Regarding the legitimacy of Exclusive Markets forex brokers, it provides FSA and WikiBit, (also has a graphic survey regarding security).

Is Exclusive Markets safe?

Pros

Cons

Is Exclusive Markets markets regulated?

The regulatory license is the strongest proof.

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Exclusive Markets Ltd

Effective Date:

--Email Address of Licensed Institution:

cc@exclusivemarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.exclusivemarkets.com/, https://exclusivemarkets.ae/, https://exclusivemarketsvn.comExpiration Time:

--Address of Licensed Institution:

Office 15 (A), Third Floor, Vairam Building, Providence, Mahe, SeychellesPhone Number of Licensed Institution:

+2484325323Licensed Institution Certified Documents:

Is Exclusive Markets A Scam?

Introduction

Exclusive Markets is an online forex broker that positions itself as a platform for both novice and experienced traders, offering a wide range of trading instruments across various asset classes. Established in 2020 and based in Seychelles, the broker claims to provide competitive trading conditions, including high leverage and low minimum deposits. However, the forex market is notorious for its risks, and traders must exercise caution when selecting a broker. The legitimacy and reliability of a broker can significantly impact a trader's experience and financial security. Therefore, it is crucial to conduct thorough research before engaging with any trading platform. This article aims to objectively evaluate whether Exclusive Markets is a trustworthy broker or a potential scam, using a comprehensive assessment framework that includes regulatory status, company background, trading conditions, customer experiences, and risk evaluation.

Regulation and Legitimacy

The regulatory environment in which a broker operates is vital in determining its legitimacy and safety for traders. Exclusive Markets is regulated by the Financial Services Authority (FSA) of Seychelles, which is known for its relatively lenient regulatory framework compared to more stringent authorities like the UK's FCA or the US's CFTC. Here is a summary of its regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSA | SD-031 | Seychelles | Active |

While the FSA provides some oversight, it does not offer the same level of investor protection as tier-1 regulatory bodies. The Seychelles FSA primarily requires brokers to maintain a minimum operational capital of $50,000, which raises concerns about the robustness of its regulatory standards. Furthermore, the lack of a compensation scheme for investors in case of broker insolvency is a significant drawback. Traders should be aware that the relaxed regulations in offshore jurisdictions can sometimes lead to a higher risk of fraud or mismanagement.

Company Background Investigation

Exclusive Markets was founded in 2020, making it a relatively new player in the forex trading industry. The company is registered in Seychelles, and its ownership structure is not entirely transparent, which can be a red flag for potential investors. The management teams background and experience are crucial in assessing the broker's reliability; however, detailed information about the team is scarce. While the broker claims to have a decade of experience in the financial services industry, the lack of publicly available information makes it difficult to verify these claims.

Additionally, the broker's transparency regarding its operations is questionable. The absence of detailed disclosures about its financial performance or regulatory compliance history can make traders hesitant. A reputable broker should provide clear and comprehensive information about its management team and operational history to build trust with its clients.

Trading Conditions Analysis

Exclusive Markets offers a variety of trading conditions that cater to different trading strategies. The broker claims to have competitive spreads and low commission structures, but it is essential to analyze these claims critically. The following table summarizes the core trading costs associated with Exclusive Markets:

| Fee Type | Exclusive Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.1 pips | 0.1 - 1.0 pips |

| Commission Model | $7 per lot (exclusive account) | $5 - $10 per lot |

| Overnight Interest Range | Varies | Varies |

While the spreads can be attractive, particularly for the exclusive account, the commission charges may be higher than average for certain account types. Additionally, the broker imposes an inactivity fee of $10 after three months of no trading activity, which can be seen as a deterrent for traders who prefer to take a break from active trading. This fee structure, along with the relatively high minimum deposit requirements for certain account types, may limit accessibility for some traders.

Customer Fund Security

The safety of client funds is paramount in the forex trading industry. Exclusive Markets claims to implement several security measures to protect client funds, including segregated accounts and negative balance protection. Segregated accounts ensure that client funds are kept separate from the broker's operational funds, reducing the risk of loss in case of insolvency. However, the lack of a compensation scheme for investors in Seychelles raises concerns about the adequacy of these protections.

Additionally, the broker's history regarding fund security has not been extensively documented, and there are no significant reports of fund mismanagement or disputes. However, the overall perception of safety with offshore brokers like Exclusive Markets remains cautious due to the inherent risks associated with less stringent regulatory environments.

