GeneTrade 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive genetrade review examines a broker that has faced significant challenges in user satisfaction. The overall rating is just 1.2 out of 5 based on available user feedback, which shows serious problems with customer experience and service quality. Despite these concerning ratings, GeneTrade continues to operate as an online trading platform offering forex, indices, and metals trading through the widely-used MetaTrader 4 platform.

GeneTrade positions itself as a global trading service provider. The company uses an ECN STP business model and offers multiple account types to cater to diverse trading needs, making it potentially suitable for different kinds of traders. The broker provides access to various asset classes including currencies, indices, and precious metals, with high leverage options available for experienced traders. However, the low user satisfaction scores and limited transparency in key areas such as regulatory compliance and fee structures raise important considerations for potential clients.

The platform primarily targets traders seeking high leverage opportunities and diversified trading instruments across global markets. While GeneTrade offers the familiar MT4 trading environment that many traders know and trust, prospective users should carefully weigh the concerning user feedback against their trading requirements before making a decision.

Important Notice

This evaluation is based on available public information and user feedback compiled from various sources. GeneTrade operates under FSC regulation, though specific regulatory standards may differ from other jurisdictions and may not provide the same level of protection as more established regulatory bodies. Traders should note that regulatory frameworks and protection levels can vary significantly between different regulatory bodies.

The assessment methodology employed in this review incorporates official broker information, user testimonials, and publicly available data. Given the limited scope of user reviews available, readers should consider seeking additional sources of information before making trading decisions that could affect their financial well-being. All information presented reflects the current state of available data and may be subject to change.

Rating Framework

Broker Overview

GeneTrade was established in 2013 and operates from its headquarters in Belize City. The company positions itself as a global financial services provider that serves traders from around the world. The company employs an ECN STP business model, which theoretically should provide direct market access and competitive pricing for traders. This model typically allows for faster order execution and reduced conflicts of interest between the broker and its clients.

The broker's primary focus centers on delivering forex and precious metals trading services to an international client base. GeneTrade has structured its operations to accommodate traders from various regions, offering multiple account configurations designed to meet different trading styles and capital requirements that range from beginner to advanced levels. The company's longevity in the market, spanning over a decade, suggests some level of operational stability despite the concerning user feedback ratings.

GeneTrade provides trading access through the MetaTrader 4 platform. This is one of the industry's most recognized and widely-adopted trading environments that millions of traders use worldwide. The platform supports trading across multiple asset categories including major and minor currency pairs, stock indices, and precious metals such as gold and silver. The broker operates under the regulatory oversight of the FSC, though specific license details and regulatory protections are not clearly detailed in available public information.

Regulatory Framework: GeneTrade operates under FSC regulation. However, the specific license number and detailed regulatory protections are not prominently disclosed in available materials, which creates uncertainty about client protection levels. This lack of transparency regarding regulatory credentials raises questions about the level of client protection available.

Deposit and Withdrawal Methods: Available information does not specify the funding options available to clients. This represents a significant information gap for potential traders evaluating the broker's accessibility and convenience in managing their trading accounts.

Minimum Deposit Requirements: Specific minimum deposit amounts are not mentioned in available sources. This makes it difficult for traders to assess the accessibility of different account types and plan their initial investment accordingly, which is a basic requirement for most traders.

Promotional Offers: No information regarding bonus structures, promotional campaigns, or incentive programs is available in current sources. This suggests either the absence of such offerings or limited marketing transparency that could indicate broader communication issues.

