Alpari 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Alpari, a prominent player in the forex trading landscape since its inception in 1998, has cultivated a substantial global user base exceeding 2 million clients. The broker operates out of Saint Vincent and the Grenadines, providing a range of trading instruments from different asset classes, including forex, CFDs, and commodities. Alpari is known for its competitive trading conditions, particularly with low minimum deposits and diverse account options, appealing to both novice and experienced traders. However, the broker faces significant scrutiny regarding its regulatory status and customer service performance, with mixed reviews surrounding fund safety and withdrawal issues. Consequently, it is best suited for retail traders who are self-educated and comfortable managing their trading risks, while beginners seeking robust educational resources and strong regulatory oversight may find better alternatives.

⚠️ Important Risk Advisory & Verification Steps

Before engaging with Alpari, potential clients should consider the following risks:

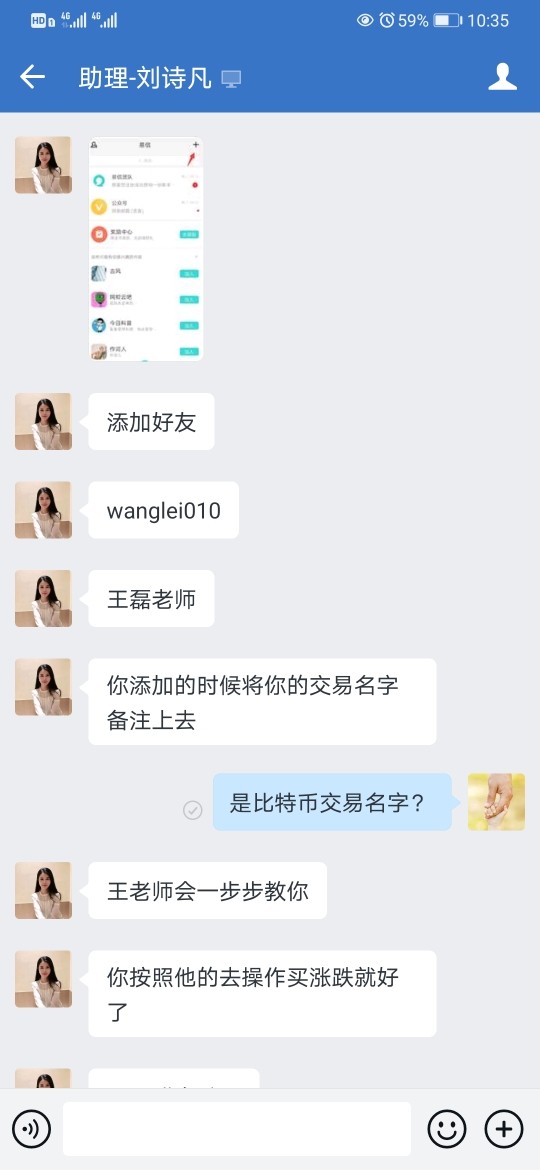

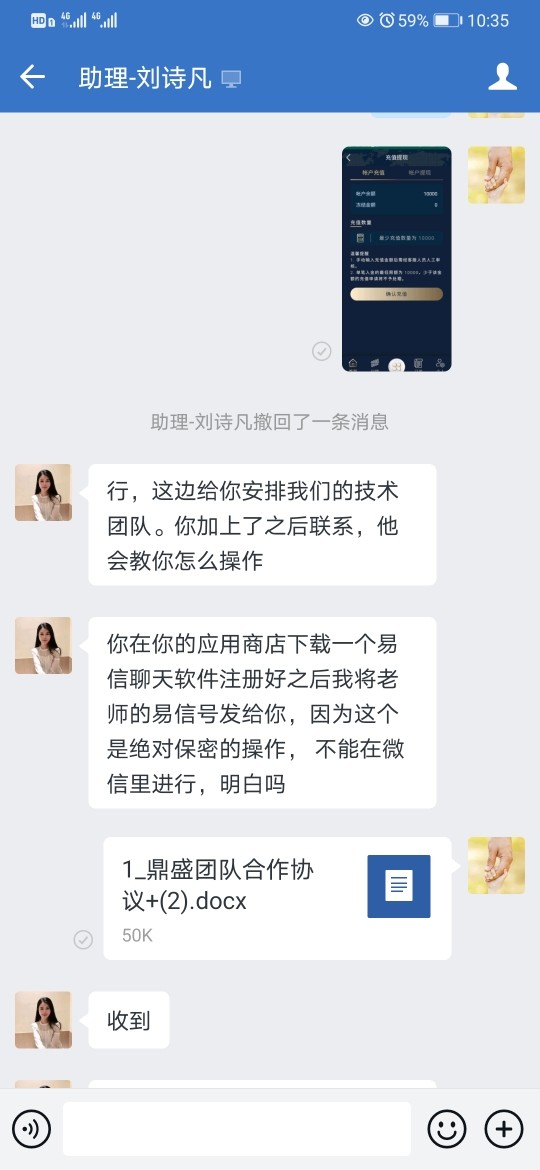

- Regulatory Concerns: Not regulated by top-tier authorities, decreasing the perceived reliability.

