Forexer 2025 Review: Everything You Need to Know

Executive Summary

This forexer review looks at a trading platform that works for both new and experienced traders who want different investment options. Forexer gives you access to many types of assets including forex currency pairs, commodities, precious metals like gold and silver, and digital assets including Bitcoin and other cryptocurrencies. The platform stands out by letting you trade on PC, mobile, and web-based interfaces.

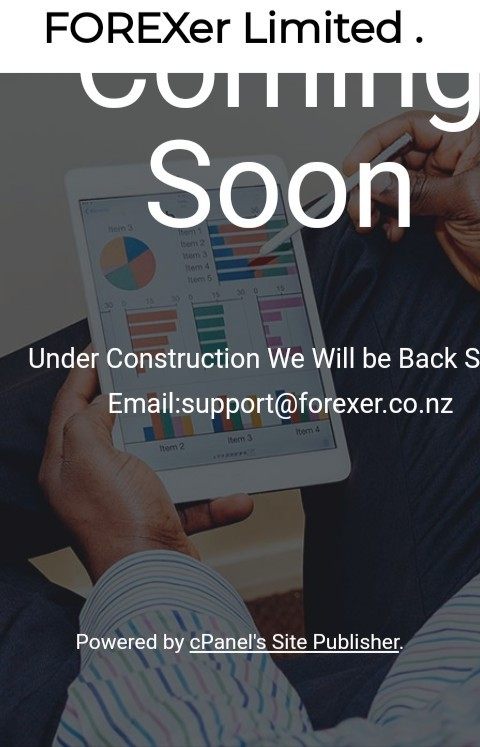

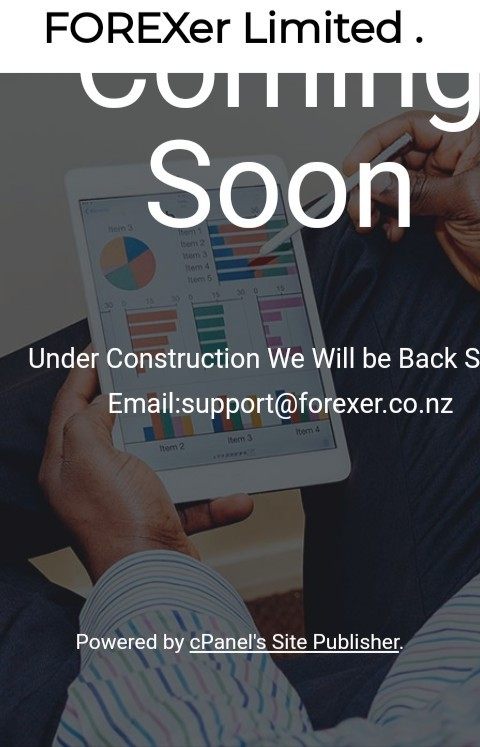

The broker supports both MetaTrader 5 and its own platform FOREXer5. This helps traders who like industry-standard tools or want custom trading environments. Forexer targets users who want variety in their trading portfolio, offering both traditional forex markets and new digital asset opportunities. However, we don't have enough details about rules, account conditions, and how transparent they are, which makes it hard to judge if the platform is trustworthy and follows regulations.

Important Disclaimers

Regional Entity Differences: Forexer's rules and how it works may be very different in different countries. We don't have detailed regulatory information for this broker, which means legal protections, compensation plans, and operational standards may be different depending on where you live and what rules apply there.

Review Methodology: This review uses available information summaries and standard criteria that we commonly use for forex and multi-asset brokers. We don't have complete data, so some parts of this review rely on general industry practices and public information. You should do more research and check current regulatory status before making trading decisions.

Rating Framework

Broker Overview

Forexer works as a multi-asset trading platform that focuses on giving access to different financial markets including foreign exchange, commodities, precious metals, and digital currencies. The broker's business model centers on helping traders at all experience levels, from beginners who want simple market access to professionals who need advanced trading tools. We don't have specific founding details and corporate background information, but the platform's structure suggests they focus on technology access and asset variety.

The platform's main offering uses two primary trading environments: the well-known MetaTrader 5 platform and the broker's own FOREXer5 system. This dual-platform approach in our forexer review shows they try to serve both traders who like industry-standard tools and those who want custom trading experiences. The asset coverage includes traditional forex currency pairs, various commodities, precious metals including gold and silver, and digital assets such as Bitcoin, giving users broad market exposure through one trading account structure.