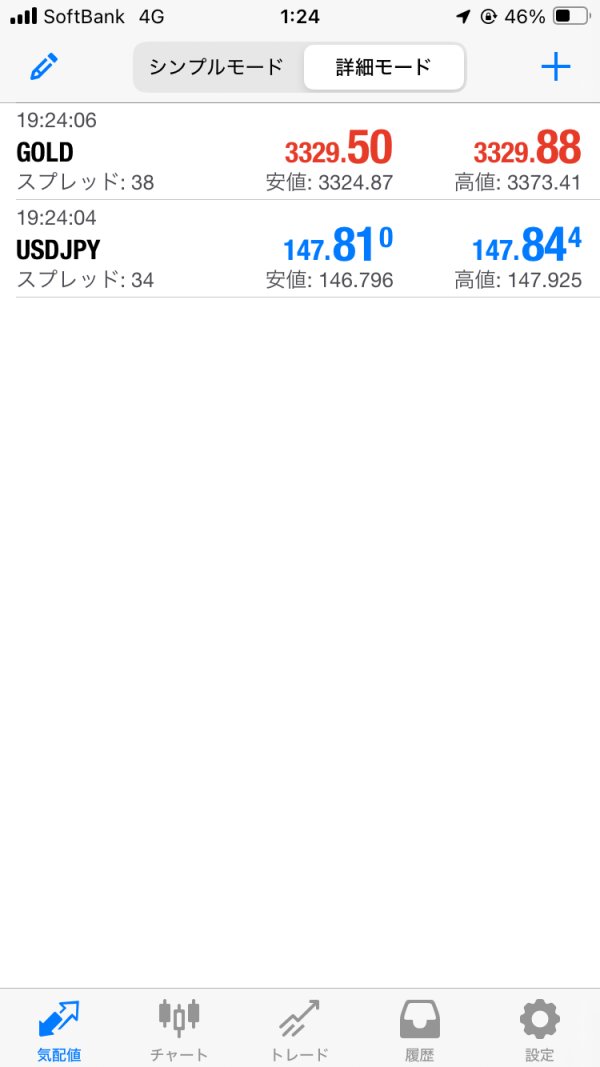

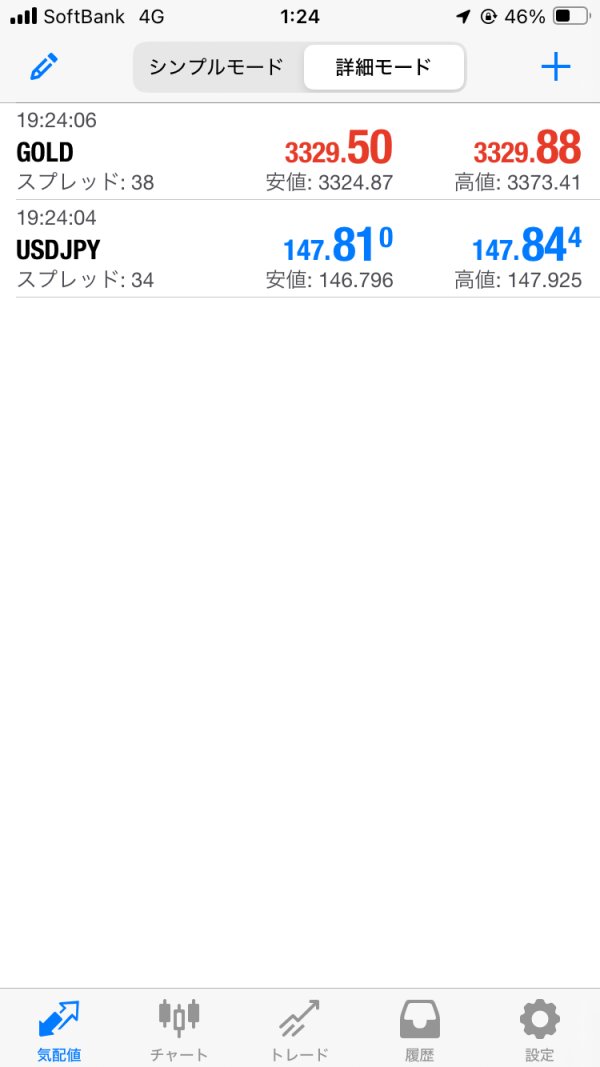

Tradeable Assets: The platform provides access to currencies, indices, and metals. This offers traders diversification opportunities across different market sectors that can help spread risk and find trading opportunities. However, the specific number of instruments and detailed asset listings are not comprehensively documented.

Cost Structure: Critical information regarding spreads, commissions, and other trading costs is notably absent from available materials. This makes it impossible to assess the broker's competitiveness in terms of trading expenses, which are crucial factors in determining profitability.

Leverage Options: While high leverage is mentioned as available, specific maximum leverage ratios and their application across different asset classes are not detailed in current sources. This lack of clarity makes it difficult for traders to understand their potential exposure and risk levels.

Platform Accessibility: The broker supports MetaTrader 4 across web and desktop environments. This provides traders with familiar and robust trading tools, though mobile platform availability specifics are not confirmed in available documentation.

Geographic Restrictions: Information regarding restricted countries or regional limitations is not specified in available materials. This creates uncertainty for international traders about their eligibility to use the platform.

Customer Support Languages: Available customer service languages and support channels are not detailed in current documentation. This genetrade review highlights significant information gaps that potential clients should consider when evaluating the broker's suitability for their trading needs.

