Regarding the legitimacy of SINO SOUND forex brokers, it provides HKGX and WikiBit, (also has a graphic survey regarding security).

Is SINO SOUND safe?

Software Index

Risk Control

Is SINO SOUND markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

RegulatedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

漢聲集團有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.gold2u.netExpiration Time:

--Address of Licensed Institution:

九龍尖沙咀東加連威老道100號港晶中心811室Phone Number of Licensed Institution:

29029999Licensed Institution Certified Documents:

Is SinoSound A Scam?

Introduction

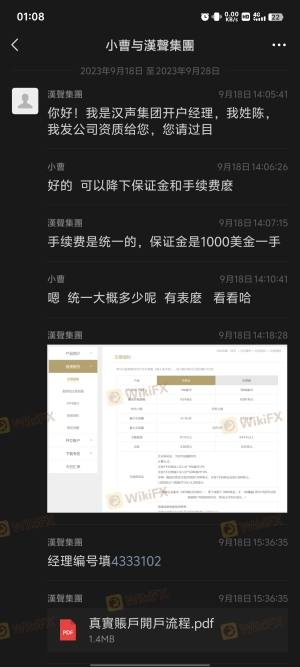

SinoSound, established in 2012 and based in Hong Kong, positions itself as a financial broker specializing in precious metals trading, particularly London gold and silver. As the foreign exchange market continues to expand, traders are increasingly seeking platforms that offer reliable services and security for their investments. However, with the proliferation of online trading platforms, it is crucial for traders to carefully evaluate the legitimacy and credibility of each broker before committing their funds. This article aims to provide a comprehensive assessment of SinoSound, analyzing its regulatory status, company background, trading conditions, client experiences, and overall safety. The evaluation is based on a thorough review of various sources, including user feedback, regulatory information, and industry standards.

Regulation and Legitimacy

The regulation of a financial broker is a critical factor in determining its legitimacy and safety. SinoSound claims to be regulated by the Chinese Gold & Silver Exchange Society (CGSE) under license number 208. This regulatory body is specific to Hong Kong and focuses on the trading of precious metals. While being regulated is a positive indicator, the quality of regulation and the broker's adherence to compliance are equally important.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CGSE | 208 | Hong Kong | Verified |

Despite having a regulatory license, some sources question the effectiveness of CGSE as a regulatory authority. They argue that the oversight may not be as stringent as that of other well-known financial regulators. Furthermore, user feedback has highlighted a concerning trend: multiple complaints regarding withdrawal issues and alleged scams. This raises red flags about SinoSound's operational integrity and adherence to regulatory standards. Traders should exercise caution and conduct thorough research before engaging with this broker.

Company Background Investigation

SinoSound's history dates back to 2012, when it was founded to provide trading services in precious metals. The company operates under the name SinoSound Holdings Ltd. The ownership structure and management team are not extensively documented, which can lead to concerns about transparency. The lack of clear information regarding the company's leadership and their professional backgrounds can make it difficult for potential clients to assess the broker's reliability.

In terms of transparency, SinoSound has a presence in the market, but there are gaps in the information provided to clients. For instance, while the company offers contact details and a physical address, it does not disclose the identities of its key executives or their qualifications. This lack of transparency can deter potential investors who prefer to know the individuals managing their funds. Overall, while SinoSound has been operational for over a decade, the opacity surrounding its management and ownership raises questions about its credibility.

Trading Conditions Analysis

When evaluating a broker, the trading conditions offered, including fees and spreads, play a significant role in determining the overall trading experience. SinoSound provides access to various financial products, including electronic trading for London gold and silver. The platform reportedly offers competitive spreads, with a standard spread of $0.5 for London gold and $0.05 for London silver. However, there are additional costs, including a commission of $50 per lot for transactions.

| Fee Type | SinoSound | Industry Average |

|---|---|---|

| Major Currency Pair Spread | $0.5 | $1.0 |

| Commission Model | $50/lot | $10-30/lot |

| Overnight Interest Range | 2.5% (buy) | 2.0-3.0% |

While the spreads may appear competitive, the commission structure is notably higher than the industry average. This could significantly impact traders, especially those engaging in frequent transactions. Moreover, the presence of various fees, particularly for withdrawals, may create additional barriers for clients seeking to access their funds. Such fee structures warrant careful consideration, as they can affect overall profitability and trading success.

