Regarding the legitimacy of SW MARKETS forex brokers, it provides VFSC and WikiBit, .

Is SW MARKETS safe?

Pros

Cons

Is SW MARKETS markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

RevokedLicense Type:

Forex Trading License (EP)

Licensed Entity:

SW Markets Global Ltd

Effective Date: Change Record

2023-06-02Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is SW Markets Safe or Scam?

Introduction

SW Markets is a forex broker that has garnered attention in the trading community, operating primarily in the online trading space. Founded in 2017, it claims to offer a range of trading services in forex, commodities, and indices. However, as with any trading platform, it is crucial for traders to exercise caution and conduct thorough due diligence before investing. The forex market is rife with scams and unscrupulous entities, making it imperative for potential investors to assess the credibility of brokers like SW Markets. This article utilizes various sources, including regulatory information, customer reviews, and expert analyses, to provide a comprehensive evaluation of SW Markets' legitimacy and safety.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy and safety. SW Markets is reportedly regulated by the Vanuatu Financial Services Commission (VFSC), which is known for its relatively lenient regulatory framework. The following table summarizes the key regulatory information regarding SW Markets:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission | 40357 | Vanuatu | Active |

While having a license from the VFSC indicates some level of oversight, it is essential to note that Vanuatu is often considered a jurisdiction with less stringent regulations compared to other financial authorities like the FCA (UK) or ASIC (Australia). This raises concerns about the quality of regulation and the level of investor protection offered. Moreover, there have been no significant regulatory disclosures or actions against SW Markets, but the lack of a robust regulatory framework makes it challenging to ascertain the broker's compliance history conclusively. Therefore, while SW Markets is technically regulated, the quality and effectiveness of that regulation remain questionable, leading to concerns about whether SW Markets is safe for traders.

Company Background Investigation

SW Markets is registered under the name SW Markets Global Limited and is headquartered in Hong Kong. The company's history is relatively short, having been established in 2017. Despite its claims of being a legitimate trading platform, there is a notable lack of transparency regarding its ownership structure and the backgrounds of its management team. This absence of information raises red flags, as reputable brokers typically provide detailed information about their executives and operational history. Furthermore, the company's website does not disclose critical information such as the identities of key personnel or their professional qualifications. This lack of transparency contributes to the skepticism surrounding whether SW Markets is a scam or a legitimate broker.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience. SW Markets presents a range of trading options, but the details surrounding its fee structure remain ambiguous. The following table outlines the core trading costs associated with SW Markets:

| Fee Type | SW Markets | Industry Average |

|---|---|---|

| Major Currency Pairs Spread | 1.5 pips | 1-2 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Moderate |

While SW Markets advertises competitive spreads, the lack of clarity regarding commissions and overnight fees can be concerning. High overnight interest rates can erode potential profits, and the absence of a clear commission structure may mislead traders regarding the true cost of trading. Therefore, potential investors should carefully consider these factors when evaluating whether SW Markets is safe for trading.

Client Fund Safety

When it comes to online trading, the safety of client funds is paramount. SW Markets claims to implement various security measures, including segregating client funds from company operational funds. However, the effectiveness of these measures remains uncertain. There is no evidence of investor protection schemes or negative balance protection policies that could safeguard traders in the event of significant losses. Furthermore, historical data does not indicate any past incidents of fund mismanagement or security breaches at SW Markets, yet the lack of robust safety protocols raises questions about whether SW Markets is a scam or a trustworthy broker.

Customer Experience and Complaints

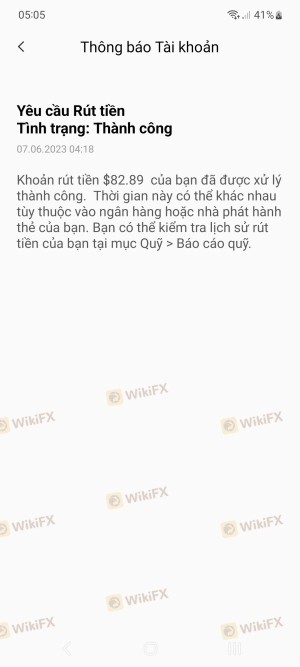

Customer feedback is a vital component in assessing a broker's reliability. A review of user experiences with SW Markets reveals a mix of opinions, with some traders reporting satisfactory experiences while others cite significant issues. Common complaints include difficulties with withdrawals, high fees, and poor customer service responsiveness. The following table summarizes the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| High Fees | Medium | Unclear policies |

| Customer Support Quality | High | Poor communication |

For instance, one trader reported that after making a profit, their withdrawal request was met with delays and a lack of communication from the support team. Such experiences contribute to the perception that SW Markets may not be safe for traders, as unresolved complaints can indicate underlying operational issues.

Platform and Trade Execution

The trading platform provided by SW Markets is essential for assessing the overall trading experience. Users have reported mixed reviews regarding the platform's performance, with some noting that it is user-friendly while others have experienced issues with order execution and slippage. Quality of execution is crucial, as delays or rejections can significantly affect trading outcomes. Furthermore, any signs of platform manipulation, such as sudden price changes or unresponsive trading during high volatility, would be serious concerns for traders. Given these factors, potential users must carefully consider whether SW Markets is safe for their trading activities.

Risk Assessment

Engaging with SW Markets involves several risks that traders should be aware of. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Offshore regulation with low oversight |

| Fund Safety | Medium | Lack of robust investor protection policies |

| Customer Service | High | Poor responsiveness to complaints |

To mitigate these risks, traders are advised to conduct thorough research, only invest what they can afford to lose, and consider using regulated brokers with a proven track record of reliability.

Conclusion and Recommendations

In conclusion, while SW Markets is technically regulated by the Vanuatu Financial Services Commission, the quality of that regulation is questionable. The lack of transparency regarding the company's ownership, combined with mixed customer reviews and concerns about fund safety, raises significant doubts about whether SW Markets is safe for trading. Potential investors should exercise caution, particularly those who are inexperienced in navigating the complexities of the forex market.

For those seeking reliable alternatives, it is advisable to consider brokers regulated by reputable authorities such as the FCA or ASIC, which offer stronger investor protections and clearer operational guidelines. Ultimately, thorough research and careful consideration are essential for anyone looking to engage with SW Markets or similar platforms.

Is SW MARKETS a scam, or is it legit?

The latest exposure and evaluation content of SW MARKETS brokers.

SW MARKETS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SW MARKETS latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.