Xinhuibao 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive xinhuibao review reveals significant concerns regarding the broker's trustworthiness and regulatory standing. Xinhuibao Brokers Limited was incorporated in Hong Kong on August 14, 2019, and operates primarily as a forex broker specializing in gold and silver trading through the MT4 platform. However, our analysis indicates substantial trust issues that potential clients should carefully consider before investing their money.

The broker has received a user rating of 3.9 out of 5 from some sources. Yet multiple reports highlight serious concerns about scams and regulatory compliance that cannot be ignored. While Xinhuibao offers the popular MetaTrader 4 trading platform and focuses on precious metals trading, the lack of clear regulatory oversight and transparency issues significantly impact its overall credibility and safety.

This broker may appeal to investors interested in gold and silver trading who prefer the familiar MT4 environment. However, the documented trust concerns and regulatory uncertainties make it essential for potential clients to exercise extreme caution before engaging with this platform or depositing any funds.

Important Notice

Due to the absence of clear regulatory information in available sources, trading experiences may vary significantly across different jurisdictions. Potential clients should be aware that regulatory protections may not be available, and the level of investor protection remains unclear and potentially dangerous.

This evaluation is based on publicly available information and user feedback collected from various sources. Given the limited transparency from the broker itself, some aspects of their services remain undocumented in available materials, which raises additional red flags.

Rating Framework

Broker Overview

Xinhuibao Brokers Limited was established on August 14, 2019, as a private company limited by shares registered in Hong Kong. The company operates under registration number CR No. 2863196 according to official Hong Kong Companies Registry records. According to these same records, the company maintains an "active" operational status and has been operating for approximately 5 years and 9 months as of 2025, which gives it some operational history but not enough to establish long-term credibility.

The broker positions itself primarily as a forex trading platform with a particular focus on precious metals trading, specifically gold and silver markets. This specialization suggests a targeted approach toward traders interested in commodity trading rather than offering a comprehensive range of financial instruments typically found with larger, more established brokers. The company operates under the Chinese name 鑫滙寶經紀有限公司, indicating its intended market focus on Chinese-speaking traders who may be seeking precious metals investment opportunities.

However, the limited availability of comprehensive service information raises questions about the broker's transparency and commitment to providing detailed information to potential clients. This xinhuibao review aims to provide clarity on these aspects based on available data, though the lack of transparency itself is concerning for potential investors.

Regulatory Status: Available materials do not specify any particular regulatory oversight beyond the basic Hong Kong company registration. This represents a significant concern for trader protection and regulatory compliance that should not be overlooked.

Deposit and Withdrawal Methods: Specific information regarding payment methods, processing times, and associated fees is not detailed in available sources. This creates uncertainty for potential clients who need to understand how they can fund their accounts and withdraw profits.

Minimum Deposit Requirements: The broker has not disclosed minimum deposit requirements in publicly available information. This makes it difficult for traders to plan their initial investment and budget accordingly.

Bonus and Promotions: No information is available regarding promotional offers, welcome bonuses, or ongoing incentive programs that might be available to new or existing clients. Most legitimate brokers clearly advertise their promotional offerings to attract new customers.

Tradeable Assets: The platform primarily focuses on gold and silver trading, though the complete range of available instruments remains unclear from available documentation. This limited focus may not meet the diversification needs of many traders.

Cost Structure: Critical information regarding spreads, commissions, overnight fees, and other trading costs is not specified in available materials. This represents a significant transparency gap that makes it impossible to calculate true trading costs.

Leverage Ratios: Leverage offerings and maximum ratios available to traders are not disclosed in accessible broker information. Understanding leverage is crucial for risk management and trading strategy development.

