STP Trading 2025 Review: Everything You Need to Know

Executive Summary

This stp trading review gives you a complete look at what this broker offers. STP Trading works as a Straight Through Processing (STP) broker, which means your trades go straight to liquidity providers without a dealing desk getting in the way. The platform focuses on low spreads and fast execution speeds, making it attractive for traders who want cost-effective trading solutions.

The broker mainly serves traders who care about low trading costs and quick order execution. Our analysis shows big gaps in public information about regulatory oversight, specific account conditions, and user feedback. The platform lets you trade forex and cryptocurrency through its STP model. However, detailed information about trading instruments and platform features is hard to find in current documentation.

STP Trading has a mixed profile based on available information. It might benefit cost-conscious traders, but there are notable concerns about transparency and regulatory clarity that you should carefully consider.

Important Disclaimers

This review uses publicly available information and existing user feedback where we can find it. You should know that different regional entities may operate under varying regulatory requirements and service standards. Our evaluation method uses data from multiple sources, though complete regulatory information and extensive user testimonials are currently limited in available documentation.

Available information about STP Trading's regulatory status and specific licensing details is fragmented. We strongly advise potential users to independently verify the broker's credentials before committing funds. Service offerings and conditions may vary significantly across different jurisdictions.

Overall Rating Framework

Broker Overview

STP Trading calls itself a Straight Through Processing broker. It operates on a business model that sends client orders directly to liquidity providers without internal dealing desk intervention. This approach should give traders more transparent pricing and faster execution speeds, as orders bypass potential conflicts of interest that can happen with market maker models.

The platform's main selling point focuses on providing low spreads and rapid order execution through its STP infrastructure. STP Trading offers access to foreign exchange markets and cryptocurrency trading, according to available information. However, specific details about the range of available instruments and exact trading conditions remain unclear in current documentation. The broker seems to target traders who care more about cost efficiency and execution speed than comprehensive educational resources or advanced analytical tools.

Critical information about the company's establishment date, corporate background, and leadership team is missing from readily available sources. This lack of transparency about fundamental corporate details raises questions about the broker's commitment to openness with potential clients. The absence of clear regulatory information and limited public documentation about the company's operational history presents challenges for traders seeking to evaluate the platform's credibility and long-term stability.

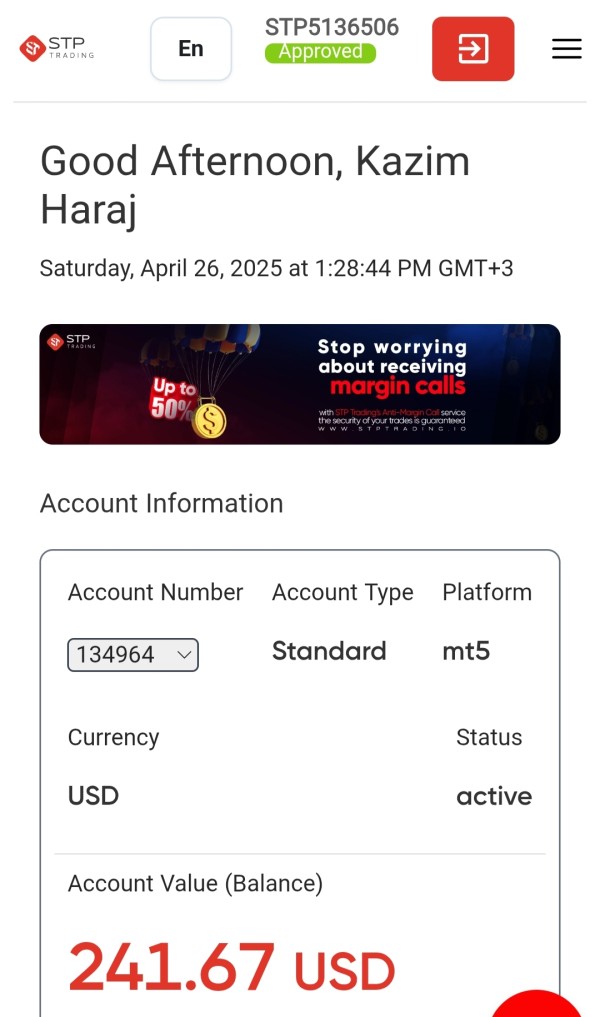

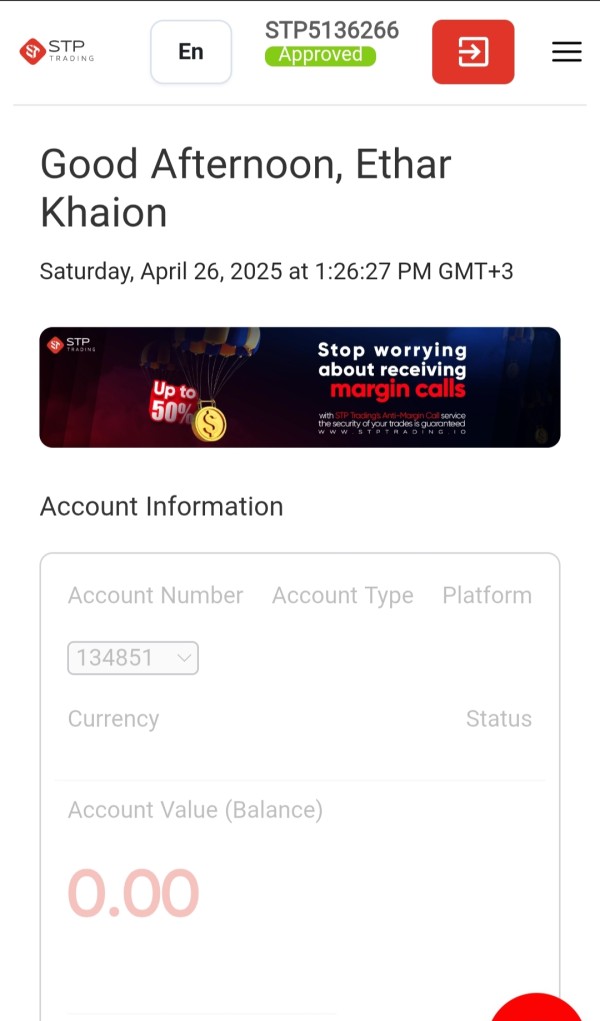

Regulatory Status: Current available information does not specify concrete regulatory oversight or licensing details, which represents a significant concern for potential users seeking regulated trading environments.