Regulatory Oversight: We don't have specific regulatory information, leaving questions about the broker's licensing jurisdiction and regulatory compliance framework.

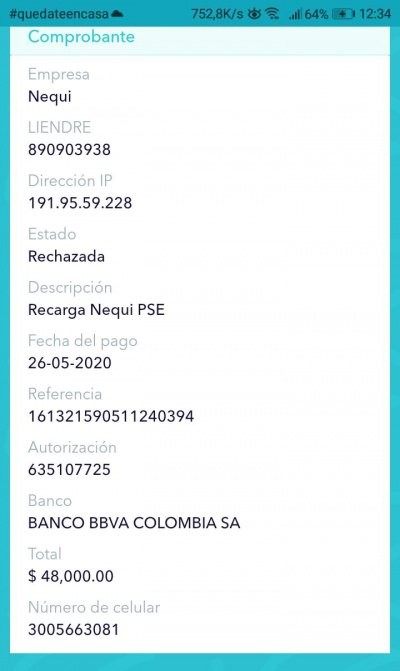

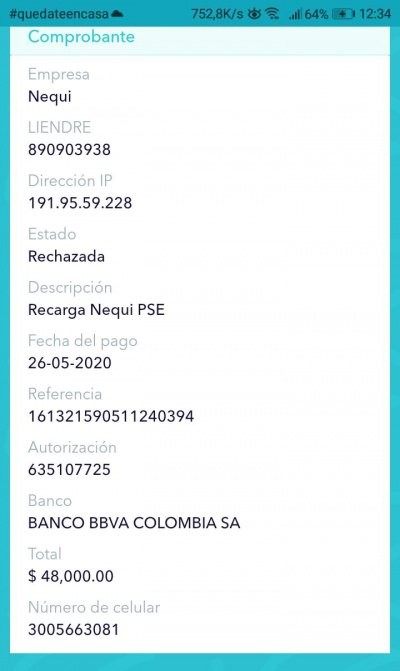

Deposit and Withdrawal Methods: Payment processing options and funding mechanisms are not specified in current documentation, requiring further investigation for potential users. Minimum Deposit Requirements: Entry-level funding requirements have not been disclosed in available materials.

Promotional Offerings: Information about bonus structures or promotional incentives is not provided in accessible documentation. Tradeable Assets: The platform offers comprehensive market access including forex currency pairs, various commodities, precious metals with emphasis on gold and silver trading, and digital assets featuring Bitcoin and other cryptocurrencies.

Cost Structure: Detailed information about spreads, commissions, and fee structures is not available in current materials, representing a significant information gap for potential users. Leverage Ratios: Specific leverage offerings and margin requirements are not detailed in available documentation.

Platform Options: Trading is supported across multiple device types including PC desktop applications, mobile applications, and web-based trading interfaces. Geographic Restrictions: Regional availability and access limitations are not specified in current materials.

Customer Support Languages: Multi-language support capabilities are not detailed in available documentation, though this forexer review notes this as an area requiring clarification.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Forexer's account conditions faces big limitations because we don't have enough information in available materials. Standard account evaluation criteria including account type variety, minimum deposit thresholds, account opening procedures, and specialized account features such as Islamic accounts cannot be properly assessed based on current documentation. This information gap represents a critical consideration for potential users, as account conditions typically form the foundation of the trader-broker relationship.

We can't compare Forexer's offerings against industry standards or competitor alternatives without specific details about account tiers, funding requirements, or verification processes. The absence of clear account condition information in this forexer review suggests that interested traders should directly contact the broker for comprehensive account details before making commitment decisions. Industry best practices typically include transparent disclosure of all account-related terms, making this information gap a notable concern.

Forexer shows strength in platform diversity by offering both MetaTrader 5 and its own FOREXer5 platform, giving users flexibility in choosing their preferred trading environment. MetaTrader 5 represents an industry-standard platform known for its advanced charting capabilities, automated trading support, and comprehensive technical analysis tools. The inclusion of a proprietary platform suggests Forexer's commitment to providing customized trading solutions potentially tailored to specific user needs or market conditions.

