SMFX 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive smfx review presents a balanced evaluation of SMFX as a trading platform. SMFX has been operating in the financial markets sector for several years. Based on available information, SMFX positions itself as a provider of online trading services with a focus on delivering competitive trading environments and customer-oriented services.

The platform offers access to various financial instruments. It emphasizes market updates and customer support as key differentiators. Our assessment reveals that SMFX caters primarily to traders seeking diversified trading opportunities with enhanced customer service support.

The broker operates under regulatory oversight. It provides access to multiple asset classes including forex, CFDs, and other financial instruments. However, the evaluation is tempered by limited availability of specific trading conditions and user feedback data.

This affects the comprehensiveness of this review. The platform appears suitable for traders who prioritize customer service quality and market information updates. However, potential users should conduct additional due diligence regarding specific trading terms and conditions that may not be readily available in public documentation.

Important Notice

Traders should be aware that SMFX operates across different jurisdictions. This may result in varying regulatory frameworks and service offerings depending on the user's location. The regulatory oversight includes supervision by financial authorities, though specific details regarding different regional entities may vary.

This review is based on available information and public sources as of 2025. Due to the limited availability of detailed user ratings and specific trading conditions in accessible documentation, this evaluation focuses on verifiable information while noting areas where additional details would enhance the assessment. Potential clients are advised to verify current terms and conditions directly with the broker before making trading decisions.

Rating Framework

Broker Overview

SMFX operates as an online trading platform provider in the financial services sector. The company has operations spanning multiple jurisdictions. According to available information, the company has established itself as a provider of trading services with particular emphasis on customer service excellence and competitive trading environments.

The platform's business model centers around providing traders with access to various financial markets through online trading technology. The broker's operational framework appears designed to serve traders seeking comprehensive market access combined with supportive customer service infrastructure. SMFX positions itself in the competitive online trading space by emphasizing market updates and trader support services, though specific details about the company's founding date and headquarters location require verification through direct sources.

The platform offers access to multiple asset classes including foreign exchange markets, contracts for difference, commodities, indices, precious metals, energy products, and cryptocurrency instruments. This smfx review notes that the broker operates under regulatory supervision, with oversight from financial service authorities. However, specific regulatory numbers and detailed compliance information should be verified directly with the company for the most current details.

Regulatory Jurisdiction: SMFX operates under financial regulatory oversight. The company receives supervision from relevant financial authorities. The specific regulatory framework and compliance details should be verified directly with the broker for current information.

Deposit and Withdrawal Methods: Specific information regarding available payment methods is not detailed in available documentation. Processing times and associated fees should be confirmed directly with the platform.

Minimum Deposit Requirements: The minimum deposit amounts for different account types are not specified in accessible materials. These details require direct inquiry with the broker for accurate information.

Bonus and Promotional Offers: Details regarding promotional offers are not mentioned in available sources. Welcome bonuses and ongoing incentive programs should be verified with the broker directly.

Tradeable Assets: The platform provides access to diverse financial instruments. These include forex pairs, CFDs on various underlying assets, commodity markets, stock indices, precious metals, energy markets, and cryptocurrency products.

Cost Structure: Specific information regarding spreads and commissions is not detailed in accessible documentation. Overnight financing charges and other trading costs require direct verification with the platform.

Leverage Ratios: Maximum leverage offerings are not specified in available materials. Margin requirements should be confirmed directly with the broker.

Platform Options: Details regarding specific trading platforms are not clearly specified in accessible information. MetaTrader versions and proprietary software options require direct confirmation.

Geographic Restrictions: Specific information about service availability in different countries is not detailed in available sources. Regulatory restrictions should be verified directly with the broker.

Customer Support Languages: The range of languages supported by customer service is not specified in accessible documentation. This smfx review emphasizes the importance of verifying these details directly with the broker to obtain the most current and accurate information.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of SMFX's account conditions faces limitations due to insufficient publicly available information. Without clear details about minimum deposit requirements, account tier differentiations, or special account features, it becomes challenging to provide a comprehensive assessment of the broker's account offerings.

The lack of specific information about account opening procedures impacts our ability to evaluate competitiveness. Verification requirements and available account types are not clearly documented. Additionally, details about special account features such as Islamic accounts, professional trader accounts, or managed account options are not readily available in accessible documentation.

This smfx review assigns a moderate rating to account conditions primarily due to the information gaps. These gaps prevent a thorough evaluation. Potential clients would benefit from direct communication with the broker to understand the full range of account options and associated terms before making commitments.

The absence of clear fee structures complicates the assessment process. Maintenance requirements and account-specific benefits are also unclear. This suggests that interested traders should prioritize obtaining detailed account information during their evaluation process.

