Is QNB Invest safe?

Pros

Cons

Is QNB Finansinvest Safe or Scam?

Introduction

QNB Finansinvest is a Turkish brokerage firm that has made its mark in the foreign exchange (forex) market since its establishment in 1996. As a subsidiary of the Qatar National Bank Group, it offers a range of trading services, including forex and contracts for difference (CFDs). However, in a market fraught with risks and potential scams, traders must exercise caution when selecting a broker. This article aims to provide a comprehensive analysis of whether QNB Finansinvest is safe or a scam, utilizing a structured evaluation framework that includes regulatory status, company background, trading conditions, customer fund safety, client experiences, platform performance, and risk assessment.

Regulation and Legitimacy

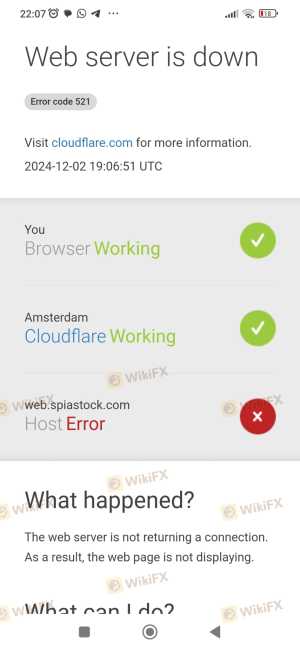

Understanding the regulatory status of a brokerage is paramount in assessing its safety. QNB Finansinvest claims to be regulated by the Capital Markets Board of Turkey (CMB). However, discrepancies in this claim have raised concerns. A detailed examination reveals that while QNB Finansinvest operates under the CMB, there are conflicting reports regarding its regulatory compliance and legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CMB | 358657 | Turkey | Verified |

The CMB is responsible for overseeing financial markets in Turkey, ensuring that brokers adhere to specific guidelines designed to protect investors. However, some sources label QNB Finansinvest as unregulated, suggesting that it may not be under the stringent supervision that traders expect. The lack of transparency regarding its regulatory status raises red flags, prompting traders to question the safety of their funds with QNB Finansinvest.

Company Background Investigation

QNB Finansinvest has a rich history, being part of a well-established banking group with a significant presence in the Middle East and Africa. The company has evolved over the years, expanding its product offerings and improving its technological infrastructure. However, a closer look at its ownership structure reveals that it operates as a market maker, which may present inherent conflicts of interest.

The management team at QNB Finansinvest consists of experienced professionals with backgrounds in finance and investment banking. Yet, the company's transparency regarding its operations and decision-making processes remains limited. Investors should be cautious when considering the level of information disclosure provided by the firm, as it may impact their confidence in the broker's integrity.

Trading Conditions Analysis

When evaluating whether QNB Finansinvest is safe, one must consider its trading conditions and fee structure. The broker offers a range of trading instruments but has been criticized for its relatively high spreads and fees compared to industry standards.

| Fee Type | QNB Finansinvest | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.6 pips | 1.2 pips |

| Commission Model | No commission | Varies |

| Overnight Interest Range | Varies | Varies |

While QNB Finansinvest does not charge additional commissions, its spreads are above the market average, which can eat into traders' profits. This fee structure may deter cost-sensitive traders and raises questions about the overall trading environment offered by the broker.

Customer Fund Safety

The safety of client funds is a critical factor in determining whether QNB Finansinvest is a safe broker. The firm claims to implement robust security measures, including fund segregation, investor protection through the Investor Compensation Center, and negative balance protection policies.

However, the effectiveness of these measures is questionable, given the mixed reviews regarding the broker's historical performance in safeguarding client assets. Traders should be aware of any past incidents involving fund security issues or disputes that might affect their decision to invest with QNB Finansinvest.

Customer Experience and Complaints

Customer feedback is an essential indicator of a broker's reliability. Reviews of QNB Finansinvest reveal a spectrum of client experiences, with several users expressing dissatisfaction regarding the responsiveness of customer support and the handling of complaints.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| High Spreads | Medium | Limited explanation |

| Customer Support Issues | High | Unresolved queries |

Common complaints include difficulties in withdrawing funds and a lack of clarity regarding the broker's trading conditions. Case studies show instances where clients faced significant delays in accessing their funds, prompting concerns about the broker's operational integrity.

Platform and Trade Execution

An evaluation of QNB Finansinvest's trading platform reveals a mixed bag of performance and user experience. The broker provides access to popular trading platforms like MetaTrader 4 and 5, but the execution quality has been scrutinized. Instances of slippage and order rejections have been reported, raising concerns about the reliability of trade execution.

Traders have noted that while the platform is generally stable, there are occasional disruptions that can affect trading outcomes. Signs of potential manipulation or unfair trading practices have not been widely reported, but the overall execution quality warrants further scrutiny.

Risk Assessment

Engaging with QNB Finansinvest entails various risks that potential clients should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Uncertain regulatory status raises concerns. |

| Financial Risk | Medium | High spreads can affect profitability. |

| Operational Risk | Medium | Customer service issues can hinder trading experience. |

To mitigate these risks, traders are advised to conduct thorough research, utilize demo accounts before committing real funds, and maintain a diversified trading strategy.

Conclusion and Recommendations

In conclusion, while QNB Finansinvest has established itself as a player in the forex market, the question remains: Is QNB Finansinvest safe? The broker's regulatory status, mixed customer feedback, and concerns over trading conditions suggest a cautious approach is warranted.

Traders should be vigilant and consider alternative brokers with stronger regulatory oversight and better customer reviews. For those still interested in QNB Finansinvest, starting with a demo account and investing only what they can afford to lose is advisable. Ultimately, the decision to engage with QNB Finansinvest should be made with careful consideration of the potential risks involved.

Is QNB Invest a scam, or is it legit?

The latest exposure and evaluation content of QNB Invest brokers.

QNB Invest Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

QNB Invest latest industry rating score is 2.33, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.33 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.