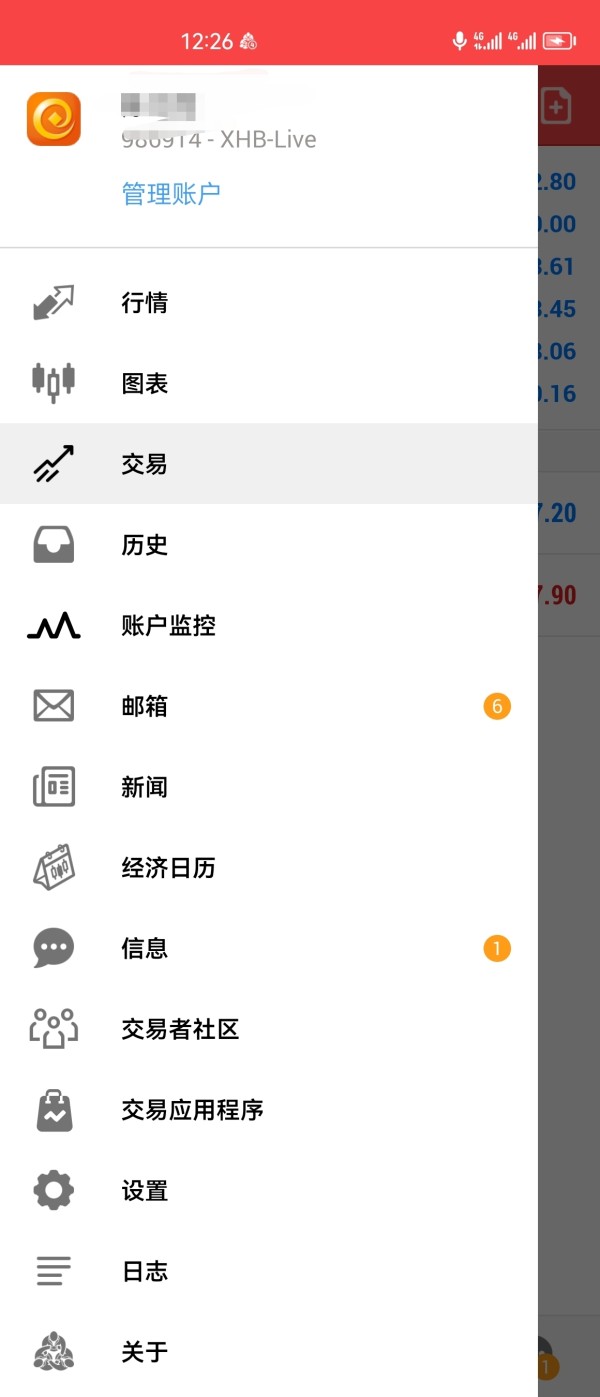

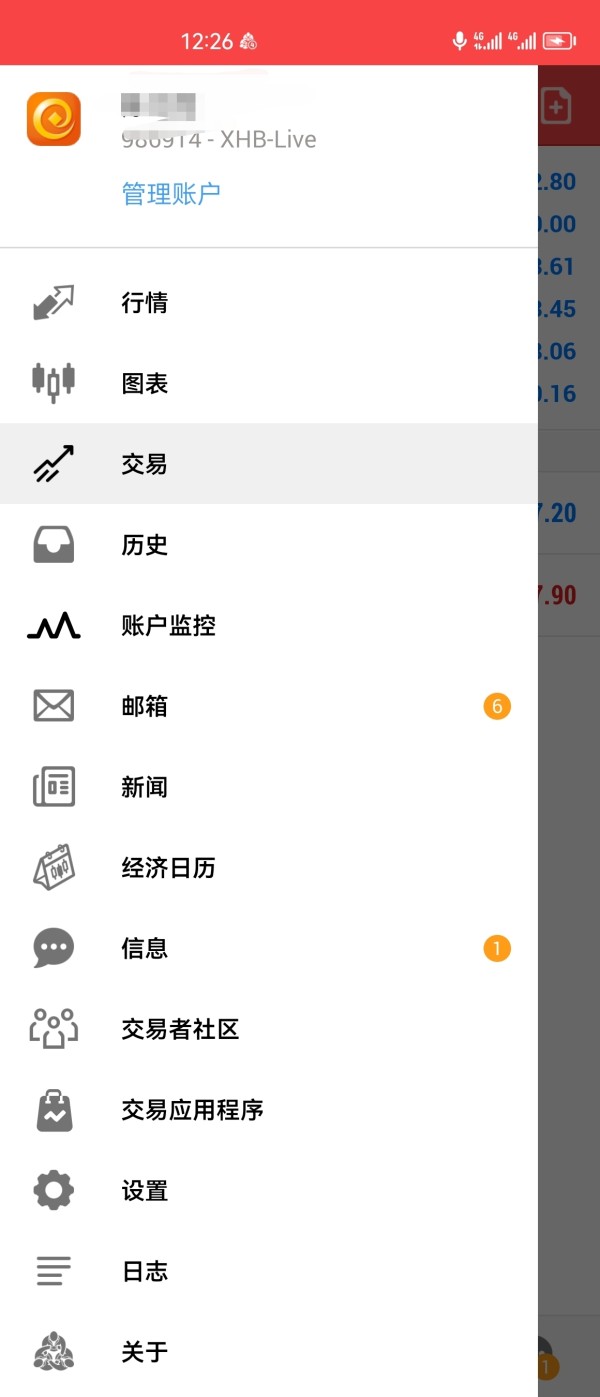

Platform Options: The broker utilizes the MetaTrader 4 trading platform, which is widely recognized and used across the industry for forex and commodity trading. This is one of the few positive aspects clearly documented about their service offering.

Geographic Restrictions: Information regarding restricted countries or regional limitations is not available in current documentation. Traders need to know if they can legally access the platform from their location.

Customer Support Languages: Specific details about supported languages for customer service are not mentioned in available materials. This xinhuibao review highlights the concerning lack of transparency in basic service information that traders typically require to make informed decisions.

Detailed Rating Analysis

Account Conditions Analysis (Score: 3/10)

The account conditions offered by Xinhuibao remain largely undocumented in available sources, which immediately raises red flags for potential traders. Standard industry practice requires brokers to clearly outline their account types, minimum deposit requirements, and account features to help clients make informed decisions about their investments.

Without specific information about account tiers, minimum funding requirements, or special account features such as Islamic accounts for Muslim traders, it becomes impossible to assess whether the broker meets individual trading needs. The absence of this fundamental information suggests either poor transparency practices or limited service offerings that may not meet professional trading standards.

Most reputable brokers provide detailed account comparison charts, clearly stating the benefits and limitations of each account type. The lack of such information in this xinhuibao review indicates potential clients would need to contact the broker directly to obtain basic account details, which is not standard industry practice and creates unnecessary barriers.

The account opening process, verification requirements, and documentation needed for account activation are also not specified in available materials. This creates uncertainty about the broker's compliance with anti-money laundering and know-your-customer requirements, which are standard regulatory obligations that protect both brokers and clients.

Xinhuibao's trading infrastructure centers around the MetaTrader 4 platform, which represents one of the few clearly documented aspects of their service offering. MT4 is widely respected in the trading community for its stability, comprehensive charting capabilities, and extensive technical analysis tools that professional traders rely on.

