UPFX 2025 Review: Everything You Need to Know

Executive Summary

UPFX is a multi-asset forex broker that has gotten attention since 2020. The company mainly draws interest because of its high leverage offers and many different trading tools. However, this upfx review shows a complex picture of a broker that causes disagreement among traders. The platform offers nice features like leverage up to 1:1000 and spreads starting from 0 pips, but it faces big challenges with regulatory oversight and keeping users happy.

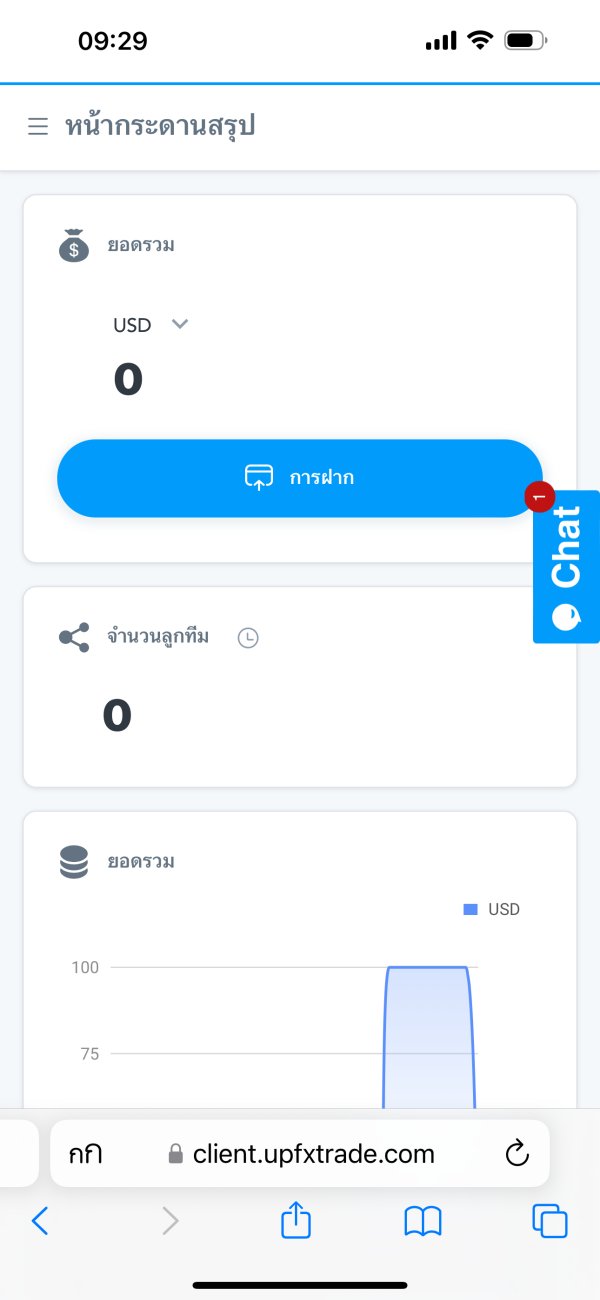

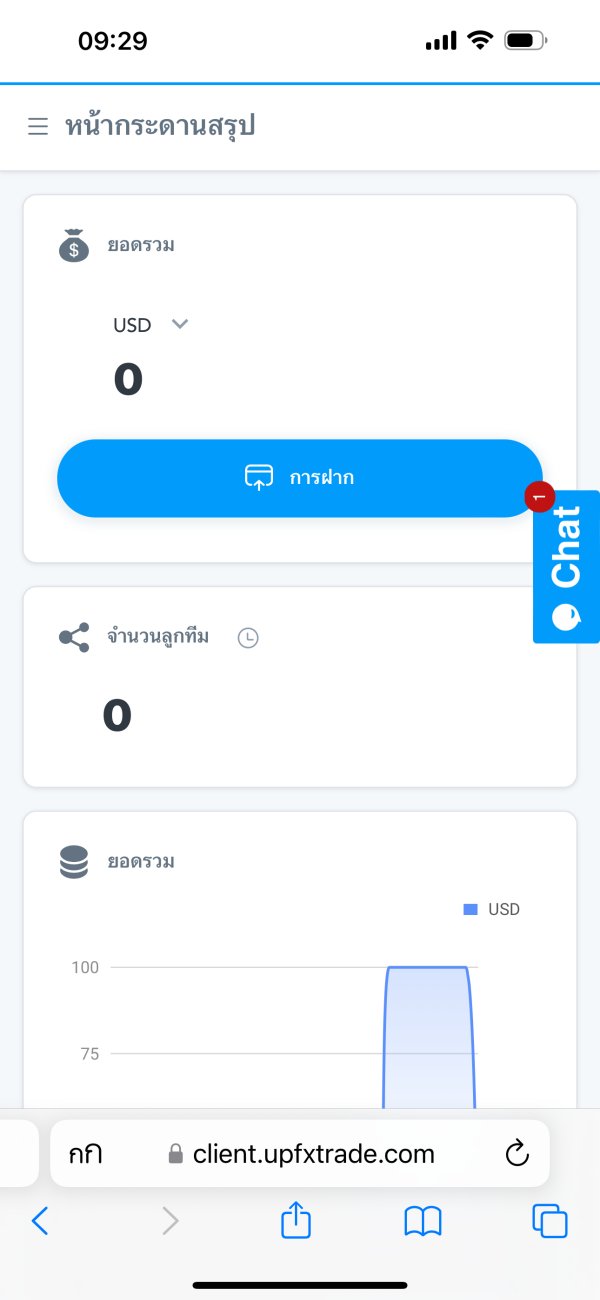

The broker says it provides a complete trading solution. It gives access to forex, commodities, indices, cryptocurrencies, and stocks through the MT5 platform. UPFX especially targets investors who want high-leverage trading opportunities across multiple asset classes, with a fairly easy minimum deposit requirement of $100. The broker offers educational courses that some users have praised, but its overall reputation has problems because of regulatory concerns and mixed user feedback.

Trustpilot data shows UPFX maintains a worrying user rating of 2.0/5. This indicates major room for improvement in service delivery and user satisfaction. The broker's unregulated status adds another layer of difficulty for potential clients, requiring careful consideration of the risks involved. This complete evaluation aims to give traders essential insights into UPFX's offerings, limitations, and overall fit for different trading needs.

Key Metrics:

- User Rating: 2.0/5 (Trustpilot)

- Minimum Deposit: $100

- Maximum Leverage: 1:1000

- Spreads: From 0 pips

Important Disclaimers

This upfx review uses complete analysis of available user feedback, market observations, and publicly available information about the broker's services. UPFX is currently considered an unregulated forex broker, which means it operates without oversight from major financial regulatory authorities. Potential investors should carefully research and understand their local regulations about forex trading before working with any unregulated broker.

The evaluation method used in this review includes multiple data sources. These include user testimonials, third-party review platforms, and market analysis. Given the limited official regulatory information available for UPFX, this assessment relies heavily on user experiences and observable market behavior. Traders are strongly advised to conduct their own research and consider the risks associated with trading through unregulated platforms before making any investment decisions.

Overall Rating Framework

Broker Overview

UPFX appeared in the forex trading landscape in 2020 as a multi-asset broker based in the United States. The company says it provides a complete trading solution, offering access to many different financial instruments including forex pairs, commodities, stock indices, cryptocurrencies, and individual stocks. The broker's business model focuses mainly on serving retail investors who seek different trading opportunities across multiple asset classes within a single platform.

Since it started, UPFX has tried to stand out through competitive trading conditions. The company especially emphasizes high leverage ratios and tight spreads. It targets traders who are comfortable with higher risk levels and seek to maximize their trading potential through enhanced leverage capabilities. However, the broker's fairly short operational history and lack of regulatory oversight have led to mixed reception within the trading community.

