Regarding the legitimacy of STP Trading forex brokers, it provides MISA and WikiBit, .

Is STP Trading safe?

Pros

Cons

Is STP Trading markets regulated?

The regulatory license is the strongest proof.

MISA Forex Trading License (EP)

Mwali International Services Authority

Mwali International Services Authority

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

STP GLOBAL LTD

Effective Date:

2023-05-24Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.stptrading.io/Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is STP Trading A Scam?

Introduction

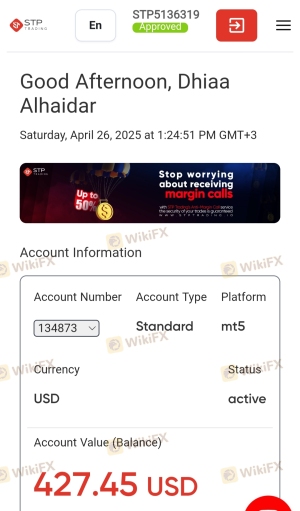

STP Trading is a forex broker that positions itself in the competitive landscape of online trading, offering a variety of financial instruments including forex, commodities, and cryptocurrencies. Established in 2019, it has attracted attention due to its low minimum deposit requirements and the promise of direct market access through its trading platform. However, the forex market is fraught with risks, and traders must exercise caution when selecting a broker. The potential for scams is significant, which necessitates a thorough evaluation of any trading platform before committing funds. This article aims to provide a balanced and objective assessment of STP Trading, examining its regulatory status, company background, trading conditions, client fund security, customer experiences, and overall risk factors.

Regulation and Legitimacy

The regulatory environment in which a broker operates is vital for establishing its legitimacy and trustworthiness. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards and practices designed to protect client interests. Unfortunately, STP Trading operates under a regulatory framework that raises concerns. Below is a summary of its regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| MISA | T2023280 | Comoros | Offshore Regulation |

STP Trading is regulated by the Mwai International Services Authority (MISA) in Comoros, which is classified as an offshore jurisdiction. While MISA provides some level of oversight, it is generally regarded as a low-tier regulator compared to more stringent authorities like the FCA (UK) or ASIC (Australia). The lack of regulation from a top-tier authority raises questions about the broker's compliance and the protection of client funds. Furthermore, the offshore nature of its regulation means that traders may have limited recourse in the event of disputes or financial mismanagement. Historical compliance records for offshore brokers often indicate a higher risk of fraud or unethical practices, making it essential for traders to approach STP Trading with caution.

Company Background Investigation

STP Trading was founded in 2019 and is operated by STP Global Ltd. The company is based in Saint Lucia, a location known for its lenient regulatory environment. While the relatively recent establishment of the broker may seem appealing to some, it lacks a long track record that could provide reassurance to potential clients. The ownership structure of STP Trading is not transparently disclosed, which raises concerns about accountability and trustworthiness.

The management team behind STP Trading has not been prominently featured in its marketing or branding efforts, making it difficult for prospective traders to gauge their experience and qualifications. A lack of detailed information about the team can lead to skepticism regarding the broker's overall reliability. Furthermore, the companys transparency is questionable, as there is limited information available regarding its operational practices, financial health, and any affiliations with other financial entities.

In the forex industry, transparency is crucial for building trust, and the absence of clear information about STP Trading's management and ownership can be a red flag for potential investors.

Trading Conditions Analysis

The trading conditions offered by a broker significantly impact a trader's experience and profitability. STP Trading claims to provide competitive spreads and a variety of account types, but a closer examination of its fee structure raises some concerns.

The following table summarizes the core trading costs associated with STP Trading:

| Fee Type | STP Trading | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.4 pips | 1.0 pips |

| Commission Structure | $8 per trade | $5 per trade |

| Overnight Interest Range | Variable | Variable |

While STP Trading offers relatively low spreads compared to the industry average, the commission per trade is higher than many competitors. This discrepancy could lead to increased trading costs, especially for high-frequency traders. Additionally, the variability of overnight interest can create uncertainty in cost management, as traders may not always be able to predict their expenses accurately.

