Is Alpha Markets safe?

Pros

Cons

Is Alpha Markets Safe or Scam?

Introduction

Alpha Markets is a relatively new player in the forex trading arena, having launched in 2022. Positioned as an online brokerage, it claims to offer a variety of trading instruments, including forex pairs, commodities, and CFDs. As the financial landscape becomes increasingly crowded, it is essential for traders to carefully evaluate the credibility of brokers like Alpha Markets before committing their funds. The potential for scams and unethical practices in the forex market necessitates a cautious approach, as traders risk losing their investments without proper due diligence. In this article, we will systematically investigate the safety and legitimacy of Alpha Markets, employing a comprehensive evaluation framework that includes regulatory status, company background, trading conditions, customer feedback, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a broker is a crucial factor in determining its safety for traders. Alpha Markets claims to be regulated by the Financial Sector Conduct Authority (FSCA) in South Africa, which is a significant point of concern given the FSCA's reputation as a lower-tier regulatory body compared to authorities like the UK's Financial Conduct Authority (FCA) or Australia's Australian Securities and Investments Commission (ASIC). This raises questions about the level of oversight and protection afforded to traders.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSCA | 43259 | South Africa | Verified |

While Alpha Markets is indeed listed under the FSCA, it is important to note that the regulatory framework in South Africa does not mandate the same level of customer protection as seen in more stringent jurisdictions. For instance, FSCA does not require brokers to maintain segregated accounts for client funds, nor does it offer a compensation scheme to protect investors in the event of broker insolvency. Consequently, while Alpha Markets may be operating legally, the lack of robust regulatory oversight raises significant concerns about the safety of client funds.

Company Background Investigation

Understanding the company behind a trading platform is vital for assessing its reliability. Alpha Markets is operated by Alpha Markets SA (Pty) Ltd, which is a juristic representative of Pal Life (Pty) Ltd, a licensed financial services provider in South Africa. However, the companys relatively recent establishment and the complexity of its corporate structure may complicate accountability and transparency.

The management team of Alpha Markets has not been extensively detailed in available resources, leaving potential investors with limited insight into their expertise and experience in the financial sector. Transparency appears to be a significant issue, as many brokers often provide detailed information about their management teams, regulatory compliance history, and operational methodologies. The lack of such information with Alpha Markets may indicate a potential red flag for prospective traders seeking a trustworthy broker.

Trading Conditions Analysis

Alpha Markets offers various trading accounts with differing conditions, including a low minimum deposit requirement of $5, which may attract novice traders. However, the overall fee structure is a critical aspect that requires scrutiny. The broker claims to offer competitive spreads and leverage up to 1:500, but the absence of detailed information on commissions and potential hidden fees raises concerns.

| Fee Type | Alpha Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 - 1.0 pips | 0.5 - 1.5 pips |

| Commission Model | Variable | Fixed or Variable |

| Overnight Interest Range | Unspecified | 0.5% - 2% |

The variability in spreads and lack of clarity regarding commissions can lead to unexpected costs for traders. These issues, combined with the potential for hidden fees, could significantly impact a trader's profitability. Therefore, it is crucial for traders to read the fine print and understand all associated costs before opening an account with Alpha Markets.

Client Fund Safety

The safety of client funds is paramount when evaluating a broker's trustworthiness. Alpha Markets claims to implement certain measures to safeguard client funds; however, the absence of segregated accounts poses a significant risk. Without such accounts, client deposits could be co-mingled with the broker's operational funds, increasing the risk of loss in the event of financial difficulties.

Additionally, Alpha Markets does not provide negative balance protection, which means traders could potentially lose more than their initial investment. This lack of protection is concerning, particularly given the high leverage offered by the broker, which can amplify both gains and losses. Historically, there have been no significant reports of fund security issues with Alpha Markets, but the aforementioned risks remain a cause for concern.

Customer Experience and Complaints

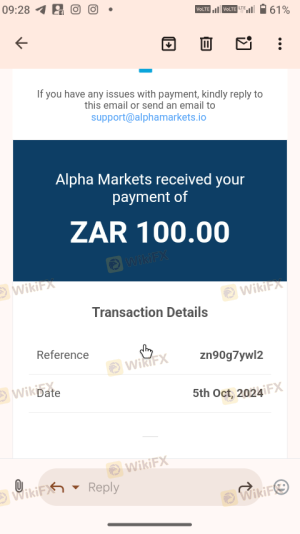

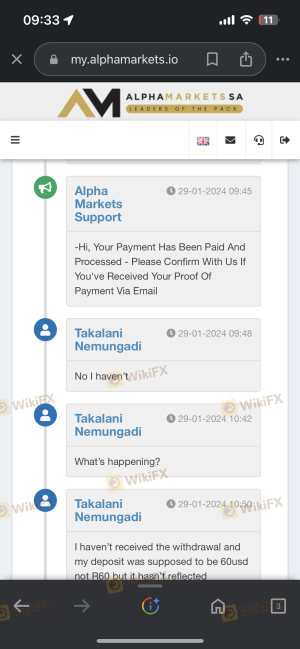

Customer feedback is an invaluable resource for assessing a broker's reliability. Reviews of Alpha Markets reveal a mixed bag of experiences, with numerous complaints regarding withdrawal issues and poor customer service. Many users have reported difficulties in accessing their funds, which raises serious questions about the broker's operational integrity.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Poor Customer Support | Medium | Average |

For instance, one user reported waiting several weeks for a withdrawal to be processed, while another noted that customer support responses were often delayed and unhelpful. Such patterns of complaints can indicate systemic issues within the broker's operations, suggesting that traders may face challenges when seeking assistance or attempting to withdraw their funds.

Platform and Trade Execution

The trading platform provided by Alpha Markets is the well-regarded MetaTrader 5 (MT5), known for its advanced features and user-friendly interface. However, the platforms performance can be compromised by the broker's operational practices. There have been reports of slippage and order rejections, which can negatively affect trading outcomes.

Traders have expressed concerns about potential manipulation, particularly given the broker's lack of transparency regarding order execution policies. Without clear information on how trades are processed, traders may be at risk of unfavorable trading conditions.

Risk Assessment

Using Alpha Markets comes with a range of risks that potential traders should consider. The absence of robust regulation, potential withdrawal issues, and the lack of client fund protection are significant factors that increase the overall risk profile of this broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of stringent oversight from FSCA. |

| Fund Safety Risk | High | No segregation of client funds or negative balance protection. |

| Operational Risk | Medium | Reports of withdrawal delays and poor customer service. |

To mitigate these risks, traders should approach Alpha Markets with caution, conduct thorough research, and consider using smaller amounts of capital when testing the broker's services.

Conclusion and Recommendations

In conclusion, while Alpha Markets operates legally under the FSCA, several red flags indicate that it may not be a safe choice for traders. The lack of robust regulatory oversight, combined with reports of withdrawal issues and poor customer service, suggests that traders should exercise caution.

For those considering trading with Alpha Markets, it is advisable to seek alternative, more reputable brokers with a proven track record of safety and reliability. Brokers regulated by top-tier authorities such as the FCA or ASIC offer a higher level of protection and accountability, making them more suitable for traders looking to safeguard their investments. Ultimately, while Alpha Markets may present itself as a viable trading option, the risks associated with its operation warrant serious consideration before proceeding.

Is Alpha Markets a scam, or is it legit?

The latest exposure and evaluation content of Alpha Markets brokers.

Alpha Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Alpha Markets latest industry rating score is 1.42, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.42 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.