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees is not detailed in available documentation. You need to contact the broker directly for this information.

Minimum Deposit Requirements: The platform's minimum deposit thresholds are not specified in current public information. This makes it difficult to assess accessibility for different trader segments.

Promotional Offers: Details about welcome bonuses, trading incentives, or promotional campaigns are not documented in available sources. This suggests either absence of such programs or limited marketing transparency.

Available Trading Assets: The platform reportedly supports forex and cryptocurrency trading. However, comprehensive asset lists, specific currency pairs, and crypto offerings are not detailed in current documentation.

Cost Structure: While low spreads are emphasized as a key feature, specific spread ranges, commission structures, and additional fees remain unclear in available information. This makes cost comparison challenging.

Leverage Options: Information about maximum leverage ratios, margin requirements, and risk management parameters is not specified in current documentation.

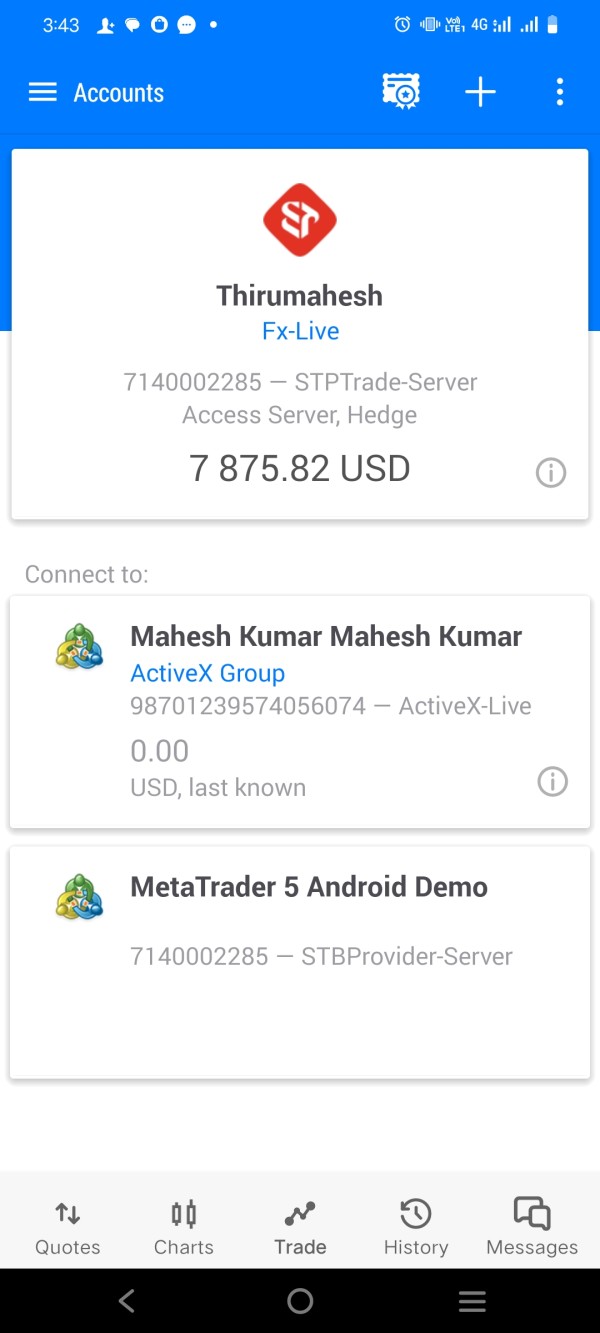

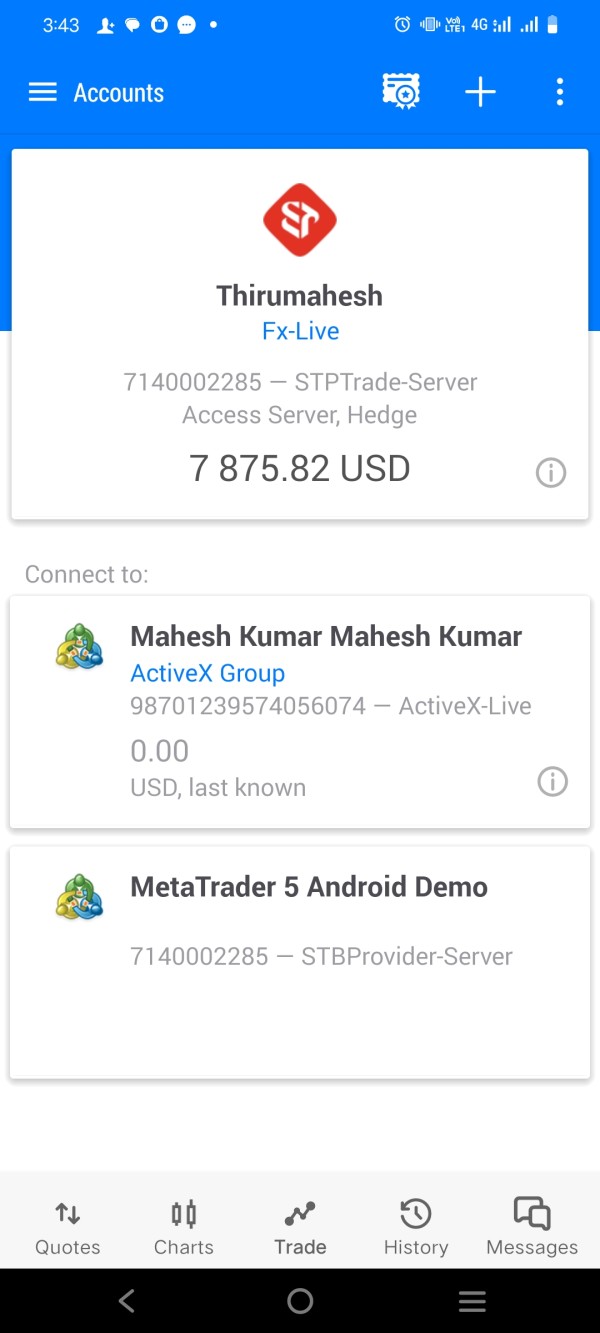

Platform Technology: The broker operates on STP Trading platform infrastructure. However, technical specifications, supported devices, and platform features are not comprehensively documented.

Geographic Restrictions: Details about service availability across different regions and any territorial limitations are not clearly specified in available sources.

