BC Review 1

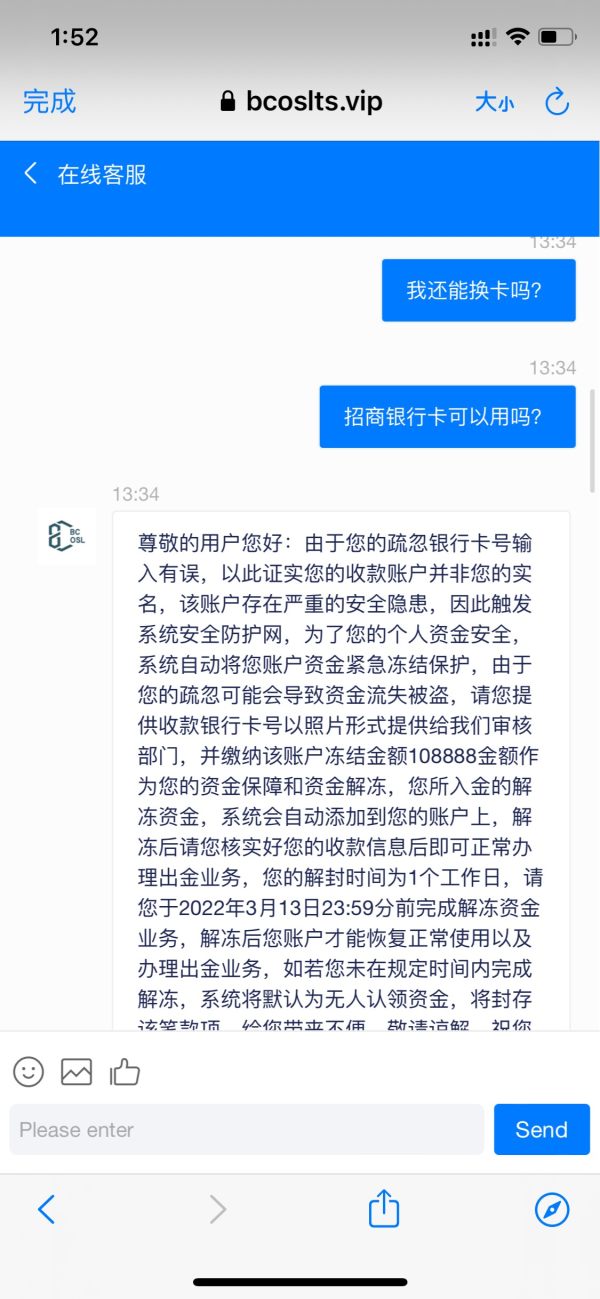

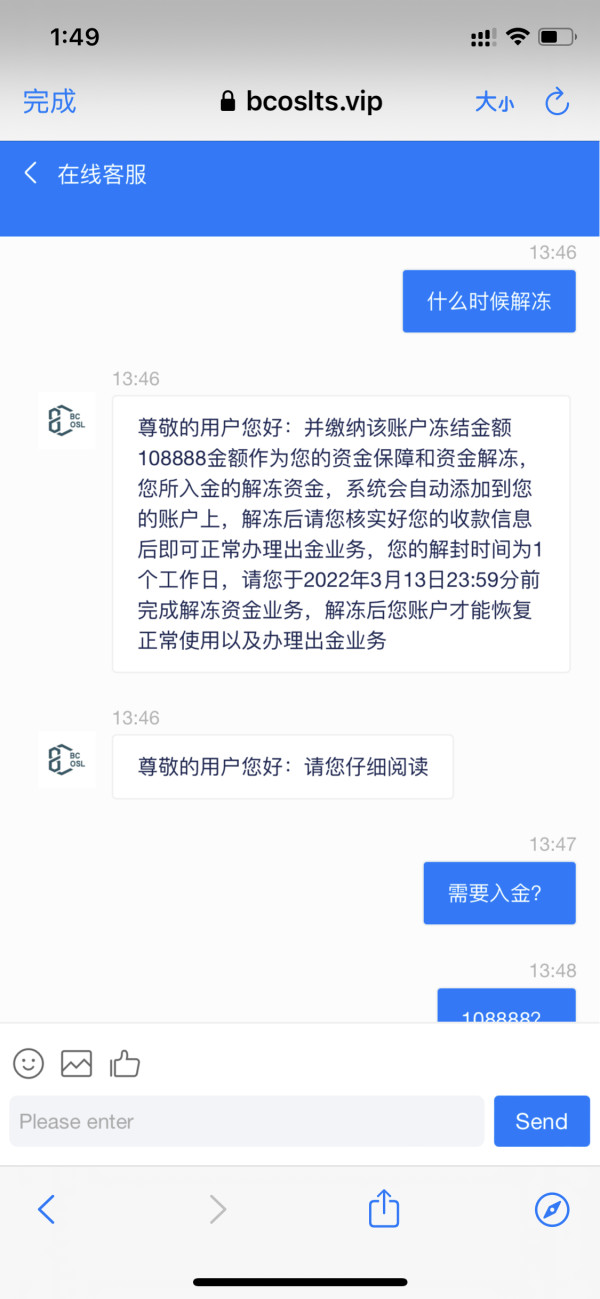

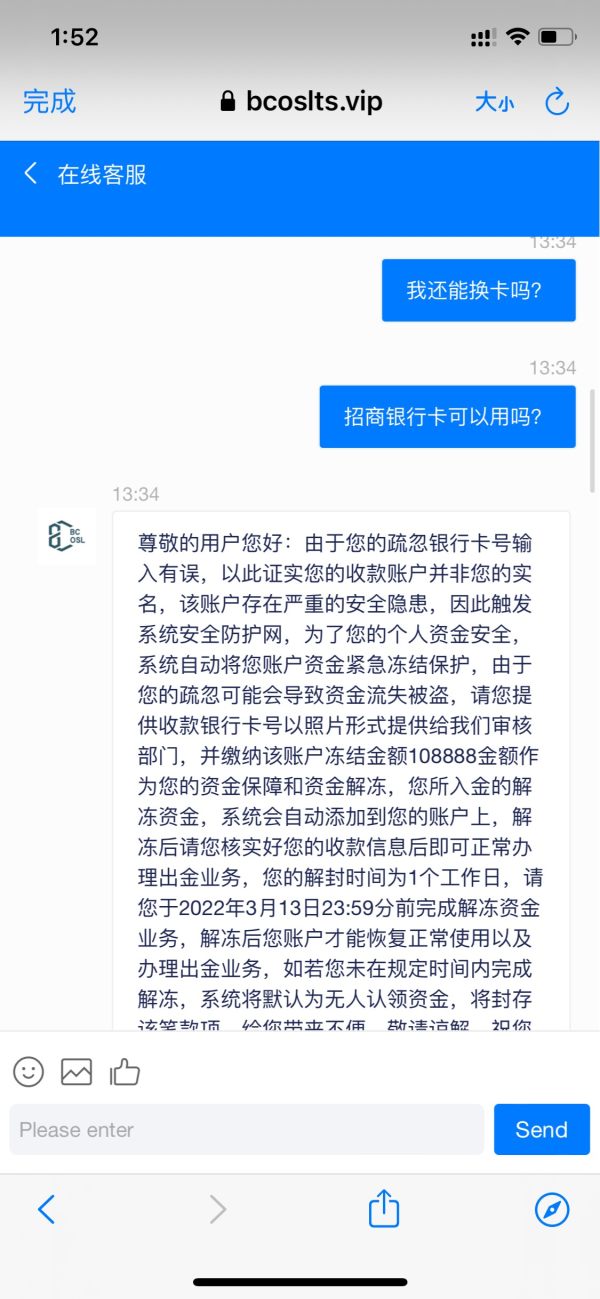

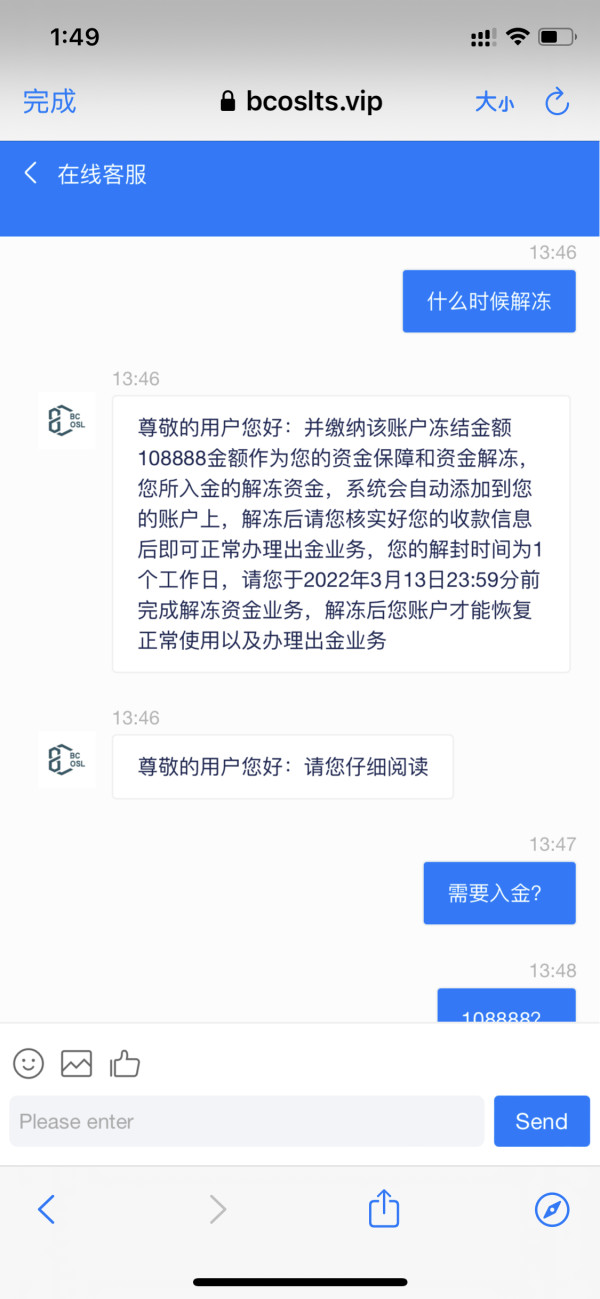

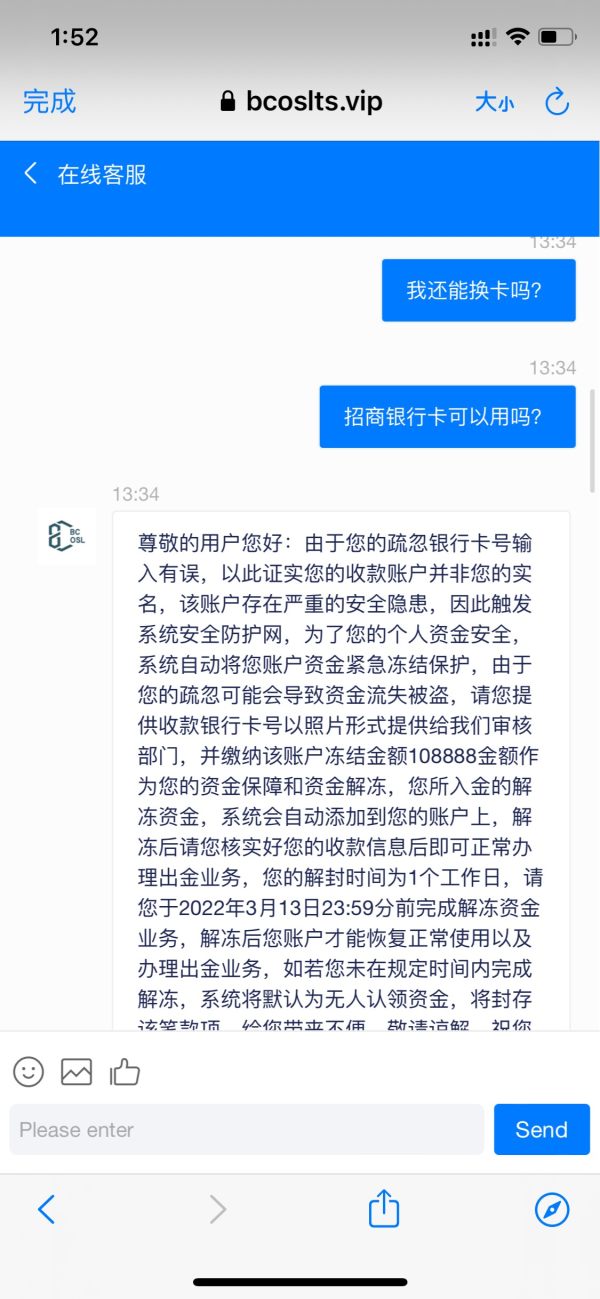

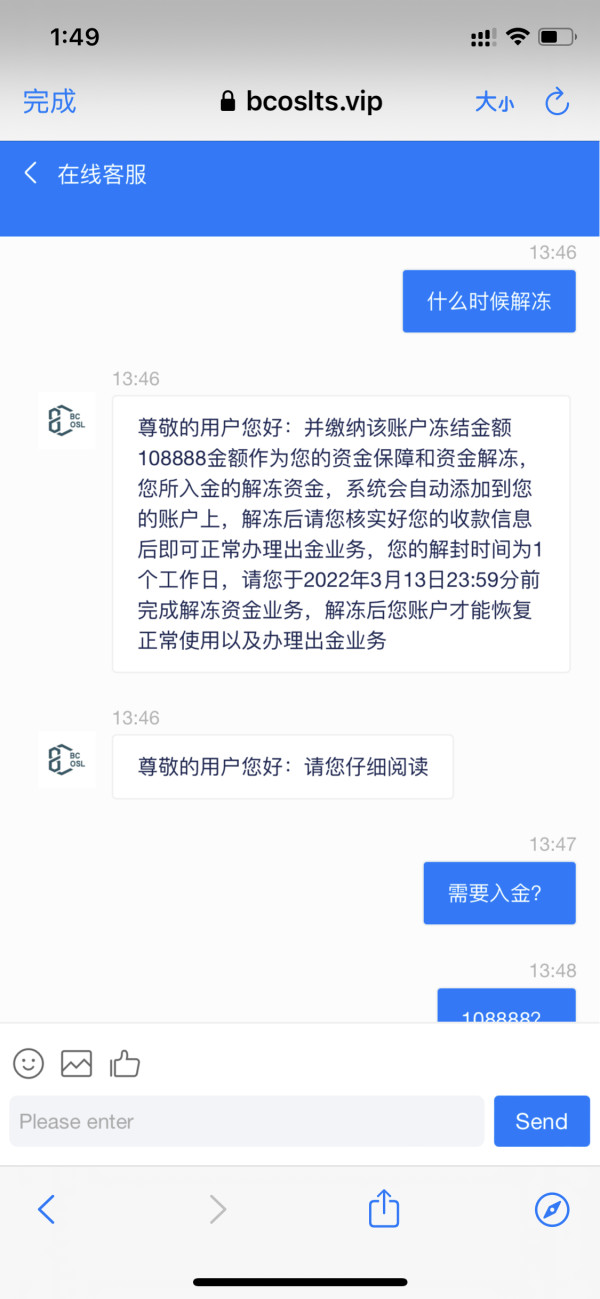

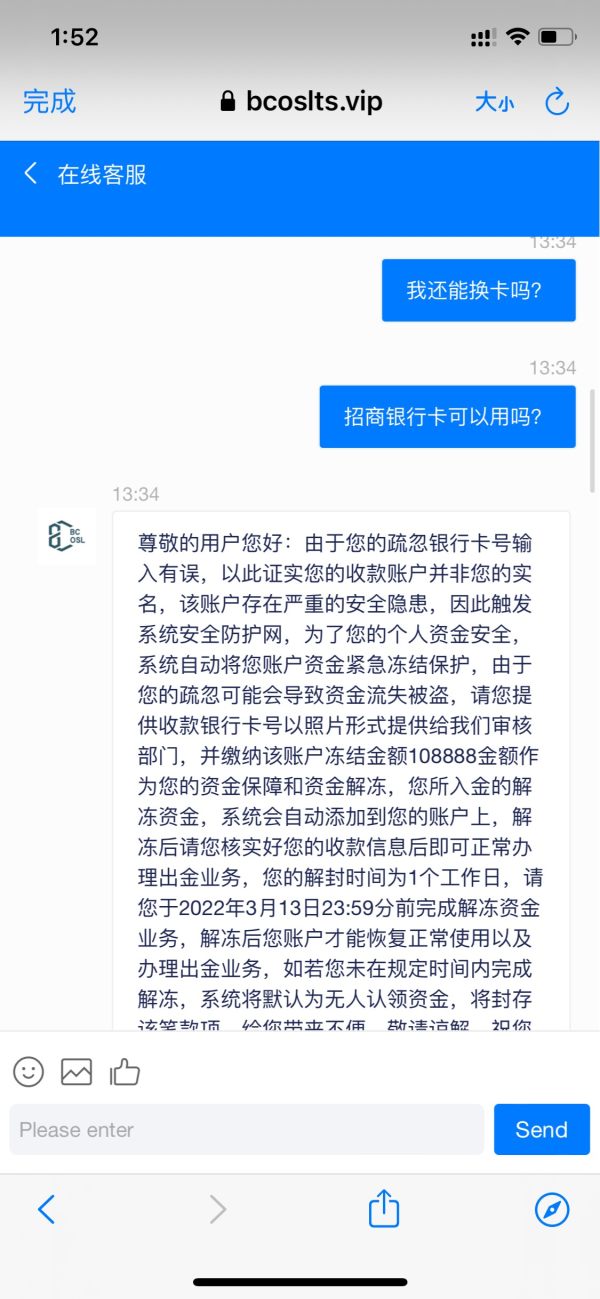

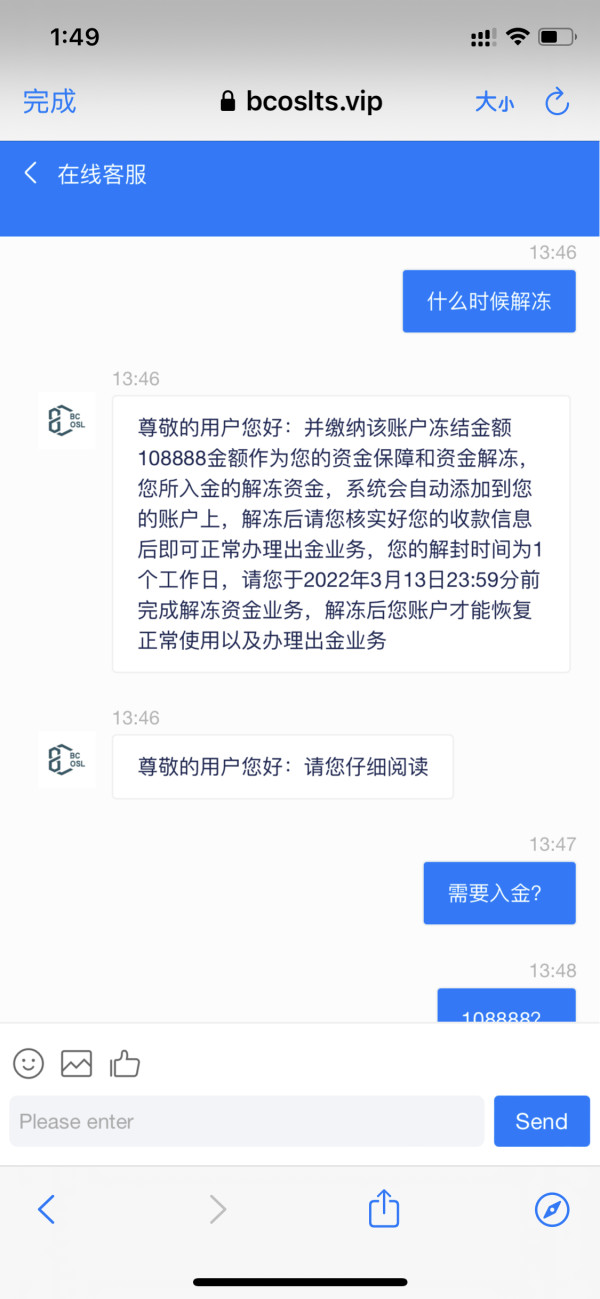

The osl platform under bc does not allow to withdraw, saything that the bank card is wrong and ask for margin.

BC Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

The osl platform under bc does not allow to withdraw, saything that the bank card is wrong and ask for margin.

