Is RCPro safe?

Pros

Cons

Is RCPro A Scam?

Introduction

RCPro, a forex and CFD broker, has garnered attention in the trading community since its inception in 2018. Operating under the ownership of Goldtech Media Services OU, this broker claims to offer a range of trading services across various financial instruments. However, potential investors must exercise caution when evaluating forex brokers like RCPro, as the industry is rife with unregulated entities that can jeopardize traders' investments. This article aims to provide a thorough investigation into the legitimacy of RCPro, assessing its regulatory compliance, company background, trading conditions, and customer experiences. Our analysis is based on a review of multiple credible sources and regulatory databases to ensure a balanced and informed perspective.

Regulation and Legitimacy

The regulatory status of a forex broker is crucial for ensuring the safety of clients' funds and the integrity of trading practices. Unfortunately, RCPro operates without any regulation, which raises significant red flags for potential investors. Below is a summary of the regulatory information concerning RCPro:

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Regulated |

The absence of a regulatory license means that RCPro is not subject to the oversight of any financial authority, which is a critical factor for traders. Reputable regulatory bodies such as the FCA in the UK or ASIC in Australia enforce strict guidelines that protect clients' investments, including fund segregation and negative balance protection. RCPro's lack of regulation indicates that it does not adhere to these standards, making it a risky choice for traders. Furthermore, the broker has been associated with previous entities that were blacklisted for fraudulent activities, further casting doubt on its legitimacy. The Estonian Financial Supervisory Authority has also issued warnings against Goldtech Media Services OU, the parent company of RCPro, stating that it does not hold the necessary licenses to operate in Estonia.

Company Background Investigation

RCPro is owned and operated by Goldtech Media Services OU, incorporated in Tallinn, Estonia. While the company has been in operation since 2018, its history is marred by a lack of transparency and regulatory compliance. The management team behind RCPro is not well-documented, and there is limited information available regarding their professional backgrounds and expertise in the financial services sector. This lack of transparency raises concerns about the broker's reliability and the experience of those managing client funds.

Furthermore, the company's website does not provide sufficient information about its ownership structure or the individuals behind its operations. This opacity is a common trait among unregulated brokers, as they often seek to obscure their identities to avoid accountability. The absence of clear communication and information disclosure is a significant concern for potential investors, as it complicates efforts to assess the broker's credibility and trustworthiness.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions is essential for assessing potential costs and overall value. RCPro presents itself as an attractive option with competitive leverage and a variety of trading instruments. However, the overall fee structure raises some concerns. Below is a comparison of key trading costs associated with RCPro:

| Fee Type | RCPro | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 3.2 pips | 1.0 - 1.5 pips |

| Commission Structure | None | Varies |

| Overnight Interest Range | N/A | Varies |

RCPro offers fixed spreads starting at 3.2 pips for major currency pairs, which is significantly higher than the industry average. This elevated cost can erode potential profits for traders, especially for those engaging in high-frequency trading. Additionally, the absence of a commission structure may seem appealing, but it often indicates that the broker compensates for this through wider spreads. Traders should be wary of such practices, as they can lead to unexpected costs.

Moreover, RCPro does not provide clear information regarding overnight interest rates, which can further complicate the cost assessment for traders who hold positions overnight. Understanding these costs is crucial for effective trading strategy development, and the lack of transparency in this area is concerning.

Client Fund Safety

The safety of client funds is a paramount concern when choosing a forex broker. RCPro's lack of regulation raises significant questions about its fund protection measures. Unlike regulated brokers, which are required to maintain segregated accounts and provide investor compensation schemes, RCPro does not offer such assurances. This means that clients' funds could be at risk in the event of financial instability or insolvency.

Furthermore, there is no indication that RCPro provides negative balance protection, which is a crucial safety feature that prevents clients from losing more money than they have deposited. The absence of these protective measures can leave traders vulnerable to significant losses, especially in the volatile forex market. Historical data suggests that unregulated brokers like RCPro often face issues related to fund security, including delayed withdrawals and outright refusal to release funds.

