RCPro Review 2

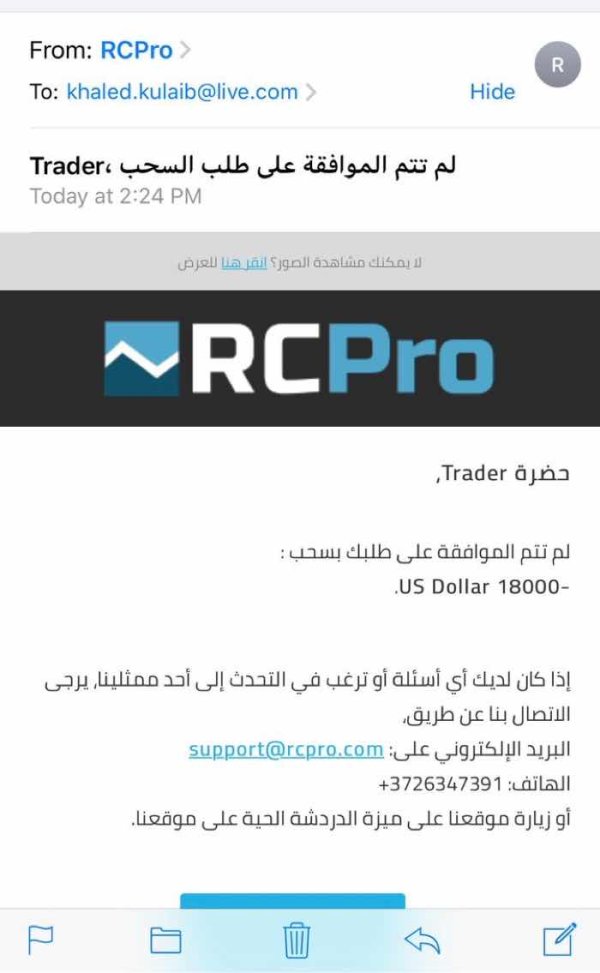

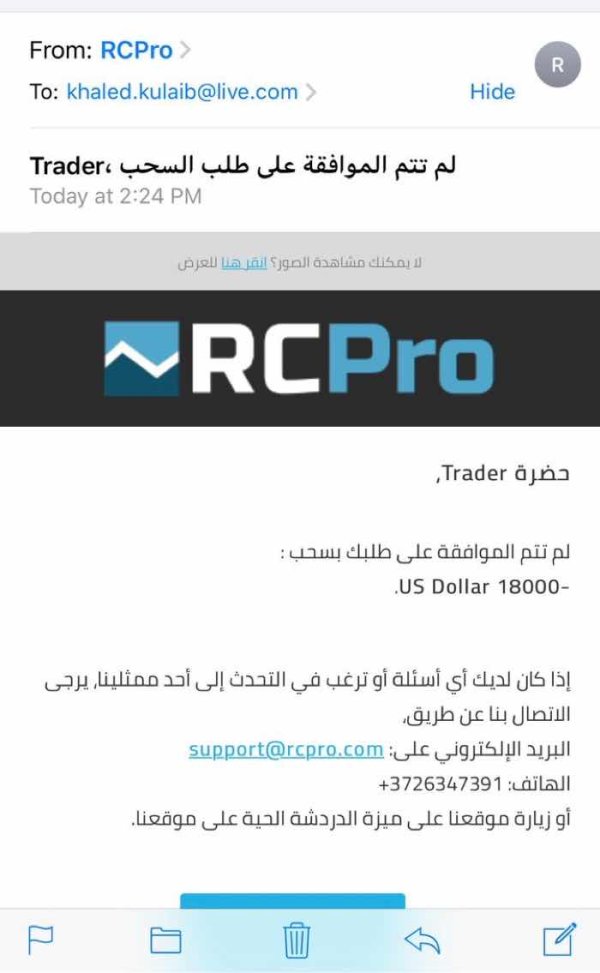

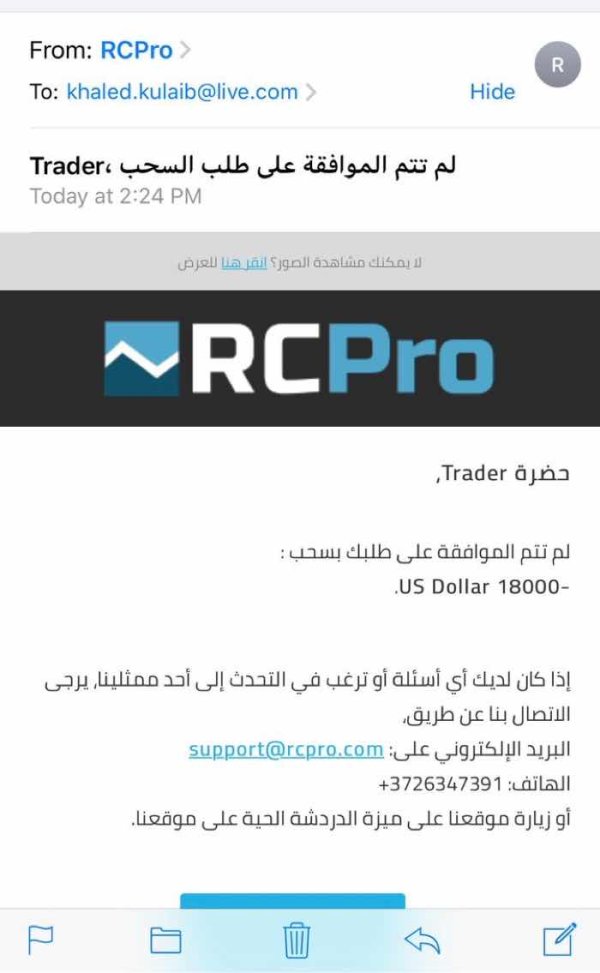

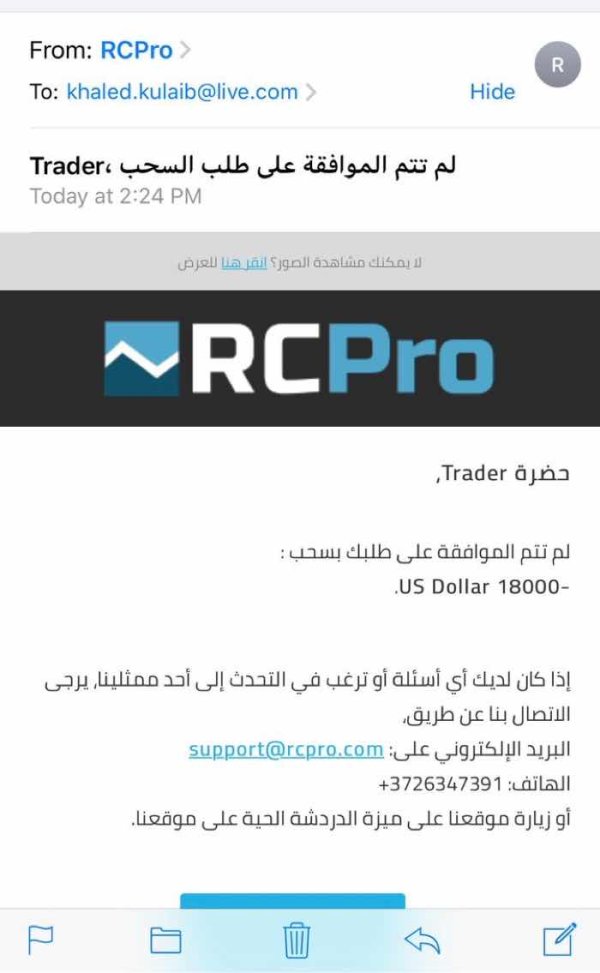

I deposited $22,000 and profited $67,000.The company refused my request(only £5,000).Even the request was successfully passes,the fund wouldn’t be process to the account.It’s their trick.

The request for withdrawal is refused。

RCPro Forex Broker provides real users with * positive reviews, * neutral reviews and 2 exposure review!