BC represents a unique entity in the digital landscape. It operates primarily as The British Columbia Review, which is a Vancouver-based online journal dedicated to the literature, arts, culture, and society of British Columbia. The platform was originally established as The Ormsby Review in 2016. This platform has evolved into a comprehensive cultural resource rather than a traditional financial services provider.

While our bc review indicates limited information regarding forex trading capabilities, the platform's commitment to providing accessible and authoritative content about British Columbia's cultural landscape deserves attention. The organization operates under the editorial leadership of Richard Mackie, who is currently on leave from 2023 to 2025. Trevor Marc Hughes serves as Non-fiction Editor and Brett Josef Grubisic as Fiction and Poetry Editor.

The platform's mission centers on delivering lively and inclusive content that explores the diverse cultural fabric of British Columbia. However, potential users seeking traditional brokerage services should note that comprehensive forex trading information remains undisclosed in available materials. The primary user base consists of individuals interested in British Columbia's literary and cultural developments, rather than traditional forex traders.

This positioning makes BC distinctly different from conventional financial service providers. It requires careful consideration from those seeking investment or trading opportunities.

Cross-Regional Entity Differences: BC has not disclosed specific regulatory information regarding financial services operations across different jurisdictions. Users considering any potential trading activities should independently verify relevant cross-regional trading policies and regulatory compliance requirements.

The platform's primary focus on cultural content rather than financial services suggests limited regulatory oversight in traditional brokerage contexts. Review Methodology: This evaluation is based on available information summaries and public materials.

The assessment lacks comprehensive trading condition details, user experience data for financial services, and specific regulatory compliance information that would typically be required for a complete brokerage evaluation.

| Evaluation Criteria | Score | Rating Basis |

|---|---|---|

| Account Conditions | N/A | No specific account condition information available in source materials |

| Tools and Resources | N/A | Trading tools and resources not detailed in available information |

| Customer Service and Support | N/A | Customer service specifics not mentioned in source materials |

| Trading Experience | N/A | Trading experience details not provided in available information |

| Trust and Security | N/A | Regulatory information and security measures not disclosed |

| User Experience | N/A | User experience feedback for financial services not available |

BC operates primarily as The British Columbia Review. It was established in 2016 under its original name, The Ormsby Review.