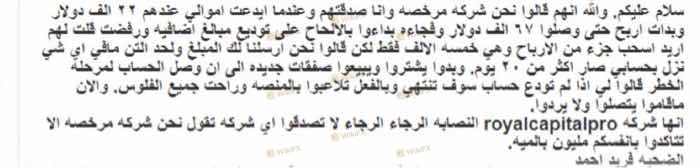

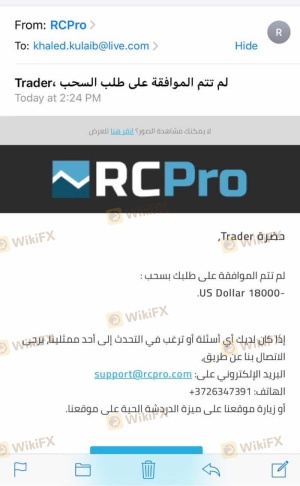

Customer Experience and Complaints

Customer feedback is an essential aspect of assessing a broker's reliability. Reviews of RCPro reveal a mixed bag of experiences, with numerous complaints highlighting issues related to fund withdrawals and customer support. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Account Blocking | High | Poor |

| Poor Customer Support | Medium | Fair |

Many users have reported difficulties in withdrawing funds, with some experiencing significant delays or even complete account blocking. In one case, a trader reported that after initially investing, they were unable to access their funds for months, leading to frustration and financial strain. The company's response to these complaints has often been inadequate, with many users feeling ignored or dismissed.

Another common issue involves the quality of customer support, which has been described as lacking in responsiveness and effectiveness. Traders have expressed concerns about the difficulty in reaching support representatives and receiving timely assistance. These patterns of complaints raise serious concerns about the overall customer experience and the broker's commitment to addressing client issues.

Platform and Trade Execution

The trading platform is a critical component of the trading experience, and RCPro utilizes the widely recognized MetaTrader 4 (MT4) platform. MT4 is known for its robust features and user-friendly interface, making it a popular choice among traders. However, there are concerns regarding the execution quality on RCPro's platform. Reports of slippage and order rejections have surfaced, with some traders experiencing issues during high volatility periods.

While MT4 itself is a reliable platform, the overall performance can be affected by the broker's infrastructure. Any signs of platform manipulation or poor execution can severely impact traders' profitability and overall trading experience. Additionally, the lack of transparency regarding order execution practices raises further concerns about the integrity of the trading environment.

Risk Assessment

Trading with RCPro presents several inherent risks, primarily due to its unregulated status and the associated lack of investor protections. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Safety | High | Lack of fund protection |

| Withdrawal Issues | High | Delays and refusals |

| Customer Support | Medium | Poor responsiveness |

The high regulatory risk associated with trading through RCPro is particularly alarming, as it exposes traders to potential financial losses without any recourse. Given the broker's history and the complaints lodged by traders, the risk of encountering withdrawal issues is also significant. To mitigate these risks, potential clients should consider trading with well-regulated brokers that offer robust investor protections and transparent trading conditions.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that RCPro is not a safe option for traders. The lack of regulation, poor customer feedback, and numerous complaints regarding fund safety and withdrawal issues are significant red flags. Traders should exercise extreme caution when considering this broker, as the risks associated with investing through RCPro far outweigh any potential benefits.

For those seeking reliable trading options, it is advisable to consider alternative brokers that are well-regulated and offer transparent trading conditions. Brokers regulated by reputable authorities such as the FCA or ASIC provide a safer trading environment, ensuring that clients' funds are protected and that their trading experience is supported by responsive customer service. By choosing a reputable broker, traders can significantly mitigate the risks associated with forex trading and enhance their overall trading experience.

Is RCPro a scam, or is it legit?

The latest exposure and evaluation content of RCPro brokers.

RCPro Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

RCPro latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.