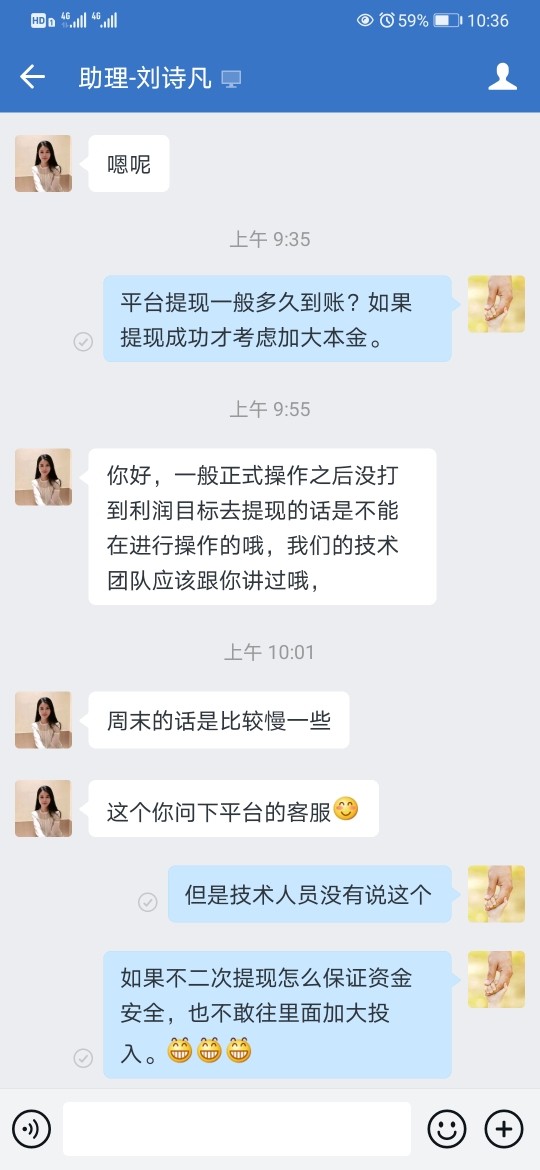

- Withdrawal Issues: Numerous negative reviews highlight delays in fund withdrawals and responsiveness of customer support.

- Complex Structure: Proper understanding of trading and account types is essential to avoid confusion.

To verify Alpari's legitimacy:

- Check regulatory compliance with local authorities and independent reviews.

- Read multiple user reviews across different platforms.

- Contact customer support with inquiries about account management and financial transactions.

Rating Framework

Broker Overview

1. Company Background and Positioning

Founded in 1998, Alpari has established itself as a respected global forex brokerage with a significant presence in online trading. Originally based in the UK, its headquarters has since relocated to Saint Vincent and the Grenadines, while maintaining operational offices in the UK. Alpari gained popularity due to its forward-thinking adoption of electronic communication networks, enabling clients to trade directly with market providers, resulting in low spreads and quick execution speeds. Its operational history spans numerous market cycles, during which Alpari has maintained a focus on sustainability and customer engagement through various promotional and social initiatives.

