Exclusive Markets 2025 Review: Everything You Need to Know

Executive Summary

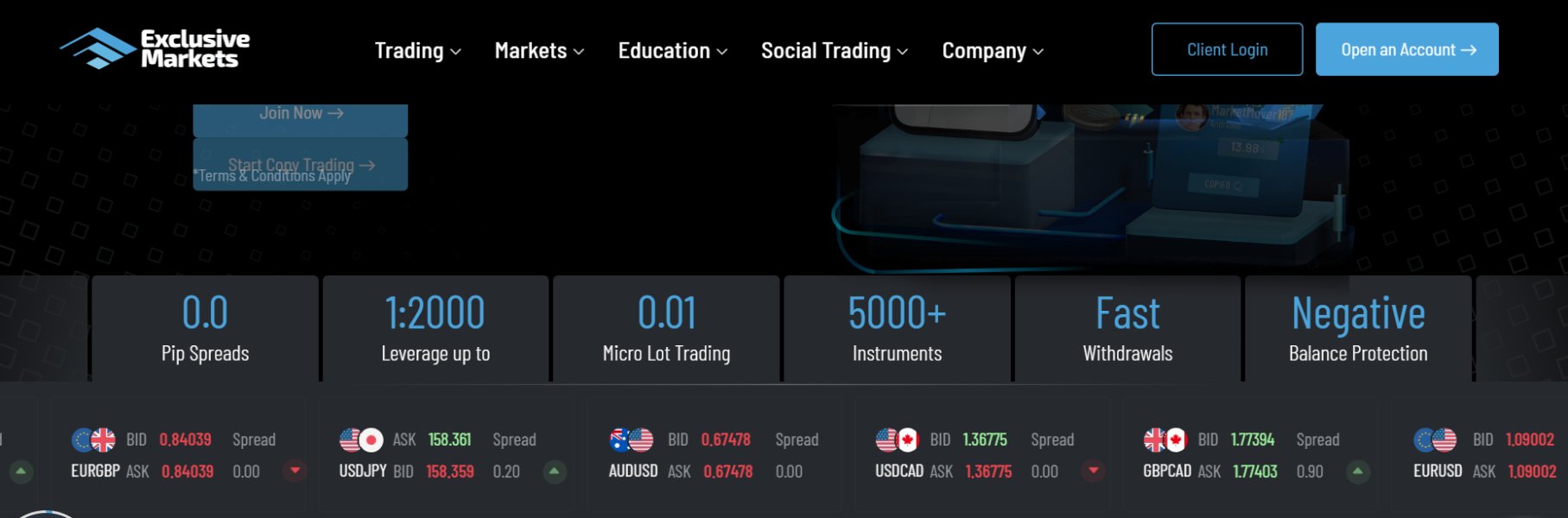

This comprehensive exclusive markets review examines a Seychelles-based broker that has positioned itself as a provider of diverse trading instruments and flexible leverage options. The company was established in 2018, though some sources indicate 2020. Exclusive Markets operates under the regulation of the Seychelles Financial Services Authority (SFSA) and offers over 30,000 trading instruments across multiple asset classes including forex, commodities, indices, stocks, ETFs, and cryptocurrencies.

The broker employs STP, ECN, and DMA execution models. It provides leverage up to 1:2000 with a minimum deposit requirement of $200 USD. While the platform supports popular MetaTrader 4 and MetaTrader 5 trading platforms, potential clients should be aware of regulatory warnings regarding unauthorized activities that have been associated with the company. This exclusive markets review provides a neutral assessment based on available information. The review highlights both the broker's extensive instrument offerings and the regulatory concerns that prospective traders should carefully consider before opening an account.

Important Disclaimers

Regional Entity Differences: Due to varying regulatory requirements across different jurisdictions, users must understand the legality and applicability of Exclusive Markets' services in their respective regions. The broker's regulatory status under SFSA may not provide the same level of protection as more established regulatory frameworks in major financial centers.

Review Methodology: This evaluation is based on publicly available information and market research. Data sources include the company's official website, industry reports, and regulatory databases. Given the limited availability of comprehensive user feedback and detailed operational information, some aspects of this review rely on standard industry practices and comparative analysis with similar brokers operating under offshore regulations.