I deposited $22,000 and profited $67,000.The company refused my request(only £5,000).Even the request was successfully passes,the fund wouldn’t be process to the account.It’s their trick.

The request for withdrawal is refused。

RCPro used to be called Royal Capital Pro. This forex broker started in 2016 and has its main office in Estonia. This Rcpro review shows a broker that has both good customer feedback and serious trust problems because it has no regulation. The company requires traders to deposit at least $10,000 USD, which is a lot of money. They also offer leverage up to 1:200, which means they mainly work with traders who have plenty of money to invest.

The broker creates an interesting puzzle in the forex world. All customers on Endorsal recommend the platform, which shows that users are happy with some parts of the service. However, the broker has no regulatory oversight, which creates big concerns for people who might want to invest. Trustpilot reviews give it 3 out of 5 stars, showing that users have mixed experiences with different parts of the service.

RCPro seems to target experienced traders who have a lot of money. The high minimum deposit requirement makes this clear. The platform focuses mainly on forex trading services, but we don't have many details about what trading tools and platform features they offer. This Rcpro review wants to give you complete information based on user feedback and market data so you can decide if this broker fits your trading needs.

Regional Entity Differences: RCPro works as an unregulated forex broker. This means no recognized financial authority watches over what they do. Traders need to know about the risks that come with unregulated brokers, including limited legal options and less protection for their money.

Review Methodology: This review uses available user feedback, public information, and market data. RCPro has limited regulatory transparency and documentation, so this review might not cover everything about how the broker works. You should do more research and think about getting professional financial advice before making trading decisions.

| Criteria | Score | Rating |

|---|---|---|

| Account Conditions | 7/10 | Good |

| Tools and Resources | 5/10 | Average |

| Customer Service | 6/10 | Above Average |

| Trading Experience | 6/10 | Above Average |

| Trust and Reliability | 3/10 | Below Average |

| User Experience | 5/10 | Average |

RCPro started in the forex market in 2016 with the name Royal Capital Pro. The company set up its main office in Estonia. The broker says it specializes in forex and wants to give traders competitive environments for currency trading. Even though it started recently, RCPro has built a customer base that seems mostly happy with the main trading services, as shown by the 100% recommendation rate on the Endorsal platform.

The broker focuses mainly on forex trading services. They work with traders who like currency markets more than different types of assets. RCPro seems to target more experienced traders instead of beginners, which you can see from their high minimum deposit requirement of $10,000. This approach suggests the broker wants to work with clients who have both experience and a lot of money to invest.

RCPro operates from Estonia without oversight from major financial authorities. This Rcpro review finds that while the company keeps running and serves clients around the world, the lack of regulatory supervision is something potential traders need to think about carefully. The broker has been in the market since 2016, which shows some stability, but this cannot replace formal regulatory protection.

Regulatory Status: RCPro works without regulation from any recognized financial authority. This means traders have limited legal protection and fewer options compared to brokers watched by established regulators like the FCA, ASIC, or CySEC.

Minimum Deposit: The broker requires a large minimum deposit of $10,000 USD. This is much higher than what most brokers in the industry require. This requirement clearly targets experienced traders with a lot of money rather than regular beginners.

Leverage Options: RCPro offers leverage up to 1:200. This gives traders moderate leverage options that balance trading flexibility with risk management considerations.

Available Assets: The platform focuses mainly on forex trading. We don't have specific information about how many currency pairs they offer or what other asset classes they might have.

Trading Platforms: We don't have clear details about what trading platform options they offer. This represents a gap in publicly available information about the broker's technology offerings.

Payment Methods: Information about deposit and withdrawal methods is not detailed in current available sources. Prospective clients might need to ask the broker directly about these details.

Costs and Fees: The fee structure, including spreads and commission details, is not outlined in available documentation. This makes it hard to assess how competitive their trading costs are.

Geographic Restrictions: We don't have specific information about regional limitations or restricted territories in current sources.

This Rcpro review finds several areas where more detailed information would help potential traders make informed decisions about the broker's services.