Based in Vancouver, British Columbia, Canada, the organization has positioned itself as a cultural institution rather than a traditional financial services provider. The platform's editorial team includes experienced professionals dedicated to promoting British Columbia's literary and artistic heritage. Under the leadership of Editor and Publisher Richard Mackie, who is currently on leave through 2025, the organization maintains its commitment to providing comprehensive coverage of regional cultural developments.

The platform's business model centers on delivering online journal services. It features reviews, essays, and memoirs that explore British Columbia's diverse cultural landscape.

The organization employs a team approach, with specialized editors handling different content categories. These include Trevor Marc Hughes as Non-fiction Editor and Brett Josef Grubisic as Fiction and Poetry Editor for the 2023-25 period. Additional team members include Social Media Manager Myshara Herbert-McMyn and Bibliographer Lee Cadwallader.

Regarding trading platform types and asset categories, available source materials do not provide specific information about financial trading capabilities. The primary focus remains on cultural content delivery rather than investment services. Similarly, main regulatory authorities overseeing potential financial operations are not mentioned in available documentation.

This suggests that BC's primary operations may not fall under traditional financial services regulation.

Regulatory Regions: Available source materials do not specify regulatory information for financial services operations. The platform's primary function as a cultural journal suggests limited traditional financial regulatory oversight.

Deposit and Withdrawal Methods: Specific deposit and withdrawal methods for potential trading accounts are not detailed in available information sources. Minimum Deposit Requirements: Source materials do not provide information regarding minimum deposit requirements for any potential trading services.

Bonus Promotions: No information about bonus promotions or incentive programs is available in the provided source materials. Tradeable Assets: Available documentation does not specify tradeable asset categories or investment instruments offered by the platform.

Cost Structure: Detailed cost structures, including spreads, commissions, or fees for potential trading services, are not outlined in available source materials. This bc review finds limited transparency regarding financial service pricing.

Leverage Ratios: Information about leverage ratios for potential trading activities is not provided in source documentation. Platform Choices: Specific trading platform options are not detailed in available materials, as the primary focus remains on cultural content delivery.

Regional Restrictions: Source materials do not specify regional restrictions for potential financial services. Customer Service Languages: Available information does not detail customer service language options.

The evaluation of BC's account conditions presents significant challenges due to the absence of specific information in available source materials. Traditional account types, such as standard, premium, or professional trading accounts, are not detailed in the documentation provided.

This lack of transparency regarding account structures makes it difficult for potential users to understand what services might be available. Minimum deposit requirements, which typically serve as a crucial factor in broker selection, remain unspecified in available materials. Without this fundamental information, prospective clients cannot assess the financial commitment required to begin any potential trading relationship with BC.

The account opening process, including required documentation, verification procedures, and timeline expectations, is not outlined in source materials. Special account functionalities, such as Islamic accounts, managed accounts, or educational accounts, are not mentioned in available documentation.

This absence of detail extends to account-related benefits, such as research access, educational resources, or preferential customer service options that might differentiate various account levels. Our bc review indicates that comprehensive account condition information would be necessary for informed decision-making regarding potential services.

Available source materials do not provide specific information about trading tools and resources that might be offered by BC. Traditional trading platforms typically offer various analytical tools, including technical indicators, charting capabilities, and market analysis features, but such offerings are not detailed in available documentation.

This absence of information makes it challenging to assess the platform's technological capabilities for potential trading activities. Research and analysis resources, which often include market reports, economic calendars, and expert analysis, are not specifically mentioned in relation to financial services. While BC demonstrates expertise in cultural analysis and review through its journal operations, the translation of this analytical capability to financial markets remains unclear from available materials.

Educational resources represent another significant gap in available information. Traditional brokers often provide webinars, tutorials, e-books, and other learning materials to support trader development, but such offerings are not detailed in BC's available documentation.

Similarly, automated trading support, including expert advisor compatibility or algorithmic trading capabilities, is not addressed in source materials.