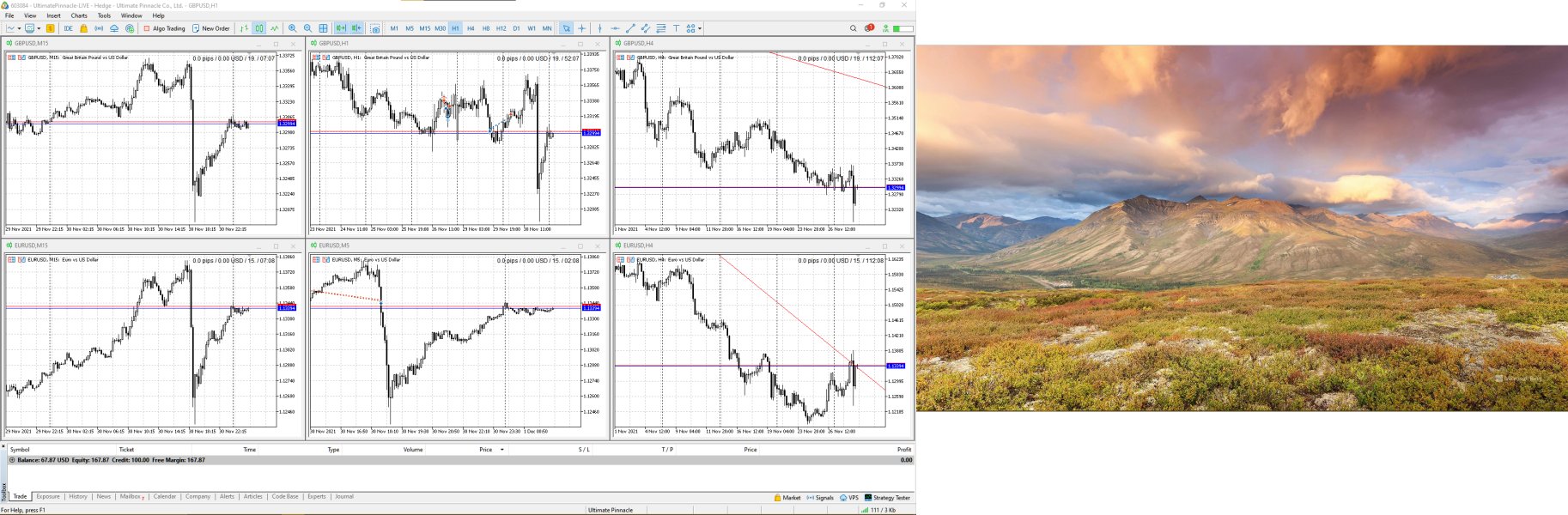

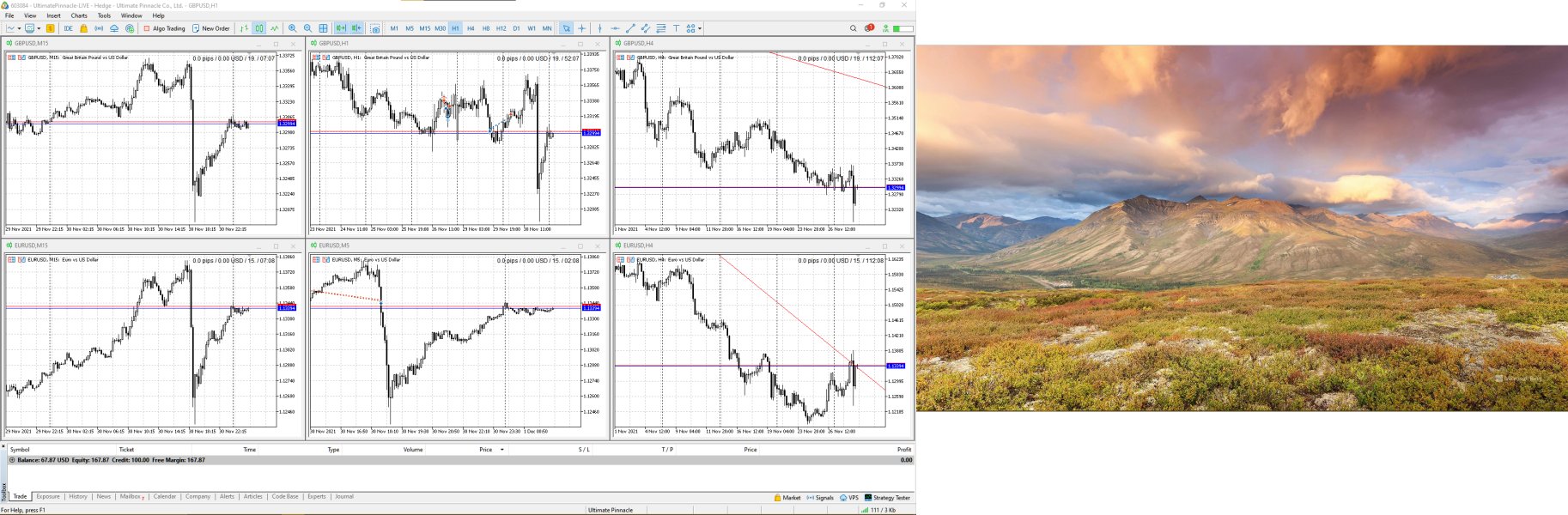

The broker operates only through the MetaTrader 5 (MT5) platform. This provides users with access to advanced trading functions and complete market analysis tools. UPFX's asset portfolio spans across major financial markets, letting traders diversify their portfolios within a single trading environment. Despite offering multiple asset classes and competitive trading conditions, the broker's unregulated status remains a big concern for potential clients seeking regulatory protection and oversight.

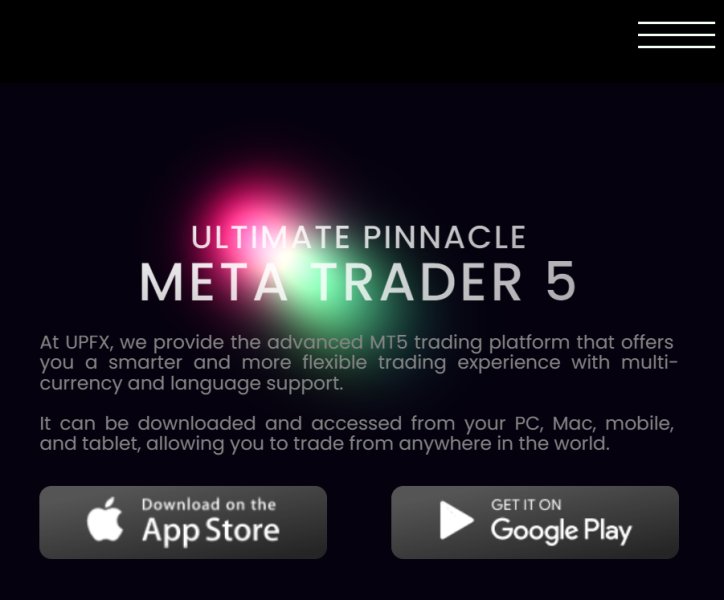

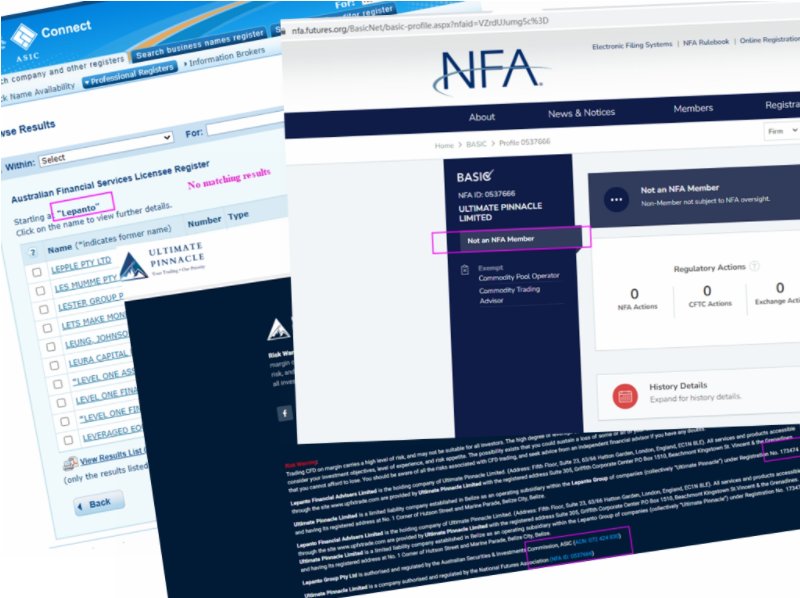

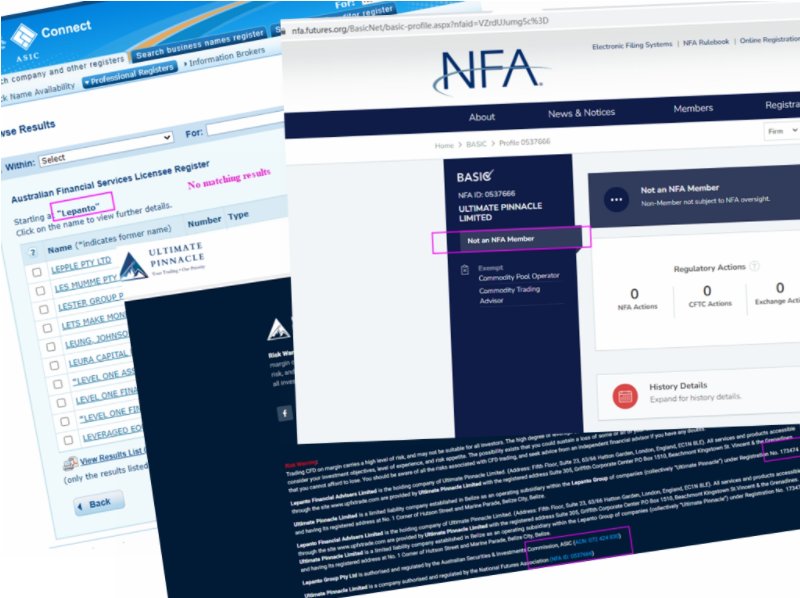

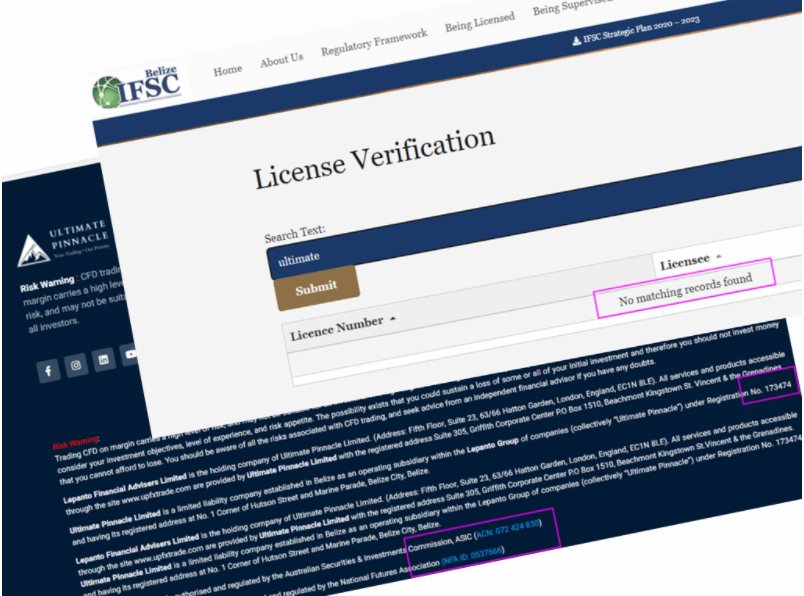

Available information shows UPFX currently operates without formal regulation from recognized financial authorities. This places it in a category that requires additional caution from potential users. This regulatory gap has implications for trader protection, dispute resolution mechanisms, and overall platform credibility within the competitive forex brokerage landscape.

