Investous 2025 Review: Everything You Need to Know

Executive Summary

Investous is a CFD trading broker that has caught attention in the forex market. However, this attention has not been positive. This Investous review shows a complex picture of a broker that offers access to over 270 financial instruments across four asset classes, but the company has faced big challenges with user satisfaction and being open about its operations.

The broker says it is a member of the Financial Commission. This gives an Investor Compensation Fund up to €20,000. However, many sources including Trustpilot show that user feedback has been mostly negative, with the platform getting a worrying 1.5/5 rating. The broker offers CFD trading across forex, stocks, indices, and commodities for investors who want diverse trading opportunities.

Recent news suggests big operational problems. Reports show that the company's website has closed and new reviews are no longer possible on major review platforms. This raises important questions about the broker's current status and whether it will survive for potential traders.

Important Disclaimers

The regulatory status of Investous may change by region. Potential users should check the broker's licensing and authorization in their specific area before doing any trading activities. The broker operates under Financial Commission membership, though specific regulatory details may differ across territories.

This review uses publicly available information and user feedback collected from various sources up to 2025. The analysis aims to give an objective assessment of Investous's services, though readers should do their own research and consider multiple sources when evaluating any financial service provider.

Rating Framework

Broker Overview

Investous works as an online CFD trading broker. The company focuses mainly on giving access to a diverse range of financial instruments through its trading platform. The broker's business model centers around Contract for Difference trading, which lets clients guess on price movements without owning the actual assets. The company has positioned itself within the competitive online trading space by focusing on its broad asset coverage and regulatory compliance.

The broker's asset offerings cover four major categories: forex, stocks, indices, and commodities. Traders can access over 270 different financial instruments through the platform. This wide range suggests an attempt to serve diverse trading preferences and strategies, from currency speculation to equity and commodity trading.

Investous operates under the oversight of the Financial Commission. This provides regulatory compliance and offers an Investor Compensation Fund with coverage up to €20,000. However, the specific establishment date and detailed company background information are not clearly documented in available source materials, which raises questions about transparency.

Regulatory Framework: Investous operates as a member of the Financial Commission. This provides regulatory oversight and establishes the Investor Compensation Fund framework. This membership requires following specific operational standards and client protection measures.

Asset Coverage: The broker offers access to over 270 financial instruments spread across four primary asset classes. This includes major and minor currency pairs in the forex market, individual stocks from various global exchanges, major stock indices, and commodity CFDs covering precious metals, energy, and agricultural products.

Compensation Protection: Through Financial Commission membership, clients benefit from an Investor Compensation Fund. This provides coverage up to €20,000, offering some level of protection for trader funds in specific circumstances.

Operational Concerns: Recent information suggests big operational challenges. Reports indicate website closure and inability to accept new reviews on major platforms. These developments raise important questions about the broker's current operational status and future viability.

Geographic Considerations: While the broker operates internationally, specific regional restrictions and licensing arrangements are not clearly detailed. Potential clients must verify local regulatory compliance independently.

Account Conditions Analysis

The specific details about Investous's account conditions remain largely undocumented in available source materials. This presents a significant transparency concern for potential traders. Traditional account analysis would typically cover minimum deposit requirements, account types, leverage options, and fee structures, but this Investous review finds limited concrete information in these areas.

Potential clients face uncertainty about the practical aspects of beginning their trading relationship with the broker. Without clear documentation of account opening requirements, minimum funding thresholds, or tiered account structures, traders cannot make informed decisions. This lack of readily available information contrasts sharply with industry standards, where reputable brokers typically provide comprehensive account specifications.

The absence of detailed fee schedules makes it difficult for traders to assess the total cost of trading with Investous. This includes spreads, commissions, overnight financing costs, and withdrawal fees. This opacity in pricing structure represents a significant disadvantage when compared to more transparent competitors in the market.

Leverage ratios and margin requirements are crucial factors in CFD trading, but they are not clearly specified in available documentation. Given the regulatory variations across different jurisdictions, this information gap becomes even more problematic for international traders seeking to understand their potential exposure and capital requirements.

Investous shows strength in its breadth of available trading instruments. The broker offers access to over 270 financial assets across four distinct categories. This extensive selection provides traders with significant diversification opportunities, spanning major and exotic currency pairs, international equities, global indices, and various commodity markets including precious metals and energy products.

The forex selection appears to cover major pairs like EUR/USD, GBP/USD, and USD/JPY. It also includes minor and exotic currency combinations. For equity traders, the platform provides access to stocks from multiple international exchanges, allowing for geographic diversification within equity portfolios. The indices offering likely includes major benchmarks such as the S&P 500, FTSE 100, and DAX, providing broad market exposure opportunities.

Commodity trading options include traditional assets like gold, silver, oil, and agricultural products. This enables traders to diversify beyond traditional financial markets. This comprehensive asset coverage positions Investous competitively in terms of trading variety, particularly for traders seeking one-stop access to multiple market sectors.