Customer service channel availability and accessibility represent crucial factors in broker evaluation. Yet specific information about BC's customer support infrastructure is not provided in available source materials.

Traditional support channels, including live chat, phone support, email assistance, and help desk services, are not detailed in the documentation reviewed. Response time expectations, which significantly impact user experience during critical trading situations, remain unspecified in available materials. Without clear service level agreements or performance metrics, potential users cannot assess the reliability of customer support when needed.

Service quality indicators, such as customer satisfaction ratings or resolution time statistics, are not provided in available documentation. Multilingual support capabilities, increasingly important in today's global trading environment, are not addressed in source materials.

The platform's Canadian base suggests English language support, but additional language options remain unclear. Customer service operating hours, including weekend and holiday availability, are not specified in available information. This creates uncertainty about support accessibility during various market conditions.

Platform stability and execution speed represent fundamental aspects of trading experience. Yet specific performance metrics are not provided in available source materials.

Without technical specifications or performance benchmarks, potential users cannot assess the platform's capability to handle trading demands effectively. Order execution quality, including slippage statistics and rejection rates, remains unaddressed in available documentation. Platform functionality completeness, encompassing features such as order types, risk management tools, and portfolio analysis capabilities, is not detailed in source materials.

Mobile trading experience, increasingly crucial for modern traders, is not specifically addressed in available information. The absence of mobile app details or mobile platform capabilities creates uncertainty about trading flexibility and accessibility.

Trading environment characteristics, including market depth information, price feed quality, and execution model transparency, are not specified in available materials. This bc review emphasizes that comprehensive trading experience evaluation requires detailed technical information that is currently unavailable in source documentation.

Regulatory qualification represents a cornerstone of broker trustworthiness. Yet specific regulatory information is not provided in available source materials.

Without clear regulatory oversight details, potential users cannot assess the level of protection and compliance standards that might apply to BC's operations. Traditional regulatory bodies, such as securities commissions or financial conduct authorities, are not mentioned in available documentation. Fund security measures, including segregated account policies, insurance coverage, and client money protection protocols, are not detailed in available materials.

These fundamental safety measures typically provide crucial protection for client funds, but their implementation at BC remains unclear from available information. Company transparency indicators, such as financial reporting, audit information, and corporate governance details, are not provided in source documentation.

Industry reputation and peer recognition, often reflected through awards, certifications, or industry association memberships, are not addressed in available materials. Negative event handling procedures, including complaint resolution processes and regulatory action responses, are not outlined in source documentation. This creates uncertainty about crisis management capabilities.

Overall user satisfaction metrics are not available in source materials. This makes it difficult to assess the general experience of individuals who may have interacted with BC's services.

Without user feedback data, testimonials, or satisfaction surveys, potential clients cannot gauge the real-world experience of working with the platform. Interface design and usability assessments are not provided in available documentation. User-friendly platform design significantly impacts trading efficiency and satisfaction, yet specific interface characteristics are not detailed in source materials.

Registration and verification process descriptions are absent from available information. This creates uncertainty about onboarding procedures and timeline expectations.

Fund operation experience, including deposit and withdrawal processes, processing times, and associated fees, is not addressed in available materials. Common user complaints or recurring issues are not documented in source materials. This prevents potential users from understanding typical challenges or limitations they might encounter.

Based on available information, BC operates primarily as The British Columbia Review, a cultural journal platform rather than a traditional forex broker. While the organization demonstrates commitment to quality content delivery in the cultural sphere, comprehensive forex trading information remains unavailable in source materials.

This bc review suggests that individuals interested in British Columbia's literary and cultural developments would find value in the platform's offerings. The platform appears most suitable for users seeking cultural content and literary reviews rather than traditional trading services. The main advantage lies in the organization's expertise in cultural analysis and regional content delivery, while the primary limitation involves the absence of detailed financial service information.

Potential users should carefully consider their objectives and seek additional information before making any service-related decisions.

FX Broker Capital Trading Markets Review