Customer Support Languages: Information about multilingual support capabilities and communication channels is not detailed in current documentation.

This stp trading review reveals significant information gaps that potential users should address through direct communication with the broker before making trading decisions.

Detailed Rating Analysis

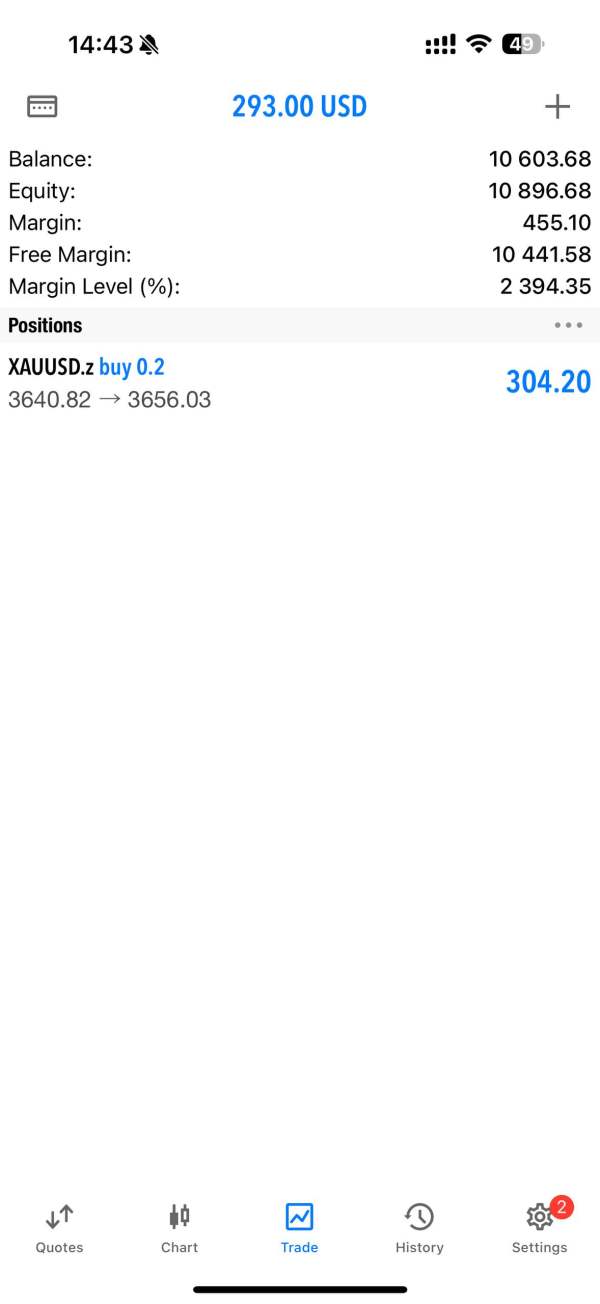

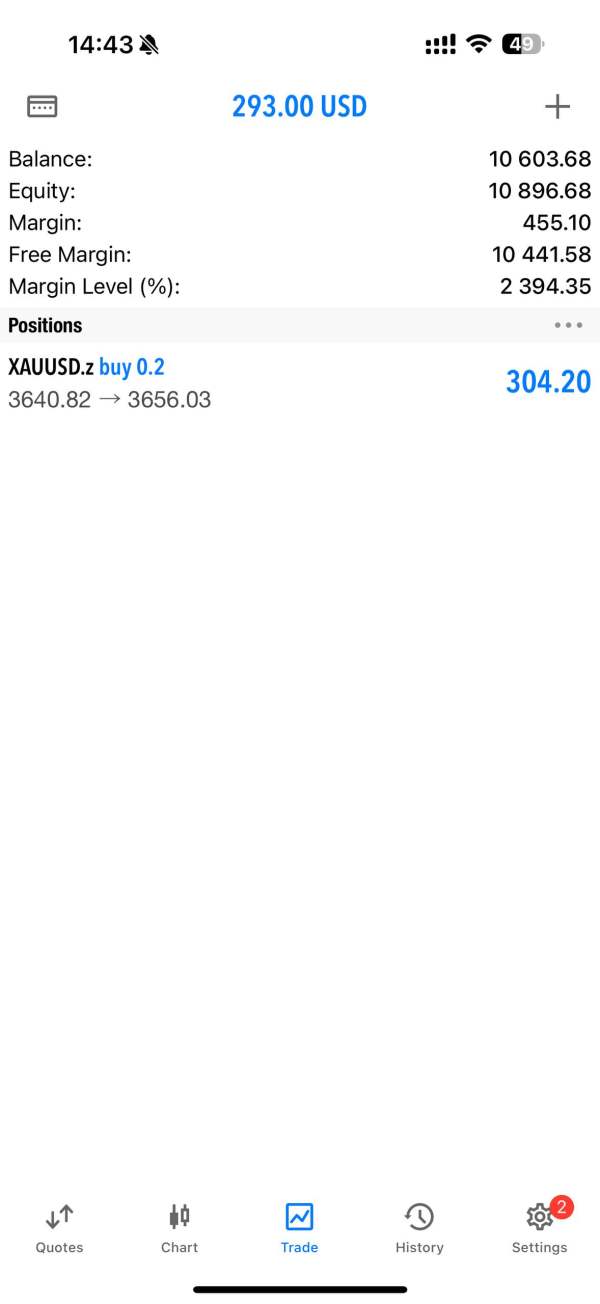

Account Conditions Analysis (5/10)