However, the analysis reveals significant gaps in information about research tools, market analysis resources, educational materials, and automated trading support. The absence of detailed information about charting capabilities, technical indicators, economic calendars, or market commentary represents a notable limitation in the overall service offering evaluation.

Customer Service and Support Analysis

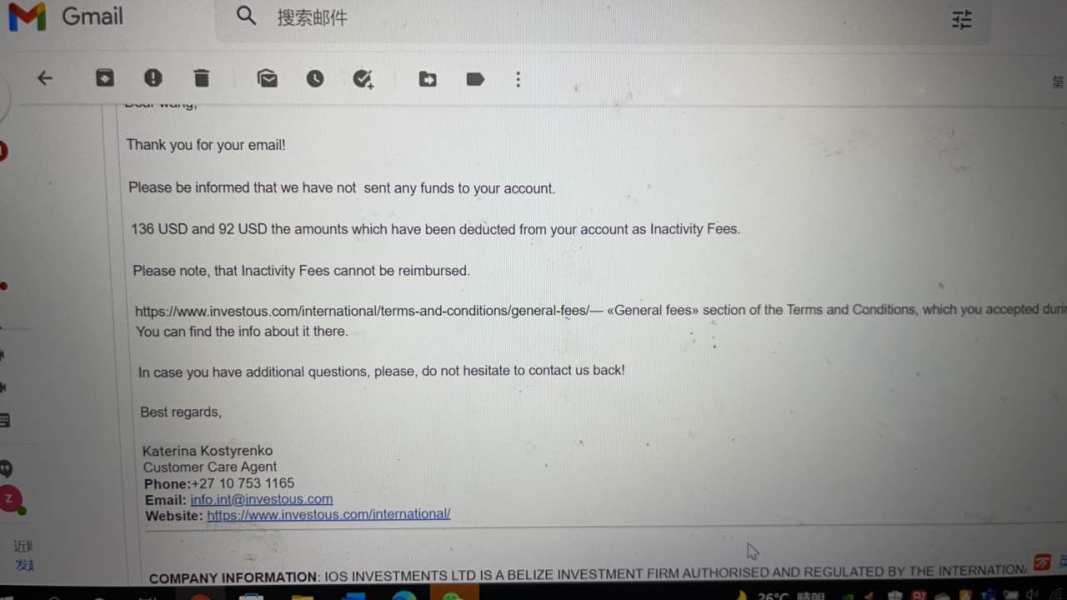

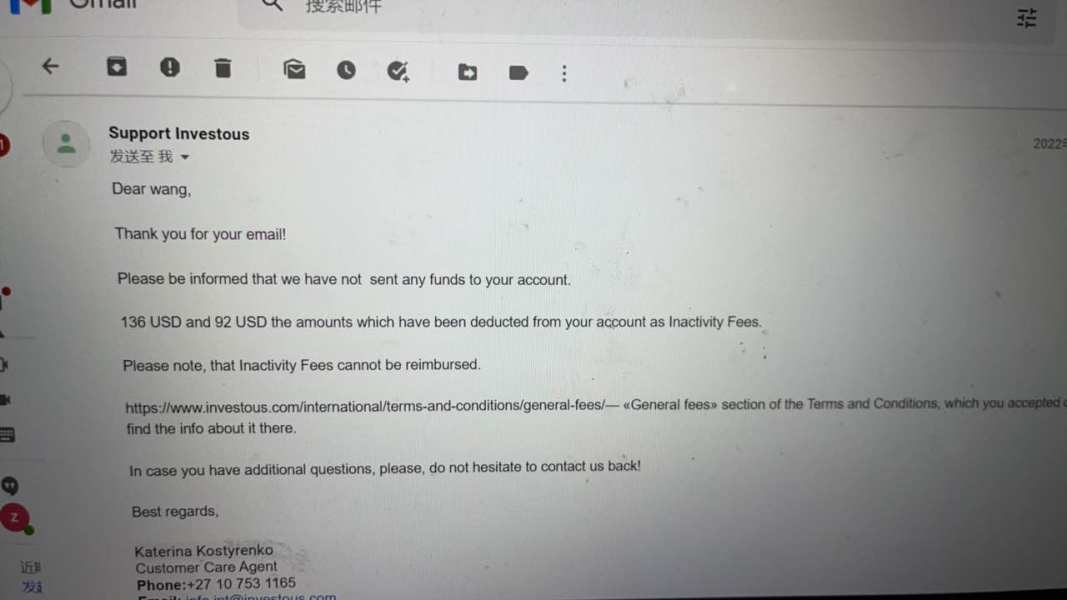

Customer service represents one of Investous's most significant weaknesses. This is evidenced by consistently poor user feedback across multiple review platforms. According to Trustpilot data, the broker maintains a concerning 1.5/5 rating, with the platform categorizing the overall user experience as "poor." This rating reflects substantial dissatisfaction among actual users of the service.