Client Funds Safety

The safety of client funds is paramount in the financial services industry. SinoSound claims to implement several measures to protect client funds, including the use of segregated accounts. This practice ensures that client funds are kept separate from the company's operational funds, providing an additional layer of security. However, the effectiveness of these measures is often contingent on the regulatory environment and the broker's adherence to compliance standards.

Despite these claims, there have been reports of past issues related to fund withdrawals and allegations of fraud. Users have reported difficulties in accessing their funds, raising concerns about the broker's operational integrity. Moreover, the absence of clear investor protection schemes, such as negative balance protection, can further exacerbate the risks associated with trading on this platform.

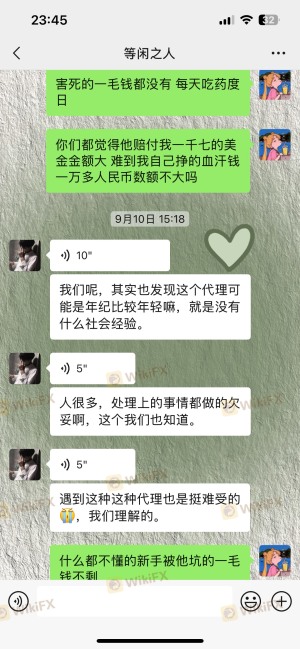

Customer Experience and Complaints

Customer feedback is an essential component in assessing the overall reliability of a trading platform. Reviews of SinoSound reveal a mixed bag of experiences, with some users reporting satisfactory trading conditions and others citing significant issues, particularly concerning withdrawals. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| High Fees | Medium | Average |

| Customer Service Quality | High | Poor |

A few notable cases illustrate the extent of dissatisfaction among users. One trader reported losing a substantial amount of money due to alleged manipulation of their trading account, while another mentioned being unable to withdraw their funds despite multiple requests. These incidents highlight potential operational shortcomings and raise concerns about the company's commitment to customer service.

Platform and Trade Execution

The performance of the trading platform is crucial for a positive trading experience. SinoSound utilizes the widely recognized MetaTrader 4 (MT4) platform, which is known for its user-friendly interface and advanced trading tools. However, user reviews suggest that the platform may experience occasional sluggishness, impacting order execution times.

Additionally, there have been claims of slippage and order rejections, which can significantly affect trading outcomes. Traders should be vigilant and monitor their execution quality closely, as any signs of platform manipulation could pose serious risks to their investments.

Risk Assessment

Engaging with SinoSound involves a range of risks that potential traders must consider. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Concerns regarding the effectiveness of CGSE regulation. |

| Withdrawal Issues | High | Reports of clients being unable to access funds. |

| Transparency | Medium | Lack of information about management and ownership. |

| Platform Performance | Medium | Occasional execution delays and slippage reported. |

To mitigate these risks, traders should conduct thorough due diligence and consider starting with a demo account to familiarize themselves with the platform before committing real funds.

Conclusion and Recommendations

In conclusion, while SinoSound is a regulated broker operating in the precious metals trading space, various concerns regarding its legitimacy and operational practices have emerged. The combination of high fees, withdrawal issues, and a lack of transparency raises red flags for potential investors. Therefore, it is prudent for traders to approach SinoSound with caution.

For those considering trading with SinoSound, it is advisable to start with a small investment and thoroughly monitor the trading conditions and customer service responsiveness. Alternatively, traders may wish to explore other brokers with a more robust regulatory framework and a proven track record of client satisfaction. Some reliable alternatives include brokers with strong reputations and comprehensive regulatory oversight, which can provide a safer trading environment.

Is SINO SOUND a scam, or is it legit?

The latest exposure and evaluation content of SINO SOUND brokers.

SINO SOUND Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SINO SOUND latest industry rating score is 6.76, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.76 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.