Regarding the legitimacy of The Access Bank UK forex brokers, it provides FCA and WikiBit, .

Is The Access Bank UK safe?

Pros

Cons

Is The Access Bank UK markets regulated?

The regulatory license is the strongest proof.

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

The Access Bank UK Limited

Effective Date:

2008-08-12Email Address of Licensed Institution:

info@theaccessbankukltd.co.uk, complaints@theaccessbankukltd.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

www.theaccessbankukltd.co.ukExpiration Time:

--Address of Licensed Institution:

4 Royal Court Gadbrook Park Rudheath Northwich Cheshire West And Chester CW9 7UT UNITED KINGDOMPhone Number of Licensed Institution:

+4401606813010Licensed Institution Certified Documents:

Is The Access Bank UK A Scam?

Introduction

The Access Bank UK is a financial institution that operates in the forex market, offering a range of banking and investment services primarily to clients in the United Kingdom and beyond. As a subsidiary of Access Bank Group, which has a significant presence in Africa, Access Bank UK aims to provide comprehensive financial solutions, including trade finance and asset management. However, the forex industry is notorious for its volatility and potential for fraud, making it crucial for traders to conduct thorough evaluations of their brokers. This article aims to assess the legitimacy and safety of The Access Bank UK by examining its regulatory status, company background, trading conditions, client safety measures, and user experiences. The analysis will be based on a review of multiple sources, including user feedback, regulatory disclosures, and expert opinions.

Regulation and Legitimacy

Regulation is a vital aspect of any financial institution, particularly in the forex sector, where the risk of fraud and mismanagement is high. The Access Bank UK is regulated by the Financial Conduct Authority (FCA), one of the most reputable financial regulators in the world. The FCA's oversight ensures that the bank adheres to strict standards of conduct, transparency, and financial stability.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 478415 | United Kingdom | Verified |

The FCA requires regulated firms to maintain a certain level of capital, segregate client funds, and provide clear information about their services and risks. This regulatory framework is designed to protect clients and ensure that they have recourse in case of disputes or misconduct. However, despite being regulated, there have been reports of clients experiencing difficulties when trying to withdraw their funds, raising questions about the effectiveness of the regulatory oversight in this instance.

Moreover, while The Access Bank UK claims to be compliant with FCA regulations, the quality of regulation and historical compliance records are crucial factors to consider. The bank's regulatory history appears to be relatively clean, with no significant infractions reported. Nevertheless, the lack of robust user experiences regarding fund withdrawals suggests that potential clients should exercise caution.

Company Background Investigation

The Access Bank UK was established as a subsidiary of Access Bank, a prominent Nigerian bank that has expanded its operations internationally since its inception in 1988. The bank has grown through a series of acquisitions and mergers, making it one of the largest financial institutions in Africa. The ownership structure is relatively straightforward, with Access Bank Group as the parent company.

The management team at The Access Bank UK comprises seasoned professionals with extensive experience in banking and finance. Their backgrounds include roles in various reputable financial institutions, which adds a layer of credibility to the bank's operations. However, transparency regarding the management team's specific qualifications and experiences could be improved, as potential clients often seek detailed information about the leaders of the institutions they choose to trust with their finances.

In terms of information disclosure, The Access Bank UK provides basic details about its services on its website, including contact information and a brief overview of its offerings. However, the lack of comprehensive educational resources or detailed explanations of investment products may leave clients feeling under-informed, which could be a red flag for potential investors.

Trading Conditions Analysis

The trading conditions offered by The Access Bank UK are essential for evaluating its competitiveness in the forex market. The bank provides a range of financial products, but specific details regarding its fee structure and trading conditions are not always transparent. Traders should be aware of any hidden fees or unusual charges that could impact their profitability.

| Fee Type | The Access Bank UK | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not disclosed | 1.0 - 2.0 pips |

| Commission Model | Not disclosed | Varies by broker |

| Overnight Interest Range | Not disclosed | Varies by broker |

The absence of clear information about spreads, commissions, and overnight fees may indicate a lack of transparency in the bank's operations. Traders should be cautious when engaging with brokers that do not provide detailed fee disclosures, as this can lead to unexpected costs that erode trading profits. Moreover, the presence of hidden fees or unclear commission structures can significantly affect a trader's bottom line, making it crucial to seek clarity before committing funds.