The negative feedback pattern suggests systemic issues with customer support responsiveness and problem resolution capabilities. While specific details about support channels, response times, and multilingual capabilities are not clearly documented in available materials, the consistently poor user ratings indicate fundamental deficiencies in customer care delivery. The severity of customer service issues appears to extend beyond typical trading support, with reports suggesting difficulties in fundamental areas such as account management, withdrawal processing, and dispute resolution.

These concerns are particularly troubling in the financial services sector. Reliable customer support is essential for addressing time-sensitive trading and account issues. The absence of detailed information about support infrastructure, including available contact methods, operating hours, and specialized support teams, further compounds concerns about the broker's commitment to customer service excellence.

For traders considering Investous, the poor customer service track record represents a significant risk factor. This could impact their overall trading experience.

Trading Experience Analysis

The evaluation of Investous's trading experience faces significant limitations. This is due to insufficient information about platform specifications, execution quality, and technical performance metrics. Available source materials do not provide detailed insights into crucial aspects such as platform stability, order execution speeds, slippage rates, or system uptime statistics.

Platform selection information is notably absent. This leaves potential traders uncertain about whether Investous offers popular trading platforms like MetaTrader 4 or MetaTrader 5, or operates through proprietary software solutions. This information gap makes it difficult to assess compatibility with existing trading strategies, expert advisors, or technical analysis workflows that traders may have developed on other platforms.

Order execution quality remains undocumented in available materials. This includes execution speeds, requote frequency, and price accuracy. These factors are crucial for active traders, particularly those using scalping strategies or trading during high-volatility market conditions where execution precision significantly impacts profitability.

Mobile trading capabilities have become essential in modern forex trading, but they are not specifically addressed in available documentation. With the increasing importance of mobile accessibility for position monitoring and trade management, this information gap represents a significant evaluation limitation for this Investous review. The absence of detailed technical specifications, system requirements, and performance benchmarks makes it challenging for potential users to assess whether the trading environment meets their specific needs and expectations.

Trust and Reliability Analysis

Trust and reliability concerns represent perhaps the most significant red flags in this Investous evaluation. The broker maintains membership in the Financial Commission and offers investor compensation up to €20,000, but multiple concerning indicators suggest substantial reliability issues that potential traders should carefully consider.

The consistently poor user ratings, particularly the 1.5/5 Trustpilot score, indicate widespread user dissatisfaction. This extends beyond typical service complaints. Such severely negative feedback patterns often reflect fundamental operational issues, including problems with fund handling, withdrawal processing, or trading execution that directly impact trader profitability and security.

Reports of website closure and the inability to accept new reviews on major platforms raise serious questions about operational continuity and business stability. These developments suggest potential business model difficulties or regulatory challenges that could affect existing and future client relationships. The presence of regulatory warnings adds another layer of concern regarding the broker's compliance status and operational legitimacy.

Such warnings typically indicate regulatory scrutiny or identified violations that could impact the broker's ability to serve clients effectively. The combination of poor user feedback, operational disruptions, and regulatory concerns creates a risk profile that significantly exceeds acceptable levels for most prudent traders, particularly those prioritizing capital security and reliable service delivery.

User Experience Analysis

User experience analysis for Investous reveals mostly negative feedback. The 1.5/5 Trustpilot rating serves as a clear indicator of widespread user dissatisfaction. This severely low rating suggests that the majority of users who took time to review their experience encountered significant problems that substantially impacted their trading activities.

The poor user satisfaction scores likely reflect multiple operational deficiencies. These include difficulties with account management, trading platform functionality, customer service responsiveness, and potentially fund withdrawal processes. Such consistently negative feedback patterns indicate systemic issues rather than isolated incidents or minor service disruptions.

The inability to leave new reviews on major platforms due to website closure suggests that current user experience may be even more problematic. Potential service disruptions are affecting existing clients. This development raises serious concerns about business continuity and the broker's ability to maintain normal operations for current account holders.

Common user complaints, based on the overall negative feedback pattern, likely include poor customer service response and technical platform issues. They also include withdrawal difficulties and general operational reliability problems. These issues collectively create a user experience that falls well below industry standards and trader expectations.

For potential traders considering Investous, the overwhelmingly negative user experience feedback should serve as a significant warning signal. This suggests high probability of encountering similar problems that could impact both trading success and capital security.

Conclusion

This comprehensive Investous review reveals a broker that offers access to over 270 financial instruments across multiple asset classes and maintains Financial Commission membership. However, the company faces substantial operational and reputational challenges that significantly impact its viability as a trading partner.

The broker's extensive asset coverage and investor compensation fund provide some positive elements. These advantages are overshadowed by consistently poor user feedback, operational disruptions including reported website closure, and concerning transparency gaps in crucial areas such as account conditions and platform specifications. The combination of severely negative user ratings, regulatory warnings, and operational uncertainty creates a risk profile that exceeds acceptable levels for most traders.

Potential clients seeking reliable CFD trading services would be well-advised to consider alternative brokers. They should look for companies with stronger track records in customer satisfaction, operational transparency, and business stability.