Qnb Finansinvest 2025 Review: Everything You Need to Know

Summary: Qnb Finansinvest presents a mixed bag of features for traders looking for a broker in the Turkish market. While it boasts a long-standing presence and regulatory compliance under the Capital Markets Board of Turkey (CMB), user reviews indicate concerns regarding high spreads and limited asset choices.

Note: It is crucial to consider that the regulatory landscape varies by region, and while Qnb Finansinvest claims to operate under CMB, some sources have raised doubts about its regulatory status, highlighting the importance of thorough due diligence.

Ratings Overview

How We Rate Brokers: Our ratings are based on a comprehensive analysis of user feedback, expert opinions, and factual data regarding broker services.

Broker Overview

Established in 1996, Qnb Finansinvest is a subsidiary of the Qatar National Bank (QNB) and operates primarily in Turkey. It offers a range of trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary web-based platform. The broker provides access to various asset classes, focusing on forex and CFDs, particularly in stock indices, commodities, and precious metals. It is regulated by the Capital Markets Board of Turkey (CMB), which is intended to provide a level of security for traders.

Detailed Breakdown

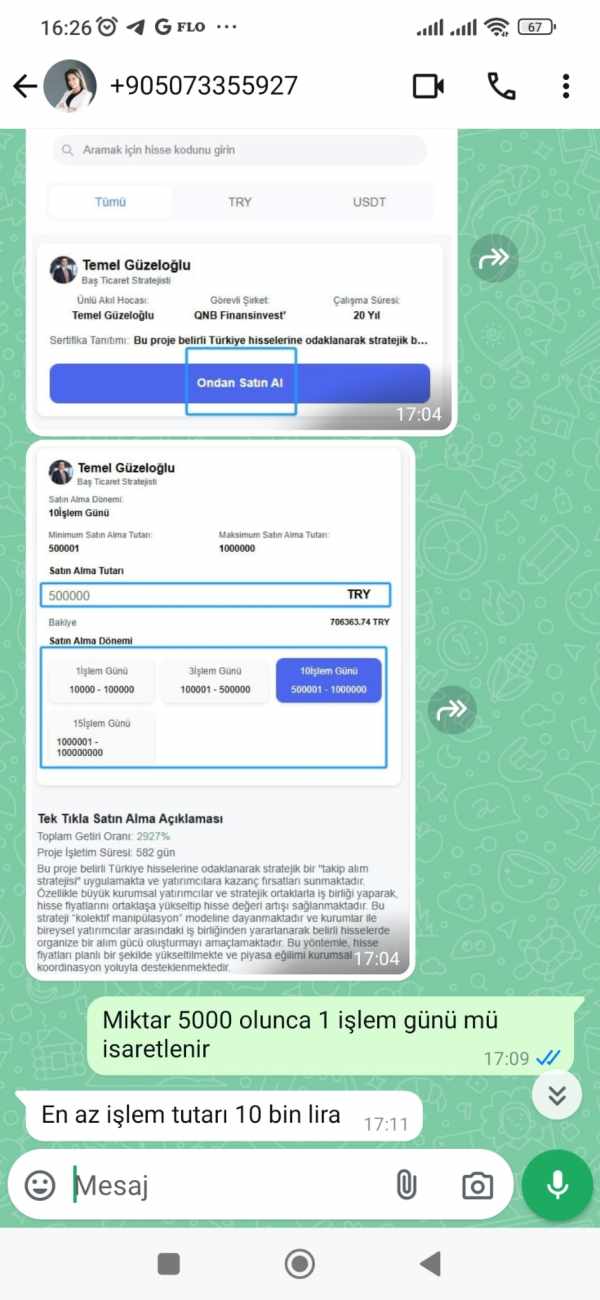

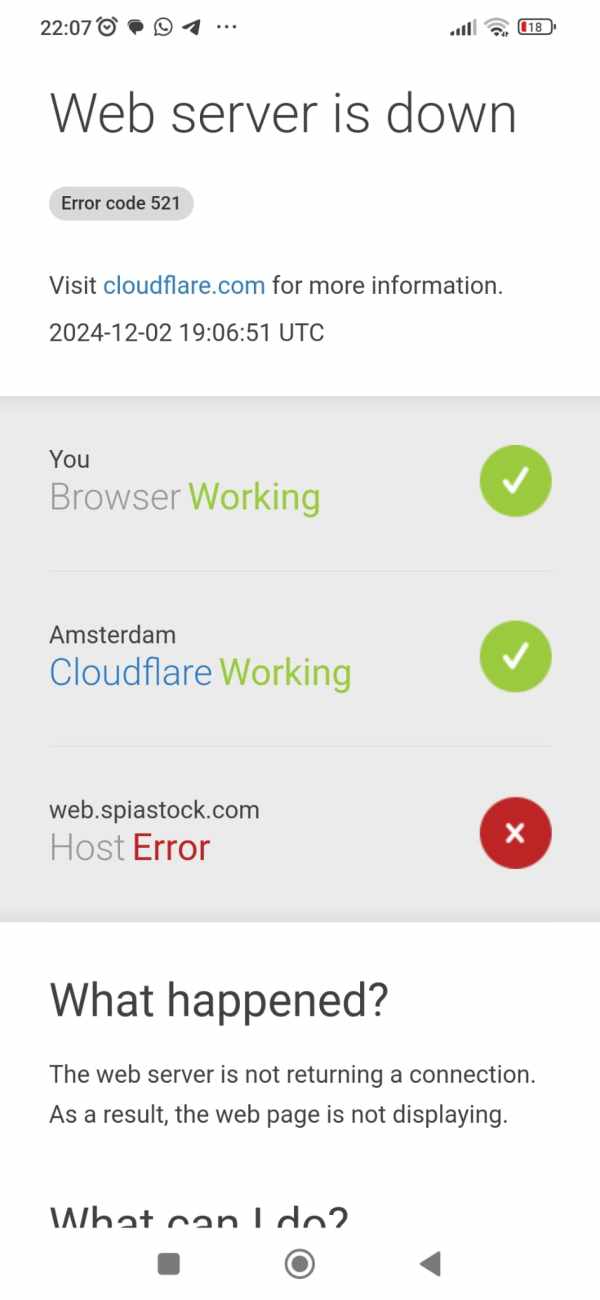

Regulated Geographical Areas: Qnb Finansinvest primarily operates within Turkey, and while it claims to be regulated by the CMB, some reviews suggest that its regulatory status might not be as solid as advertised. This discrepancy can raise concerns for potential investors regarding the safety of their funds.

Deposit/Withdrawal Currencies: The broker accepts Turkish Lira (TRY) and USD for deposits and withdrawals. However, traders should be aware of potential conversion fees if the withdrawal currency differs from the account currency.

Minimum Deposit: The minimum deposit requirement is set at TRY 50,000, which is relatively high compared to many other brokers that cater to retail clients.

Bonuses/Promotions: Currently, Qnb Finansinvest does not offer any bonuses or promotional incentives, which may deter some traders looking for added value.

Available Asset Classes: The broker provides access to over 30 currency pairs and CFDs on gold, silver, copper, oil, and major stock indices like the S&P 500 and Dow Jones. However, the selection is limited compared to competitors, which can be a drawback for more experienced traders seeking diverse trading opportunities.