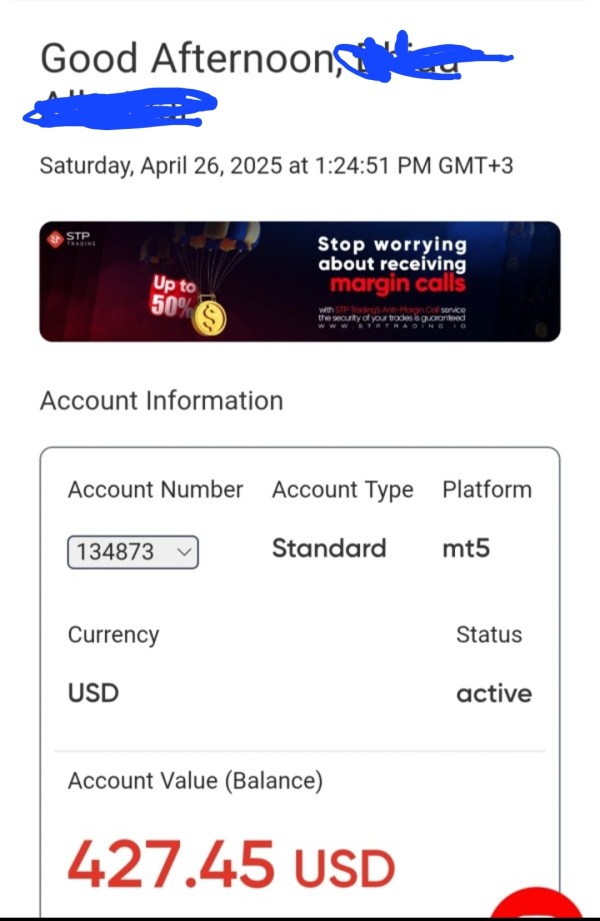

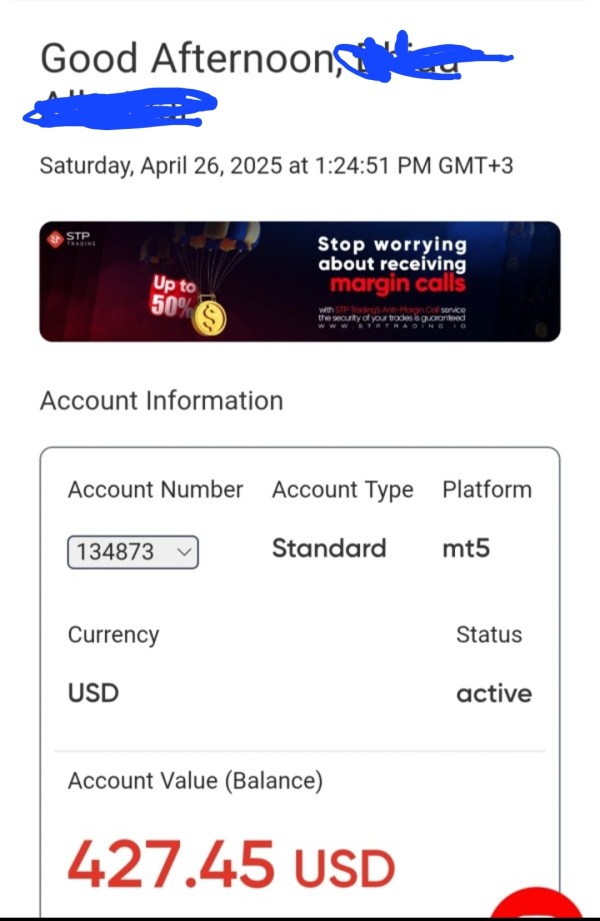

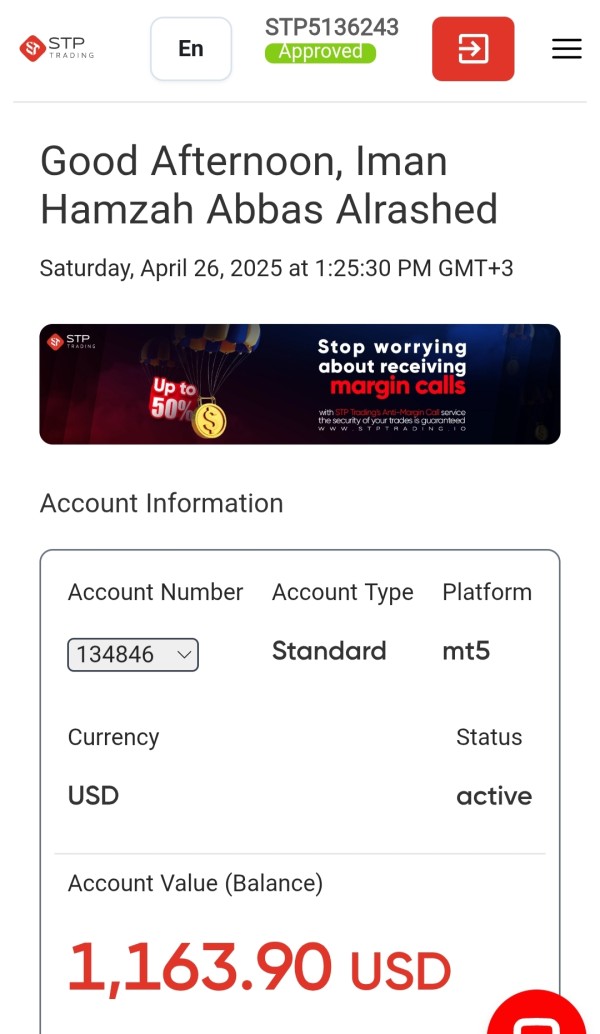

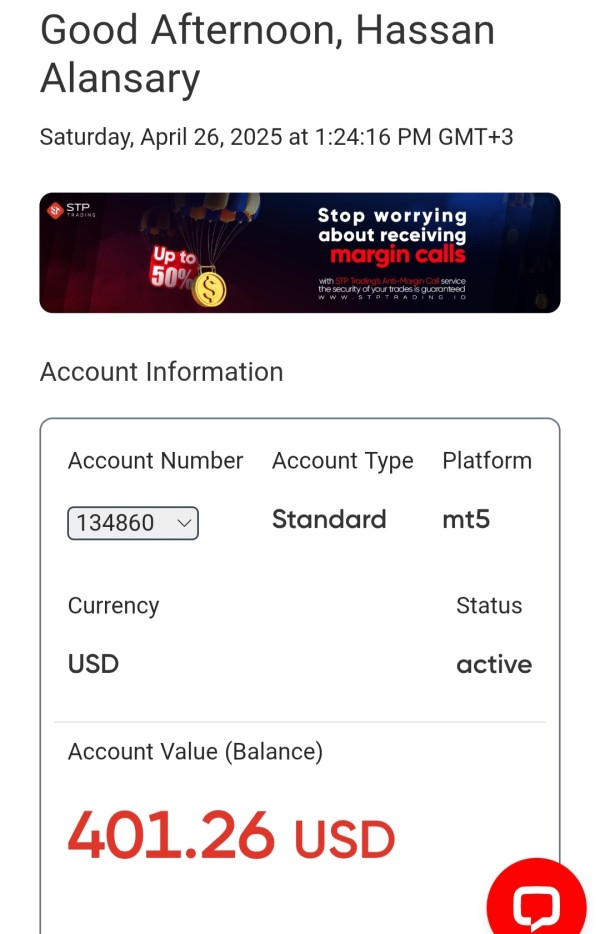

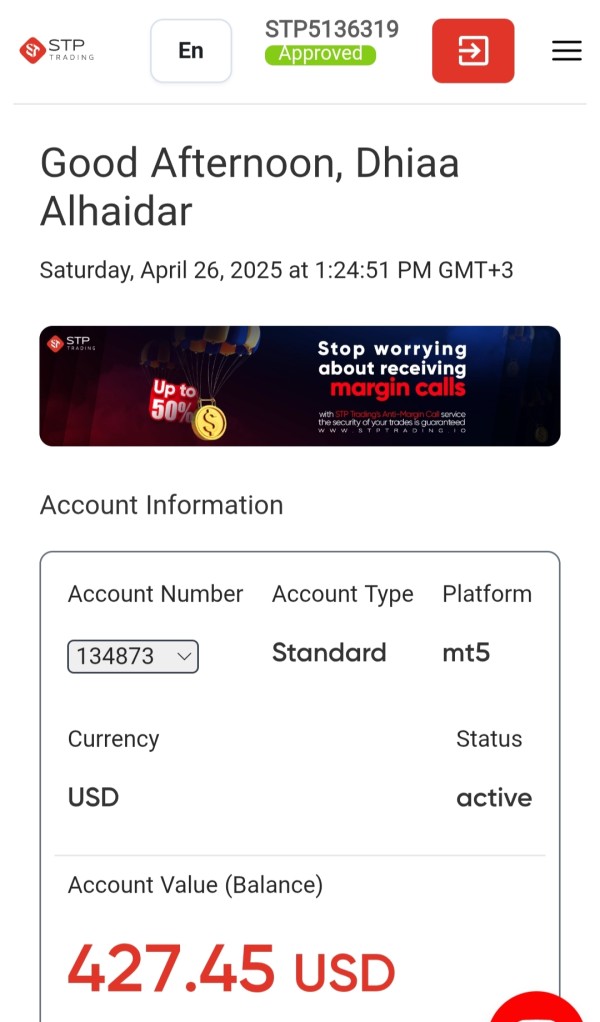

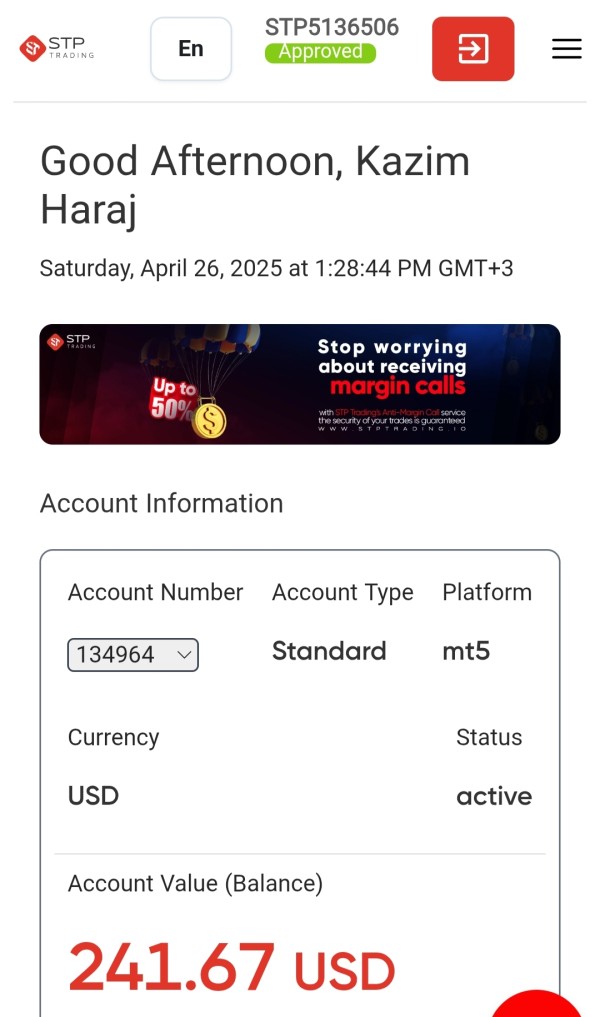

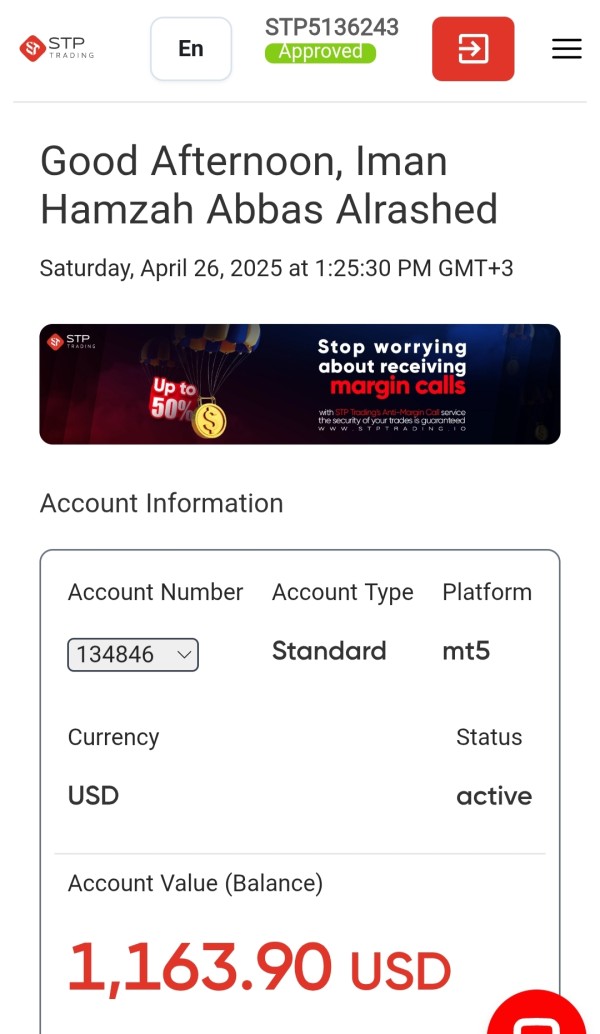

The evaluation of STP Trading's account conditions reveals substantial information gaps that significantly impact the assessment. Available documentation does not provide clear details about account types, tier structures, or specific features that differentiate various account offerings. This lack of transparency makes it challenging for potential traders to understand what they can expect when opening an account with the platform.

