Is Macro Equities safe?

Pros

Cons

Is Macro Equities Safe or a Scam?

Introduction

Macro Equities is a relatively new player in the forex market, operating from Saint Vincent and the Grenadines. It claims to offer a diverse range of trading instruments, including currency pairs, commodities, stocks, and cryptocurrencies, appealing to traders worldwide. However, the lack of regulatory oversight raises significant concerns about its legitimacy and safety. As the forex market continues to attract both seasoned and novice traders, it is crucial for individuals to thoroughly assess the brokers they engage with. This article aims to provide an objective analysis of Macro Equities, focusing on its regulatory status, company background, trading conditions, customer safety, user experiences, platform performance, and associated risks.

To conduct this investigation, we relied on various online reviews, regulatory databases, and financial analysis platforms. By synthesizing this information, we aim to clarify whether Macro Equities is a trustworthy broker or if it poses potential risks to its clients.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its credibility and safety. Unfortunately, Macro Equities operates without any valid regulatory oversight, which poses significant risks for traders. The absence of regulation means that there is no external authority monitoring the broker's activities, raising concerns about adherence to industry standards and customer protection.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of a regulatory framework means that traders have no recourse in case of disputes or issues arising from trading activities. Regulatory bodies typically enforce strict compliance standards, ensuring that brokers operate transparently and fairly. Without such oversight, traders are left vulnerable to potentially unscrupulous practices. The absence of a governing authority also raises questions about the broker's financial stability and operational integrity, making it imperative for traders to exercise caution when considering engagement with Macro Equities.

Company Background Investigation

Macro Equities was established relatively recently, with its operational base in Saint Vincent and the Grenadines. While the company appears to offer a variety of financial instruments, its short history raises questions about its reliability and long-term viability. The ownership structure and management team details are not readily available, leading to concerns about transparency. A lack of information about the individuals behind the broker can make it difficult for potential clients to trust the organization.

The management team's background is crucial in evaluating a broker's credibility. Experienced professionals in the financial sector often indicate a higher likelihood of ethical business practices. However, the absence of publicly available information regarding the management team of Macro Equities leaves potential clients in the dark about the broker's operational ethos. The overall opacity can be a red flag for traders seeking a reliable and trustworthy trading environment.

Trading Conditions Analysis

When evaluating a broker's trading conditions, several factors come into play, including spreads, commissions, and overnight interest rates. Macro Equities presents itself as offering competitive trading conditions, but the lack of transparency regarding fees can be concerning. Traders should be wary of any hidden costs that may not be clearly outlined.

| Fee Type | Macro Equities | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | 1.8 pips (fixed) | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The spread for major currency pairs at 1.8 pips is higher than the industry average, which could affect trading profitability. Furthermore, the lack of clarity around commission structures and overnight interest rates raises concerns about the overall cost of trading with this broker. Traders should always seek to understand the complete fee structure before committing funds to ensure that they are not subjected to unexpected costs that could erode their trading capital.

Client Funds Safety

The safety of client funds is paramount when choosing a broker. Macro Equities has not provided sufficient information regarding its measures for safeguarding client deposits. Without proper fund segregation, investor protection mechanisms, and negative balance protection, clients may be at risk of losing their funds in case of financial difficulties faced by the broker.

In the absence of a regulatory framework, there is no guarantee that client funds are held in separate accounts, which is a standard practice among regulated brokers. This lack of information about fund safety measures is a significant concern for potential traders. Historical issues regarding fund safety, if any, further underscore the need for a cautious approach when considering Macro Equities as a trading partner.

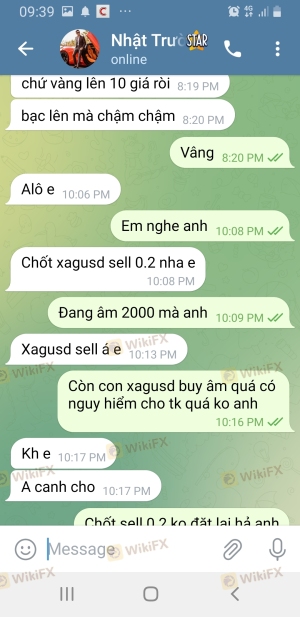

Customer Experience and Complaints

User feedback and real-life experiences provide valuable insights into the operations of a broker. Unfortunately, Macro Equities has received several negative reviews online. Common complaints include issues with withdrawal processes, lack of transparency, and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Transparency Issues | Medium | Poor |

| Customer Service Quality | High | Limited |

One user reported difficulties withdrawing funds, describing the experience as frustrating and indicative of a lack of transparency. Another complaint highlighted slippage issues during trading, which raises concerns about the broker's execution quality. Such patterns of complaints should serve as a warning to potential clients about the reliability of Macro Equities.

Platform and Trade Execution

The trading platform's performance is crucial for a successful trading experience. Macro Equities offers access to popular platforms like MetaTrader 4 (MT4). However, the overall stability, speed, and user experience of the platform are essential factors that need thorough evaluation.

Issues related to order execution, such as slippage and order rejections, can significantly impact trading outcomes. If traders frequently experience slippage or find their orders rejected, it may indicate underlying problems with the broker's execution practices. Furthermore, any signs of platform manipulation should raise immediate red flags for traders.

Risk Assessment

Engaging with Macro Equities presents several risks that potential clients should consider. The absence of regulatory oversight, coupled with negative user experiences, creates a high-risk environment for traders.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No oversight from recognized authorities. |

| Financial Stability Risk | Medium | Lack of transparency regarding funds. |

| Execution Risk | High | Reports of slippage and order rejections. |

To mitigate these risks, traders should conduct thorough due diligence before investing. It may be prudent to start with a demo account to test the broker's platform and services without risking real capital. Additionally, traders should consider diversifying their investments and not committing substantial funds to a single broker until they are confident in its reliability.

Conclusion and Recommendations

In conclusion, the evidence suggests that Macro Equities poses significant risks for potential traders. The lack of regulatory oversight, combined with negative user feedback and transparency issues, raises serious concerns about its legitimacy and operational integrity.

For traders seeking a reliable broker, it is advisable to explore alternatives that offer robust regulatory frameworks and positive user experiences. Brokers regulated by top-tier authorities provide a higher level of investor protection and transparency, making them safer options for trading.

In summary, while Macro Equities may offer attractive trading conditions, the associated risks and lack of oversight make it a broker that traders should approach with extreme caution.

Is Macro Equities a scam, or is it legit?

The latest exposure and evaluation content of Macro Equities brokers.

Macro Equities Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Macro Equities latest industry rating score is 1.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.