Is GDL safe?

Pros

Cons

Is GDL Safe or Scam?

Introduction

GDL is a forex broker that has emerged in the competitive landscape of online trading. Based in Nigeria, GDL offers a variety of trading services, including forex, CFDs, and commodities. However, the influx of unregulated brokers in the forex market necessitates a cautious approach from traders. Many brokers operate without proper oversight, which can lead to significant risks for traders, including the potential loss of funds. This article aims to provide a comprehensive analysis of GDL by examining its regulatory status, company background, trading conditions, customer safety measures, client experiences, platform performance, and overall risk assessment. Our investigation is based on a review of multiple sources, including expert analyses and user feedback, to determine whether GDL is safe or potentially a scam.

Regulation and Legitimacy

The regulatory status of a forex broker is crucial as it provides a layer of protection for traders. GDL currently operates without any valid regulatory oversight, which raises significant concerns regarding its legitimacy. Below is a summary of GDLs regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Nigeria | Unregulated |

The absence of a regulatory license means that GDL is not subject to the stringent rules and oversight that regulated brokers must adhere to. This lack of governance can result in high risks for traders, including the potential for fraud or mismanagement of funds. Furthermore, historical compliance issues associated with brokers in similar jurisdictions often indicate a pattern of negligence towards client protection. Therefore, the question of is GDL safe is complicated by its unregulated status, making it imperative for potential clients to approach with caution.

Company Background Investigation

GDL was established in 2015 and has since positioned itself as a player in the forex trading market. However, its relatively short history raises questions about its stability and reliability. The ownership structure of GDL is not transparently disclosed, which further complicates the assessment of its trustworthiness.

The management team‘s background is also unclear, with limited information available regarding their professional experience and qualifications in the financial sector. This lack of transparency can be a red flag for potential clients, as a competent and experienced management team is often indicative of a broker’s reliability. A broker that fails to provide clear information about its operations and management may not prioritize the interests of its clients.

In terms of transparency, GDL has not demonstrated a commitment to open communication with its clients. The limited availability of information regarding its ownership and management raises concerns about its operational integrity. Thus, traders must question whether is GDL safe given the obscurity surrounding its corporate structure.

Trading Conditions Analysis

GDL offers a variety of trading conditions, but the absence of regulatory oversight raises concerns about the fairness of these conditions. The broker's fee structure, while not explicitly detailed on its website, has been reported to include hidden charges that could affect overall trading costs. Below is a comparison of core trading costs associated with GDL:

| Fee Type | GDL | Industry Average |

|---|---|---|

| Spread on Major Pairs | High | Medium |

| Commission Model | High | Low |

| Overnight Interest Range | Variable | Standard |

The potential for high spreads and commissions can significantly impact a traders profitability. Moreover, any unusual fees or conditions might suggest that the broker is not operating in the best interests of its clients. Traders should be wary of such practices and consider whether is GDL safe given its potentially unfavorable trading conditions.

Customer Funds Safety

The safety of customer funds is paramount when selecting a forex broker. GDL's lack of regulatory oversight means that it is not required to implement strict measures for fund security. Reports indicate that GDL does not offer adequate segregation of client funds, which is a critical safety measure that protects traders' capital in case of broker insolvency.

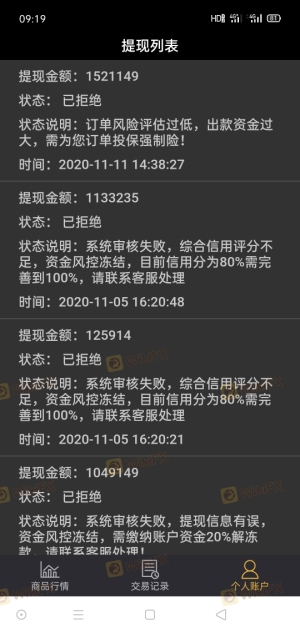

Furthermore, there is no evidence of investor protection policies, such as negative balance protection, which would shield clients from losing more than they deposit. Historical complaints from users have highlighted issues regarding fund withdrawals, suggesting that GDL may not prioritize the safety of its clients investments. Therefore, evaluating whether is GDL safe must include a serious consideration of its inadequate safety measures for customer funds.

Customer Experience and Complaints

Customer feedback is essential in assessing a broker's reliability. Reviews for GDL have been mixed, with several users reporting negative experiences, particularly concerning fund withdrawals and customer service responsiveness. Common complaints include difficulties in retrieving funds, lack of communication from the support team, and high-pressure sales tactics. Below is a summary of major complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Poor |

| Transparency Concerns | High | Poor |

For instance, one user reported being unable to withdraw their funds after multiple requests, leading to frustration and distrust towards the broker. Such complaints indicate a potential pattern of behavior that could jeopardize clients investments. Consequently, the question of is GDL safe is further complicated by the negative feedback from clients regarding their experiences.

Platform and Execution

The trading platform offered by GDL is another critical aspect to consider. Reviews suggest that the platform experiences frequent downtimes and issues with order execution. Traders have reported instances of slippage during high volatility, which can result in significant financial losses. Moreover, there are concerns about the broker's execution quality, with some users claiming that their orders were manipulated or delayed.

The performance and reliability of a trading platform are crucial for effective trading, and any signs of manipulation can severely undermine a trader's confidence in the broker. Thus, evaluating whether is GDL safe involves scrutinizing the platforms reliability and execution quality.

Risk Assessment

The overall risk associated with trading through GDL can be categorized into several areas. Below is a summary of key risk factors:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Lack of fund protection measures |

| Operational Risk | Medium | Platform reliability issues |

| Customer Service Risk | High | Poor responsiveness and support |

Given these risk factors, it is evident that trading with GDL carries significant risks. Potential clients should consider implementing risk mitigation strategies, such as limiting their initial investment and thoroughly researching the brokers practices before committing larger sums.

Conclusion and Recommendations

In conclusion, the evidence suggests that GDL poses several risks that potential traders should carefully consider. The absence of regulatory oversight, coupled with numerous complaints regarding fund withdrawals and customer service, raises serious concerns about the broker's legitimacy. Therefore, the question of is GDL safe must be answered with caution.

For traders seeking reliable alternatives, it may be prudent to consider brokers that are regulated by reputable authorities, such as the FCA or ASIC. These brokers typically offer better protection for client funds and more transparent trading conditions. Ultimately, traders must conduct thorough due diligence before engaging with any broker to ensure their investments are secure.

Is GDL a scam, or is it legit?

The latest exposure and evaluation content of GDL brokers.

GDL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GDL latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.