Minimum deposit requirements are not specified in current public information, which are crucial for accessibility assessment. Details about account opening procedures, required documentation, and verification processes remain unclear. The absence of information about specialized account types, such as Islamic accounts for Muslim traders or professional accounts for experienced traders, suggests either limited product diversity or inadequate marketing communication.

Traders cannot make informed decisions about which account type might best suit their trading needs without clear information about account benefits, fee structures, or exclusive features tied to different account levels. This lack of clarity regarding fundamental account conditions contributes to the below-average rating in this category.

According to this stp trading review, the broker needs to significantly improve transparency regarding account offerings to better serve potential clients and compete effectively in the market.

The assessment of STP Trading's tools and resources reveals limited publicly available information about the platform's analytical and educational offerings. Current documentation does not detail the availability of technical analysis tools, charting capabilities, or market research resources that are typically expected from modern trading platforms.

Educational resources appear to be either limited or poorly documented, which are increasingly important for trader development and retention. The absence of information about webinars, trading guides, market analysis, or educational content suggests that the platform may not prioritize trader education as a core service offering.

Automated trading support, including Expert Advisor (EA) compatibility, algorithmic trading tools, or API access, is not mentioned in available sources. This gap is particularly significant as automated trading has become increasingly important for many forex traders seeking to implement systematic trading strategies.

The lack of comprehensive information about available tools and resources makes it difficult for traders to assess whether the platform can support their analytical needs and trading methodologies. This uncertainty contributes to the below-average rating in this critical evaluation category.

Customer Service and Support Analysis (5/10)

The evaluation of STP Trading's customer service capabilities is hampered by limited publicly available information about support channels, response times, and service quality. Contact information including multiple international phone numbers is available, but comprehensive details about support availability, multilingual capabilities, and problem resolution processes are not well documented.

Available contact information suggests international presence with phone numbers for UAE, Qatar, Kuwait, Switzerland, Saudi Arabia, Oman, and Bahrain. This indicates potential regional support capabilities. However, specific information about support hours, response time commitments, or service level agreements is not detailed in current documentation.

The absence of user testimonials or reviews specifically addressing customer service experiences makes it challenging to assess the actual quality of support provided. The rating remains neutral without concrete feedback about problem resolution effectiveness, staff knowledge levels, or overall customer satisfaction with support services.

The platform would benefit from more transparent communication about its customer service capabilities. This includes clear information about available support channels, expected response times, and multilingual support options to better serve its international client base.