Regulatory Status: UPFX currently operates as an unregulated forex broker, lacking oversight from major financial regulatory authorities. This absence of regulatory supervision means that clients do not benefit from the protection typically provided by regulated brokers, including compensation schemes and standardized complaint resolution procedures.

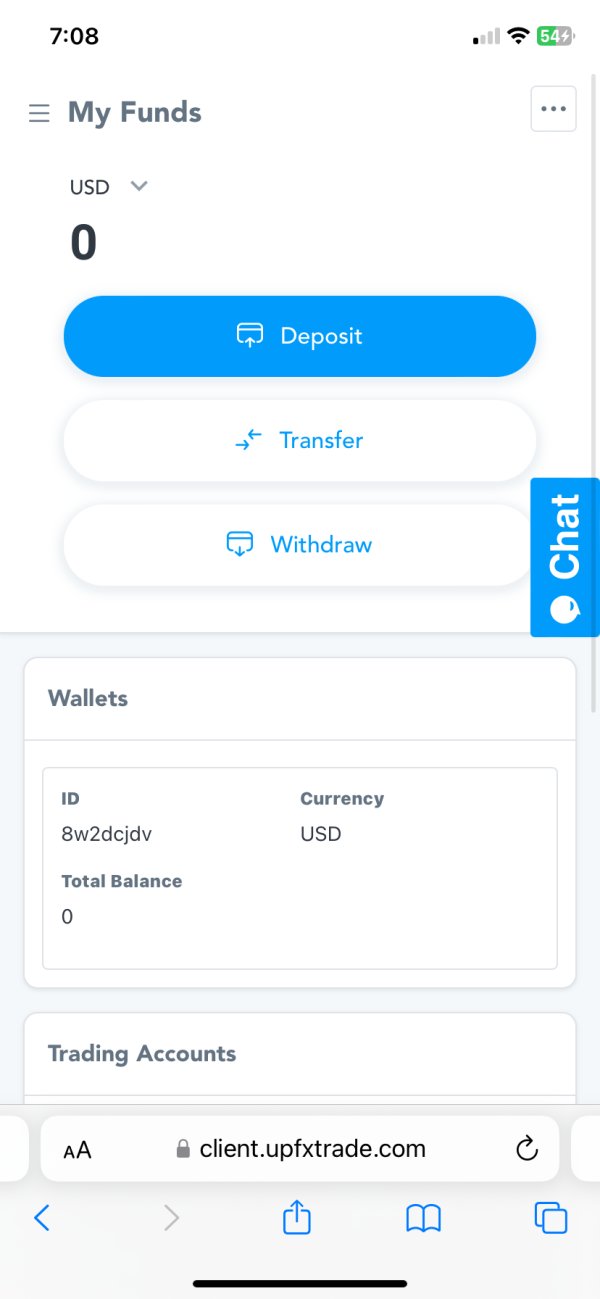

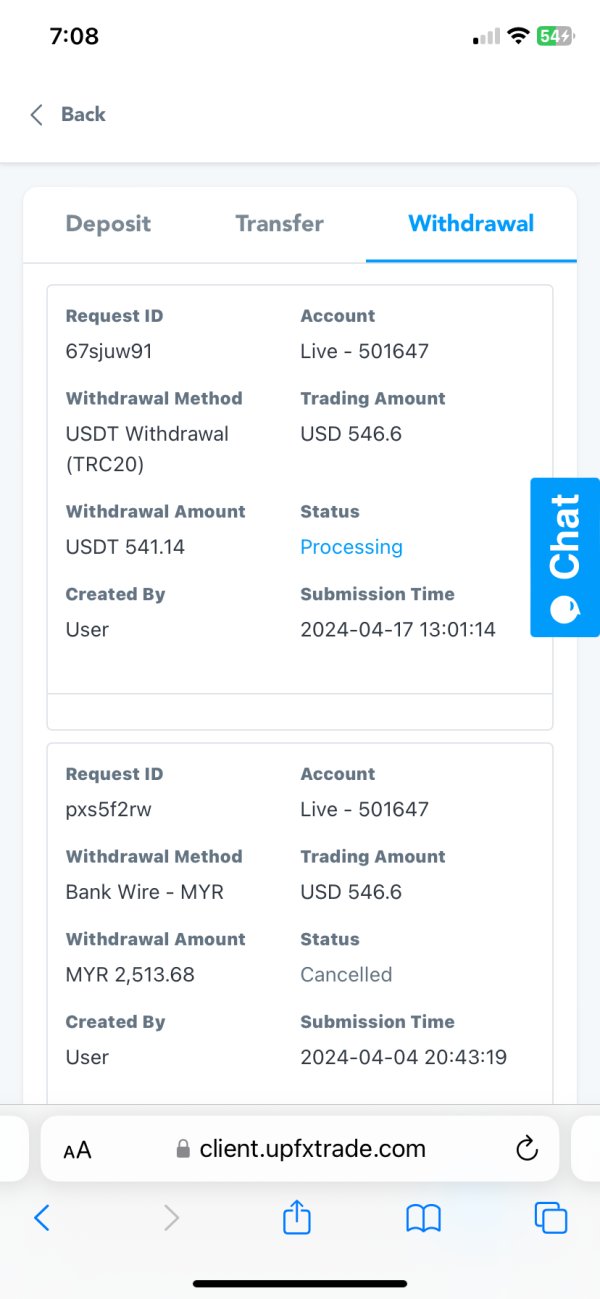

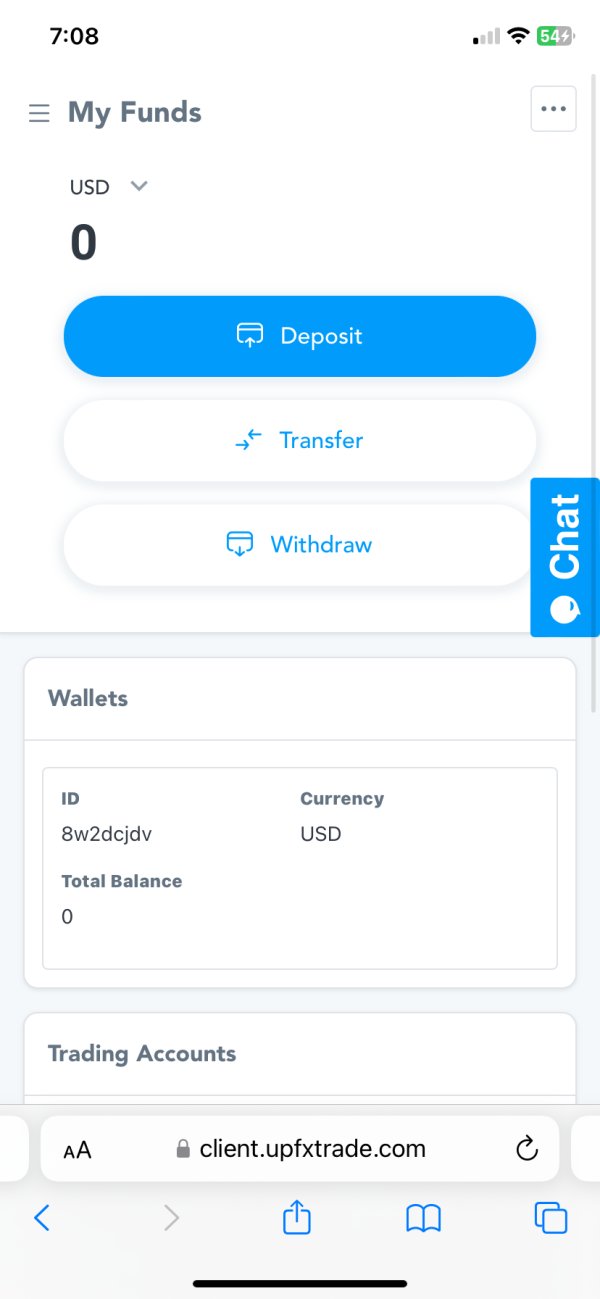

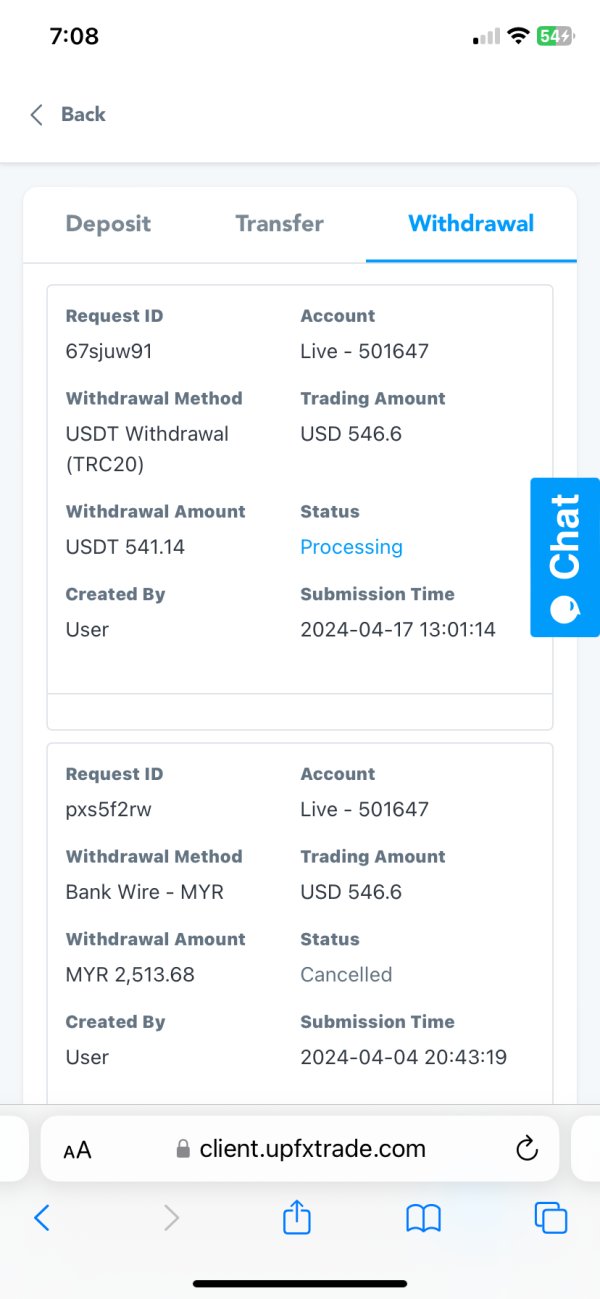

Payment Methods: Specific information about deposit and withdrawal methods is not detailed in available sources. This represents a transparency gap that potential clients should clarify directly with the broker before account opening.

