Switch Markets 2025 Review: Everything You Need to Know

Executive Summary

Switch Markets is a notable forex broker in the competitive trading world. It offers compelling trading conditions that work for traders of all experience levels. This switch markets review shows a broker that has positioned itself well since starting in 2019, providing zero-commission trading with competitive spreads starting from zero pips. The broker operates under dual regulatory framework with ASIC, combined with its STP and ECN business models, creating a trading environment that focuses on transparency and direct market access.

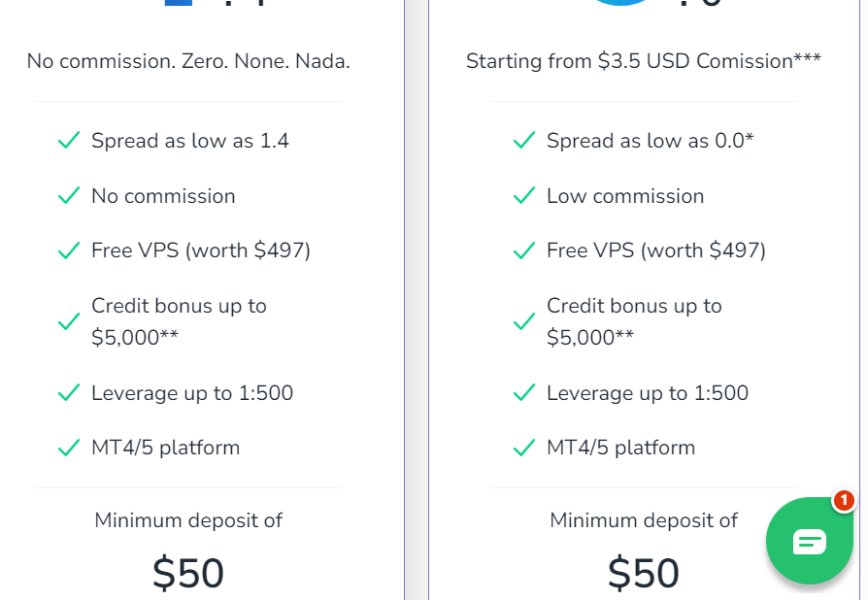

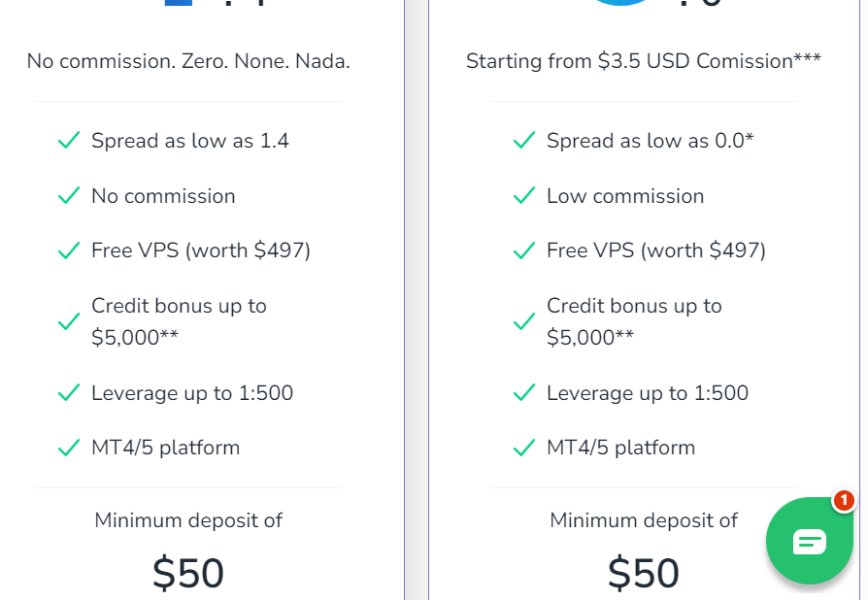

Key highlights include leverage up to 1:500, making it attractive for traders who want enhanced market exposure. The broker offers a comprehensive range of deposit and withdrawal methods including traditional banking, credit/debit cards, e-wallets, and cryptocurrency options. Switch Markets sweetens the deal with deposit bonuses reaching up to $5,000, providing additional trading capital for new clients. The broker primarily targets retail traders who seek diversified asset exposure across forex, stocks, indices, commodities, and cryptocurrencies, all accessible through the industry-standard MetaTrader 4 and MetaTrader 5 platforms. The low entry barrier with a minimum deposit of just $50 USD makes it particularly accessible to newcomers while maintaining features that satisfy experienced traders' requirements.

