Is UPFX safe?

Pros

Cons

Is UpFX A Scam?

Introduction

UpFX is a forex and CFD broker that has gained attention in the trading community for its competitive offerings and user-friendly platforms. Established in 2020, it claims to provide access to a wide range of financial instruments, including forex pairs, commodities, and indices. As the forex market continues to expand, traders must exercise caution and conduct thorough evaluations of brokers to ensure their safety and reliability. The importance of regulatory oversight, transparency, and customer feedback cannot be overstated, as these factors are critical in determining a broker's legitimacy. This article will investigate UpFX's regulatory status, company background, trading conditions, customer experiences, and overall safety to provide a comprehensive evaluation of whether UpFX is a scam or a legitimate trading platform.

Regulation and Legitimacy

Regulatory oversight is a fundamental aspect of any trading platform, as it ensures that brokers adhere to specific standards designed to protect traders. In the case of UpFX, the broker claims to be regulated by the Vanuatu Financial Services Commission (VFSC) and the International Financial Services Commission (IFSC) in Belize. However, many reviews indicate that UpFX lacks substantial regulatory backing, raising concerns about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| VFSC | 40202 | Vanuatu | Unverified |

| IFSC | 173474 | Belize | Unverified |

The unverified status of these licenses suggests that UpFX may not be operating under the rigorous standards typically associated with regulated brokers. Regulatory quality is crucial for ensuring that a broker follows best practices, including proper fund segregation and transparency in operations. The absence of a solid regulatory framework can expose traders to significant risks, including potential fraud and mismanagement of funds. Historical compliance issues further exacerbate these concerns, making it imperative for traders to approach UpFX with caution.

Company Background Investigation

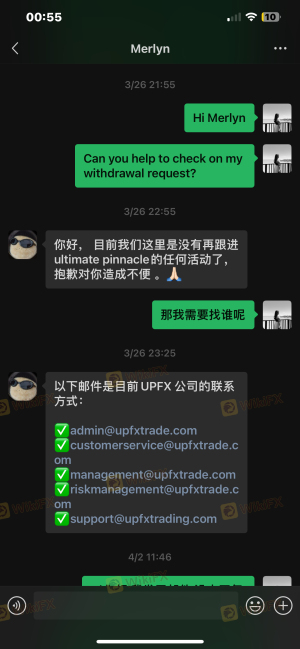

UpFX operates under the company name Ultimate Pinnacle Limited, with its registered address in Belize. The broker claims to have a management team with extensive experience in the financial markets, but detailed information about the team is scarce. Transparency regarding ownership and management is crucial for building trust, and the lack of readily available information raises red flags.

The company's history indicates that it is relatively new in the market, having been established in 2020. While a new broker can offer innovative solutions, it may also lack the stability and experience of more established firms. Furthermore, the absence of clear information about its ownership structure and management team makes it difficult to assess the broker's credibility and operational integrity. Traders should be wary of brokers that do not provide adequate background information, as this can be indicative of potential issues down the line.

Trading Conditions Analysis

UpFX offers various trading conditions that may appeal to different types of traders. However, the overall fee structure and trading costs warrant careful scrutiny. The broker provides a competitive leverage ratio of up to 1:500, which can be enticing for traders looking to maximize their exposure. However, high leverage also increases the risk of significant losses, especially for inexperienced traders.

| Fee Type | UpFX | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 2.0 pips | 1.5 pips |

| Commission Model | $4 per lot | $3 per lot |

| Overnight Interest Range | Varies | Varies |

While UpFX advertises low spreads, user reviews indicate that spreads can be variable and sometimes significantly higher than advertised, particularly during volatile market conditions. This inconsistency can lead to unexpected trading costs, undermining the broker's competitive edge. Additionally, the commission structure may not be as favorable as it appears when compared to industry averages, potentially impacting overall profitability for traders.

Client Funds Security

The safety of client funds is paramount when choosing a broker. UpFX claims to implement several measures to secure client deposits, including segregated accounts and a commitment to investor protection. However, the lack of robust regulatory oversight raises concerns about the actual implementation of these measures.

The broker's claims about fund segregation and negative balance protection should be verified against regulatory standards. Traders should be cautious, as the absence of a solid regulatory framework can lead to inadequate protection of client funds. Furthermore, any historical issues related to fund security, such as withdrawal problems or disputes, can indicate systemic issues within the broker's operations.

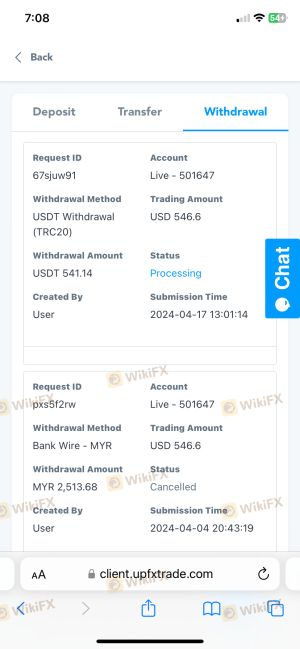

Customer Experience and Complaints

Analyzing customer feedback provides valuable insights into a broker's reliability and service quality. UpFX has received mixed reviews from users, with some praising its trading conditions and customer support, while others express frustration over withdrawal delays and poor communication.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support Availability | Medium | Inconsistent |

| Platform Stability | Medium | Occasional issues |

Common complaints include difficulties in withdrawing funds, with some users reporting that their withdrawal requests took weeks to process. This raises concerns about the broker's operational efficiency and customer service quality. Additionally, there have been reports of unresponsive customer support, which can exacerbate traders' frustrations when issues arise.

Platform and Trade Execution

The trading platform is a critical component of a trader's experience, and UpFX offers the widely-used MetaTrader 4 (MT4) platform. While MT4 is known for its reliability and user-friendly interface, the performance of UpFX's platform should be evaluated based on execution quality and stability.

Traders have reported mixed experiences with order execution, including instances of slippage and rejections during high volatility periods. If a broker frequently experiences execution issues, it can significantly impact trading outcomes and overall satisfaction. Any signs of platform manipulation should be carefully scrutinized, as they can indicate deeper operational problems.

Risk Assessment

Using UpFX comes with a set of inherent risks that traders should be aware of. The lack of robust regulation, mixed customer feedback, and potential issues with fund security all contribute to a higher risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of credible regulation |

| Operational Risk | Medium | Complaints about withdrawals |

| Market Risk | High | High leverage can amplify losses |

To mitigate these risks, traders should consider starting with a small investment and thoroughly testing the platform using a demo account. Additionally, maintaining effective risk management strategies, such as setting stop-loss orders and not over-leveraging, can help protect capital.

Conclusion and Recommendations

In conclusion, while UpFX presents itself as a competitive broker with appealing trading conditions, several factors raise concerns about its legitimacy. The lack of robust regulatory oversight, mixed customer feedback, and reported issues with fund withdrawals suggest that traders should exercise caution when considering this broker.

For traders seeking reliable options, it may be prudent to explore alternatives such as brokers with strong regulatory backing, transparent operations, and positive customer reviews. Brokers like OANDA, IG, and Forex.com are examples of established firms that provide a higher level of security and customer service.

Ultimately, potential traders should conduct thorough research, consider their risk tolerance, and remain vigilant when selecting a broker in the ever-evolving forex market.

Is UPFX a scam, or is it legit?

The latest exposure and evaluation content of UPFX brokers.

UPFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

UPFX latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.