Minimum Deposit: The broker maintains an accessible minimum deposit requirement of $100, making it suitable for novice traders and those preferring to start with smaller capital allocations. This low barrier to entry aligns with industry trends toward making forex trading access more democratic.

Promotional Offers: Information about bonus programs, promotional offers, or incentive structures is not specified in available materials. This suggests either limited promotional activities or insufficient transparency in marketing communications.

Trading Assets: UPFX provides access to a complete range of tradable instruments including major and minor forex pairs, precious metals, energy commodities, stock indices from global markets, popular cryptocurrencies, and individual stocks from major exchanges. This variety enables portfolio management across multiple asset classes.

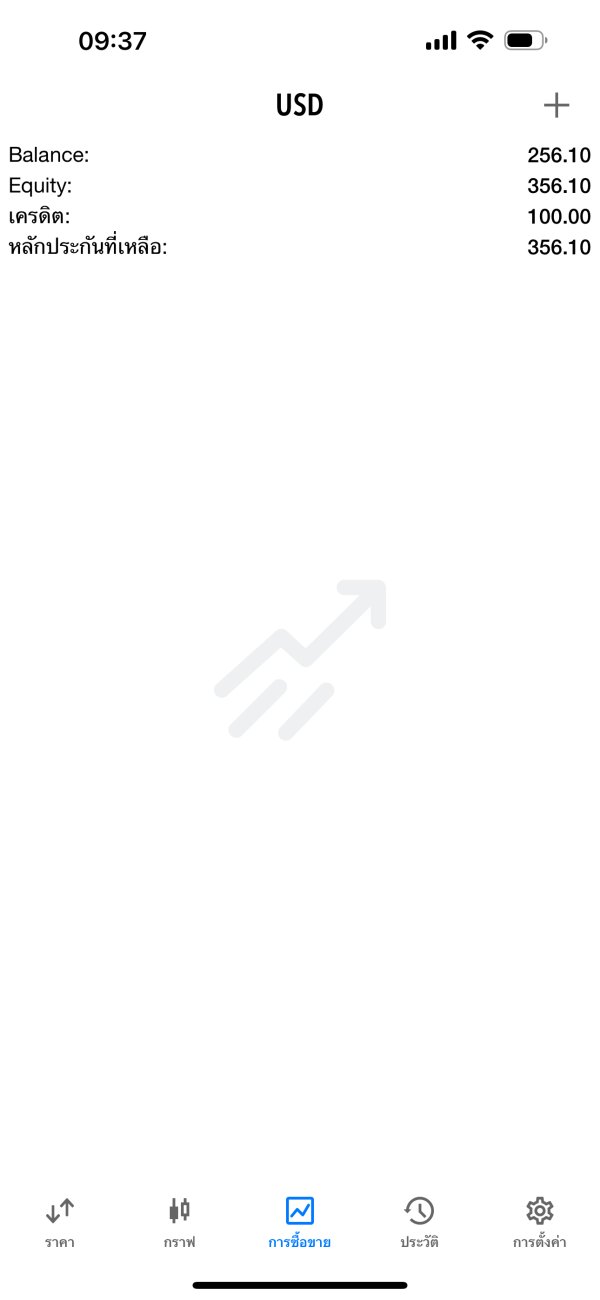

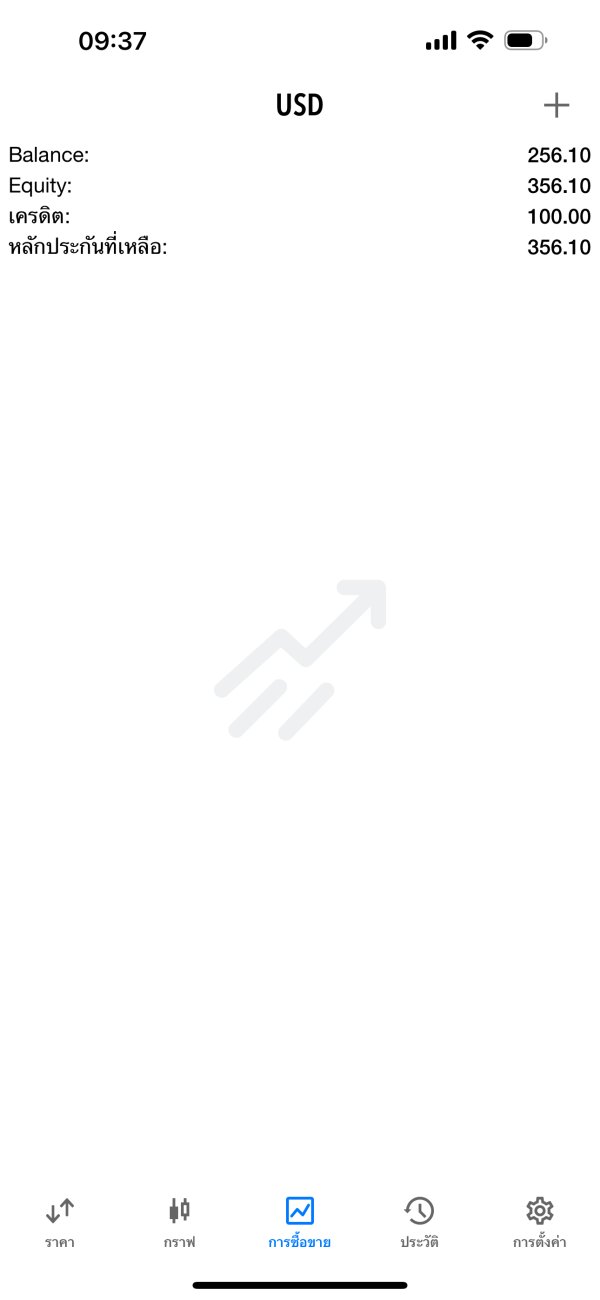

Cost Structure: The broker advertises spreads starting from 0 pips, which appears competitive for high-frequency trading strategies. However, detailed information about commission structures, overnight financing rates, and other potential costs requires further clarification from official sources.

Leverage Options: UPFX offers maximum leverage up to 1:1000, catering to traders who seek enhanced position sizing capabilities. This high leverage ratio requires careful risk management and is suitable mainly for experienced traders who understand the associated risks.

Trading Platforms: The broker only offers MetaTrader 5 (MT5) as its trading platform, providing access to advanced charting tools, automated trading capabilities, and complete market analysis features. The absence of MT4 or proprietary platforms may limit options for traders preferring alternative interfaces.

Geographic Restrictions: Specific information about regional restrictions or prohibited jurisdictions is not detailed in available sources. This requires potential clients to verify accessibility based on their location.

Customer Support Languages: Available customer service language options are not specified in the reviewed materials. This represents another area where transparency could be improved.

Detailed Rating Analysis

Account Conditions Analysis (6/10)

UPFX's account conditions present a mixed picture that reflects both accessibility and limitations. The broker's $100 minimum deposit requirement stands as one of its more attractive features, positioning it favorably for retail traders who prefer to begin with modest capital commitments. This low entry threshold aligns with modern industry standards that prioritize accessibility for diverse trader demographics.

However, the available information reveals limited details about account type varieties or specialized account features. The absence of clearly defined account tiers, such as standard, premium, or VIP categories, may limit traders' ability to access enhanced services or preferential conditions as their trading volume increases. Additionally, there is no mention of Islamic accounts or other specialized offerings that cater to specific trader requirements.

The account opening process details remain unclear from available sources. This creates uncertainty about verification requirements, documentation needs, and approval timeframes. User feedback suggests that while the low minimum deposit is appreciated, the overall account management experience could benefit from greater transparency and more complete account options.

When compared to established regulated brokers, UPFX's account conditions appear basic. They lack the sophisticated tier structures and specialized features that experienced traders often seek. This upfx review indicates that while the broker succeeds in providing accessible entry conditions, it falls short in delivering complete account management solutions that would appeal to a broader range of trading professionals.