Important Notice

Traders should know that Switch Markets operates under different regulatory frameworks across various jurisdictions, with primary regulation under ASIC in Australia. The broker's services and available features may vary depending on the client's location and local regulatory requirements. Prospective traders must ensure compliance with their local financial regulations and verify the specific terms and conditions applicable in their jurisdiction.

This review is based on comprehensive analysis of publicly available information, user feedback from multiple sources, and industry standards as of 2025. The evaluation considers various factors including trading conditions, platform functionality, customer service quality, and regulatory compliance to provide an objective assessment for potential clients.

Rating Framework

Overall Rating: 7.2/10

Broker Overview

Switch Markets emerged in the forex trading sector in 2019. The company established its presence with headquarters strategically located in Australia and Saint Vincent and the Grenadines. The broker operates under a hybrid business model combining Straight Through Processing (STP) and Electronic Communication Network (ECN) execution methods, ensuring that client orders receive direct market access with minimal intervention. This approach allows Switch Markets to provide competitive pricing while maintaining transparency in trade execution.

The company has positioned itself as a technology-forward broker. It leverages advanced trading infrastructure to serve clients across multiple global markets. With offices in Sydney, Kingstown, and Kuala Terengganu, Switch Markets demonstrates its commitment to serving diverse geographical markets while maintaining regulatory compliance in key jurisdictions. This switch markets review indicates that the broker has focused on building a robust operational framework that supports both novice and experienced traders.

Switch Markets offers trading access through the widely recognized MetaTrader 4 and MetaTrader 5 platforms. The broker provides clients with professional-grade trading tools and analytical capabilities. The broker's asset portfolio spans five major categories: foreign exchange pairs, individual stocks, market indices, commodities, and cryptocurrencies, totaling over 1,000 tradeable instruments. Primary regulatory oversight comes from the Australian Securities and Investments Commission (ASIC), providing clients with regulatory protection and ensuring adherence to strict financial service standards.

Regulatory Jurisdiction: Switch Markets operates under ASIC regulation in Australia. This ensures compliance with stringent financial service regulations and provides client protection through established regulatory frameworks that govern forex and CFD trading activities.

