Regarding the legitimacy of PJB forex brokers, it provides BAPPEBTI, ICDX and WikiBit, (also has a graphic survey regarding security).

Is PJB safe?

Pros

Cons

Is PJB markets regulated?

The regulatory license is the strongest proof.

BAPPEBTI Forex Trading License (EP)

Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan

Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan

Current Status:

RevokedLicense Type:

Forex Trading License (EP)

Licensed Entity:

PT. PIALANG JEPANG BERJANGKA

Effective Date:

--Email Address of Licensed Institution:

info@pjbindo.comSharing Status:

No SharingWebsite of Licensed Institution:

www.pjbindo.comExpiration Time:

--Address of Licensed Institution:

SuMMiTMas II LanTai 17, Jl. Jend. SudirMan Kav. 61-62 Senayan Kebayoran Baru, JakarTa SelaTan 12190Phone Number of Licensed Institution:

02127510027Licensed Institution Certified Documents:

ICDX Derivatives Trading License (EP)

Indonesia Commodity and Derivatives Exchange

Indonesia Commodity and Derivatives Exchange

Current Status:

RevokedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Pialang Jepang Berjangka, PT

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is PJB Safe or a Scam?

Introduction

PJB, short for PT Pialang Jepang Berjangka, is an Indonesian forex broker that has been operating since 2018. Positioned in the competitive landscape of foreign exchange trading, PJB aims to provide a platform for both novice and experienced traders. However, the forex market is notorious for its potential pitfalls, which makes it crucial for traders to conduct thorough due diligence before committing their funds. This article seeks to evaluate the safety and legitimacy of PJB by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. Our investigation is based on a review of industry reports, user feedback, and regulatory disclosures, providing a comprehensive framework for assessing whether PJB is a safe broker or a potential scam.

Regulation and Legitimacy

Regulation is a cornerstone of trust in the forex trading industry, as it ensures that brokers adhere to financial standards designed to protect investors. PJB's regulatory status raises some concerns. According to reports, PJB was previously regulated by the Indonesian Commodity Futures Trading Regulatory Agency (Bappebti), but its license has since been revoked. This revocation is significant, as it indicates a lack of oversight, which can lead to potential risks for traders.

| Regulatory Agency | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Bappebti | 44/Bappebti/SI/05/2014 | Indonesia | Revoked |

The absence of a valid regulatory license is a red flag for potential investors. In the forex market, brokers that operate without regulation can engage in unethical practices, including the manipulation of trading conditions or the misappropriation of client funds. It is crucial for traders to be aware of this lack of oversight when considering PJB as a trading partner. Furthermore, the historical compliance record of PJB is questionable, given the revocation of its license. This raises serious concerns about the broker's legitimacy and operational transparency.

Company Background Investigation

PJB was established in 2018, and while it has a relatively short operational history, the background of the company is critical to understanding its reliability. Information regarding the ownership structure and management team is limited, making it difficult to assess the broker's stability and credibility. Transparency in a broker's operations is essential for building trust, and PJB's lack of detailed disclosures about its management and ownership raises concerns.

The management teams professional experience is another crucial factor in evaluating a broker's legitimacy. A well-experienced team can significantly impact a broker's operations and customer service quality. Unfortunately, there is little publicly available information regarding the qualifications and expertise of PJB's management. This lack of transparency may indicate a potential risk for traders, as it becomes challenging to ascertain the level of professionalism and integrity behind the broker's operations.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for any trader looking to maximize their investment. PJB's fee structure has been described as competitive; however, the absence of detailed information raises questions about hidden fees or unfavorable trading conditions.

| Fee Type | PJB | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not disclosed | 1-3 pips |

| Commission Model | Not disclosed | Variable |

| Overnight Interest Range | Not disclosed | 0.5-1.5% |

The lack of transparency in fees can be a tactic used by less scrupulous brokers to lure in traders with seemingly attractive conditions, only to impose hidden costs later on. Traders should approach PJB with caution and consider the potential for unexpected charges that could erode their profits. Furthermore, the absence of clear information regarding overnight interest rates and commission structures can complicate trading strategies, especially for those who rely on precise cost calculations for their trading plans.

