Regarding the legitimacy of SMFX forex brokers, it provides CYSEC and WikiBit, (also has a graphic survey regarding security).

Is SMFX safe?

Pros

Cons

Is SMFX markets regulated?

The regulatory license is the strongest proof.

CYSEC Forex Execution License (STP)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

SM CAPITAL MARKETS Ltd

Effective Date:

2017-11-02Email Address of Licensed Institution:

info@smcapitalmarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

www.smcapitalmarkets.com, www.scopemarkets.eu, www.scopeprime.euExpiration Time:

--Address of Licensed Institution:

23, Spyrou Kyprianou Avenue, Floor 4, 3070 Limassol, CyprusPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is SMFX A Scam?

Introduction

SMFX is an online forex broker that claims to provide traders with access to a variety of trading instruments, including forex, commodities, and CFDs. Established in 1997, SMFX positions itself as a reputable player in the forex market. However, the rise of online trading has also led to an increase in fraudulent activities, making it crucial for traders to carefully evaluate brokers before committing their funds. This article aims to investigate whether SMFX is a scam or a legitimate trading platform by examining its regulatory status, company background, trading conditions, customer experiences, and risk factors.

Regulation and Legitimacy

Understanding a broker's regulatory status is vital for assessing its legitimacy. SMFX operates under two different entities: SM Capital Markets Ltd, regulated by the Cyprus Securities and Exchange Commission (CySEC), and Scope Markets Ltd, based in Belize. While CySEC is a reputable regulatory authority that enforces strict standards, the Belize registration raises concerns due to its less stringent regulatory framework. Below is a summary of the core regulatory information for SMFX:

| Regulatory Authority | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| CySEC | 339/17 | Cyprus | Active |

| IFSC | IFSC/60/373/TS/19 | Belize | Active |

CySEC's oversight ensures that client funds are kept in segregated accounts and provides an investor compensation scheme in case of company insolvency. However, the Belize entity does not offer the same level of protection, which could raise red flags for potential traders. The dual regulatory framework may provide a sense of security, but the presence of an offshore entity can be a cause for concern. Therefore, while SMFX is regulated, its offshore operations may expose traders to higher risks.

Company Background Investigation

SMFX has been operational since 1997, and its long-standing presence in the market suggests a level of stability. However, the company operates through two different entities, which can complicate its ownership structure. The management team behind SMFX has a background in finance and trading, but details about their specific qualifications and experiences are limited. Transparency is crucial in the trading industry, and potential clients should be aware of who is managing their investments.

The company's commitment to transparency and information disclosure appears to be average, with some reviews indicating that detailed information about its operations is not readily available. While the company claims to offer competitive trading conditions and advanced technology, the lack of comprehensive information may lead to skepticism among potential traders. Overall, while SMFX has a history of operation, the opacity surrounding its management and ownership structure could be a point of concern for traders evaluating its credibility.

Trading Conditions Analysis

SMFX offers a variety of trading accounts, including standard, VIP, and ECN accounts, each with different trading conditions. The broker's fee structure appears competitive, but there are some nuances that potential traders should consider. The primary costs associated with trading on SMFX include spreads, commissions, and overnight interest rates. Below is a comparison of core trading costs:

| Cost Type | SMFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.8 pips | 1.5 pips |

| Commission Structure | Variable | Varies |

| Overnight Interest Range | Average | Average |

While the spreads for major currency pairs are slightly higher than the industry average, the overall fee structure is competitive. However, traders should pay attention to any unusual fees or commissions that may apply, especially for withdrawals or inactivity. Transparency in fee disclosures is essential, and any hidden charges could significantly impact a trader's profitability.