The multi-platform accessibility across PC, mobile, and web interfaces shows a modern approach to trading technology, helping users who need flexibility in their trading activities. However, specific information about research resources, educational materials, market analysis tools, and automated trading capabilities remains limited in available documentation. The platform's support for multiple asset classes suggests robust underlying technology infrastructure, though detailed technical specifications and platform performance metrics are not provided in current materials.

Customer Service and Support Analysis

Customer service evaluation for Forexer cannot be comprehensively conducted because we don't have enough information about support channels, response times, service quality metrics, and availability schedules. Standard customer service assessment criteria including live chat availability, phone support, email response times, and multi-language capabilities are not detailed in available materials. This represents a significant information gap, as customer support quality often determines user satisfaction and problem resolution effectiveness.

The absence of specific customer service information limits potential users' ability to assess the broker's commitment to client support and problem resolution. Industry standards typically include 24/5 support during market hours, multiple communication channels, and qualified support staff capable of addressing technical and account-related inquiries. Without documented support structures, users cannot evaluate whether Forexer meets these industry expectations or provides adequate assistance for their trading needs.

Trading Experience Analysis

Assessment of Forexer's trading experience relies primarily on the platform offerings mentioned in available materials. The provision of both MetaTrader 5 and FOREXer5 platforms suggests attention to user experience diversity, though specific performance metrics such as execution speed, platform stability, and order processing quality are not documented. Mobile platform availability indicates recognition of modern trading mobility requirements, allowing users to access markets and manage positions across different devices.

However, critical trading experience factors including execution quality, slippage rates, platform downtime statistics, and overall trading environment characteristics cannot be evaluated based on current information. This forexer review notes that trading experience assessment typically requires detailed technical performance data and user feedback, neither of which is sufficiently available in accessible materials. The multi-asset trading capability suggests a comprehensive trading environment, though specific user experience metrics remain undocumented.

Trust and Regulation Analysis

The trust and regulation assessment for Forexer faces significant challenges because we don't have specific regulatory information in available materials. Regulatory oversight represents a fundamental aspect of broker evaluation, as it provides legal framework protection, operational standards compliance, and dispute resolution mechanisms for traders. Without clear regulatory licensing details, jurisdiction information, or compliance documentation, potential users cannot assess the legal protections available through this broker.

Trust factors including fund segregation practices, regulatory reporting compliance, industry reputation, and negative incident handling cannot be properly evaluated without specific documentation. The absence of regulatory information raises questions about operational transparency and legal accountability that potential users should address through direct inquiry. Industry best practices include clear disclosure of regulatory status, licensing numbers, and compliance frameworks, making this information gap a significant consideration in broker selection decisions.

User Experience Analysis

User experience evaluation for Forexer is limited by the absence of documented user feedback, satisfaction metrics, and comprehensive platform usability information. While the broker targets both novice and experienced traders, specific user experience elements including interface design quality, navigation ease, registration processes, and common user concerns are not detailed in available materials. The multi-platform offering suggests attention to accessibility, though detailed usability assessments cannot be conducted without user feedback data.

The platform's positioning for diverse trader types indicates an attempt to accommodate varying experience levels, though specific user journey optimization, onboarding processes, and user satisfaction outcomes are not documented. Without comprehensive user feedback or detailed interface descriptions, potential users cannot assess whether Forexer's user experience aligns with their specific needs and preferences. This represents a notable limitation in evaluating the broker's overall user-centric approach and interface quality.

Conclusion

This forexer review reveals a trading platform with notable strengths in platform diversity and asset variety, offering both MetaTrader 5 and proprietary FOREXer5 platforms alongside comprehensive market access including forex, commodities, precious metals, and digital assets. The multi-platform approach across PC, mobile, and web interfaces demonstrates modern technological accessibility suitable for traders requiring flexibility in their trading activities.

However, significant information gaps regarding regulatory oversight, account conditions, customer service frameworks, and detailed operational transparency limit the comprehensive evaluation of this broker. The absence of specific regulatory information, user feedback data, and detailed operational metrics represents considerable limitations for potential users seeking thorough broker assessment. Forexer appears most suitable for traders prioritizing asset diversity and platform flexibility, though prospective users should conduct additional due diligence regarding regulatory status and operational details before making commitment decisions.