SMFX demonstrates strength in providing access to diversified financial instruments. This forms a solid foundation for traders seeking variety in their trading activities. The platform's offering of forex, CFDs, commodities, indices, precious metals, energy products, and cryptocurrencies indicates a comprehensive approach to market access.

However, the evaluation of tools and resources is limited by the lack of specific information. Research capabilities, analytical tools, educational resources, and trading platform features are not well documented. Without details about market analysis provision, economic calendars, technical analysis tools, or educational content, it becomes difficult to assess the full value proposition of the platform's resource offerings.

The absence of information regarding automated trading support also impacts the evaluation. Expert advisors and algorithmic trading capabilities are not clearly specified. Additionally, details about mobile trading applications, web-based platforms, or downloadable software are not clearly specified in available documentation.

Despite these information limitations, the diverse range of tradeable assets suggests recognition of market exposure importance. SMFX appears to understand that clients need varied trading opportunities. This contributes positively to the overall assessment of tools and resources.

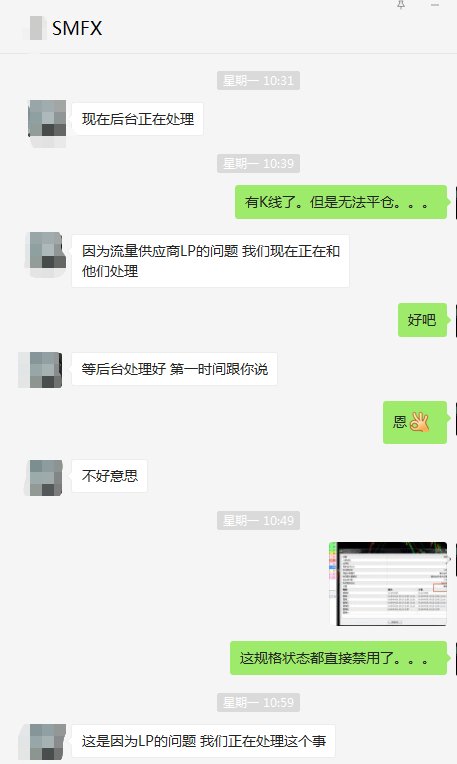

Customer Service and Support Analysis

Customer service appears to be a significant focus area for SMFX. Available information highlights the broker's emphasis on providing excellent customer service and regular market updates to traders. This focus on customer-oriented service delivery suggests a commitment to supporting trader needs beyond basic transaction processing.

The platform's emphasis on market updates indicates understanding of trader information needs. Keeping traders informed about market developments can be valuable for trading decision-making. However, specific details about customer service channels, availability hours, response times, and multilingual support are not clearly specified in accessible documentation.

Without information about specific communication methods, evaluation becomes challenging. Live chat, telephone support, email responsiveness, and dedicated account management services are not detailed. Additionally, details about support quality during different market conditions or crisis situations are not available for assessment.

The positive emphasis on customer service in available materials suggests recognition of trader support importance. SMFX appears to understand that quality service matters to clients. However, the lack of specific service level details and user feedback limits the ability to provide a more comprehensive evaluation of actual service delivery quality.

Trading Experience Analysis

The trading experience evaluation for SMFX is influenced by the mention of a competitive trading environment. This suggests attention to providing favorable trading conditions for platform users. However, the assessment is limited by insufficient information about specific platform features, execution quality, and user interface design.

Without details about order execution speeds, evaluation becomes challenging. Slippage rates, platform stability, and advanced trading features are not documented. Additionally, information about charting capabilities, technical analysis tools, and customization options is not readily available in accessible documentation.

The mention of mobile application availability suggests recognition of mobile trading importance. Modern traders increasingly need mobile access to markets. However, specific details about mobile platform features, functionality, and user experience are not detailed in available sources.

This smfx review notes that while the competitive trading environment emphasis is positive, information gaps limit comprehensive assessment. The lack of specific technical details, user feedback, and platform feature information prevents thorough evaluation. Users cannot fully understand the actual trading experience quality they can expect.