Rating Framework

Broker Overview

Exclusive Markets emerged in the competitive forex and CFD trading landscape with its establishment in 2018. However, conflicting sources suggest a 2020 founding date. The company is headquartered in Mahe, Seychelles, and has built its business model around providing flexible and diversified financial services through STP (Straight Through Processing), ECN (Electronic Communication Network), and DMA (Direct Market Access) execution methods. This multi-faceted approach positions the broker to cater to various trading styles and preferences. It serves retail traders seeking competitive spreads and institutional clients requiring direct market access.

The broker's operational framework centers on delivering comprehensive trading solutions across multiple asset classes. The company supports both MetaTrader 4 and MetaTrader 5 platforms. Exclusive Markets provides access to forex pairs, commodities, indices, stocks, ETFs, and cryptocurrencies. The company operates under the oversight of the Seychelles Financial Services Authority (SFSA), which provides a regulatory framework. However, traders should note that offshore regulation typically offers different protections compared to major financial centers. This exclusive markets review reveals a broker attempting to balance accessibility with comprehensive market coverage, though regulatory considerations remain paramount for potential clients.

Regulatory Jurisdiction: Exclusive Markets operates under the supervision of the Seychelles Financial Services Authority (SFSA). This is an offshore regulatory body that provides oversight for financial services companies based in Seychelles. While SFSA regulation offers some level of oversight, traders should understand the differences between offshore and major regulatory frameworks.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods was not detailed in available sources. This represents a significant information gap for potential clients seeking to understand funding options and processing procedures.

Minimum Deposit Requirements: The broker maintains a $200 USD minimum deposit requirement. This positions it competitively within the retail trading market. This threshold makes the platform accessible to beginning traders while not being prohibitively low as to suggest inadequate operational standards.

Bonus and Promotional Offers: Available sources did not mention specific bonus structures or promotional campaigns. This indicates either a conservative approach to marketing incentives or limited information disclosure about such programs.

Available Trading Assets: The platform provides access to an extensive range of over 30,000 trading instruments. These span forex currency pairs, commodities including precious metals and energy products, major global indices, individual stocks, exchange-traded funds (ETFs), and cryptocurrency products. This broad selection caters to diverse trading strategies and market interests.

Cost Structure and Fees: Commission structures begin at $5, with variable spreads across different instruments. The specific spread ranges and additional fee structures were not comprehensively detailed in available sources. This represents an area where potential clients would need to seek additional clarification directly from the broker.

Leverage Options: Maximum leverage extends up to 1:2000. This provides significant capital amplification opportunities for experienced traders. This high leverage ratio should be approached with appropriate risk management strategies, particularly given the potential for substantial losses.

Platform Selection: Trading is facilitated through MetaTrader 4 and MetaTrader 5 platforms. These are industry-standard solutions that provide comprehensive charting tools, automated trading capabilities, and extensive technical analysis features. Both platforms support various operating systems and mobile trading applications.

Geographic Restrictions: Specific information about geographic restrictions and service availability was not detailed in available sources. However, regulatory compliance typically requires certain jurisdictional limitations.

Customer Support Languages: Available customer service languages were not specified in accessible sources. This represents another information gap for international clients. This exclusive markets review identifies this as an area requiring direct inquiry with the broker.

Comprehensive Rating Analysis

Account Conditions Analysis (7/10)