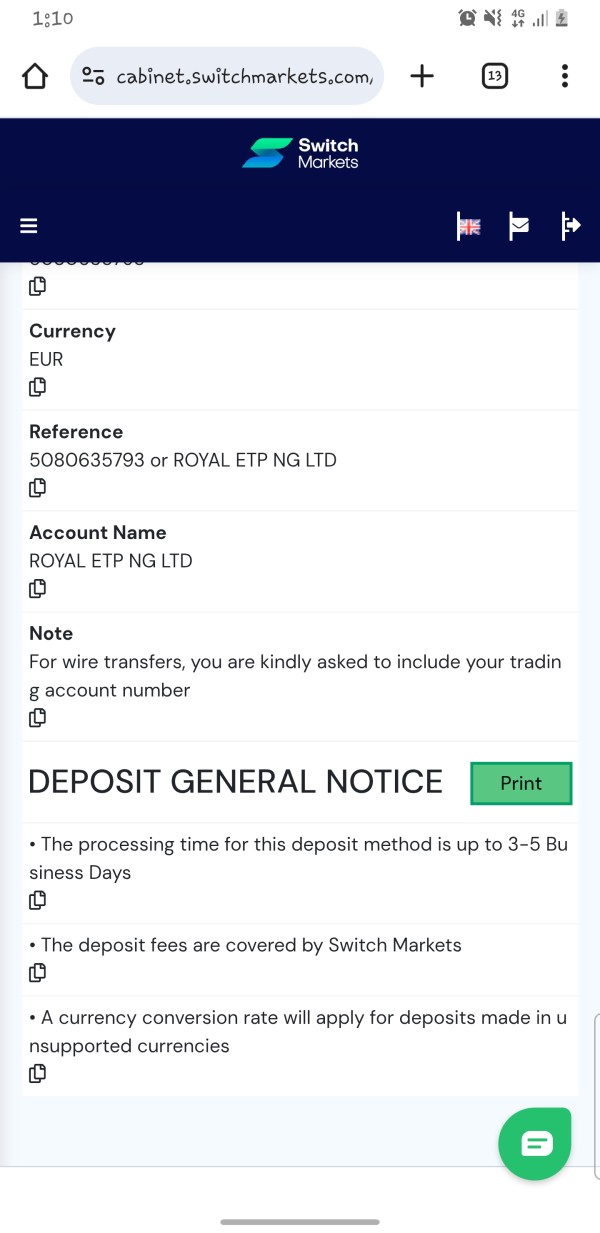

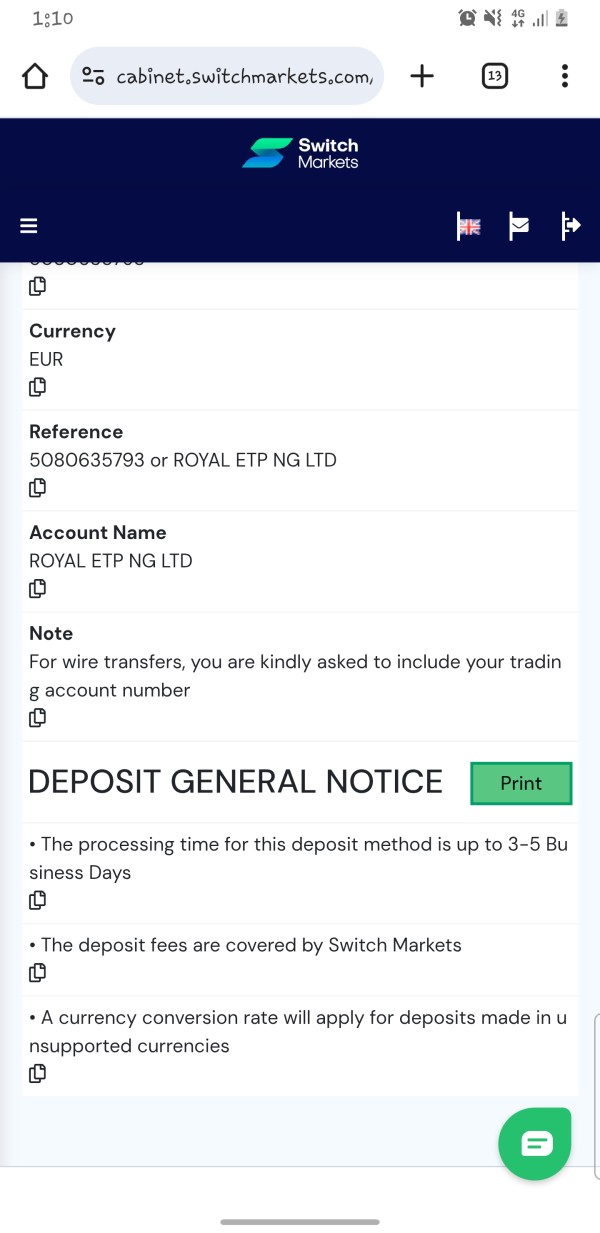

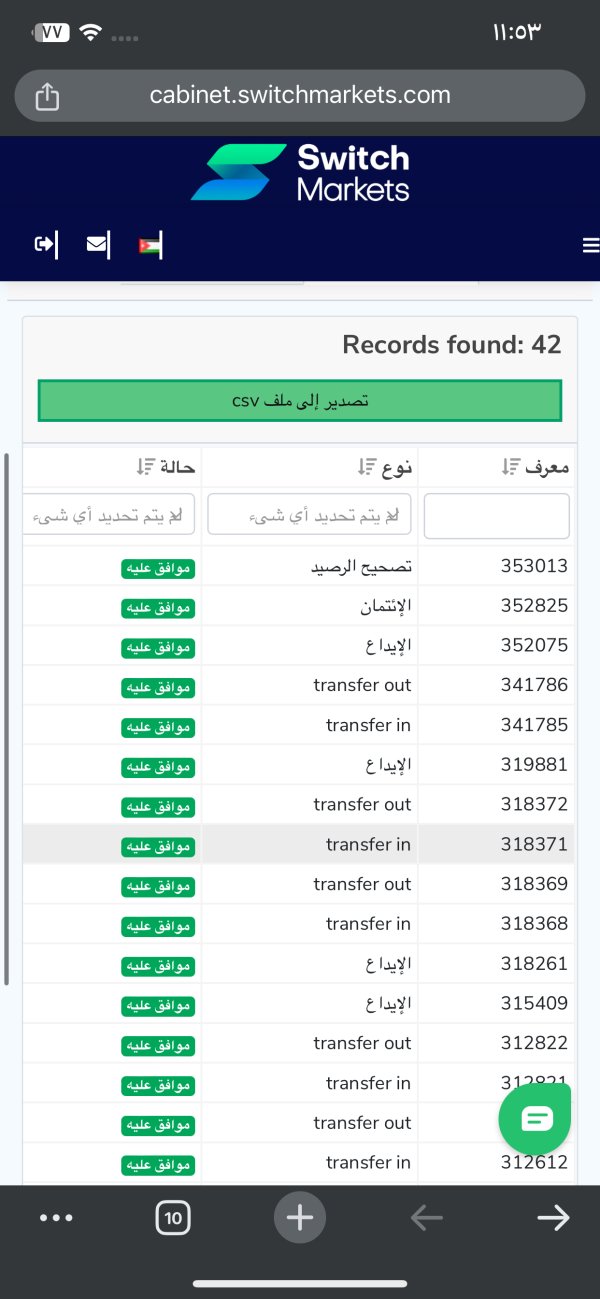

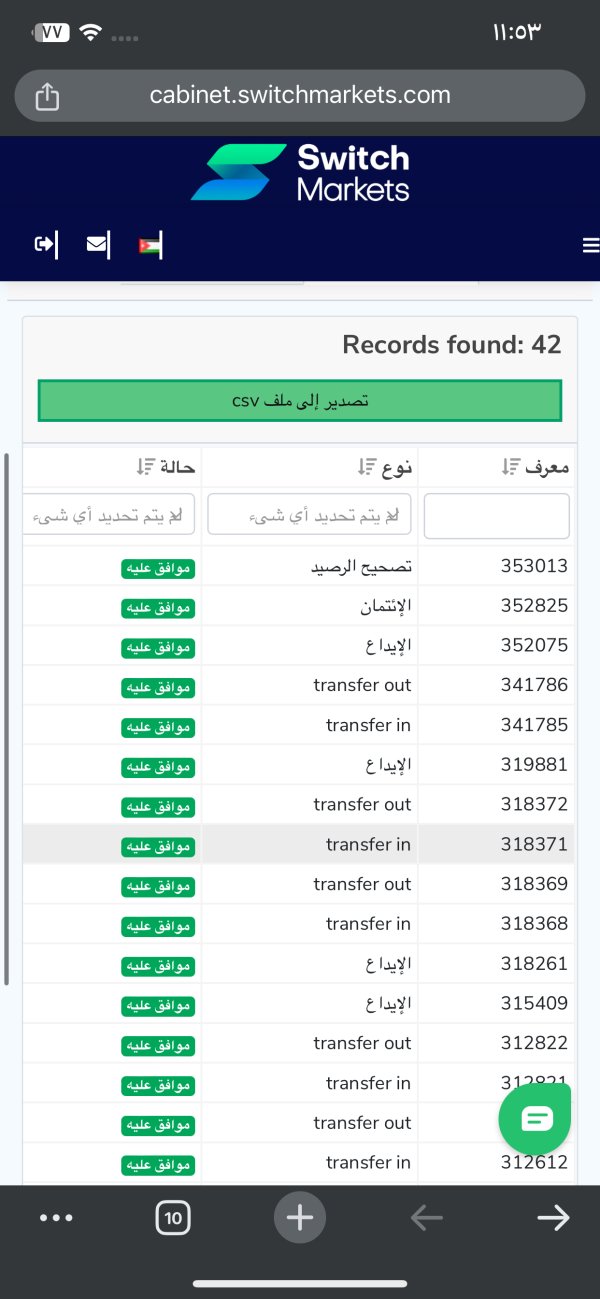

Deposit and Withdrawal Methods: The broker supports diverse funding options including traditional bank transfers, major credit and debit cards, popular e-wallet services, and cryptocurrency deposits. This accommodates various client preferences for account funding and profit withdrawal.

Minimum Deposit Requirement: With a minimum deposit of just $50 USD, Switch Markets maintains an accessible entry point that welcomes new traders. It provides sufficient flexibility for account funding strategies.

Promotional Offers: New clients can benefit from deposit bonuses reaching up to $5,000. This provides additional trading capital that can enhance initial trading capacity and extend trading opportunities for qualifying accounts.