2. Core Business Overview

Alpari specializes in forex trading and has expanded its services to include a diverse array of trading options. Clients can engage in trading across multiple asset classes, including CFDs on commodities, indices, and spans over 50 forex pairs. The brokers offerings include unique account types designed to cater to different trader needs, such as the nano and standard accounts, with varying leverage options, starting as high as 1:3000. While it claims compliance with certain regulatory standards, Alpari operates primarily under licenses from lower-tier jurisdictions, adding to concerns about investor protection.

Quick-Look Details Table

In-depth Analysis of Each Dimension

1. Trustworthiness Analysis

Alpari's operations are framed within the offshore jurisdiction of Saint Vincent and the Grenadines, a region often scrutinized for lax regulatory standards. While Alpari is a member of the Financial Commission, which offers a compensation fund up to $20,000, this does not compare favorably against major regulatory bodies like the FCA or ASIC. The absence of robust regulatory oversight raises alarms among potential traders regarding the safety of their funds.

User Self-Verification Guide

To ensure your interests are protected, follow these steps:

- Examine licenses—Verify brokers with legitimate regulatory bodies.

- Check client reviews on multiple platforms and forums.

- Ensure communication with support services for clarity on trading conditions.

- Monitor for any legal action or complaints against the broker.

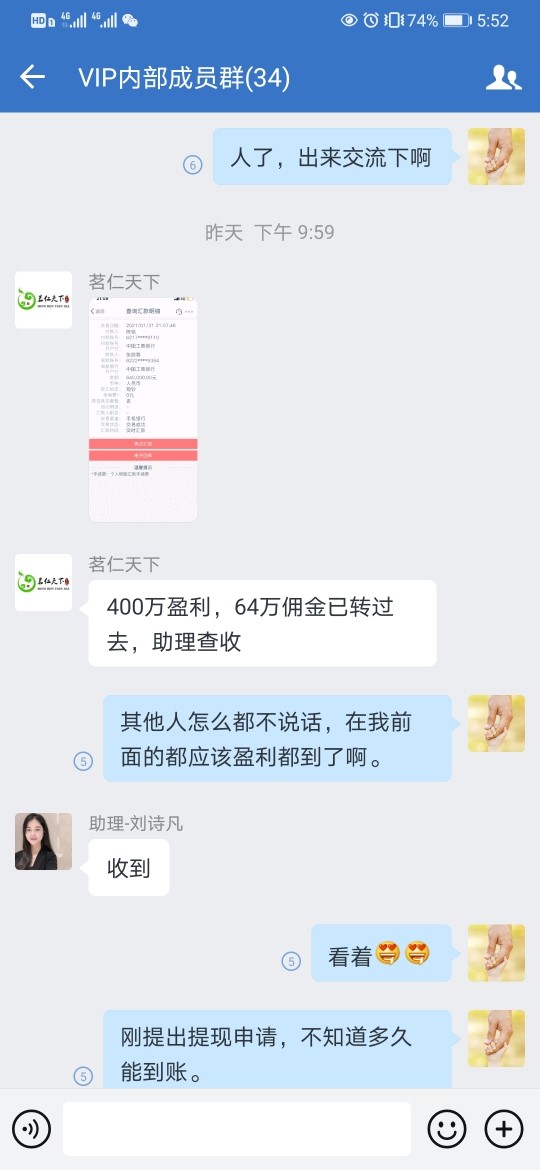

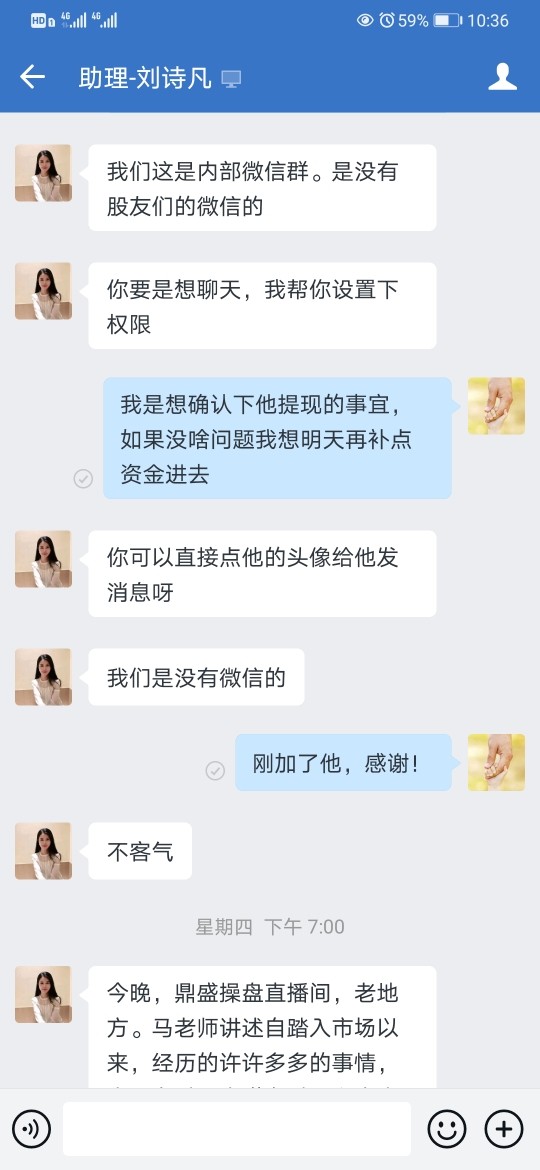

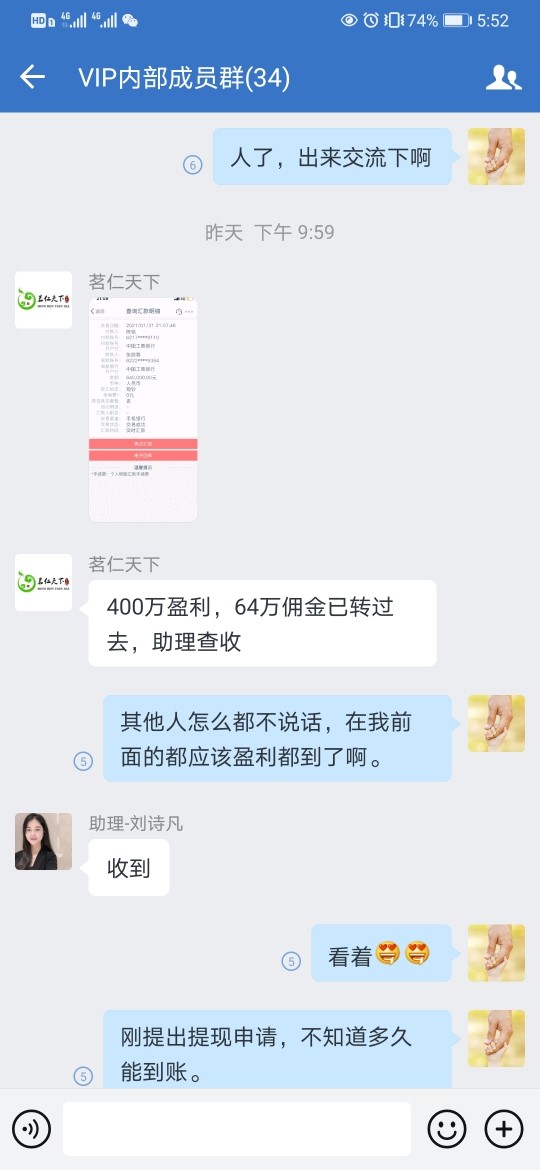

Industry Reputation and Summary

While some users report positive experiences, particularly in trading, others have criticized Alpari for operational challenges, specifically concerning withdrawals and customer service. Claims of arising discrepancies in user experiences indicate a need for prospective clients to approach trading with caution, particularly regarding fund management and withdrawal processes.