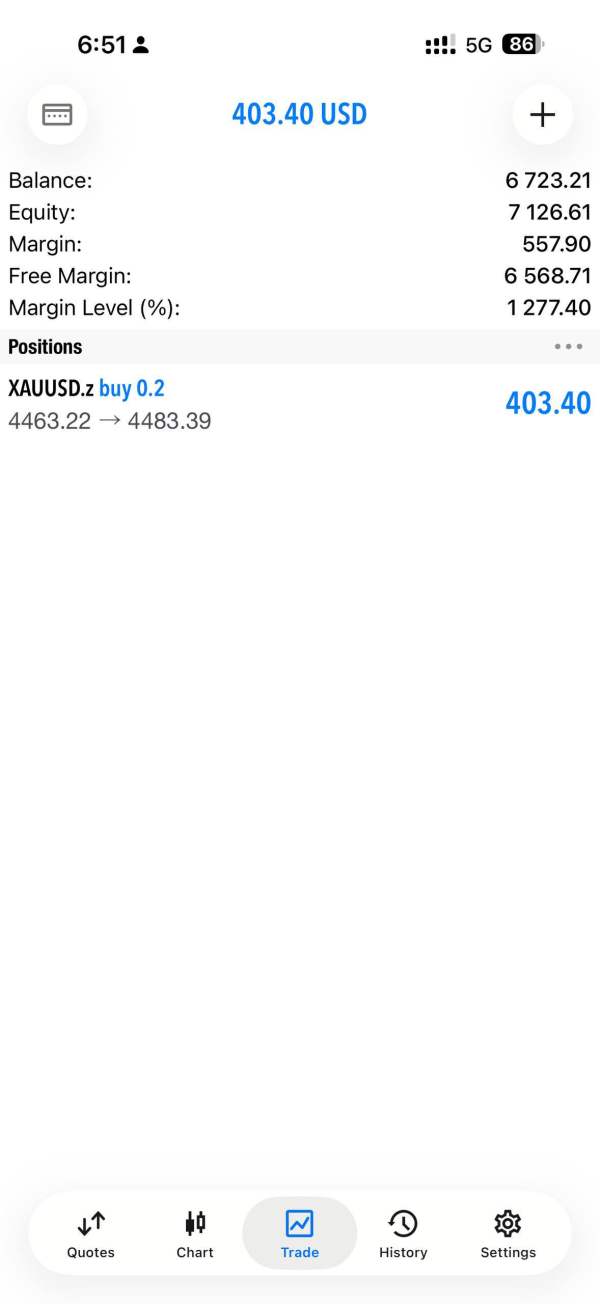

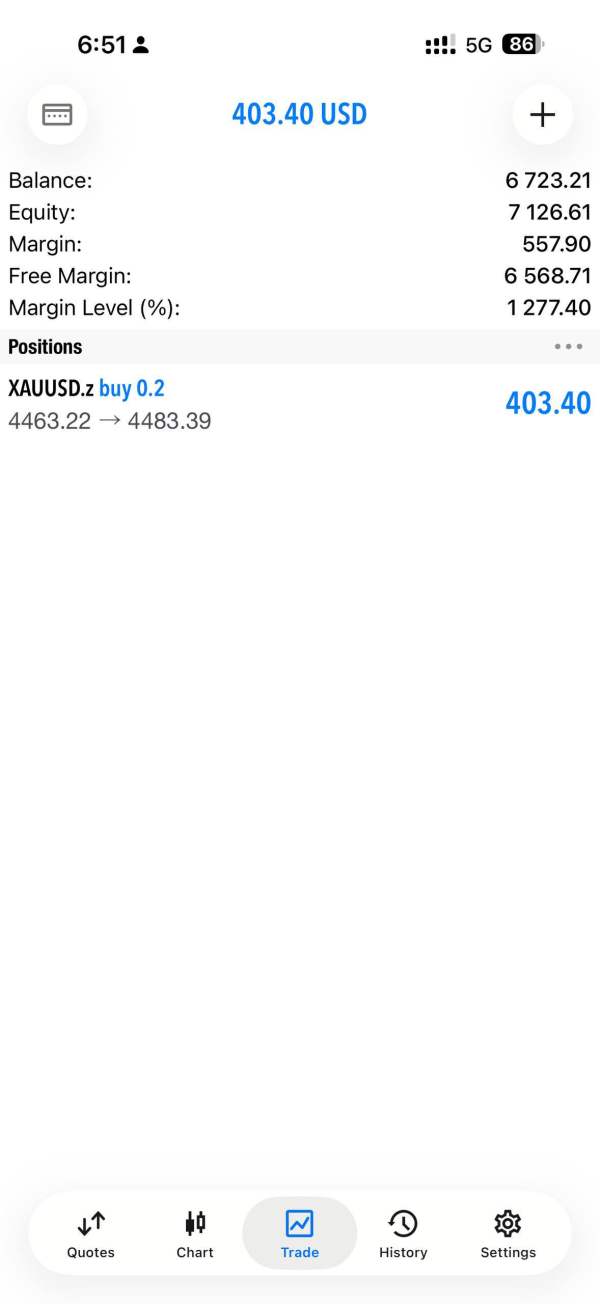

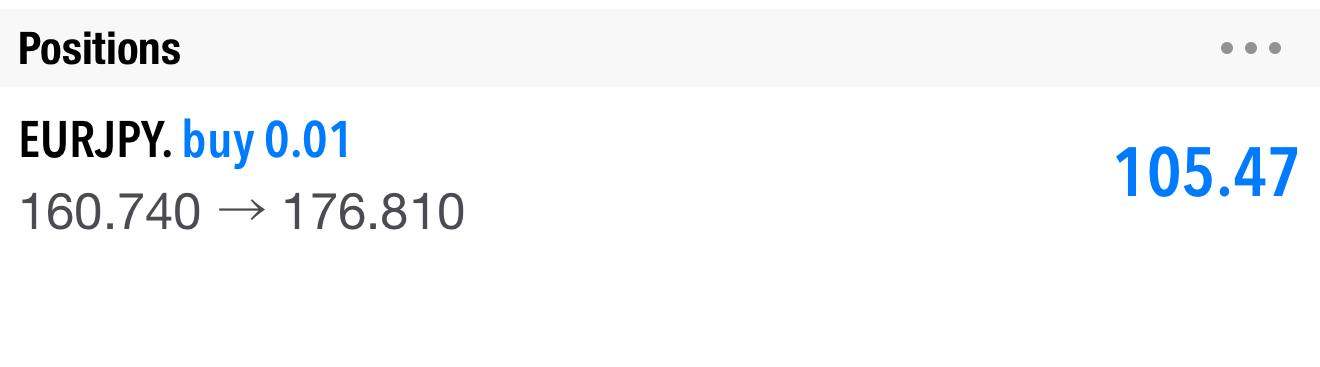

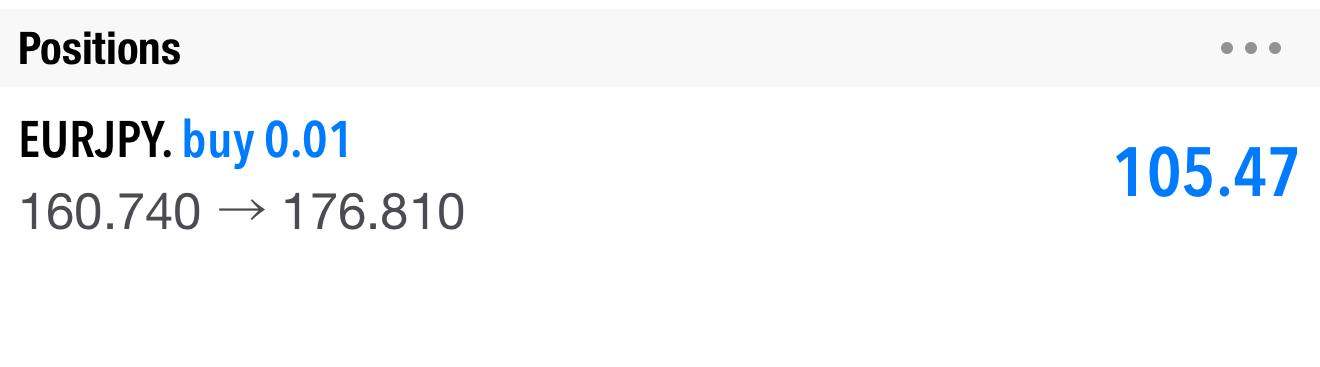

Trading Experience Analysis (6/10)

STP Trading's core value proposition of low spreads and fast execution through its Straight Through Processing model represents the strongest aspect of the platform's offerings. The STP execution model theoretically provides advantages in terms of order processing speed and pricing transparency, as trades are routed directly to liquidity providers without dealing desk intervention.

The emphasis on low spreads addresses a key concern for active traders seeking to minimize trading costs. This is particularly important for scalping strategies or high-frequency trading approaches. Fast execution speeds, when properly implemented, can significantly impact trading performance, especially during volatile market conditions or when trading news events.

The actual trading experience assessment is limited by the lack of detailed performance metrics, such as average execution speeds, typical spread ranges across different currency pairs, or slippage statistics. The evaluation relies primarily on the theoretical advantages of the STP model without concrete data about platform stability, uptime statistics, or user feedback about actual trading conditions.

This stp trading review notes that while the STP model provides a solid foundation for quality trading experiences, the lack of detailed performance data and user testimonials prevents a higher rating in this category.