Account Conditions Analysis

GeneTrade's account structure appears to offer multiple account types designed to accommodate different trader profiles. However, specific details about each account tier remain unclear from available sources, which makes it difficult for traders to choose the right option. The absence of clearly defined minimum deposit requirements makes it challenging for potential clients to understand the accessibility threshold for different account levels. This lack of transparency in basic account information represents a significant drawback for traders who need to plan their initial investment and understand the commitment required.

The account opening process details are not well-documented in available materials. This could indicate either a streamlined approach or insufficient transparency in onboarding procedures that might create confusion for new clients. Professional traders typically expect clear information about verification requirements, funding timelines, and account activation processes, none of which are adequately addressed in current public information.

Special account features such as Islamic accounts for traders requiring swap-free trading are not mentioned in available sources. Given the global nature of GeneTrade's operations, the absence of information about religious or cultural accommodations may limit the broker's appeal to certain trader demographics who require these specific services. The limited user feedback available does not provide sufficient insight into the practical experience of account management and the responsiveness of account-related services.

When compared to industry standards, the lack of detailed account condition information places GeneTrade at a disadvantage. This is particularly true when compared to more transparent competitors who provide comprehensive account specifications that help traders make informed decisions. This genetrade review must note that the insufficient account details represent a significant barrier to informed decision-making for potential clients.

GeneTrade's tool offering centers around the MetaTrader 4 platform. This provides a solid foundation for technical analysis and automated trading strategies that many professional traders rely on. MT4's comprehensive charting capabilities, technical indicators, and Expert Advisor support offer traders access to professional-grade trading tools. However, the extent of additional proprietary tools or enhanced features beyond the standard MT4 package is not clearly documented in available information.

Research and analysis resources appear to be limited based on available sources. There is no mention of market research, economic calendars, or analytical reports that many traders consider essential for informed decision-making and successful trading strategies. The absence of educational resources is particularly notable, as many brokers use comprehensive educational programs to support trader development and platform adoption.

Automated trading support through MT4's Expert Advisor functionality should theoretically be available. However, specific information about EA hosting, VPS services, or algorithmic trading support is not mentioned in current sources, which limits understanding of advanced capabilities. Advanced traders often require robust automation infrastructure, and the lack of detailed information about these capabilities represents a potential limitation.

The limited user feedback available does not provide sufficient insight into the practical quality and reliability of available tools. Without comprehensive user testimonials about tool performance, execution quality, and platform stability, it becomes difficult to assess the real-world trading experience that GeneTrade provides to its clients.

Customer Service and Support Analysis

Customer service quality and availability represent critical factors in broker selection. However, available information about GeneTrade's support infrastructure is notably limited, which raises concerns about service quality. The absence of clearly defined customer service channels, response time commitments, and support availability hours raises concerns about the level of assistance traders can expect when issues arise.

Multi-language support capabilities are not specified in available sources. This could significantly impact international clients' ability to receive effective assistance, especially during urgent trading situations. Given GeneTrade's positioning as a global service provider, the lack of information about language support represents a potential barrier for non-English speaking traders.

The single user review available provides insufficient data to assess support quality, response effectiveness, or problem resolution capabilities. Professional traders typically require prompt, knowledgeable support for technical issues, account problems, and trading-related questions that can arise at any time. Without comprehensive feedback about support experiences, potential clients cannot adequately evaluate this crucial service aspect.

Problem resolution processes and escalation procedures are not documented in available materials. This leaves traders uncertain about how disputes or technical issues would be handled when they need assistance most. The absence of case studies or examples of successful problem resolution further compounds concerns about GeneTrade's commitment to customer satisfaction and support excellence.

Trading Experience Analysis

The trading experience evaluation for GeneTrade faces significant limitations due to insufficient available data. Information about platform performance, execution quality, and user satisfaction is notably lacking in available sources. While the broker utilizes the MetaTrader 4 platform, which generally provides stable and reliable trading functionality, specific performance metrics such as execution speeds, slippage rates, and platform uptime are not documented in available sources.

Order execution quality represents a crucial factor in trading success. However, information about GeneTrade's execution policies, requote frequency, and price improvement practices is notably absent from available documentation. Traders require confidence in their broker's ability to execute orders at requested prices without excessive delays or rejections, particularly during volatile market conditions. Platform functionality completeness beyond standard MT4 features is not well-documented, making it difficult to assess whether GeneTrade provides enhanced tools, custom indicators, or improved user interfaces that could enhance the trading experience.