However, beyond the MT4 platform, information about additional trading tools, market research resources, or educational materials is notably absent from available sources. Modern brokers typically offer economic calendars, market analysis, trading signals, and educational webinars to support their clients' trading activities and help them make better investment decisions.

The lack of information about research and analysis resources is particularly concerning for traders who rely on fundamental analysis or market insights to inform their trading decisions. Professional traders often require access to market news, analyst reports, and economic data to develop effective trading strategies that can generate consistent profits.

Furthermore, details about automated trading support, expert advisors, or algorithmic trading capabilities are not mentioned in available documentation. While MT4 supports these features natively, broker-specific policies and limitations regarding automated trading remain unclear, which could limit advanced trading strategies.

Customer Service and Support Analysis (Score: 4/10)

Customer service quality and availability represent critical factors in broker selection, yet Xinhuibao's support infrastructure remains poorly documented in available sources. Essential information such as contact methods, support hours, response times, and available languages is not clearly specified, which creates uncertainty for traders who may need assistance.

Professional forex brokers typically offer multiple contact channels including live chat, email support, phone assistance, and sometimes callback services. The absence of clear customer service information makes it difficult for potential clients to assess whether they would receive adequate support when needed, especially during urgent trading situations.

Response time expectations, which are crucial during volatile market conditions or urgent account issues, are not established in available materials. Traders often require immediate assistance for technical problems, account access issues, or trading-related questions, particularly during active trading sessions when every minute can impact profitability.

The availability of multilingual support, given the broker's apparent focus on Chinese-speaking markets, is also not documented. This creates uncertainty for international clients who may require support in their native languages to fully understand complex trading concepts and resolve account issues.