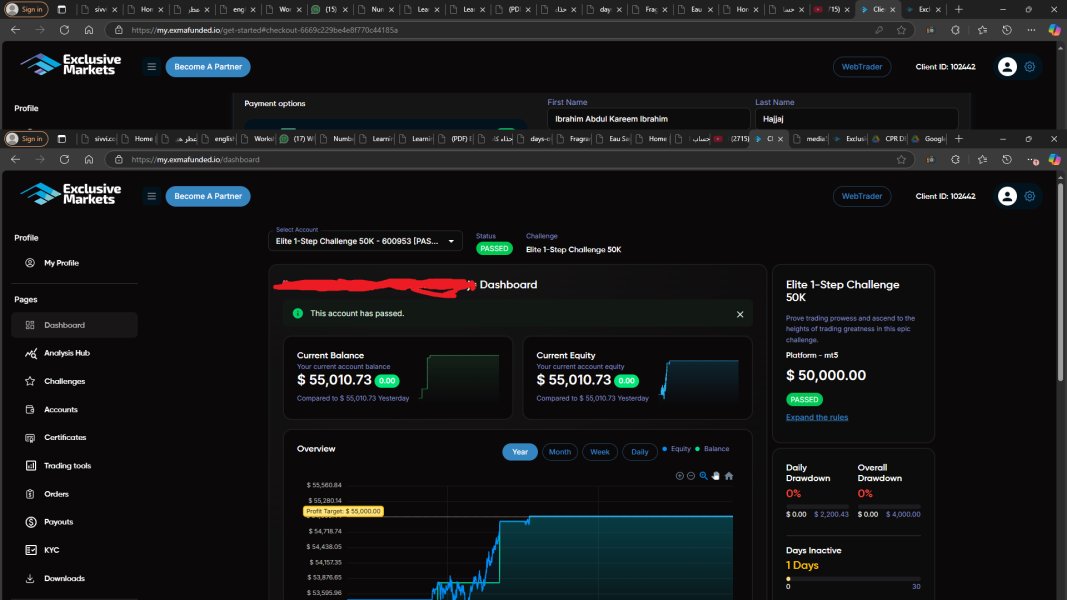

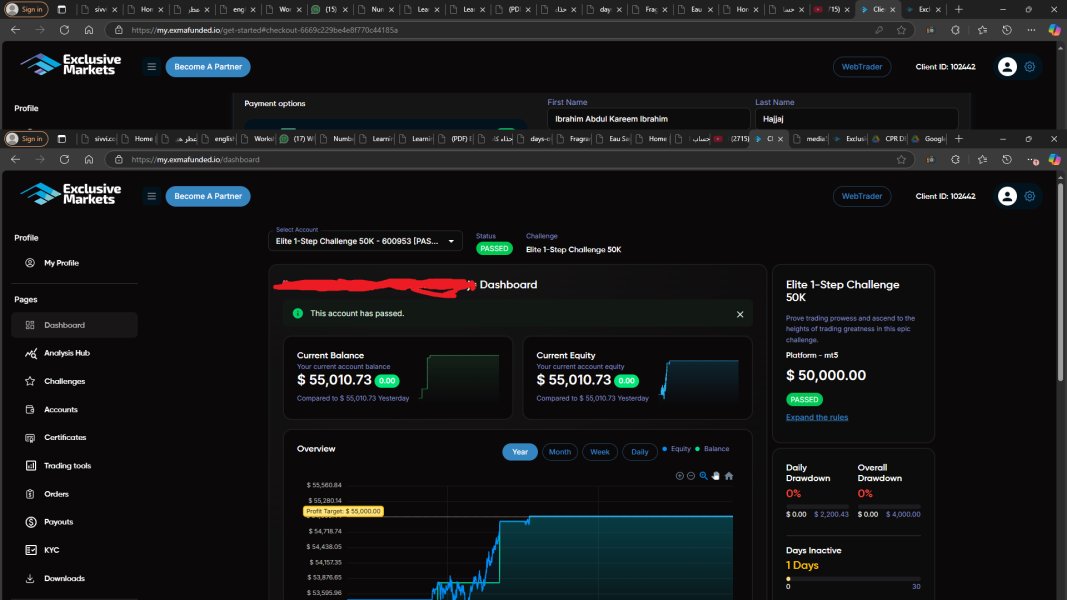

Exclusive Markets demonstrates competitive account structuring with its $200 minimum deposit requirement. This positions it accessibly within the retail trading market without compromising operational standards. The commission structure starting at $5 provides transparency in cost expectations, though the complete fee schedule requires additional clarification from direct broker communication. The leverage offering up to 1:2000 represents one of the more aggressive ratios available in the market. It appeals to experienced traders seeking maximum capital efficiency while requiring sophisticated risk management approaches.

However, this exclusive markets review notes significant information gaps regarding specific account types, their respective features, and any specialized offerings such as Islamic accounts for Sharia-compliant trading. The account opening process, verification requirements, and timeline for account activation were not detailed in available sources. This creates uncertainty for potential clients planning their onboarding experience. Additionally, the absence of information about account maintenance fees, inactivity charges, or minimum trading volume requirements leaves important cost considerations unanswered.

The broker's multi-model execution approach (STP, ECN, DMA) suggests different account types may be available to accommodate various trading preferences. However, specific details about how these models are implemented across different account tiers remain unclear. This lack of comprehensive account information impacts the overall rating despite the competitive basic parameters.