Mobile trading capabilities, while likely available through standard MT4 mobile apps, are not specifically confirmed or detailed. This creates uncertainty about the full range of trading options available to users who need flexibility in their trading approach.

The limited user feedback available, consisting of only one review with a concerning 1.2 rating, provides insufficient insight into real-world trading experiences. Without comprehensive user testimonials about execution quality, platform stability, and overall satisfaction, this genetrade review cannot provide definitive assessments of the practical trading experience traders can expect.

Trust and Reliability Analysis

Trust and reliability concerns represent significant challenges for GeneTrade based on available information and user feedback. The broker's FSC regulation provides some level of regulatory oversight, though the absence of specific license numbers and detailed regulatory protections raises questions about the comprehensiveness of client safeguards available.

Fund safety measures and client protection protocols are not clearly documented in available sources. This represents a critical information gap for traders concerned about capital security and the safety of their investments. Professional traders typically expect detailed information about segregated accounts, deposit insurance, and fund protection mechanisms, none of which are adequately addressed in current public materials.

Company transparency appears limited based on the lack of detailed financial reporting, regulatory compliance updates, or comprehensive operational information available to the public. The absence of industry recognition, awards, or third-party certifications further contributes to concerns about the broker's standing within the financial services community and its commitment to best practices.

The concerning 1.2 user rating, while based on limited feedback, suggests potential issues with client satisfaction and service delivery. The lack of positive user testimonials or case studies demonstrating successful client relationships raises additional questions about GeneTrade's ability to meet trader expectations and maintain long-term client relationships that are essential for business success.