Trading Experience Analysis (Score: 4/10)

The trading experience offered by Xinhuibao remains largely undocumented in available sources, making it challenging to assess platform performance, execution quality, and overall trading environment. Critical factors such as order execution speed, slippage rates, and platform stability are not addressed in accessible materials, which are fundamental concerns for active traders.

Platform reliability during high-volatility periods, which is crucial for active traders, is not documented through user feedback or performance metrics. Traders need confidence that their orders will be executed promptly and at expected prices, particularly during important market events when price movements can be rapid and significant.

Mobile trading capabilities, which are essential for modern traders who need platform access while away from their computers, are not specifically detailed in available information. While MT4 offers mobile applications, broker-specific features or limitations are not clarified, which could impact trading flexibility.

The quality of price feeds, market depth information, and real-time data accuracy are fundamental aspects of trading experience that remain unaddressed in this xinhuibao review due to insufficient available information. These factors directly impact trading profitability and risk management capabilities.

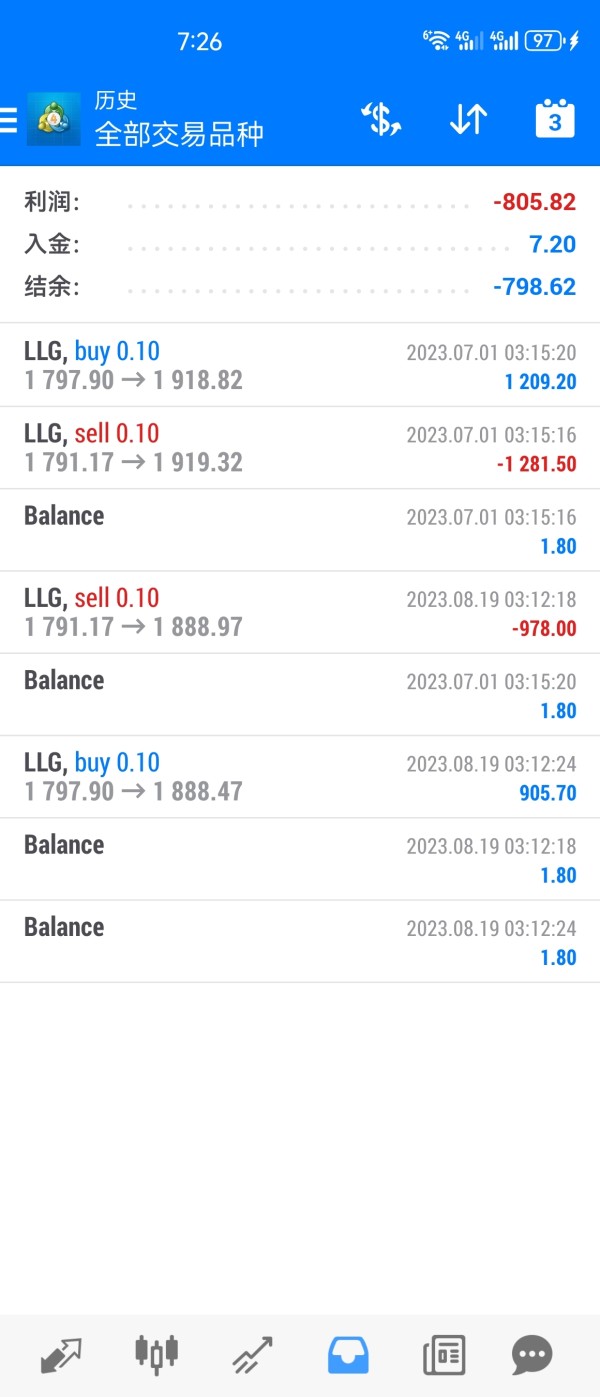

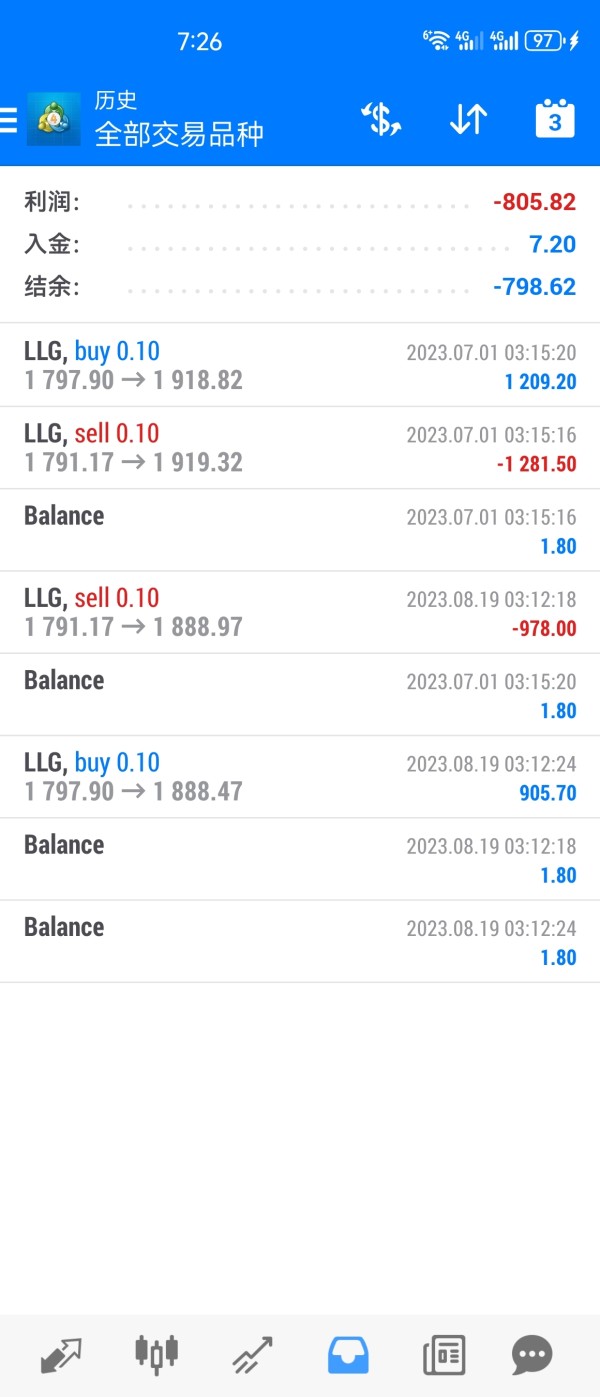

Trust and Safety Analysis (Score: 2/10)