The standout feature of Exclusive Markets lies in its extensive instrument offering of over 30,000 tradeable assets. This represents one of the most comprehensive selections available in the retail trading market. This vast array spans traditional forex pairs, commodities, global indices, individual stocks, ETFs, and cryptocurrency products. It provides traders with unprecedented diversification opportunities within a single platform environment. The support for both MetaTrader 4 and MetaTrader 5 platforms ensures access to industry-standard trading tools, advanced charting capabilities, and automated trading functionalities.

The platform selection demonstrates technical competency, as both MT4 and MT5 offer robust analytical tools, extensive indicator libraries, and support for expert advisors and algorithmic trading strategies. These platforms provide multi-timeframe analysis, one-click trading, and comprehensive order management systems that cater to both manual and automated trading approaches.

However, available sources did not detail proprietary research resources, market analysis tools, educational materials, or additional trading utilities that might distinguish the broker's offering beyond the standard MetaTrader functionality. The absence of information about economic calendars, market commentary, trading signals, or educational resources represents a significant gap in understanding the full scope of tools available to clients. While the instrument diversity and platform quality merit recognition, the lack of comprehensive information about additional resources limits the potential for a higher rating.

Customer Service and Support Analysis (Rating Withheld)

This exclusive markets review cannot provide a comprehensive evaluation of customer service and support due to insufficient information in available sources. Critical details about customer service channels, availability hours, response times, and service quality metrics were not accessible through standard research methods. The absence of information about supported languages, communication methods (phone, email, live chat), and regional support offices creates a significant evaluation gap.

Customer service represents a crucial component of broker selection, particularly for traders requiring technical support, account assistance, or dispute resolution services. Without access to user testimonials, service level agreements, or operational details about the support infrastructure, potential clients cannot adequately assess this dimension of the broker's offering.

The lack of available information about customer service may indicate limited disclosure practices or suggest that support services may not meet industry standards for accessibility and responsiveness. Prospective clients should prioritize direct communication with the broker to evaluate support quality before committing to account opening. This information gap significantly impacts the overall broker assessment and represents a critical area for improvement in transparency.

Trading Experience Analysis (6/10)

The trading experience evaluation for Exclusive Markets relies primarily on the technical capabilities provided through MetaTrader 4 and MetaTrader 5 platforms. Both platforms offer robust trading environments with comprehensive functionality. These platforms provide stable execution environments, extensive analytical tools, and support for various trading styles from scalping to long-term position trading. The multi-execution model approach (STP, ECN, DMA) suggests potential for quality order processing and competitive pricing across different market conditions.

However, this exclusive markets review identifies substantial information gaps regarding platform performance metrics, execution speeds, slippage rates, and requote frequency. User feedback about platform stability, order execution quality, and overall trading experience was not available in accessible sources. This limits the ability to assess real-world performance. The absence of information about mobile trading applications, platform customization options, and additional trading tools beyond standard MetaTrader functionality further constrains the evaluation.

The extensive instrument offering of 30,000+ assets suggests diverse trading opportunities, but without detailed information about spreads, execution quality across different asset classes, or platform performance during high-volatility periods, traders cannot fully assess the practical trading environment. The rating reflects the solid foundation provided by established trading platforms while acknowledging the significant unknowns about actual execution quality and user experience.

Trust and Safety Analysis (5/10)

Exclusive Markets operates under the regulation of the Seychelles Financial Services Authority (SFSA). This provides a basic regulatory framework but lacks the comprehensive oversight and client protection measures associated with major financial regulatory authorities such as the FCA, ASIC, or CySEC. The SFSA regulatory environment offers limited investor compensation schemes and dispute resolution mechanisms compared to more established regulatory jurisdictions.

