Fee Type | Xinhuibao | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | ||

| Commission Model | ||

| Overnight Interest Range |

While specific figures for Xinhuibao's trading costs are not readily available, the general consensus among users suggests that the broker may impose unusual fees, which can eat into profits. Such practices are often indicative of a broker that prioritizes its own financial gain over the interests of its clients. Therefore, it is essential for traders to investigate the fee structure thoroughly before deciding whether is Xinhuibao safe for their trading activities.

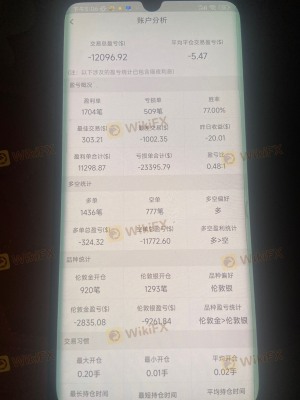

Client Fund Security

Ensuring the safety of client funds is a top priority for any reputable broker. Xinhuibao claims to implement various security measures to protect client assets. However, the effectiveness of these measures is questionable given the broker's regulatory status.

Traders should inquire about the segregation of client funds, investor protection schemes, and negative balance protection policies. A broker that does not provide clear information on these critical aspects may pose a higher risk to traders. Furthermore, any historical issues related to fund security or disputes with clients should be scrutinized. The lack of transparency and potential for fund mismanagement significantly raises concerns about whether is Xinhuibao safe for traders.

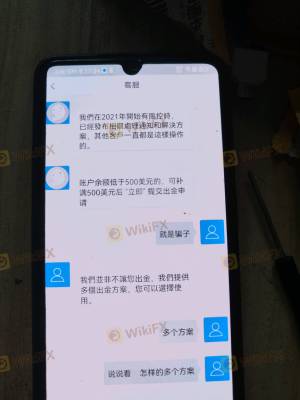

Customer Experience and Complaints

Customer feedback is a vital component of assessing a broker's reliability. Analyzing user experiences can reveal patterns of behavior that may indicate underlying issues. Xinhuibao has received numerous complaints, with users reporting difficulties in withdrawing funds and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Poor |

The table above summarizes the primary complaints associated with Xinhuibao. High severity levels, particularly regarding withdrawal issues, are alarming and suggest that traders may encounter significant obstacles when trying to access their funds. Such patterns are often indicative of a broker that may not have the best interests of its clients at heart. Therefore, potential clients should be wary and consider whether is Xinhuibao safe, given the negative experiences reported by others.

Platform and Execution

A broker's trading platform is the primary interface through which traders interact with the market. The performance, stability, and user experience of a trading platform are crucial for successful trading. Xinhuibao reportedly uses a standard trading platform, but there are concerns regarding its execution quality, including instances of slippage and rejected orders.

Traders should be cautious of any signs of platform manipulation, as this can severely impact their trading outcomes. A broker that fails to provide a reliable trading environment may not be a trustworthy option. Consequently, evaluating the platform's performance is essential in determining whether is Xinhuibao safe for trading activities.

Risk Assessment

Using a broker like Xinhuibao comes with inherent risks that potential clients must carefully consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Potential for clone licensing raises significant concerns. |

| Fund Security | High | Lack of transparency regarding fund protection measures. |

| Customer Service Issues | Medium | Numerous complaints regarding withdrawal difficulties. |

| Platform Reliability | High | Concerns about execution quality and potential manipulation. |

The table above summarizes the key risk areas associated with Xinhuibao. As indicated, the overall risk level is high, particularly regarding regulatory compliance and fund security. Potential clients should be aware of these risks and consider implementing risk mitigation strategies, such as starting with a small deposit and monitoring their trading experience closely.

Conclusion and Recommendations

In summary, the investigation into Xinhuibao raises several significant concerns regarding its safety and legitimacy. The broker's questionable regulatory status, lack of transparency, and numerous customer complaints suggest that it may not be a trustworthy option for traders. Therefore, it is prudent for potential clients to approach Xinhuibao with caution.

If you are considering trading with Xinhuibao, it is essential to weigh the risks carefully and explore alternative brokers with a stronger regulatory framework and positive customer feedback. Reliable options may include brokers with established reputations and comprehensive regulatory oversight. Ultimately, ensuring your trading safety should be the top priority, and conducting thorough research is crucial in achieving that goal.

Is 91PME.COM a scam, or is it legit?

The latest exposure and evaluation content of 91PME.COM brokers.

91PME.COM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

91PME.COM latest industry rating score is 6.72, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.72 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.