Forwex, an online broker, emerged in the competitive forex trading space to attract retail traders aiming to capitalize on low-cost trading options. Despite its attractive proposition for low fees, it has not been without controversies. The broker's positioning in the market reflects a keen understanding of retail traders needs for affordability and accessibility, yet its regulatory standing raises questions that could deter potential investors.

Forwex operates primarily as a Forex and CFD broker, providing access to various asset classes including foreign currencies, commodities, and indices. However, significant scrutiny surrounds its claimed affiliations with regulatory bodies, leading to uncertain perceptions regarding trader protections. This inconsistency in regulatory information can lead to increased apprehension among potential clients regarding the safety of their investments.

Understanding the risks involved with Forwex begins with assessing its trustworthiness.

One significant concern is the regulatory claims made by Forwex. Users report inconsistencies that create uncertainty regarding whether the broker operates under adequate oversight. Such discrepancies jeopardize the safety of traders' investments.

- Visit the NFA's BASIC Database: Check if Forwex is listed and examine its regulatory history.

- Explore Financial Watchdog Websites: Look for any warnings or alerts against Forwex.

- Consult User Reviews on Independent Sites: Validate the experiences shared by fellow traders to glean insights into withdrawal processes and operational integrity.

"I fell victim to a scam after my account was flagged for review and I was asked to pay additional clearance fees. Unfortunately, after making the payment, the broker stopped responding." - User Review