2. Trading Costs Analysis

Advantages in Commissions

Alpari claims to deliver competitive trading costs with spreads starting from as low as 0.2 pips on certain accounts. The fee structures outlined vary per account type, with commission-free alternatives particularly beneficial for retail traders focused on high-frequency trading.

The "Traps" of Non-Trading Fees

Despite competitive spreads, traders have noted issues with withdrawal fees and other potentially hidden costs that can arise depending on the payment method used. Such experiences highlight the need for traders to evaluate the full cost structure before committing to trading decisions.

Cost Structure Summary

For retail traders, Alpari offers flexible options, but thorough investigation into potential non-trading fees is essential. Heres a breakdown of typical costs:

Alpari offers robust trading platforms, primarily MetaTrader 4 and 5, which are widely recognized in the forex community for their charting capabilities and automated trading support. Clients utilizing these platforms can benefit from numerous customizability options and trading tools, a factor appealing to both beginner and advanced traders alike.

While Alpari provides essential trading tools such as an economic calendar and charting functionalities through AutoChartist, the lack of comprehensive educational resources, especially for inexperienced traders, limits the platform's overall usability.

Users generally find Alpari's platforms intuitive; however, the relatively steep learning curve for new traders may hinder their initial trading experience. Taking user feedback into account, improvements to educational resources could enhance the overall usability and user satisfaction.

4. User Experience Analysis

Introduction to User Experience Metrics

User experience is critical to Alpari's value proposition, indicated by feedback related to ease of account setup and platform navigation. While positive feedback includes ease of fund transfers and account management, the site navigation and help resources often need improvement.

Detailed Evaluation of Features

Despite varied response times from customer support, Alpari's multi-channel assistance—encompassing live chat, email, and calls—enables users to engage through their preferred platforms. However, the lack of clear communication regarding operational hours illustrates an area needing refinement.

Overall Summary of User Interaction

Trading with Alpari is designed to appeal to a diverse audience, yet inconsistencies in service experiences detract from its overall reliability as a trading platform.

5. Customer Support Analysis

Support Framework Overview

Alpari's customer support system is designed to respond to traders across various regions. However, the inconsistency reported in wait times and issue resolutions raises questions about the efficacy of support operations.

Communicative Efficiency

Customer service channels come equipped with live chat, email, and phone options, which, despite being responsive on some occasions, also showcase delays which could lead to heightened frustrations for traders requiring immediate assistance.

Potential Improvements

Enhancing operational transparency, particularly regarding support hours and efficiency metrics, could lead to improved client experiences. Communities and forums affiliated with Alpari also serve as additional resources for customers seeking answers to common inquiries.

6. Account Conditions Analysis

Account Diversity Analysis

Alpari offers a range of account types, including Nano, Standard MT4/MT5, and ECN, catering to different trader profiles. Each account type presents unique features, allowing flexibility according to trading strategy and capital availability.

Condition Assessment

Minimum deposit requirements across account types vary significantly, with some options allowing for as little as $5. Additionally, leverage options can go as high as 1:3000, appealing to both novice and seasoned traders. However, traders should approach high leverage with caution due to associated risks.

Conclusion on Account Conditions

Alpari's diverse account conditions enable traders of various backgrounds to find suitable trading solutions; however, the necessity for due diligence regarding leverage and market conditions is paramount for long-term trading success.

Quality Control

In the event of conflicting user feedback, it is essential to cite user reviews from credible platforms and consider that individual experiences may differ. Transparency, backed by thorough independent verification, should guide potential traders in drawing balanced conclusions.

To further fortify this review, additional data on regulatory compliance, more comprehensive testimonials from active users, and up-to-date processing fees for withdrawals should be included to bolster the article's comprehensiveness.

In conclusion, while Alpari offers a compelling trading environment with a rich suite of tools and options, potential traders must navigate the inherent risks associated with its regulatory framework and customer service experiences. An informed approach to trading with Alpari, complete with self-verification of the brokers claims, enables traders to assess whether this platform aligns with their trading objectives. Always consider alternate options if you require extensive support and robust regulatory guarantees before making trading commitments.