Tradeable Assets: The broker provides access to comprehensive asset classes including major, minor, and exotic forex pairs, individual company stocks, global market indices, precious metals and energy commodities, plus popular cryptocurrencies. This supports diversified trading strategies.

Cost Structure: Switch Markets operates with zero-commission trading across all asset classes, while spreads begin from zero pips on major currency pairs. This creates a competitive cost environment that benefits high-frequency and scalping strategies particularly.

Leverage Ratios: Maximum leverage reaches 1:500 on forex pairs. This provides significant market exposure potential for traders who understand leverage risks and employ appropriate risk management strategies.

Platform Options: Clients access markets through MetaTrader 4 and MetaTrader 5 platforms. Both are renowned for their stability, comprehensive analytical tools, and extensive customization options that support various trading methodologies.

Geographic Restrictions: Specific regional limitations are not detailed in available information. Potential clients need to verify service availability in their jurisdiction during the account opening process.

Customer Support Languages: While specific language support details are not mentioned in available materials, customer service typically includes English support. Additional language options may be available based on regional offices.

Detailed Rating Analysis

Account Conditions Analysis (Score: 8/10)

Switch Markets demonstrates strong performance in account conditions. This is primarily driven by its accessible $50 minimum deposit requirement that significantly lowers the barrier to entry compared to many competitors requiring substantially higher initial investments. This switch markets review finds that the broker offers standard account types suitable for different trader profiles, from beginners testing strategies with smaller capital to experienced traders implementing sophisticated approaches.

The zero-commission structure across all tradeable assets represents a significant advantage, particularly for active traders who would otherwise face substantial transaction costs. This fee structure, combined with spreads starting from zero pips, creates an environment where traders can focus on market movements rather than cost considerations. User feedback consistently highlights satisfaction with the straightforward account opening process, which appears streamlined and efficient.

The broker's bonus program, offering up to $5,000 in deposit bonuses, adds considerable value to the account conditions. However, traders should carefully review terms and conditions associated with bonus withdrawals. While information regarding Islamic accounts or other specialized account types is not detailed in available materials, the standard offering appears comprehensive for mainstream trading needs. The combination of low entry requirements, competitive costs, and bonus opportunities positions Switch Markets favorably in the account conditions category.

Switch Markets provides solid trading infrastructure through MetaTrader 4 and MetaTrader 5 platforms. Both are industry-standard solutions recognized for their reliability, comprehensive charting capabilities, and extensive technical analysis tools. These platforms offer over 50 built-in technical indicators, multiple timeframe analysis, and advanced order types that support various trading strategies from scalping to long-term position trading.

The broker's platform selection demonstrates understanding of trader needs, as MT4 and MT5 remain the most widely adopted trading platforms globally. Both platforms support automated trading through Expert Advisors (EAs) and provide access to the MQL community for custom indicator development. However, this review notes that specific information regarding proprietary research tools, market analysis resources, or educational materials is not detailed in available information.

User feedback suggests positive experiences with platform functionality and reliability. The absence of mentioned educational resources or research tools represents a potential area for improvement. The platforms' mobile versions ensure traders can monitor and execute trades remotely, supporting modern trading requirements for flexibility and accessibility. While the core trading tools are robust, the limited information about additional resources prevents a higher rating in this category.

Customer Service and Support Analysis (Score: 7/10)

User feedback indicates that Switch Markets maintains responsive customer service. Clients report satisfactory response times when seeking assistance. The broker's multiple office locations in Sydney, Kingstown, and Kuala Terengganu suggest a commitment to providing regional support, though specific details about support channels, availability hours, or multilingual capabilities are not comprehensively detailed in available materials.

The positive user reviews regarding customer service suggest that the broker prioritizes client communication and problem resolution. However, without specific information about support channels such as live chat, phone support, or email response times, it's challenging to provide a complete assessment of service capabilities. The geographic distribution of offices implies 24-hour support potential, which would be valuable for traders across different time zones.

The absence of detailed information about customer service features such as dedicated account managers, educational webinars, or technical support specialists limits the ability to fully evaluate this dimension. While user satisfaction appears positive based on available feedback, the lack of comprehensive service information prevents a higher rating. Prospective clients should verify specific support options during the account opening process to ensure their communication preferences are accommodated.