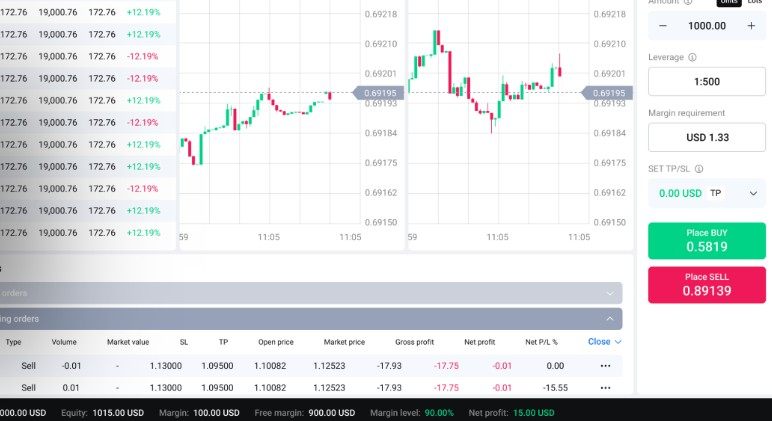

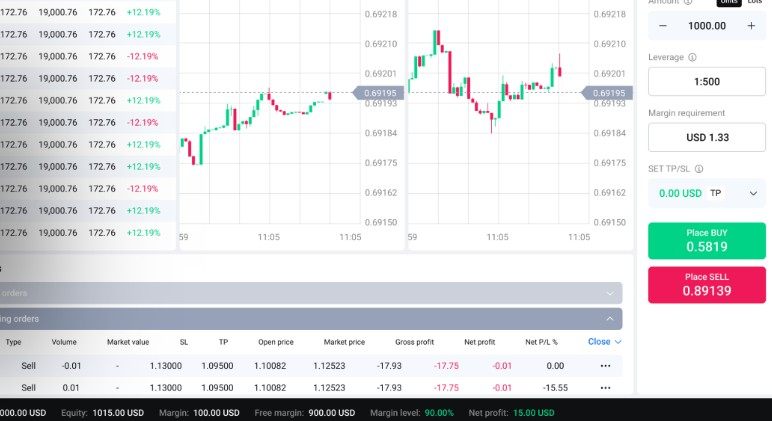

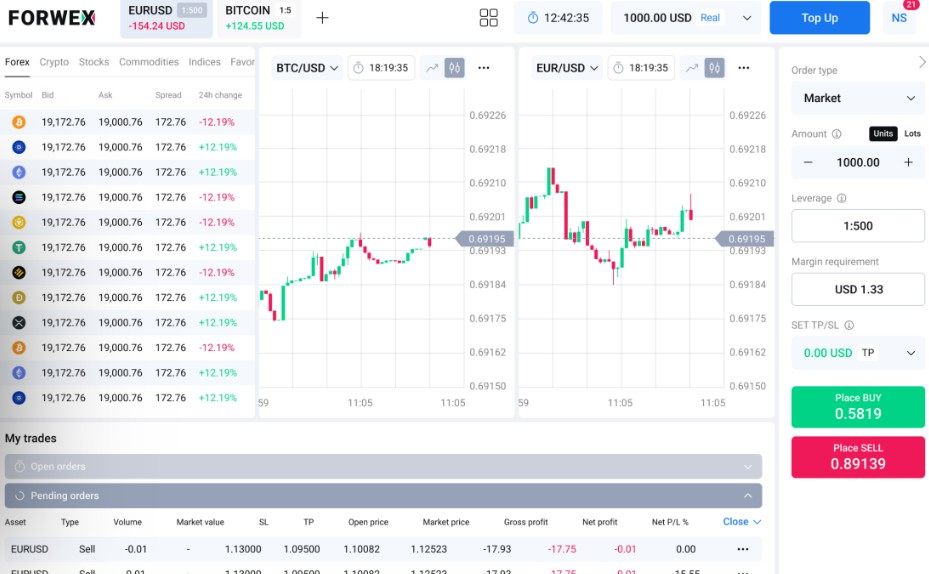

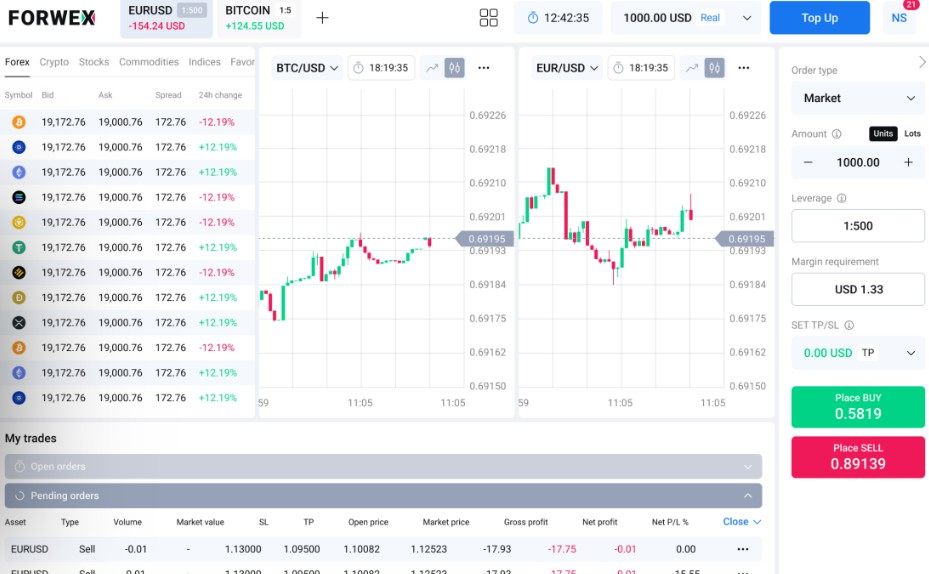

Trading Costs Analysis

Navigating the cost structure of Forwex reveals a dual-edged opportunity for traders.

The broker offers attractive commissions that can appeal to cost-conscious traders, with a commission structure that significantly lowers trading expenses compared to industry standards. However, it is crucial to consider non-trading fees, which can become burdensome. For instance, high withdrawal fees have been flagged by users.

Customer reviews indicate that withdrawal fees can reach $30, which can be detrimental for smaller accounts.

In summary, while Forwex presents a competitive cost advantage, traders should weigh this against potential pitfalls, particularly those who may not frequently execute trades.

A significant attraction of Forwex lies in its commitment to providing multiple trading platforms.

Users can access MT4 and WebTrader, which support various trading styles from beginners to more seasoned traders. Nevertheless, there are some limitations in terms of advanced analytical tools and educational resources that may appeal to professional traders looking for in-depth market analyses.

Overall user feedback emphasizes that while these platforms offer a level of professionalism, they may lack the rich feature set needed for adept trading strategies.

"While the platform is easy to navigate, I often find it lacks the analytics I need for deeper market insight." - [User Feedback]

User Experience Analysis

The user experience at Forwex is a mixed bag.

The onboarding process is simple and streamlined, which is beneficial for new traders. Nevertheless, users report challenges when it comes to the overall navigation and functionality of the platform once they have set up their accounts. Clarifying interfaces and user pathways can enhance user satisfaction.

Furthermore, persistent concerns about fund withdrawals erect barriers to satisfaction for many clients, damaging potential repeat business.

Customer Support Analysis

Forwex's customer support is a critical area of concern.

Despite having multiple channels available, including email and live chats, numerous complaints indicate slow response times. Users have reported delays of several days for basic queries, which is particularly troubling during urgent trading situations.

A responsive support system is vital for any broker, especially when traders encounter issues. The dissatisfaction shared by clients raises alarms about the efficacy of Forwex's customer service.

Account Conditions Analysis

For traders, the conditions surrounding accounts at Forwex warrant careful attention.

The broker provides a variety of account types suitable for different trading strategies; however, the minimum deposit of USD 100 may translate into a barrier for some traders, especially when paired with the aforementioned withdrawal fees. The flexibility afforded to account types is commendable, yet the implications of hidden costs feel restrictive.

In conclusion, while Forwex offers an attractive proposition with competitive pricing and a user-centric platform, the significant risks associated with regulatory concerns and user complaints cannot be overlooked. Potential traders must proceed with caution, fortifying their engagement through diligent research and availing themselves of the self-verification steps outlined above.