Costs (Spreads, Fees, Commissions): Qnb Finansinvests spreads start at 1.6 pips for major pairs like EUR/USD, which is higher than the market average. While the broker does not charge deposit or withdrawal fees, banks may impose their own fees, which can impact the overall cost of trading.

Leverage: The broker offers leverage up to 1:10, which is standard for Turkish brokers but may be considered low for traders used to higher leverage ratios offered by other international brokers.

Allowed Trading Platforms: Qnb Finansinvest supports multiple trading platforms, including MT4, MT5, and its proprietary web trader. This variety allows traders to choose a platform that best suits their trading style.

Restricted Regions: The broker is not available for clients in certain regions, including Singapore, which limits its accessibility for international traders.

Available Customer Service Languages: Customer support is primarily available in Turkish and English, with support channels including email and a chatbot. However, the lack of direct human interaction in live chat may frustrate some users.

Repeated Ratings Overview

Detailed Ratings Breakdown

-

Account Conditions (5.5/10): The high minimum deposit requirement of TRY 50,000 is a significant barrier for many retail traders, particularly those just starting.

Tools and Resources (6.0/10): While Qnb Finansinvest offers various trading platforms and analytical tools, the limited educational resources may not meet the needs of novice traders.

Customer Service and Support (4.5/10): The reliance on chatbots for customer service and the limited availability of phone support are notable drawbacks, as many users report difficulties in resolving issues promptly.

Trading Setup (Experience) (6.0/10): The trading experience is generally smooth, but higher spreads may impact profitability, especially for high-frequency traders.

Trustworthiness (4.0/10): Questions surrounding its regulatory status and mixed reviews from users contribute to a lower trust rating for Qnb Finansinvest.

User Experience (5.5/10): User feedback highlights a mixed experience, with some traders satisfied with the platform's functionality, while others express frustration over customer service and withdrawal processes.

In conclusion, while Qnb Finansinvest has a long history and offers a range of trading platforms, potential users should carefully weigh the pros and cons highlighted in this Qnb Finansinvest review before committing significant funds. The brokers high minimum deposit, limited asset choices, and concerns regarding customer service may be critical factors for traders to consider.