RCPro's account structure clearly focuses on traders with a lot of money. The $10,000 minimum deposit serves as the main barrier to entry. This large requirement puts the broker well above typical industry standards, where many good brokers let you open accounts with deposits as low as $100-$500. The high threshold suggests RCPro wants to work only with serious, well-funded traders who can meet this financial commitment.

The leverage offering of 1:200 represents a moderate approach compared to some brokers who offer leverage ratios of 1:500 or higher. This conservative leverage policy may appeal to traders who are careful about risk while still providing enough leverage for meaningful position sizing. The leverage ratio matches many regulated brokers' standards, suggesting a responsible approach to risk management despite the lack of regulatory oversight.

User feedback about account conditions seems generally positive. The 100% recommendation rate on Endorsal suggests that clients who meet the minimum requirements find the account terms acceptable. However, the high entry barrier naturally limits the broker's accessibility to a broader range of retail traders, which may explain the focused but limited customer base.

We don't have detailed information about different account types, Islamic accounts, or tiered account structures in available sources. This suggests either a simplified account offering or limited public disclosure of account variations. This Rcpro review notes that potential clients may need to ask directly about account customization options and specific terms beyond the basic minimum deposit and leverage information.

The available information about RCPro's trading tools and resources gives us limited insights into what the broker offers for technology and education. This lack of detailed information about analytical tools, research resources, and educational materials represents a big gap in public documentation that potential traders should consider when evaluating the broker.

Trading platforms and their features remain unclear from available sources. This makes it difficult to assess the quality and functionality of the broker's technology infrastructure. Modern forex trading relies heavily on strong platforms with advanced charting, automated trading capabilities, and real-time data feeds. The absence of specific platform information in public sources may indicate either limited platform options or poor marketing transparency.

Research and market analysis resources are not detailed in available documentation. This could impact traders who rely on broker-provided market insights and analytical tools. Many competitive brokers offer daily market analysis, economic calendars, and expert commentary as value-added services to support trader decision-making.

Educational resources are not specifically mentioned in available sources. These are crucial for trader development and platform familiarization. This gap may particularly affect traders who are new to the platform or those seeking to improve their trading skills through broker-provided educational content.

The limited information about tools and resources contributes to the moderate rating in this category. Potential clients cannot adequately assess the value proposition beyond basic trading execution services.

Customer service evaluation for RCPro faces limitations due to sparse detailed feedback in available sources. While the 100% recommendation rate on Endorsal suggests overall customer satisfaction, specific details about support quality, response times, and service channels remain unclear from public documentation.

We don't have detailed information about customer support channels, such as live chat, phone support, or email response systems. This makes it difficult to assess how accessible and responsive the broker's customer service team is. Modern forex brokers typically offer multiple communication channels with specified response times and multilingual support options.

Support availability hours and timezone coverage are not specified in available sources. This could be crucial information for international traders operating across different time zones. The lack of this information may indicate either limited support hours or insufficient public disclosure of service standards.

Language support options remain unspecified. This could impact international traders who prefer customer service in their native languages. Given RCPro's Estonian headquarters and international client base, multilingual support capabilities would be expected but are not documented in available sources.

The moderate rating for customer service reflects the positive user recommendations balanced against the lack of detailed service information. Potential clients may need to directly test support responsiveness and quality before committing to the platform, as public documentation provides insufficient detail for comprehensive evaluation.

The trading experience evaluation for RCPro relies mainly on user satisfaction indicators rather than detailed platform performance data. The 100% recommendation rate on Endorsal suggests that clients who actively use the platform find the trading experience satisfactory, though specific performance metrics are not available in public sources.

Platform stability and execution quality cannot be thoroughly assessed from available information. Technical performance data, uptime statistics, and execution speed measurements are not documented in accessible sources. These factors are crucial for active traders who require reliable platform performance during volatile market conditions.

Order execution quality, including information about slippage rates, requotes, and fill rates, is not detailed in available documentation. This absence of execution statistics makes it challenging for potential traders to evaluate the broker's operational efficiency compared to industry standards.

