Is BC safe?

Pros

Cons

Is BC Safe or a Scam?

Introduction

BC, a forex broker, has emerged as a player in the foreign exchange market, attracting traders with promises of competitive spreads and a diverse range of trading instruments. However, the forex trading landscape is riddled with risks, and choosing the right broker is crucial for safeguarding investments. Traders must exercise caution and conduct thorough due diligence before committing their funds to any broker, especially in an industry where scams and unregulated firms can be prevalent. This article aims to evaluate whether BC is a safe trading option or a potential scam. To achieve this, we have analyzed regulatory status, company background, trading conditions, customer experiences, and overall risk assessments based on data from various reputable sources.

Regulation and Legitimacy

Understanding a broker's regulatory status is fundamental to assessing its legitimacy. BC claims to be regulated in Australia, which is typically a positive sign for traders. However, the term "exceeded" in its regulatory status raises red flags regarding its compliance with local laws. Below is a summary of BC's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 630 414 434 | Australia | Exceeded |

The Australian Securities and Investments Commission (ASIC) is known for its stringent regulations. However, BC's "exceeded" status suggests that it may not fully comply with the regulatory requirements, which can pose risks for traders. Additionally, the lack of a transparent history regarding its compliance raises concerns about the broker's reliability. Traders should be cautious of brokers with ambiguous regulatory statuses, as they may not provide the same level of investor protection as fully compliant firms.

Company Background Investigation

BC's history and ownership structure provide insight into its reliability. Established approximately five to ten years ago, BC is registered under the name Big As Capital Pty Ltd. The management team, while not extensively documented, comprises individuals with varying degrees of experience in the financial markets. However, the lack of detailed information regarding the management's background and professional expertise can be a cause for concern. Transparency is critical in the financial services sector, and any broker that does not disclose relevant information about its leadership may not be trustworthy.

The broker's website also lacks comprehensive contact information, making it difficult for potential clients to verify its legitimacy. This absence of transparency can lead to increased skepticism about whether BC is a safe option for trading. In an industry where trust is paramount, potential clients should be wary of brokers that do not provide sufficient information about their operations and management.

Trading Conditions Analysis

The trading conditions offered by BC are another crucial factor to consider when evaluating its safety. BC claims to provide competitive spreads starting from 0.5 pips and leverage of up to 1:500. However, the overall cost structure may not be as favorable as it appears. Below is a comparison of BC's core trading costs against industry averages:

| Fee Type | BC | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.5 pips | 1.0 pips |

| Commission Model | Variable | Standard |

| Overnight Interest Range | High | Moderate |

While the spreads may seem attractive, the potential for high overnight interest charges can significantly impact profitability, especially for traders who hold positions for extended periods. Furthermore, the absence of clear information regarding commission structures can lead to unexpected costs. Traders should thoroughly review the fee schedule and consider how these costs may affect their trading strategies.

Customer Funds Security

The security of customer funds is paramount when assessing whether BC is a safe trading option. BC claims to implement measures such as segregated accounts for client funds, which is a standard practice among reputable brokers. However, the lack of detailed information on the specific security measures in place raises concerns.

Additionally, traders should inquire about investor protection policies and whether BC participates in any compensation schemes. The absence of clear information regarding these aspects can be a warning sign. Historical data on any past security breaches or disputes would also be beneficial to evaluate BC's track record in this area. If BC has a history of issues related to fund safety, it could indicate a higher risk for potential clients.

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating a broker's reliability. Reviews of BC suggest a mixed bag of experiences, with some users praising its trading platform while others express frustration over withdrawal difficulties and customer service responsiveness. Below is a summary of common complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Service | Medium | Mixed Reviews |

| Platform Stability | Low | Generally Positive |

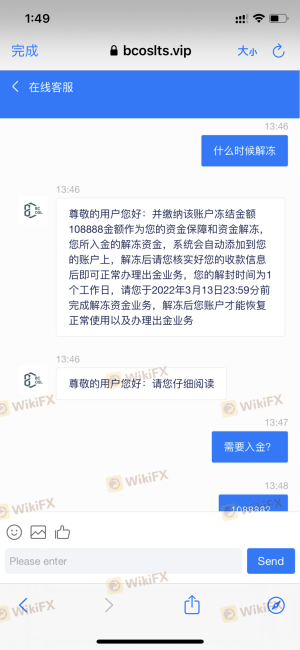

Several users have reported challenges when attempting to withdraw funds, which can be a significant red flag. A broker's ability to facilitate swift and hassle-free withdrawals is a critical indicator of its trustworthiness. Additionally, a lack of timely and effective responses from customer support can exacerbate frustrations for traders facing issues.

In one notable case, a trader reported waiting weeks for a withdrawal request to be processed, which led to concerns about the broker's liquidity and operational efficiency. Such experiences can tarnish a broker's reputation and lead traders to question whether BC is truly a safe option.

Platform and Trade Execution

The performance and reliability of a broker's trading platform are crucial for a positive trading experience. BC utilizes the MT5 trading platform, which is well-regarded in the industry for its functionality and user-friendly interface. However, reports of occasional slippage and order rejections have surfaced, raising concerns about the quality of trade execution.

Traders should be aware of the potential for slippage, especially during volatile market conditions, as this can significantly impact trading outcomes. Any signs of platform manipulation or consistent issues with order execution can further contribute to skepticism about BC's overall reliability.

Risk Assessment

When evaluating the risks associated with using BC, it is essential to consider various factors. Below is a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Exceeded regulatory status |

| Fund Security | Medium | Lack of transparency on measures |

| Customer Service | Medium | Mixed reviews on responsiveness |

| Withdrawal Process | High | Reports of delays and difficulties |

Given the identified risks, traders should approach BC with caution. It is advisable to start with a smaller investment and closely monitor the trading experience. Additionally, seeking alternative brokers with stronger regulatory standing and better customer feedback may mitigate potential risks.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that while BC offers certain attractive trading conditions, significant concerns regarding its regulatory status, transparency, and customer service persist. The "exceeded" regulatory status, along with mixed customer feedback, raises doubts about whether BC is truly a safe trading option.

For traders seeking to engage in forex trading, it is crucial to prioritize safety and reliability. Alternatives with robust regulatory oversight, transparent operations, and positive customer experiences should be considered. Brokers such as [insert reputable alternatives] may provide a more secure trading environment for both novice and experienced traders. Always conduct thorough research and consider your risk tolerance before choosing a broker.

Is BC a scam, or is it legit?

The latest exposure and evaluation content of BC brokers.

BC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BC latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.