Customer Experience and Complaints

Customer feedback plays a critical role in assessing a broker's reliability. Exclusive Markets has received a mix of reviews, with some users praising its trading conditions and customer support, while others report issues related to withdrawals and customer service response times. The following table summarizes the common types of complaints received about Exclusive Markets:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Mixed |

| Customer Support Responsiveness | Medium | Generally Positive |

| Inactivity Fees | Low | Clarified |

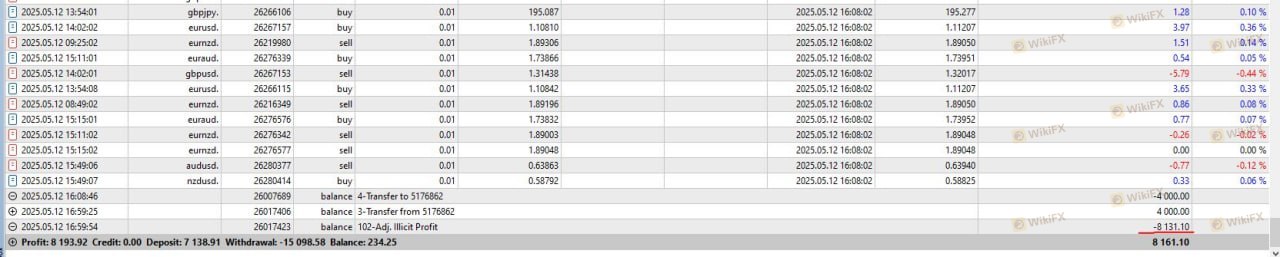

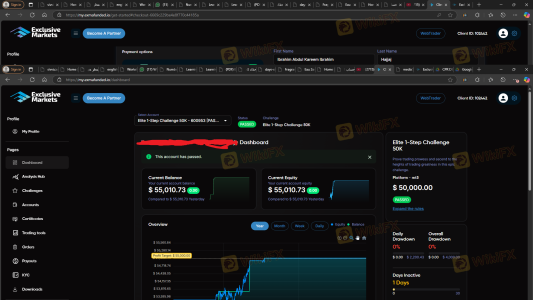

One notable case involved a trader who experienced significant delays in withdrawing funds, leading to frustration and concerns about the broker's reliability. While the company did respond to the complaint, the resolution process took longer than expected, which is a common issue reported by clients. Overall, while many traders report satisfactory experiences, the recurring complaints about withdrawal issues should not be overlooked.

Platform and Trade Execution

The trading platforms offered by Exclusive Markets, namely MetaTrader 4 and MetaTrader 5, are well-regarded in the industry for their performance and user-friendliness. However, the execution quality and reliability of the platforms are critical for successful trading. Traders have reported mixed experiences regarding order execution speed and slippage, with some noting satisfactory performance while others encountered issues during high volatility.

The broker claims to provide fast execution speeds, which is essential for day traders and scalpers. However, any signs of platform manipulation or execution delays could significantly impact a trader's profitability. It is crucial for potential clients to consider these factors and assess whether they can tolerate the risks associated with potential execution issues.

Risk Assessment

Using Exclusive Markets involves several risks that traders should be aware of. The following risk assessment table summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Offshore regulation may lack adequate oversight. |

| Fund Security Risk | Medium | Segregated accounts are in place, but no compensation scheme exists. |

| Withdrawal Risk | Medium | Reports of delays in fund withdrawals are concerning. |

| Execution Risk | Medium | Mixed reviews on order execution quality and speed. |

To mitigate these risks, traders should conduct thorough due diligence before opening an account. It is advisable to start with a demo account to familiarize oneself with the trading environment and test the broker's execution capabilities without risking real funds.

Conclusion and Recommendations

In conclusion, while Exclusive Markets presents itself as a legitimate forex broker with a variety of trading options and competitive conditions, several factors warrant caution. The broker's offshore regulation, mixed customer reviews, and reports of withdrawal delays raise concerns about its overall reliability. While it is not classified as a scam, traders should approach it with a healthy level of skepticism.

For traders seeking a safer environment, it may be prudent to consider brokers with stronger regulatory oversight and a proven track record of customer satisfaction. Recommended alternatives include brokers regulated by tier-1 authorities, such as the FCA or ASIC, which are known for their stringent compliance requirements and investor protection measures. Ultimately, traders must weigh their options carefully and choose a broker that aligns with their trading goals and risk tolerance.

Is Exclusive Markets a scam, or is it legit?

The latest exposure and evaluation content of Exclusive Markets brokers.

Exclusive Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Exclusive Markets latest industry rating score is 2.34, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.34 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.