Client Fund Security

The security of client funds is paramount when choosing a forex broker. PJB's measures for safeguarding client funds appear to be inadequate, particularly in light of its revoked regulatory status. A reputable broker typically segregates client funds from operational funds to protect them in the event of financial difficulties. However, it is unclear whether PJB implements such practices.

Additionally, investor protection mechanisms are crucial for ensuring that traders can recover their funds in the event of broker insolvency. Given the lack of regulatory oversight, it is uncertain whether PJB offers any such protections. Historical issues regarding fund security have not been reported, but the absence of a robust regulatory framework heightens the risk for traders.

Customer Experience and Complaints

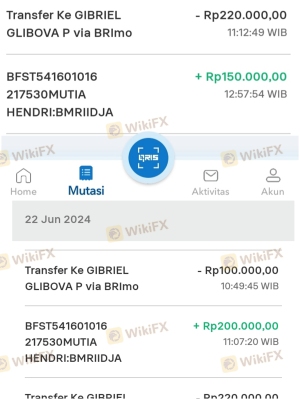

Customer feedback plays a vital role in assessing a broker's reliability. Reviews of PJB reveal a mixed bag of experiences, with some users reporting satisfactory trading conditions while others express concerns over withdrawal difficulties and lack of responsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support Availability | Medium | Limited availability |

The most common complaints revolve around withdrawal issues, where traders report significant delays or even denials of their requests. Such patterns are often indicative of a broker that may be struggling with liquidity or engaging in practices designed to retain client funds. The response quality from PJB also appears to be lacking, with many users citing long wait times for customer support. This raises concerns regarding the broker's commitment to customer service and the overall trading experience.

Platform and Trade Execution

The trading platform is another critical aspect of a broker's offering. PJB provides a platform that is reportedly user-friendly, but there are concerns regarding its stability and execution quality. Issues such as slippage and order rejections can significantly impact trading outcomes. Traders need to be aware of these potential pitfalls when considering PJB as their broker.

A lack of transparency regarding execution quality can also be a red flag. If traders frequently experience slippage or rejected orders, it may indicate underlying issues with the broker's operational integrity. Furthermore, signs of potential platform manipulation, such as excessive slippage during volatile market conditions, should be closely monitored.

Risk Assessment

Using PJB as a forex broker presents several risks that potential traders should consider.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulation |

| Fund Security Risk | High | Lack of protection mechanisms |

| Customer Service Risk | Medium | Slow response times |

The absence of regulation poses a significant risk, as traders may have limited recourse in the event of disputes or issues. Additionally, the lack of clarity regarding fund security further compounds these risks. Traders should be particularly cautious and consider implementing risk mitigation strategies, such as limiting the amount of capital deposited with PJB or diversifying their trading activities across multiple platforms.

Conclusion and Recommendations

In conclusion, the evidence suggests that PJB raises several red flags that warrant caution. The absence of a valid regulatory license, coupled with concerns about fund security and customer service, indicates that potential traders should approach this broker with skepticism. While there may be some positive aspects to PJB, the risks involved may outweigh the benefits for many traders.

For those considering trading with PJB, it is advisable to start with a small investment and remain vigilant regarding any unusual fees or withdrawal issues. Additionally, traders may want to explore alternative brokers with strong regulatory oversight and a proven track record of customer satisfaction. Options such as brokers regulated by top-tier authorities could provide a safer trading environment and more robust investor protections. Ultimately, ensuring the safety of your investments should be the top priority, and thorough research is essential in making an informed decision about whether PJB is safe or a scam.

Is PJB a scam, or is it legit?

The latest exposure and evaluation content of PJB brokers.

PJB Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PJB latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.