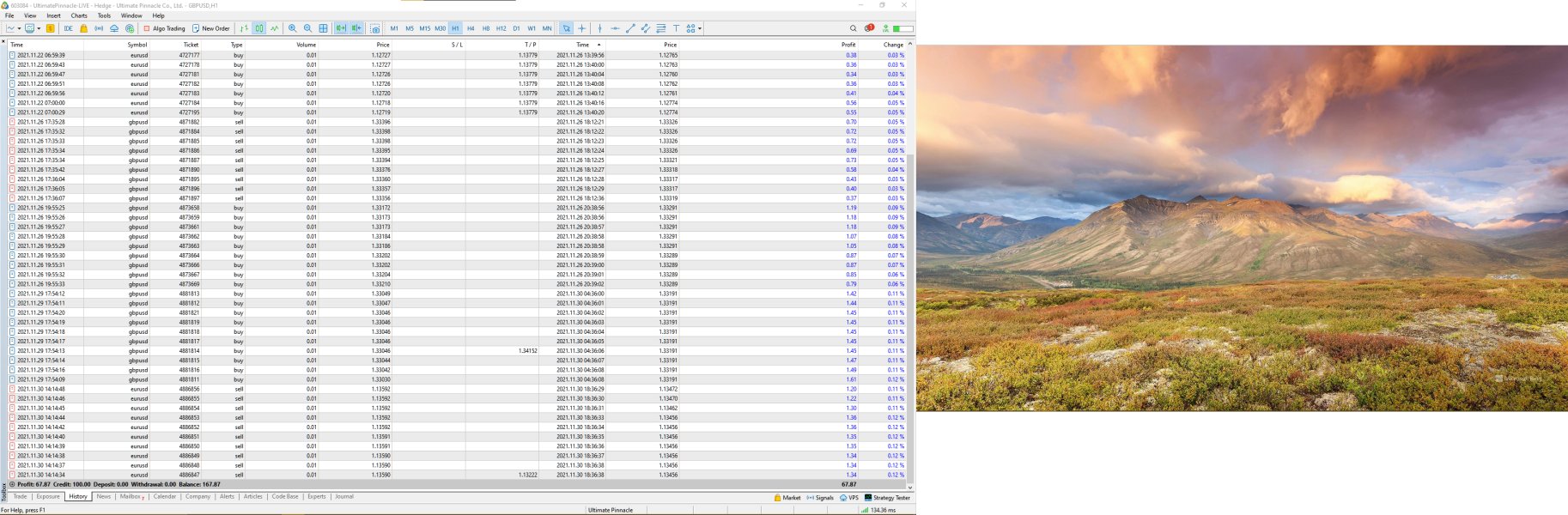

UPFX demonstrates relative strength in its tools and resources offering, mainly through its MT5 platform integration and educational initiatives. The MetaTrader 5 platform provides traders with access to advanced charting capabilities, technical analysis tools, and automated trading functions that meet professional trading standards. The platform's complete nature supports multiple asset classes within a unified interface, enhancing trading efficiency.

The broker's educational resources have received positive recognition from users, with specific praise for course quality and practical applicability. According to user feedback, "The course that UPFX provide is very good, I can make my first dollar from trading," indicating that the educational content successfully translates theoretical knowledge into practical trading skills. This educational focus demonstrates the broker's commitment to trader development beyond mere platform provision.

However, the available information lacks details about market research capabilities, daily analysis reports, or economic calendar integration. These analytical resources are typically essential for informed trading decisions and represent potential gaps in UPFX's service portfolio. Additionally, there is insufficient information about automated trading support, expert advisor capabilities, or advanced order types that sophisticated traders often require.

The platform's multi-asset support enables diversified trading strategies. But the absence of detailed information about research tools, market insights, or professional analysis services suggests room for improvement in complete resource provision.

Customer Service and Support Analysis (4/10)

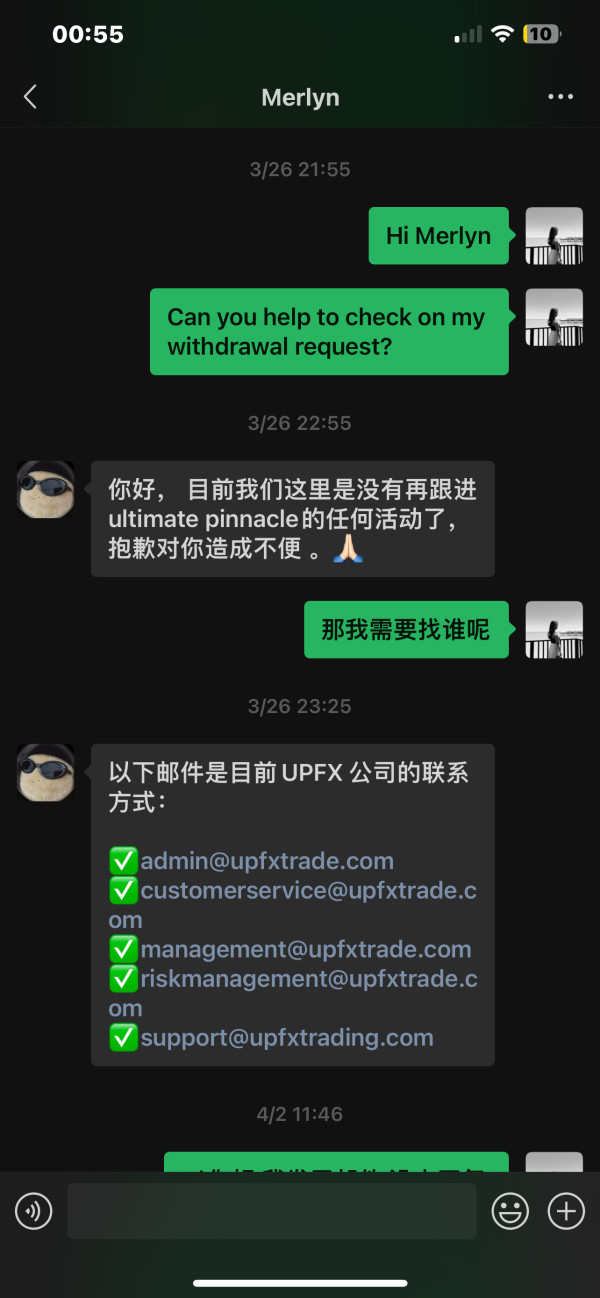

Customer service represents a significant weakness in UPFX's service delivery, as evidenced by consistently negative user feedback and limited transparency about support infrastructure. The available information lacks specific details about customer service channels, response timeframes, or service availability, which itself indicates inadequate communication about support capabilities.

User feedback consistently highlights poor customer service experiences. Complaints focus on responsiveness, problem resolution effectiveness, and overall service quality. The 2.0/5 Trustpilot rating reflects widespread dissatisfaction with customer support interactions, suggesting systemic issues in service delivery rather than isolated incidents.

The absence of clearly defined support channels creates additional uncertainty for potential clients who prioritize reliable customer assistance. These channels include live chat, email response times, or telephone support availability, which appears lacking in UPFX's current offering. Professional forex brokers typically provide complete support information, including multilingual capabilities and 24/5 availability.

Furthermore, there is no available information about escalation procedures, complaint resolution mechanisms, or management contact options for serious issues. This transparency gap compounds the negative user feedback and suggests that customer service improvements should be a priority for the broker's operational enhancement.

Trading Experience Analysis (5/10)

The trading experience with UPFX presents a complex picture combining attractive technical specifications with concerning user feedback about practical implementation. While the broker offers competitive spreads starting from 0 pips and high leverage up to 1:1000, user reports suggest that the actual trading environment may not consistently deliver on these theoretical advantages.

Platform stability concerns emerge from user feedback, with traders reporting issues that affect order execution reliability and overall trading performance. The MT5 platform itself provides robust functionality, but the broker's implementation appears to suffer from technical challenges that impact user experience. Common complaints include slippage during volatile market conditions and requote situations that can affect trading strategy execution.

The high leverage offering, while attractive to risk-tolerant traders, requires exceptional platform reliability to be safely utilized. User feedback suggests that the trading environment may not consistently provide the stability necessary for high-leverage trading strategies, potentially exposing traders to increased risks beyond normal market volatility.

Mobile trading experience details are not specified in available sources. This represents a gap in understanding the broker's complete trading ecosystem. Modern traders increasingly rely on mobile platforms for flexibility, making this information absence particularly relevant for complete evaluation. This upfx review indicates that while UPFX provides competitive trading conditions on paper, the practical trading experience requires significant improvement to match user expectations.

Trust and Safety Analysis (3/10)

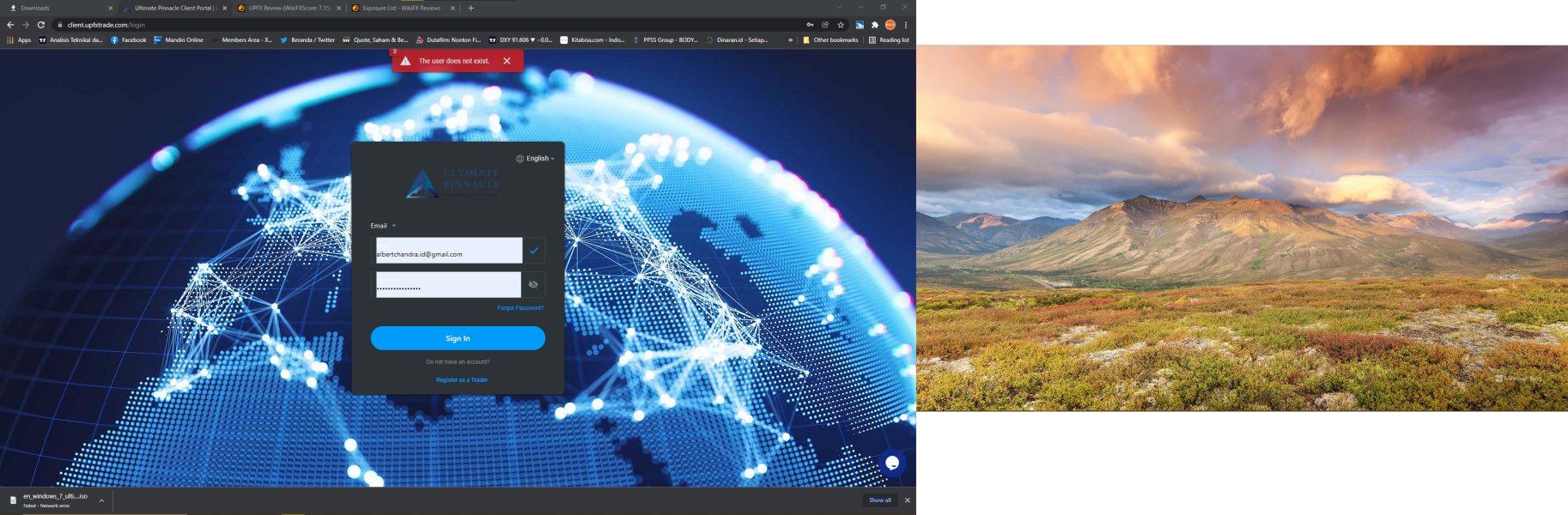

Trust and safety represent UPFX's most significant challenges, mainly due to its unregulated status and negative user feedback about reliability. The broker's operation without formal regulatory oversight eliminates the protective frameworks that regulated brokers must maintain, including segregated client funds, compensation schemes, and standardized dispute resolution procedures.