Client Funds Safety

The safety of client funds is a top priority for any financial institution. The Access Bank UK claims to implement various measures to ensure the security of client deposits, including segregating client funds from the bank's operational funds. This practice is essential for protecting clients in the event of the bank's insolvency.

Additionally, as a regulated entity under the FCA, The Access Bank UK participates in the Financial Services Compensation Scheme (FSCS), which provides up to £85,000 in compensation for eligible clients in case of the bank's failure. This regulatory protection is a significant factor that enhances the bank's credibility. However, historical reports of clients experiencing difficulties in withdrawing their funds raise concerns about the effectiveness of these safety measures.

While the bank may have established protocols for safeguarding client funds, the lack of positive user experiences regarding fund accessibility raises questions about the practical implementation of these policies. Potential clients should weigh these concerns against the bank's regulatory protections before deciding to invest.

Customer Experience and Complaints

User experiences can provide valuable insights into the reliability and service quality of a financial institution. Feedback about The Access Bank UK has been mixed, with some users reporting satisfactory experiences, while others have expressed frustration over withdrawal issues and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Difficulties | High | Slow response |

| Customer Service Issues | Medium | Inconsistent |

Common complaints include the inability to withdraw funds promptly and delays in customer service responses. For instance, several clients have reported being unable to access their capital, which has raised red flags about the bank's operational integrity. The bank's responses to these complaints have been criticized for being slow and inadequate, which can exacerbate frustrations for clients seeking assistance.

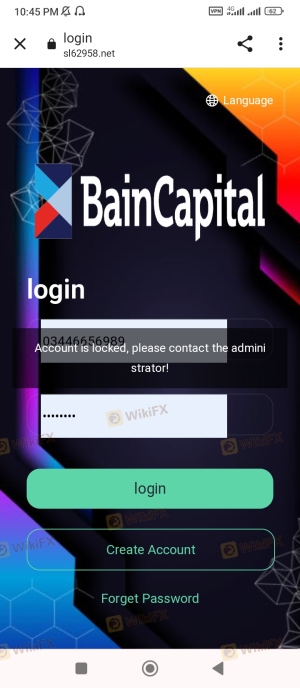

A couple of notable cases involve clients who reported investing significant sums only to find themselves locked out of their accounts with no clear explanation or timeline for resolution. These experiences highlight the importance of evaluating not just the regulatory status of a broker but also the real-world implications of their service delivery.

Platform and Execution

The trading platform offered by The Access Bank UK is crucial for traders seeking a seamless trading experience. Reviews indicate that while the platform is functional, users have reported issues related to stability and execution quality.

Traders have experienced slippage during high volatility periods, leading to execution at less favorable prices than anticipated. Additionally, some users have reported instances of order rejections, which can be detrimental in fast-moving markets. The quality of execution is a critical factor for traders, and any signs of manipulation or poor performance should be carefully scrutinized.

Risk Assessment

Engaging with The Access Bank UK carries certain risks that potential clients should consider. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | Medium | Regulated but with reported withdrawal issues. |

| Customer Service Quality | High | Mixed feedback on responsiveness and effectiveness. |

| Fund Accessibility | High | Reports of difficulties in withdrawing funds. |

To mitigate these risks, potential clients should conduct thorough due diligence, including seeking out user testimonials and expert reviews. It is also advisable to start with smaller investments to gauge the bank's responsiveness and operational reliability before committing larger sums.

Conclusion and Recommendations

In conclusion, while The Access Bank UK is a regulated financial institution with a solid background, there are significant concerns regarding its operational practices, particularly related to fund withdrawals and customer service responsiveness. The mixed reviews and reports of withdrawal difficulties suggest that potential clients should exercise caution when considering this broker.

For traders seeking a reliable forex broker, it may be prudent to explore alternatives with a proven track record of positive user experiences and transparent fee structures. Brokers that offer comprehensive educational resources, responsive customer service, and clear communication about fees and trading conditions are generally more trustworthy.

In summary, while The Access Bank UK is not outrightly a scam, the reported issues warrant careful consideration. Potential clients should weigh the regulatory protections against the practical challenges of engaging with this institution, and consider diversifying their options by exploring other reputable brokers in the market.

Is The Access Bank UK a scam, or is it legit?

The latest exposure and evaluation content of The Access Bank UK brokers.

The Access Bank UK Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

The Access Bank UK latest industry rating score is 8.14, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 8.14 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.