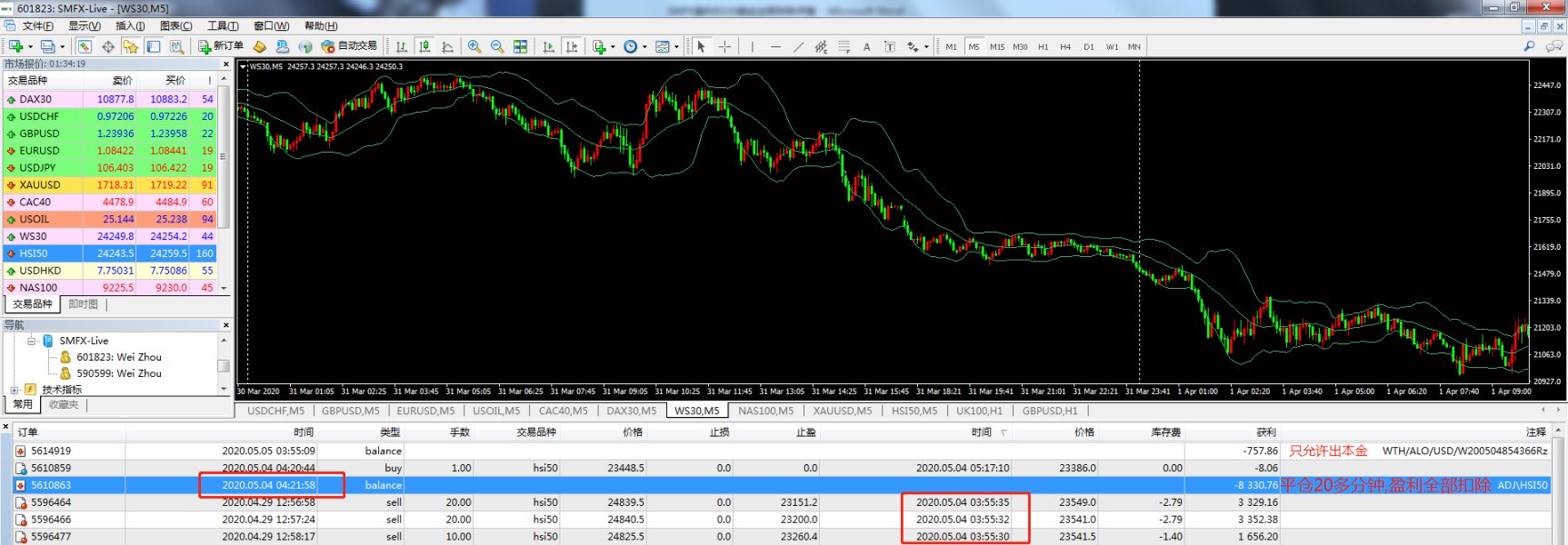

Trust and Reliability Analysis

SMFX operates under regulatory oversight from financial authorities. This provides a foundation for trust and reliability assessment. Regulatory supervision typically involves compliance with financial service standards, client fund protection measures, and operational transparency requirements, though specific details about these protections should be verified directly with the broker.

The presence of regulatory oversight suggests operation within established financial service frameworks. These frameworks generally include requirements for segregated client funds, adequate capitalization, and regular reporting to regulatory authorities. However, specific details about fund protection measures, insurance coverage, or compensation schemes are not detailed in available documentation.

Information about the company's transparency practices is not readily available in accessible sources. Financial reporting, audit procedures, and corporate governance structures are not documented. Additionally, details about the company's track record, any regulatory actions, or industry recognition are not specified in available materials.

While regulatory oversight provides a positive foundation for trust assessment, limited information reduces evaluation comprehensiveness. The absence of specific safety measures, transparency practices, and corporate accountability details impacts the reliability evaluation.

User Experience Analysis

The evaluation of user experience faces significant limitations due to absent user feedback. Interface descriptions and practical usage information are not available in documentation. Without access to user ratings, testimonials, or detailed reviews, it becomes challenging to assess the practical experience that traders encounter when using the platform.

Information about registration processes is not detailed in accessible sources. Account verification procedures, platform navigation, and overall usability are not documented. Additionally, details about the learning curve for new users, platform customization options, and accessibility features are not available for assessment.

The lack of specific information about common user challenges complicates evaluation. Platform limitations and areas for improvement are not documented. Without feedback about deposit and withdrawal experiences, customer service interactions, or platform performance during different market conditions, the assessment remains incomplete.

This limitation highlights the importance of thorough due diligence for potential users. Demo account testing and direct communication with existing users or the broker's support team can help. These steps can provide better understanding of the practical user experience before committing to the platform.

Conclusion

This smfx review presents a measured assessment of SMFX as a trading platform that demonstrates commitment to customer service. The broker provides access to diversified financial instruments. The broker's emphasis on competitive trading environments and market updates suggests recognition of important trader needs, though the evaluation is constrained by limited availability of specific operational details.

SMFX appears most suitable for traders who prioritize customer service quality and seek access to multiple asset classes. The platform particularly benefits those who value regular market updates and support services. However, potential users should conduct additional research to obtain specific information about trading conditions, costs, and platform features that are not readily available in public documentation.

The main strengths identified include the diverse range of tradeable assets and the stated focus on customer service excellence. The primary limitations for evaluation include the absence of detailed trading condition information, user feedback, and specific platform feature descriptions. These are important factors for comprehensive broker assessment.