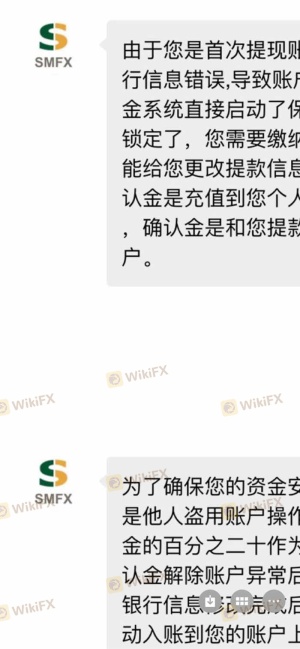

Customer Fund Safety

The safety of customer funds is a critical factor in determining whether a broker is trustworthy. SMFX claims to implement several measures to protect client funds, including segregated accounts and negative balance protection. Segregated accounts ensure that client funds are kept separate from the company's operational funds, providing an additional layer of security. Furthermore, the investor compensation scheme offered by CySEC adds another layer of protection in the event of insolvency.

However, the lack of similar protections for the Belize entity raises concerns. Historical issues related to fund security have been reported in the forex industry, and any past controversies involving SMFX could further exacerbate these concerns. Therefore, while SMFX does offer some protections for its clients, the dual regulatory framework may present risks that traders need to carefully consider.

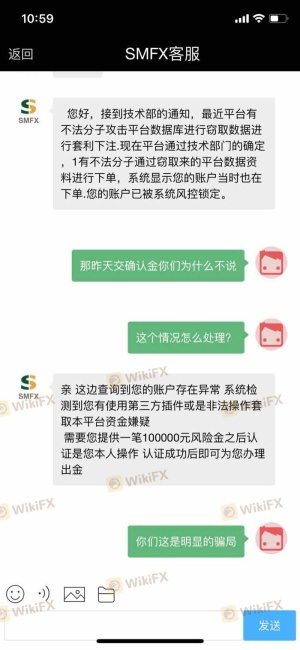

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating a broker's reliability. Reviews of SMFX indicate a mixed bag of experiences, with some traders praising the platform's ease of use and customer support, while others have reported issues with withdrawals and responsiveness. Common complaints include delays in processing withdrawal requests and a lack of adequate support during critical trading times. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Customer Support Availability | Medium | Limited hours |

| Transparency in Fees | Medium | Inconsistent |

A few notable cases highlight these issues, including instances where traders faced significant delays in accessing their funds. These experiences raise concerns about SMFX's commitment to customer service and its ability to address issues in a timely manner. While some traders have had positive experiences, the overall sentiment suggests that potential clients should proceed with caution.

Platform and Execution

The trading platform offered by SMFX is primarily based on MetaTrader 4 (MT4), a widely used platform known for its user-friendly interface and robust functionality. However, the execution quality, including slippage and order rejection rates, is crucial for a trader's success. Reviews indicate that while the platform performs well under normal conditions, there have been reports of slippage during high volatility periods.

Moreover, any signs of platform manipulation, such as frequent re-quotes or unexplained order rejections, could signal deeper issues within the broker's operations. Traders should be vigilant and monitor their execution quality closely to ensure they are not subject to unfair practices.

Risk Assessment

Engaging with SMFX carries certain risks that traders must consider. The dual regulatory framework, while providing some level of protection, also introduces complexities that could expose traders to higher risks. Below is a risk scorecard summarizing key risk areas:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Dual regulation may lead to inconsistencies. |

| Fund Safety | High | Offshore entity lacks robust protections. |

| Customer Service | Medium | Complaints about withdrawal delays. |

To mitigate these risks, traders should conduct thorough research, maintain realistic expectations, and only invest funds they can afford to lose. Additionally, using risk management strategies, such as setting stop-loss orders, can help protect against significant losses.

Conclusion and Recommendations

In conclusion, while SMFX is a regulated broker with a long history in the forex market, several factors warrant caution. The dual regulatory framework, mixed customer experiences, and potential issues with fund safety raise concerns about the broker's reliability. Although there are no clear signs of fraud, the presence of an offshore entity and reports of withdrawal issues should prompt traders to exercise due diligence.

For novice traders, it may be wise to consider alternative brokers with stronger regulatory oversight and better customer service records. Established brokers regulated by reputable authorities, such as FCA or ASIC, may offer a more secure trading environment. Ultimately, potential traders should weigh the evidence carefully and consider their own risk tolerance before proceeding with SMFX.

Is SMFX a scam, or is it legit?

The latest exposure and evaluation content of SMFX brokers.

SMFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SMFX latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.