The absence of regulatory supervision creates uncertainty about fund safety measures, operational transparency, and recourse mechanisms in case of disputes. Regulated brokers typically must demonstrate capital adequacy, maintain segregated client accounts, and submit to regular audits—protections that are not guaranteed with unregulated entities like UPFX.

User feedback includes serious allegations about the broker's reliability, with some sources indicating fraud concerns that further compromise trust levels. These allegations, combined with the low Trustpilot rating, suggest widespread user dissatisfaction that extends beyond service quality to fundamental trust issues about the broker's operations.

The lack of transparency about company ownership, management structure, and operational procedures compounds these trust concerns. Professional forex brokers typically provide complete company information, regulatory compliance details, and clear operational policies, which appear insufficient in UPFX's current presentation. These factors collectively contribute to the low trust rating and suggest that significant improvements in transparency and regulatory compliance would be necessary to enhance user confidence.

User Experience Analysis (4/10)

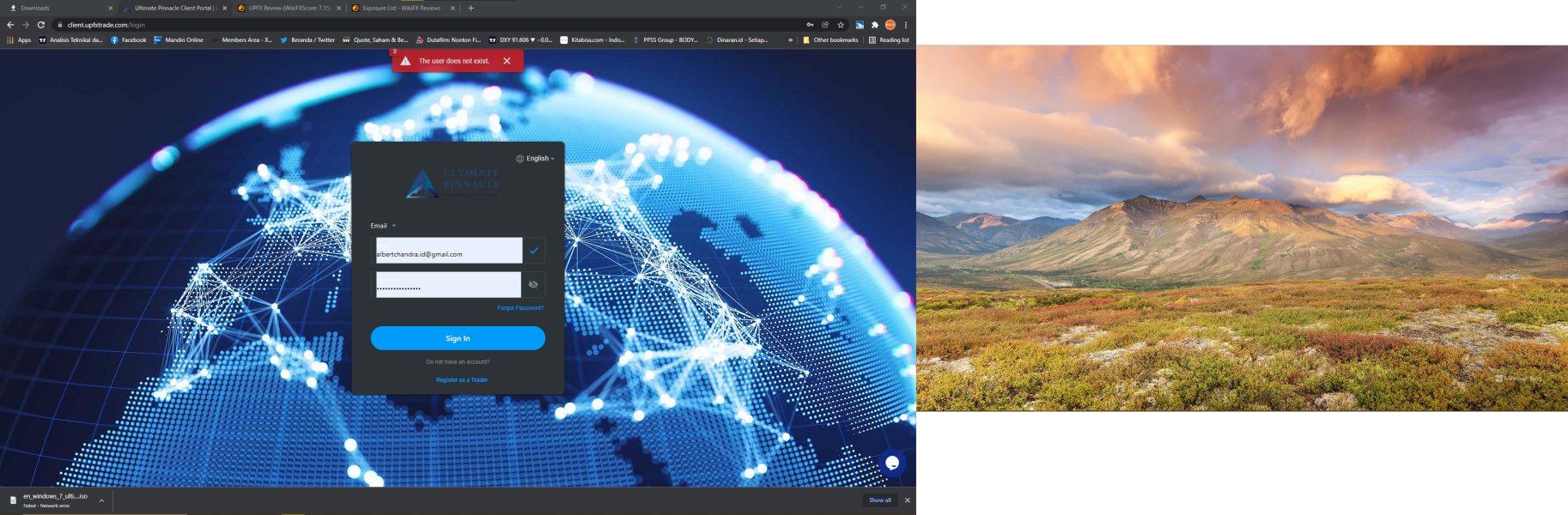

Overall user experience with UPFX reflects significant dissatisfaction, as evidenced by the 2.0/5 Trustpilot rating and consistent negative feedback across multiple review platforms. This low satisfaction score indicates systemic issues that affect various aspects of the user journey, from account opening through ongoing trading activities.

The user interface and platform usability details are not extensively documented in available sources, but the MT5 platform generally provides professional-grade functionality. However, user feedback suggests that the broker's implementation and supporting services may not effectively complement the platform's capabilities, resulting in suboptimal overall experience.

Registration and verification process feedback is limited in available sources. But the negative overall ratings suggest potential issues with onboarding efficiency and user support during account setup. Modern traders expect streamlined, transparent account opening procedures with clear communication about requirements and timelines.