Mobile trading capabilities and cross-platform synchronization features are not specifically addressed in available sources. This represents another gap in the comprehensive evaluation of the trading experience. Modern traders increasingly rely on mobile platforms for market monitoring and trade management.

The moderate rating reflects user satisfaction indicators balanced against the lack of detailed technical performance information. The 3/5 Trustpilot rating suggests mixed experiences among users, indicating that while some traders are highly satisfied as shown by the Endorsal recommendations, others may have encountered issues that affected their overall experience.

Trust and reliability represent the most significant concern in this Rcpro review. This is mainly due to the broker's unregulated status. Operating without oversight from recognized financial authorities such as the FCA, ASIC, CySEC, or other major regulators significantly impacts the broker's trustworthiness profile. This regulatory gap means traders have limited legal recourse and protection compared to clients of regulated brokers.

The absence of regulatory oversight raises questions about fund security, segregation of client funds, and compliance with international financial standards. Regulated brokers typically maintain client funds in segregated accounts and provide compensation schemes for client protection, safeguards that may not be available with unregulated entities like RCPro.

Company transparency regarding financial statements, operational procedures, and corporate governance is not evident from available public sources. Regulated brokers are typically required to publish regular financial reports and maintain transparent operational standards, information that appears limited for RCPro.

The broker's operational history since 2016 provides some indication of business continuity. This suggests the company has maintained operations for several years. However, longevity alone cannot substitute for regulatory protection and transparent business practices that regulated brokers must maintain.

Industry reputation and recognition through awards or professional certifications are not documented in available sources. This further limits the assessment of the broker's standing within the professional forex trading community. The low trust rating reflects these significant concerns about regulatory protection and transparency.

User experience assessment for RCPro presents a mixed picture based on available feedback sources. The Trustpilot rating of 3 out of 5 stars indicates moderate user satisfaction, suggesting that while some clients have positive experiences, others encounter issues that impact their overall satisfaction with the broker's services.

The contrast between the 100% recommendation rate on Endorsal and the moderate Trustpilot rating highlights the importance of considering multiple feedback sources. This discrepancy could indicate that highly engaged users who actively participate in recommendation platforms have more positive experiences, while the broader user base reflected in Trustpilot reviews shows more varied satisfaction levels.

Interface design and platform usability cannot be thoroughly evaluated from available sources. Detailed user interface descriptions and usability feedback are not documented. Modern forex trading platforms require intuitive design and efficient navigation to support effective trading activities.

Account registration and verification processes are not detailed in available sources. This makes it difficult to assess the ease of onboarding new clients. Streamlined registration with reasonable verification requirements typically contributes to positive initial user experiences.

The high minimum deposit requirement of $10,000 naturally limits the user base to well-funded traders. This may contribute to higher satisfaction among those who can meet this threshold. However, this barrier excludes many retail traders who might otherwise evaluate the platform's user experience.

The moderate user experience rating reflects the mixed feedback indicators and the limited detailed information available about platform usability and client onboarding processes.

This Rcpro review reveals a forex broker that presents both opportunities and significant concerns for potential traders. RCPro's eight-year operational history and strong customer recommendations on Endorsal indicate that the broker can deliver satisfactory services to its target clientele of well-funded traders. The $10,000 minimum deposit requirement and 1:200 leverage offering suggest a focus on serious traders with substantial capital and risk management awareness.

However, the broker's unregulated status represents the most significant drawback. It exposes traders to risks that regulated alternatives would reduce through investor protection schemes and regulatory oversight. The limited transparency regarding trading conditions, platform features, and operational procedures further complicates the evaluation process for potential clients.

RCPro appears most suitable for experienced traders with significant capital who prioritize the broker's specific service offerings over regulatory protection. The mixed user feedback suggests that while some clients achieve satisfactory results, others may encounter issues that impact their trading experience. Potential traders should carefully weigh the risks associated with unregulated brokers against any perceived benefits of RCPro's services before making investment decisions.

FX Broker Capital Trading Markets Review