Regarding the legitimacy of Darwinex forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is Darwinex safe?

Pros

Cons

Is Darwinex markets regulated?

The regulatory license is the strongest proof.

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

TRADESLIDE TRADING TECH LTD

Effective Date: Change Record

2013-07-15Email Address of Licensed Institution:

compliance@darwinex.comSharing Status:

No SharingWebsite of Licensed Institution:

www.darwinex.comExpiration Time:

--Address of Licensed Institution:

Level39 Ltd 1 Canada Square London Tower Hamlets E14 5AA UNITED KINGDOMPhone Number of Licensed Institution:

+442037691554Licensed Institution Certified Documents:

Is Darwinex A Scam?

Introduction

Darwinex, established in 2012, positions itself as a unique player in the forex market by connecting traders with investors. The platform allows traders to develop and share their trading strategies, known as "Darwins," which investors can then buy into, creating a symbiotic relationship between the two parties. With the rise of online trading, it is crucial for traders to carefully evaluate forex brokers to ensure their safety and reliability. This article aims to provide a comprehensive analysis of Darwinex, examining its regulatory status, company background, trading conditions, customer experiences, and overall safety measures. The assessment is based on a thorough review of various sources, including regulatory information, customer feedback, and expert analyses.

Regulation and Legitimacy

The regulatory framework is one of the most critical factors in evaluating a forex broker's legitimacy. Darwinex is regulated by the UK's Financial Conduct Authority (FCA), one of the top-tier regulatory bodies globally, as well as the Comisión Nacional del Mercado de Valores (CNMV) in Spain. This regulation ensures that Darwinex adheres to strict financial standards, providing a level of security for traders' funds.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 586466 | United Kingdom | Verified |

| CNMV | 311 | Spain | Verified |

| FSA | 8433817-1 | Seychelles | Verified |

The FCA requires brokers to maintain segregated accounts for client funds, ensuring that traders' money is not used for the broker's operational expenses. Additionally, clients are covered by the Financial Services Compensation Scheme (FSCS), which protects deposits up to £85,000 in case of broker insolvency. This high level of regulatory oversight significantly reduces the risk of fraud and mismanagement, establishing Darwinex as a trustworthy broker.

Company Background Investigation

Darwinex was founded as Tradeslide Trading Tech Limited and has grown into a recognized broker with a focus on technology and innovation. The company is headquartered in London, with a significant presence in Spain. The management team consists of experienced professionals from the finance and technology sectors, which enhances the broker's credibility.

The firm emphasizes transparency and information disclosure, regularly updating its clients on changes in trading conditions, fees, and regulatory developments. This level of openness is crucial for building trust with clients and maintaining a positive reputation in the competitive forex market.

Trading Conditions Analysis

Darwinex offers a competitive trading environment, with a fee structure that includes spreads and commissions. The broker employs a commission-based model on top of spreads, which can be appealing for active traders. However, it is essential to understand the full cost of trading to avoid unexpected expenses.

| Fee Type | Darwinex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.3 pips | 0.7 pips |

| Commission Model | $2.5 per lot | $3.0 per lot |

| Overnight Interest Range | Variable | Variable |

Darwinex's spreads are competitive, particularly for major currency pairs. However, traders should be aware of the commission structure, which can add to the overall trading costs. Additionally, while the broker does not charge for deposits, withdrawals may incur fees depending on the method used. This complexity in the fee structure can be a concern for some traders, especially those who are not familiar with commission-based trading.

Customer Funds Safety

The safety of customer funds is paramount when choosing a forex broker. Darwinex employs several measures to ensure the security of client deposits. All client funds are held in segregated accounts, which means they are kept separate from the broker's operating funds. This practice protects traders' money in the event of financial difficulties faced by the broker.

Furthermore, Darwinex offers negative balance protection, ensuring that clients cannot lose more than their initial investment. This feature is particularly beneficial in volatile market conditions, where rapid price changes can lead to significant losses.

Historically, Darwinex has not faced any major controversies regarding fund safety, which is a positive indicator of its operational integrity. The combination of regulatory oversight, fund segregation, and negative balance protection positions Darwinex as a secure option for traders.

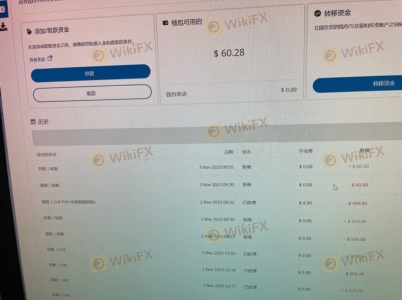

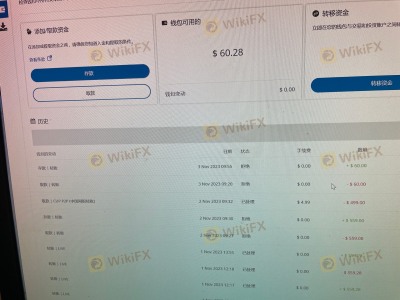

Customer Experience and Complaints

Customer feedback is a vital aspect of evaluating a broker's reliability. Overall, Darwinex has received a mix of positive and negative reviews from its clients. Many users appreciate the innovative features of the platform and the ability to invest in traders' strategies. However, some common complaints include issues with withdrawal processing times and the high minimum deposit requirement.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Addressed |

| High Minimum Deposit | Low | Acknowledged |

| Platform Complexity | Moderate | Improvements ongoing |

For instance, one user reported delays in receiving their withdrawal, which raised concerns about the broker's operational efficiency. While the company has addressed these issues, it highlights the need for potential clients to consider their withdrawal experiences when choosing a broker.

Platform and Trade Execution

Darwinex provides access to the widely used MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, both of which are known for their reliability and advanced features. The platforms offer a user-friendly interface, extensive charting tools, and support for automated trading strategies.

In terms of order execution, Darwinex boasts fast execution speeds and competitive slippage rates, allowing traders to capitalize on market movements effectively. However, there have been isolated reports of order rejections, which can be concerning for high-frequency traders. Overall, the execution quality is generally considered satisfactory, but traders should remain vigilant.

Risk Assessment

Evaluating the risks associated with using Darwinex is essential for informed decision-making. While the broker is well-regulated and offers several safety measures, there are inherent risks in forex trading that should not be overlooked.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Low | Strong regulatory oversight. |

| Operational Risk | Medium | Potential delays in withdrawals. |

| Market Risk | High | Volatility in forex markets. |

To mitigate these risks, traders should practice sound risk management strategies, including setting stop-loss orders and diversifying their portfolios. Additionally, conducting thorough research and staying informed about market conditions can help traders navigate the inherent risks of forex trading.

Conclusion and Recommendations

In conclusion, Darwinex is a legitimate forex broker that operates under strict regulatory oversight, providing a secure trading environment for its clients. While there are no significant signs of fraud, potential clients should be aware of certain aspects, such as the high minimum deposit and occasional withdrawal delays.

For experienced traders looking for innovative trading solutions and the ability to invest in strategies, Darwinex presents a compelling option. However, beginners may find the broker's offerings somewhat challenging due to limited educational resources and the higher entry cost.

If you are considering alternatives, brokers such as IG, OANDA, or Forex.com may provide more comprehensive educational support and lower minimum deposit requirements, making them suitable options for novice traders. Ultimately, it is essential to evaluate your trading needs and preferences before selecting a broker.

Is Darwinex a scam, or is it legit?

The latest exposure and evaluation content of Darwinex brokers.

Darwinex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Darwinex latest industry rating score is 7.26, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.26 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.