User Experience Analysis

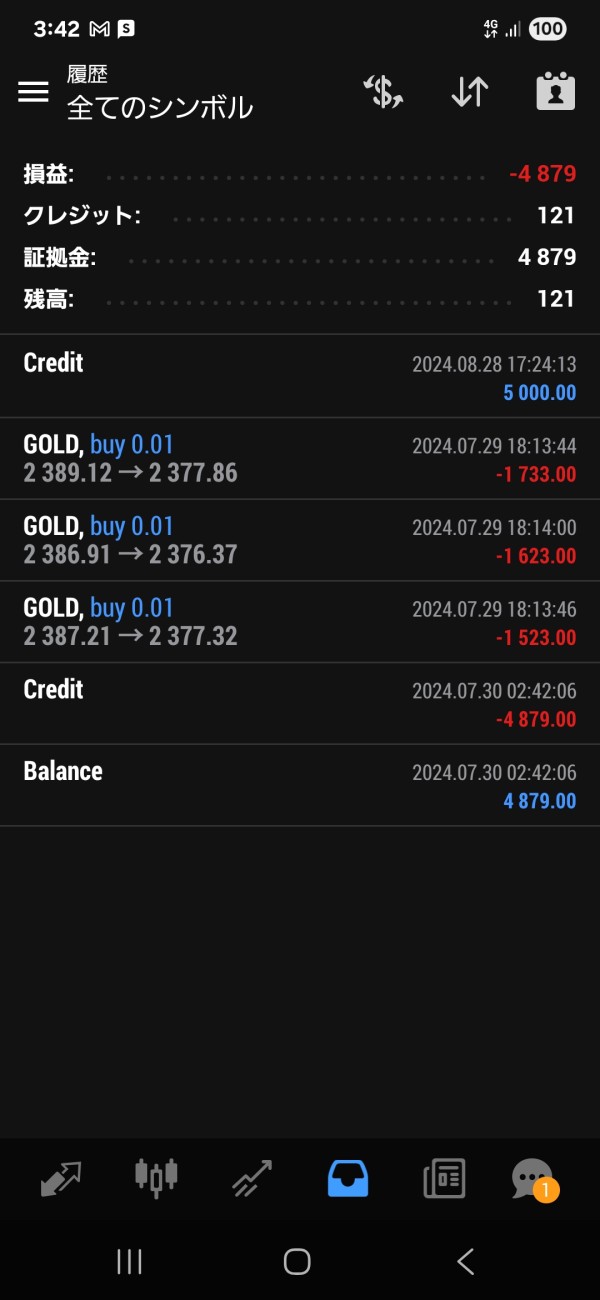

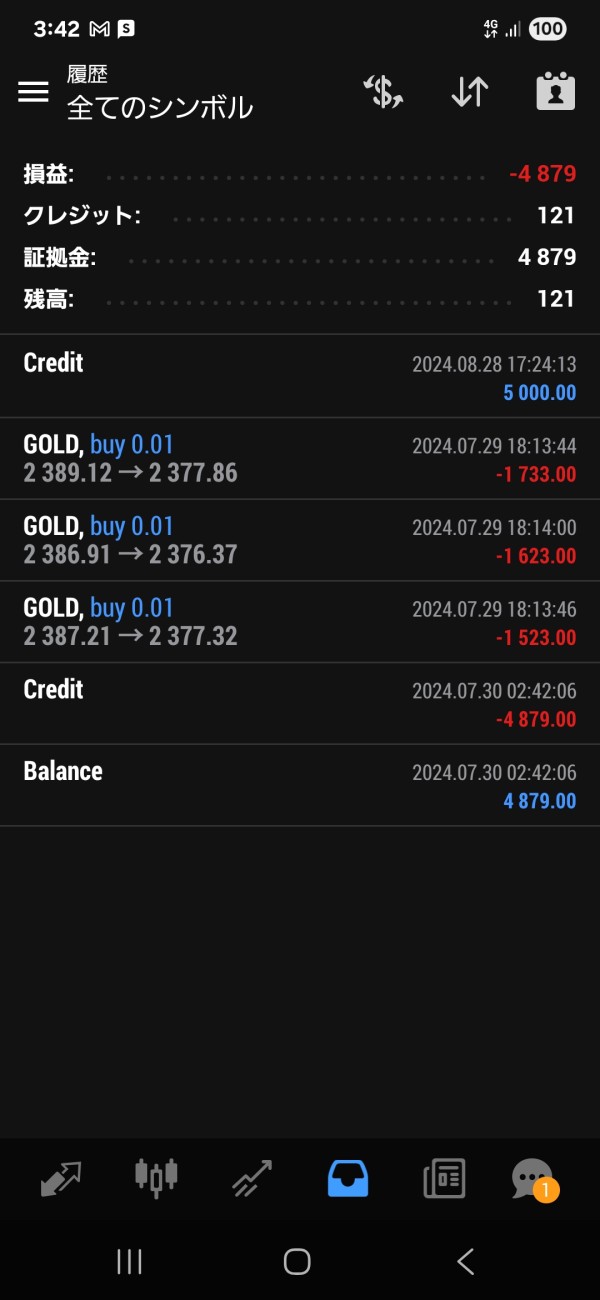

User experience evaluation for GeneTrade reveals significant concerns based on the available 1.2 user rating. This indicates substantial dissatisfaction among the limited number of reviewers who have shared their experiences with the platform. This low satisfaction score suggests potential issues with various aspects of the trading relationship, though specific problem areas are not detailed in available feedback.

Interface design and platform usability, while likely benefiting from MT4's established user experience, may suffer from limited customization or enhancement beyond standard platform offerings. The absence of detailed user interface improvements or proprietary enhancements could limit the overall user experience compared to brokers who invest in platform development and user satisfaction.

Registration and verification processes are not well-documented in available sources. This makes it difficult to assess the convenience and efficiency of account opening procedures that new traders must complete. Streamlined onboarding represents an important factor in overall user satisfaction, particularly for new traders entering the market.

Fund operation experiences, including deposit and withdrawal processes, timeline expectations, and fee structures, are not adequately documented in available materials. These operational aspects significantly impact user satisfaction and represent critical evaluation criteria for potential clients who need reliable access to their funds.

The limited scope of available user feedback prevents comprehensive analysis of common complaints, satisfaction drivers, or specific improvement areas. This lack of detailed feedback makes it impossible to identify patterns or specific issues that could enhance the overall user experience.

Conclusion

This comprehensive genetrade review reveals a broker facing significant challenges in user satisfaction and transparency. With an overall user rating of 1.2 out of 5, GeneTrade demonstrates substantial room for improvement in client service and satisfaction delivery that affects its competitiveness in the market. While the broker offers access to popular trading instruments through the established MetaTrader 4 platform and provides high leverage options, these features are overshadowed by concerning gaps in transparency and user feedback.

GeneTrade may appeal to experienced traders seeking high leverage opportunities and access to diverse trading instruments across forex, indices, and metals markets. However, the limited regulatory transparency, absence of detailed cost structures, and poor user ratings make it difficult to recommend for most trader profiles who prioritize transparency and reliable service.

The broker's main advantages include multiple account type options and global accessibility that could serve international traders. The significant disadvantages encompass poor user feedback, limited transparency regarding fees and regulatory protections, and insufficient information about customer support quality that creates uncertainty for potential clients. Potential clients should carefully consider these factors and seek additional information before committing to a trading relationship with GeneTrade.