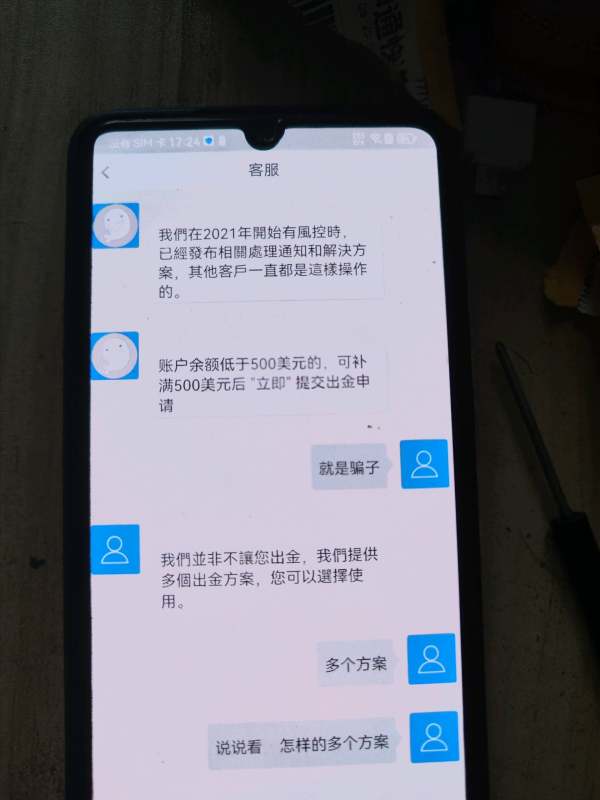

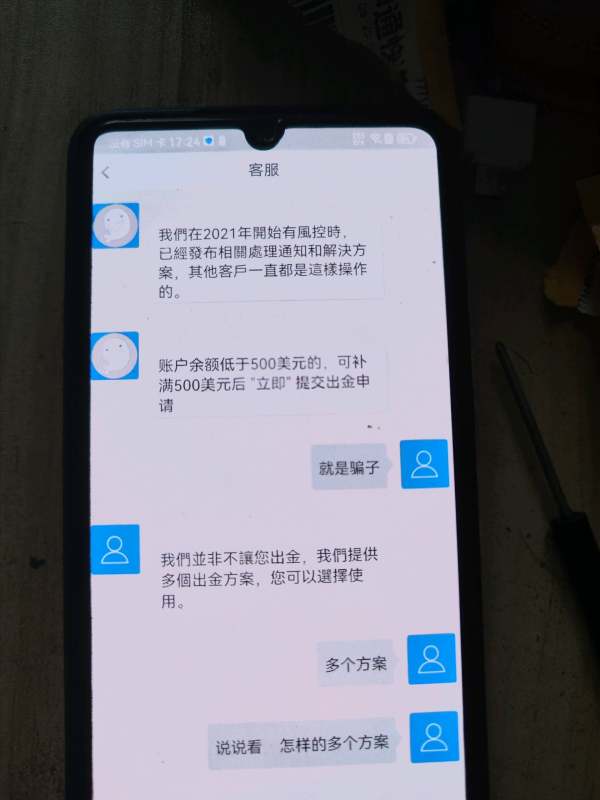

Trust and safety concerns represent the most significant issues identified in this evaluation. Multiple sources indicate problems with scam reports and regulatory compliance, which are serious red flags for potential clients considering this broker for their investment needs.

The absence of clear regulatory oversight beyond basic Hong Kong company registration is particularly concerning. Reputable forex brokers typically hold licenses from recognized financial authorities such as the FCA, ASIC, CySEC, or other established regulatory bodies that provide investor protection and operational oversight to ensure client safety.

Fund safety measures, such as segregated client accounts, deposit insurance, or investor compensation schemes, are not documented in available materials. These protections are standard offerings from regulated brokers and provide crucial safeguards for client funds in case of broker insolvency or other financial difficulties.

The reported issues regarding scams and regulatory problems, combined with limited transparency about business operations, create a high-risk environment for potential clients. Professional traders typically avoid brokers with documented trust issues, regardless of other potential benefits such as platform features or trading conditions.

User Experience Analysis (Score: 3/10)

User experience assessment for Xinhuibao is complicated by limited available feedback and the concerning trust issues identified in various reports. While some sources indicate a user rating of 3.9 out of 5, this positive feedback is overshadowed by significant concerns about safety and regulatory compliance that could impact long-term user satisfaction.

The overall user satisfaction appears to be negatively impacted by trust concerns rather than platform functionality issues. Traders who prioritize security and regulatory protection are likely to find the documented concerns unacceptable, regardless of platform features or trading tools that may be available.

Interface design and usability information is not available in current sources, making it impossible to assess whether the broker provides an intuitive and efficient trading environment beyond the standard MT4 interface. User-friendly design is important for both new and experienced traders who need to execute trades quickly and efficiently.

Common user complaints appear to center around trust and safety concerns rather than technical platform issues. This pattern suggests that while the basic trading functionality may be adequate, the fundamental business practices raise serious concerns for user confidence and long-term satisfaction with the service.

Conclusion

This comprehensive xinhuibao review reveals a broker with significant limitations and concerning trust issues that overshadow any potential benefits. While the platform offers MT4 trading capabilities and focuses on gold and silver markets, the documented concerns about regulatory compliance, transparency, and reported scam issues create an unacceptable risk profile for most traders who value safety and security.

The broker may theoretically appeal to traders specifically interested in precious metals trading who are comfortable with the MT4 platform. However, the lack of regulatory oversight, limited transparency, and documented trust concerns make it difficult to recommend this broker to any trader category, regardless of their experience level or investment goals.

The primary advantages include access to the reliable MT4 platform and specialization in precious metals trading. However, these benefits are significantly outweighed by major disadvantages including poor transparency, lack of regulatory protection, documented trust issues, and insufficient customer information disclosure that creates unnecessary risks for potential clients.

Potential clients are strongly advised to consider well-regulated alternatives that provide comprehensive investor protections, transparent business practices, and established track records in the forex trading industry. The risks associated with Xinhuibao appear to far outweigh any potential benefits, making it an unsuitable choice for serious traders who prioritize capital preservation and regulatory safety.