Trading Experience Analysis (Score: 8/10)

Switch Markets delivers a strong trading experience. It is particularly noted for fast execution speeds that support various trading strategies including scalping and high-frequency approaches. The combination of STP and ECN execution models ensures that trades receive direct market access with minimal slippage, creating an environment conducive to precise trade execution.

The zero-spread offering on major currency pairs, combined with zero-commission trading, creates optimal conditions for active trading strategies. User feedback consistently highlights positive experiences with trade execution quality and platform stability. The availability of leverage up to 1:500 provides flexibility for traders seeking enhanced market exposure, though this should be balanced with appropriate risk management practices.

MetaTrader 4 and MetaTrader 5 platforms offer comprehensive trading functionality including advanced charting tools, technical indicators, and automated trading capabilities through Expert Advisors. The platforms' stability and feature richness contribute significantly to the overall trading experience. However, specific information about mobile trading capabilities, advanced order types, or unique trading features is not detailed in available materials.

This switch markets review finds that the broker's focus on execution quality and platform reliability creates a trading environment that meets professional standards. It supports both manual and automated trading approaches effectively.

Trust and Reliability Analysis (Score: 6/10)

Switch Markets operates under ASIC regulation, which provides a foundation of regulatory oversight and client protection within the Australian financial services framework. ASIC regulation includes requirements for client fund segregation, financial reporting, and operational standards that enhance broker reliability. However, specific details about the broker's license number, additional regulatory certifications, or compliance measures are not comprehensively detailed in available information.

The broker's establishment in 2019 means it has a relatively short operational history compared to more established competitors. This may influence long-term reliability assessment. While no significant negative events or regulatory issues are mentioned in available materials, the limited operational track record requires careful consideration for risk-averse traders.

User feedback does not indicate major trust concerns, and the regulatory framework provides basic protection. The absence of detailed information about fund security measures, insurance coverage, or transparency initiatives limits the ability to assign a higher trust rating. The broker's multiple office locations suggest operational stability, though comprehensive corporate transparency information is not available in the reviewed materials.

Prospective clients should verify current regulatory status and review the broker's client agreement thoroughly. This helps understand protection measures and operational policies before committing significant trading capital.

User Experience Analysis (Score: 7/10)

Switch Markets receives generally positive user feedback. Available reviews indicate satisfaction with overall trading experience and platform functionality. The broker's user base appears to appreciate the straightforward account opening process, competitive trading conditions, and reliable platform performance. The balance of positive and neutral reviews suggests consistent service delivery without major user experience issues.

The platform selection of MT4 and MT5 contributes positively to user experience, as these platforms offer familiar interfaces for experienced traders while remaining accessible to newcomers. The low minimum deposit requirement enhances accessibility, allowing users to test the broker's services without significant financial commitment. Multiple deposit and withdrawal options provide flexibility in account management.

However, the absence of detailed information about user interface design, account management features, or client portal functionality limits the comprehensive assessment of user experience elements. While core trading functionality appears solid based on user feedback, additional features such as educational resources, research tools, or community features that could enhance the overall user experience are not detailed in available materials.

The combination of competitive trading conditions, reliable platforms, and positive user feedback creates a satisfactory user experience. Additional service features could potentially elevate this rating in future assessments.

Conclusion

Switch Markets presents itself as a competitive forex broker that successfully balances accessibility with professional trading conditions. This comprehensive evaluation reveals a broker that excels in providing cost-effective trading through zero-commission structures and competitive spreads, while maintaining reliable execution through established MetaTrader platforms. The low $50 minimum deposit requirement makes it particularly suitable for new traders, while the high leverage options and diverse asset selection cater to more experienced traders seeking market exposure across multiple asset classes.

The broker is most suitable for retail traders who prioritize cost-effective trading conditions and appreciate the flexibility of trading across forex, stocks, indices, commodities, and cryptocurrencies from a single platform. Active traders will particularly benefit from the zero-commission structure and tight spreads, while the ASIC regulation provides necessary regulatory protection for serious trading endeavors.

Primary advantages include exceptionally competitive cost structures, reliable platform execution, accessible entry requirements, and comprehensive asset selection. However, areas for improvement include enhanced transparency regarding regulatory details, more comprehensive educational and research resources, and detailed information about advanced trading features and customer service capabilities. Overall, Switch Markets represents a solid choice for traders seeking a cost-effective, regulated broker with professional trading infrastructure.