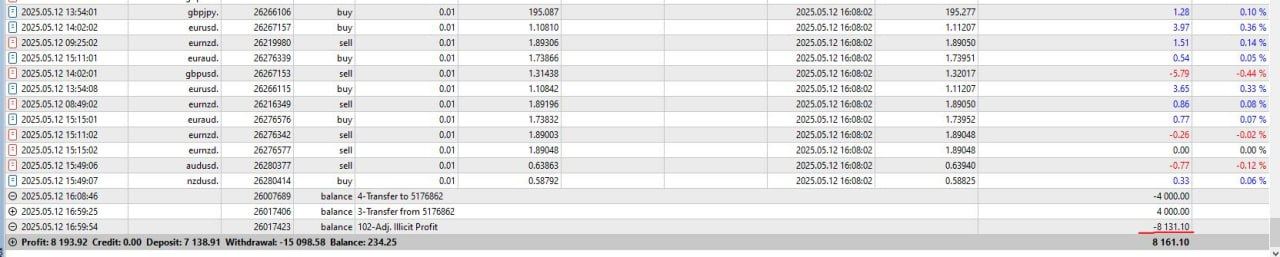

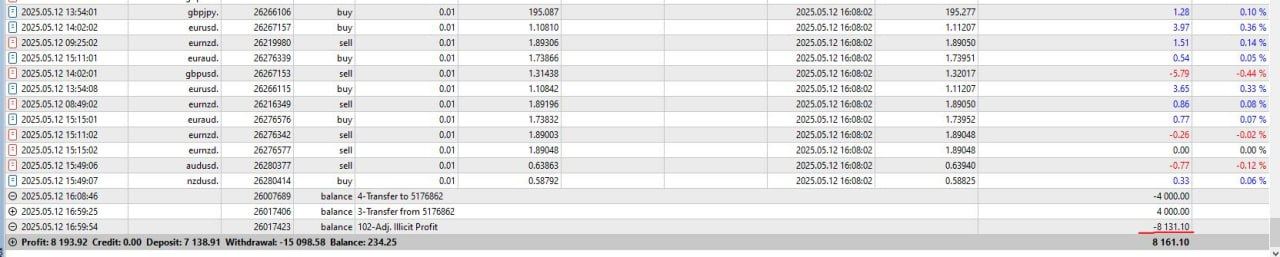

Significantly impacting the trust assessment are warnings about unauthorized activities associated with the company, which raise serious concerns about operational compliance and regulatory standing. These warnings suggest potential issues with business practices or regulatory compliance that prospective clients must carefully consider. The nature and resolution status of these warnings were not detailed in available sources. This creates uncertainty about current operational status and regulatory good standing.

The absence of detailed information about client fund protection measures, segregated account policies, negative balance protection, and insurance coverage further impacts the trust evaluation. Without transparency about how client funds are safeguarded and what protections exist in case of broker insolvency, traders cannot adequately assess the safety of their capital. The combination of offshore regulation, regulatory warnings, and limited transparency about safety measures results in a moderate trust rating that reflects significant caution requirements for potential clients.

User Experience Analysis (Rating Withheld)

Comprehensive user experience evaluation cannot be completed due to insufficient information about client feedback, satisfaction ratings, and practical usage experiences. Available sources did not include user testimonials, independent reviews, or detailed assessments of the overall client journey from account opening through ongoing trading activities.

Critical user experience elements such as website navigation, account registration processes, verification procedures, platform download and setup, and ongoing account management experiences were not documented in accessible sources. The absence of information about user interface design, ease of use, learning curves for new traders, and overall client satisfaction metrics prevents meaningful evaluation of this crucial broker dimension.

User experience encompasses multiple touchpoints including initial research and onboarding, platform usage, customer service interactions, funding and withdrawal processes, and long-term relationship management. Without access to user feedback about these elements, potential clients cannot understand what to expect from their engagement with the broker. This information gap represents a significant limitation in the overall broker assessment and highlights the importance of seeking direct user feedback and conducting personal due diligence before account opening.

Conclusion

This exclusive markets review reveals a broker with notable strengths in instrument diversity and platform selection, balanced against significant concerns regarding regulatory standing and information transparency. The offering of over 30,000 trading instruments and support for industry-standard MetaTrader platforms demonstrates technical capability and market access breadth that appeals to experienced traders seeking comprehensive trading opportunities.

However, the regulatory warnings, offshore jurisdiction limitations, and substantial information gaps about customer service, user experience, and operational details create considerable uncertainty for potential clients. The broker appears more suitable for experienced traders who can navigate regulatory complexities and conduct thorough due diligence, rather than beginning traders seeking comprehensive support and protection.

Primary advantages include extensive instrument selection and flexible leverage options, while key disadvantages center on regulatory concerns and limited operational transparency. Prospective clients should carefully weigh these factors and consider direct engagement with the broker to address information gaps before making account opening decisions.