Moreover, STP Trading's fee structure may not be entirely transparent, with potential hidden costs that could arise during trading. Traders should be vigilant regarding any unusual fees that may appear during the trading process, as these can significantly affect overall profitability.

Client Fund Security

The security of client funds is a paramount concern for any trader. STP Trading claims to implement various measures to ensure the safety of client deposits, but an in-depth analysis is required to evaluate the effectiveness of these measures.

STP Trading offers segregated accounts for client funds, which is a positive step towards ensuring that traders' money is kept separate from the broker's operational funds. This practice is essential for protecting client assets in the event of bankruptcy or financial instability. Furthermore, the broker claims to provide negative balance protection, which prevents clients from losing more than their deposited amount.

However, the lack of a robust regulatory framework raises concerns about the enforcement of these security measures. In the past, many offshore brokers have faced issues related to fund mismanagement and insufficient protection for clients. Without a trustworthy regulatory authority overseeing STP Trading, traders may find themselves at risk if the broker encounters financial difficulties or engages in unethical practices.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability and service quality. STP Trading has received a mix of reviews from its clients, with some praising its low entry barriers and trading platform, while others have reported significant issues.

The following table summarizes the main types of complaints received about STP Trading:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Account Management Issues | Medium | No resolution |

| Lack of Communication | High | Poor support |

Common complaints include delays in withdrawals, which can be a significant concern for traders who require timely access to their funds. Additionally, several users have reported difficulties in reaching customer support, leading to frustration and dissatisfaction. Such issues can severely impact a trader's experience and raise questions about the broker's commitment to client service.

One notable case involved a trader who reported that their withdrawal request was delayed for several weeks, and despite multiple attempts to contact customer support, they received little to no assistance. This incident highlights potential weaknesses in STP Trading's operational processes and customer service.

Platform and Trade Execution

The performance and reliability of a trading platform are critical to a trader's success. STP Trading utilizes the MetaTrader 5 platform, which is widely regarded for its advanced features and user-friendly interface. However, user experiences vary, with some traders reporting issues related to platform stability and order execution.

A common concern among users is the occurrence of slippage during volatile market conditions, which can lead to unfavorable trade execution prices. Moreover, there have been allegations of order rejections, raising suspicions of potential manipulation or internal conflicts of interest.

Overall, while STP Trading offers a reputable trading platform, traders should be cautious of execution quality and ensure they understand the potential risks associated with trading on this platform.

Risk Assessment

Engaging with STP Trading involves several risks that traders must consider before investing their funds. The following risk assessment table summarizes key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Operates under low-tier offshore regulation. |

| Financial Risk | Medium | Potential for fund mismanagement due to lack of oversight. |

| Operational Risk | High | Reports of withdrawal delays and customer service issues. |

| Market Risk | Medium | Standard market volatility applies. |

To mitigate these risks, traders should conduct thorough research, maintain a diversified portfolio, and consider using risk management tools such as stop-loss orders. Additionally, it may be wise to start with a smaller investment to gauge the broker's reliability before committing larger sums.

Conclusion and Recommendations

In conclusion, while STP Trading presents itself as an appealing option for forex and cryptocurrency trading, several factors warrant caution. The broker's offshore regulatory status, mixed customer feedback, and reports of operational issues raise red flags regarding its legitimacy and reliability.

Traders should be particularly wary of the potential for withdrawal delays and the overall transparency of the broker's fee structure. For those considering STP Trading, it is advisable to proceed with caution, conduct thorough due diligence, and perhaps start with a smaller investment to assess the broker's performance.

For traders seeking more reliable alternatives, consider established brokers regulated by top-tier authorities, such as Forex.com or Pepperstone, which offer robust client protection and a proven track record in the industry.

Is STP Trading a scam, or is it legit?

The latest exposure and evaluation content of STP Trading brokers.

STP Trading Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

STP Trading latest industry rating score is 5.76, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.76 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.