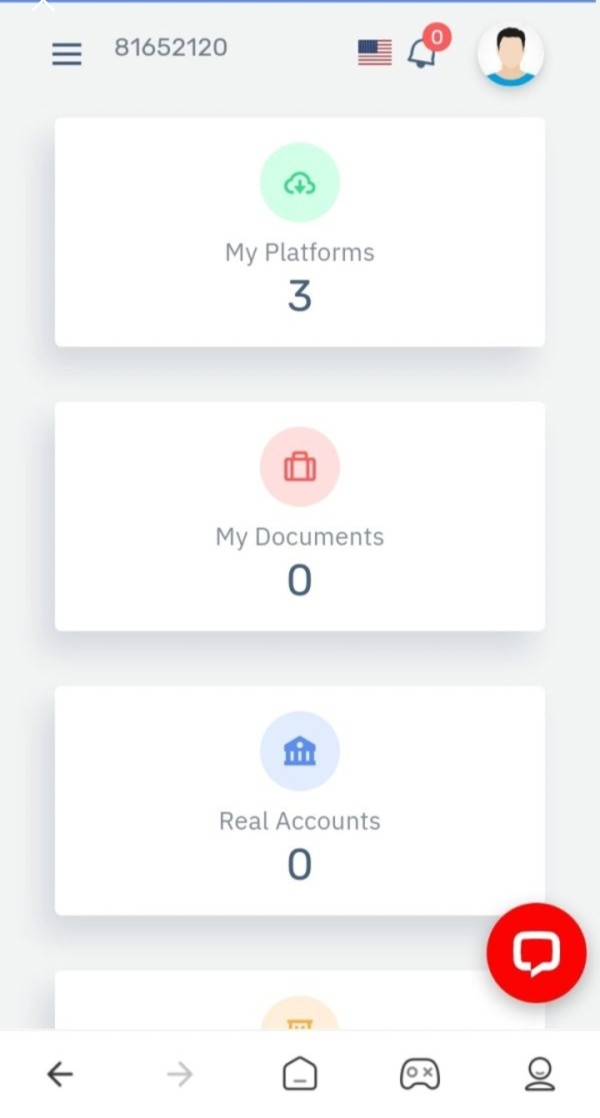

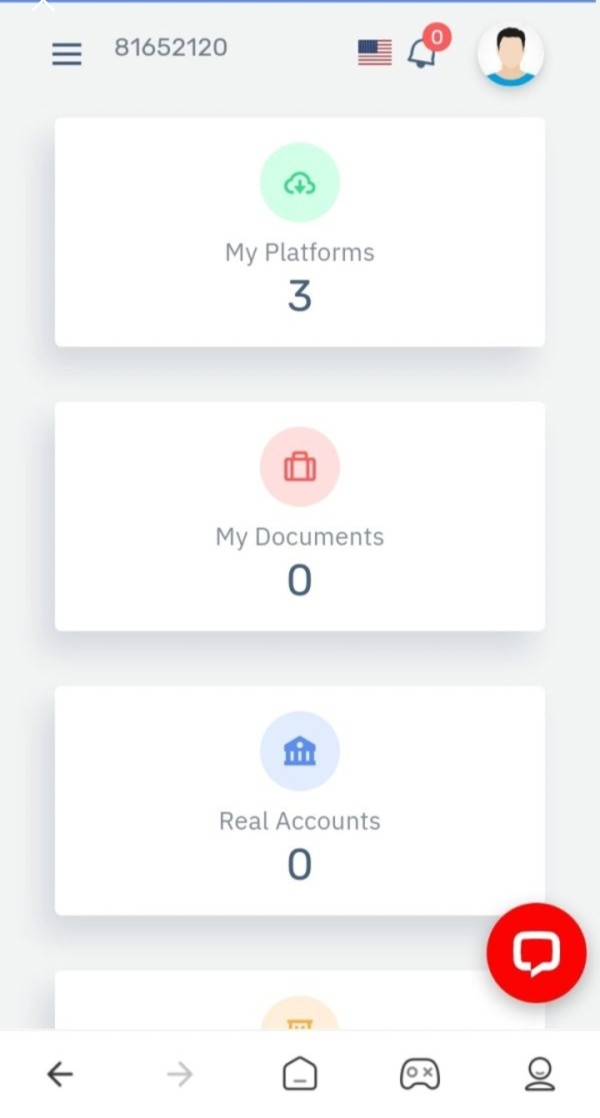

Trust and Reliability Analysis (3/10)

The trust and reliability assessment reveals significant concerns that potential users should carefully consider. The most notable issue is the absence of clear regulatory information, including specific licensing details, regulatory oversight, or compliance with recognized financial authorities. This regulatory ambiguity represents a substantial red flag for traders seeking secure and regulated trading environments.

Fund security measures, such as segregated client accounts, deposit protection schemes, or insurance coverage, are not detailed in available documentation. The lack of transparency regarding client fund protection creates uncertainty about asset safety, which is fundamental to broker trustworthiness.

Company transparency is further compromised by limited information about corporate structure, leadership team, financial statements, or operational history. The absence of readily available information about the company's background and track record makes it difficult for potential clients to assess the broker's stability and credibility.

The trust rating remains poor without substantial regulatory oversight, transparent corporate information, or comprehensive user feedback to verify the platform's reliability. Potential users should exercise significant caution and conduct thorough due diligence before engaging with the platform.

User Experience Analysis (5/10)

The user experience evaluation is significantly limited by the scarcity of actual user feedback and detailed platform documentation. It's challenging to assess how traders actually perceive their interaction with the platform without comprehensive user testimonials, reviews, or case studies.

Interface design and usability information is not detailed in current documentation. This makes it impossible to evaluate the platform's accessibility, navigation efficiency, or overall design quality. The registration and account verification process details are similarly unclear, preventing assessment of onboarding experience quality.

Fund management operations, including deposit and withdrawal procedures, processing times, and associated user experiences, lack detailed documentation. This information gap prevents potential users from understanding what to expect regarding money management processes.

The absence of information about common user complaints, satisfaction surveys, or improvement initiatives suggests either limited user engagement or inadequate feedback collection processes. The rating remains neutral without substantial user experience data, though the lack of available feedback itself represents a concern for transparency and user engagement.

Conclusion

This comprehensive stp trading review reveals a platform with mixed characteristics that require careful consideration by potential users. STP Trading's core offering of low spreads and fast execution through its Straight Through Processing model presents theoretical advantages for cost-conscious traders, but significant transparency and regulatory concerns overshadow these potential benefits.

The broker appears most suitable for experienced traders who prioritize low trading costs and can navigate environments with limited regulatory clarity. However, the substantial information gaps regarding regulatory oversight, specific account conditions, and user feedback make it difficult to recommend the platform for most retail traders. This is particularly true for those seeking regulated and transparent trading environments.

Key advantages include the STP execution model and emphasis on low spreads. Major drawbacks encompass regulatory ambiguity, limited transparency, and insufficient publicly available information about platform features and user experiences. Potential users should conduct extensive due diligence and consider these limitations carefully before making any trading decisions.