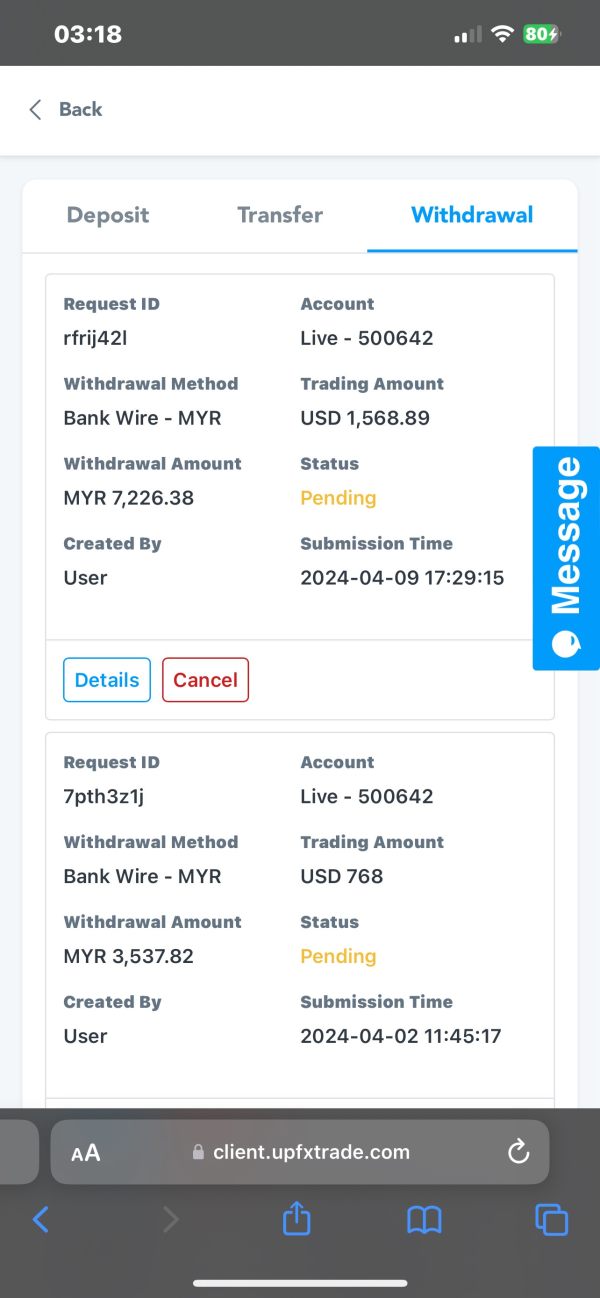

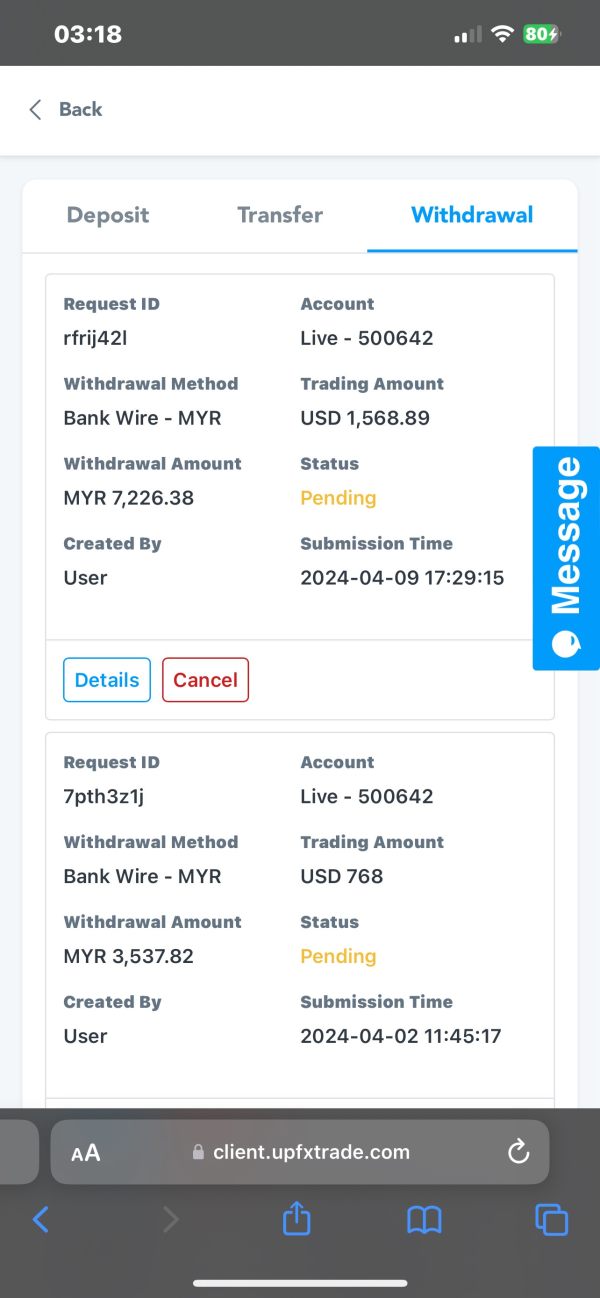

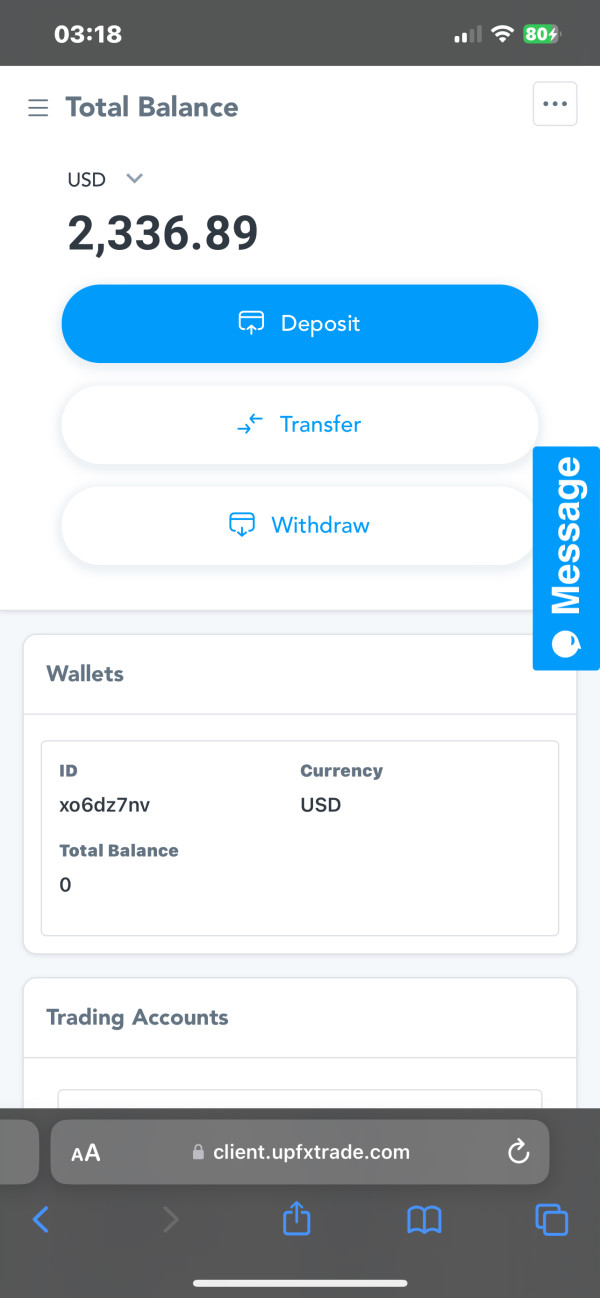

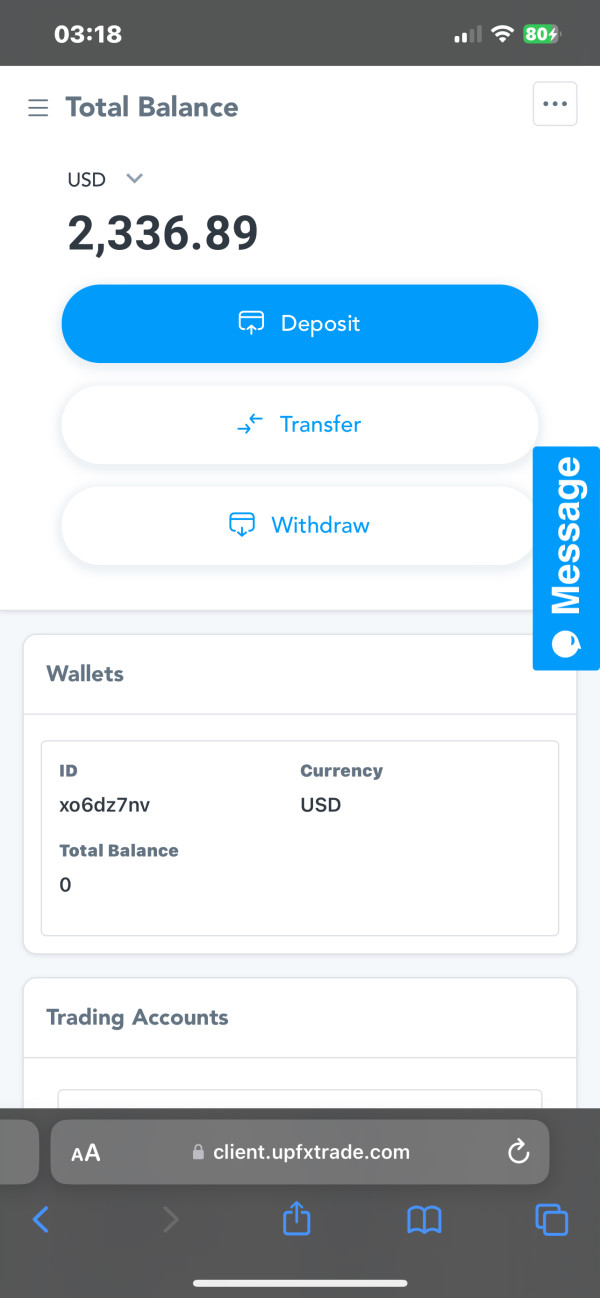

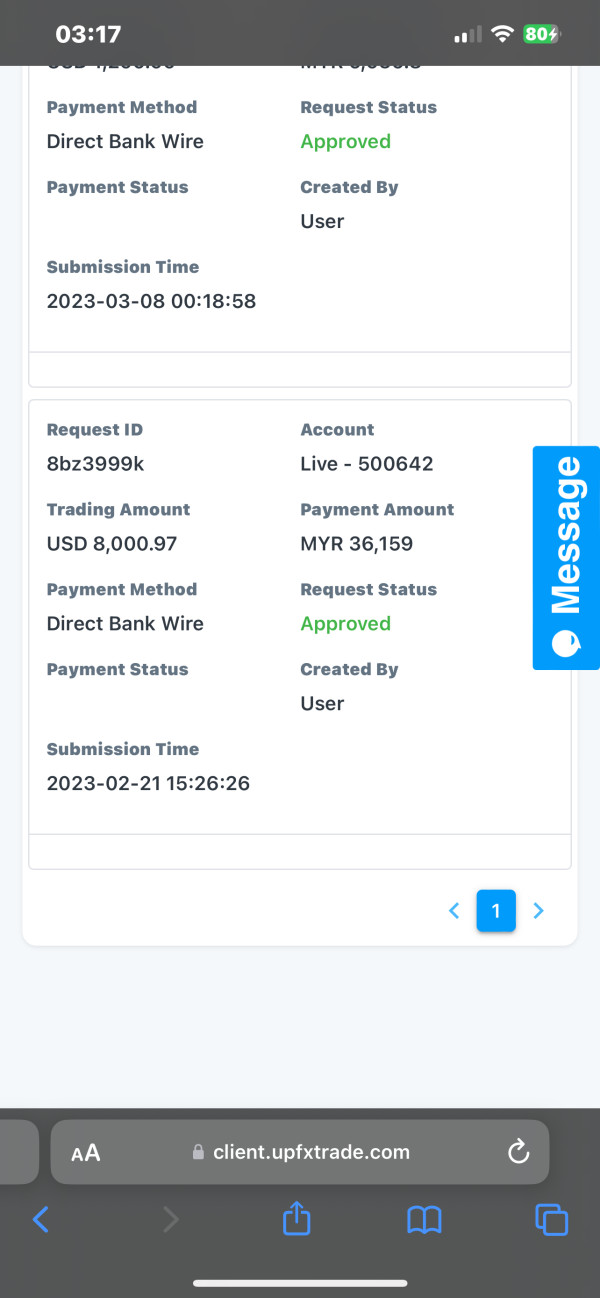

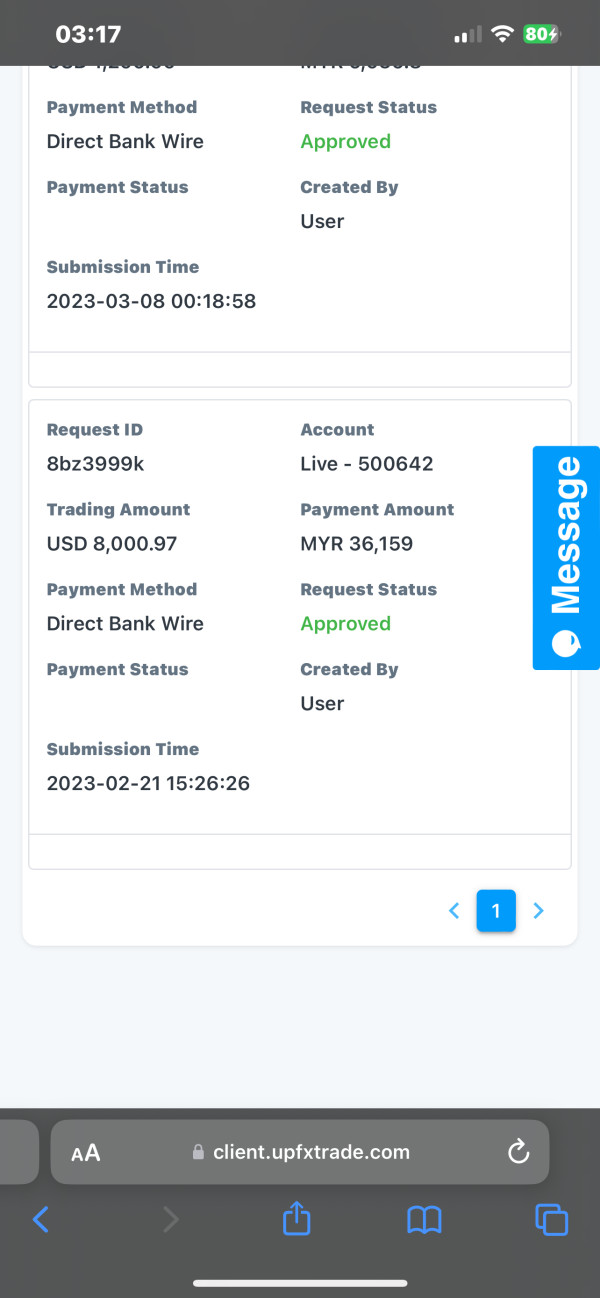

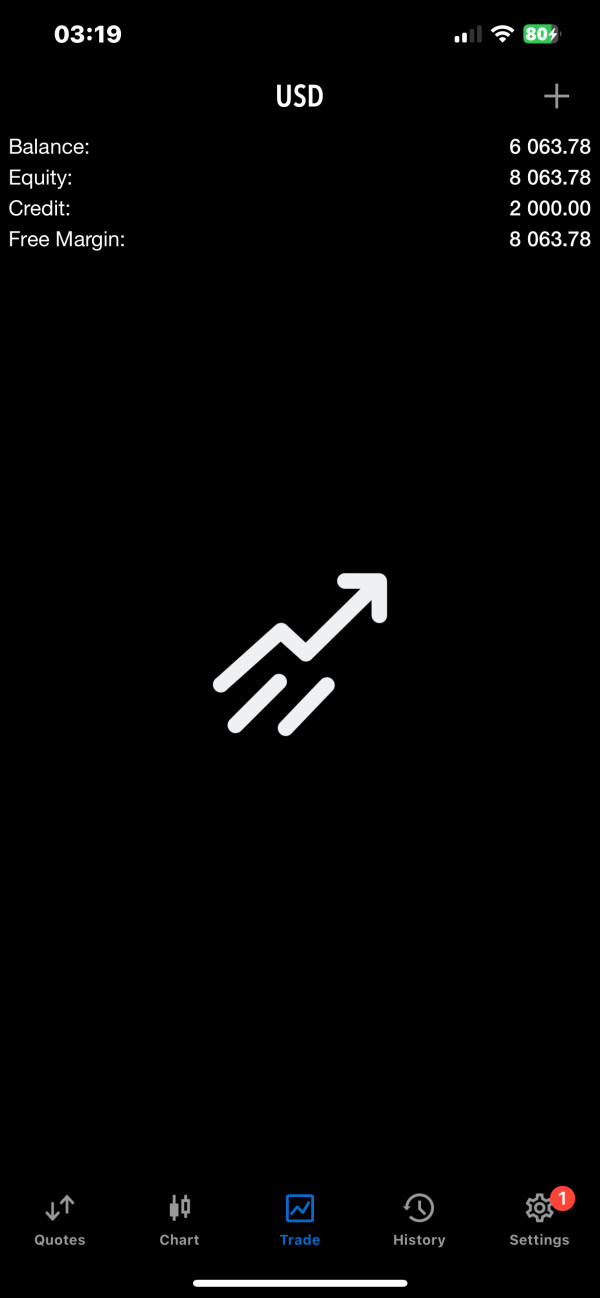

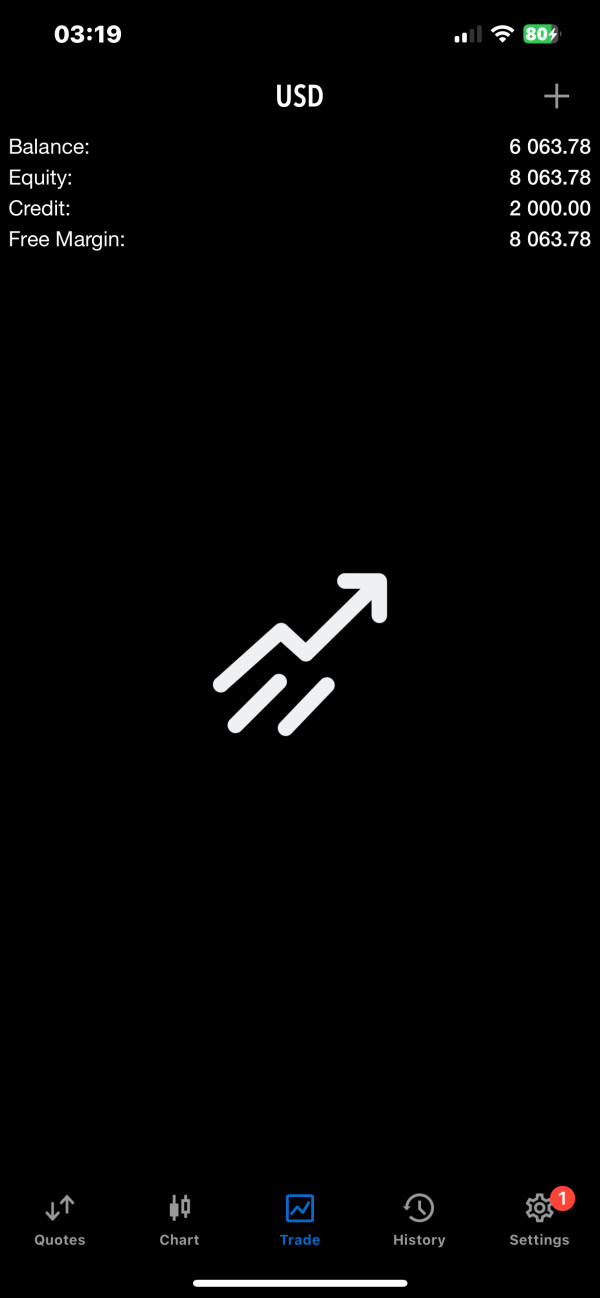

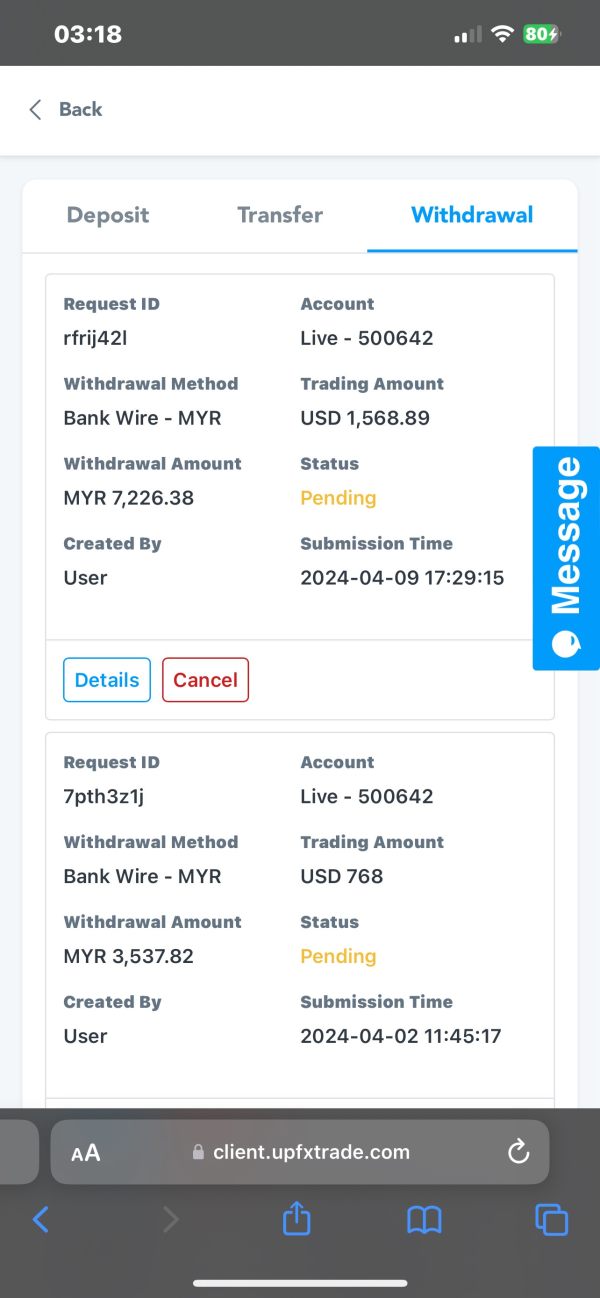

Fund management operations appear to be a significant source of user dissatisfaction, with complaints about deposit and withdrawal processes affecting overall user experience. Efficient, transparent fund operations are fundamental to positive broker relationships, and deficiencies in this area significantly impact user satisfaction.

The user demographic that might benefit from UPFX appears limited to high-risk tolerance traders who prioritize leverage access over regulatory protection and complete service quality. However, even within this demographic, the negative user feedback suggests that service improvements would be necessary to provide satisfactory user experience.

Conclusion

This complete upfx review reveals a broker with mixed characteristics that require careful consideration by potential users. UPFX presents attractive technical specifications, including high leverage ratios up to 1:1000, competitive spreads starting from 0 pips, and access to diverse asset classes through the MT5 platform. The low $100 minimum deposit makes the platform accessible to retail traders seeking entry-level forex trading opportunities.

However, significant concerns overshadow these potential advantages. The broker's unregulated status eliminates essential trader protections, while consistently negative user feedback indicates systemic service delivery issues. The 2.0/5 Trustpilot rating reflects widespread dissatisfaction across multiple service areas, particularly customer support and overall reliability.

UPFX might appeal to high-risk tolerance traders who prioritize leverage access and are comfortable with unregulated broker relationships. However, the negative user feedback suggests that even risk-tolerant traders should carefully consider alternative options with better service track records and regulatory oversight.

Key Advantages: High leverage options, low minimum deposit, multi-asset platform access, competitive spreads

Primary Disadvantages: Unregulated status, poor user satisfaction ratings, customer service deficiencies, trust and reliability concerns

Potential users should thoroughly research regulatory requirements in their jurisdiction and consider the risks associated with unregulated broker relationships before proceeding with UPFX.