RCG Markets 2025 Review: Everything You Need to Know

Executive Summary

RCG Markets is a South African-based forex and CFD broker that works in the online trading industry. This broker has built a strong reputation over time. According to our comprehensive rcg markets review, this brokerage offers multiple account types and trading platforms, with users consistently rating their services highly. The broker has received lots of positive feedback from clients. One long-term client stated, "It's been 3 years now with RCG markets and reality is that it's been the best broker ever."

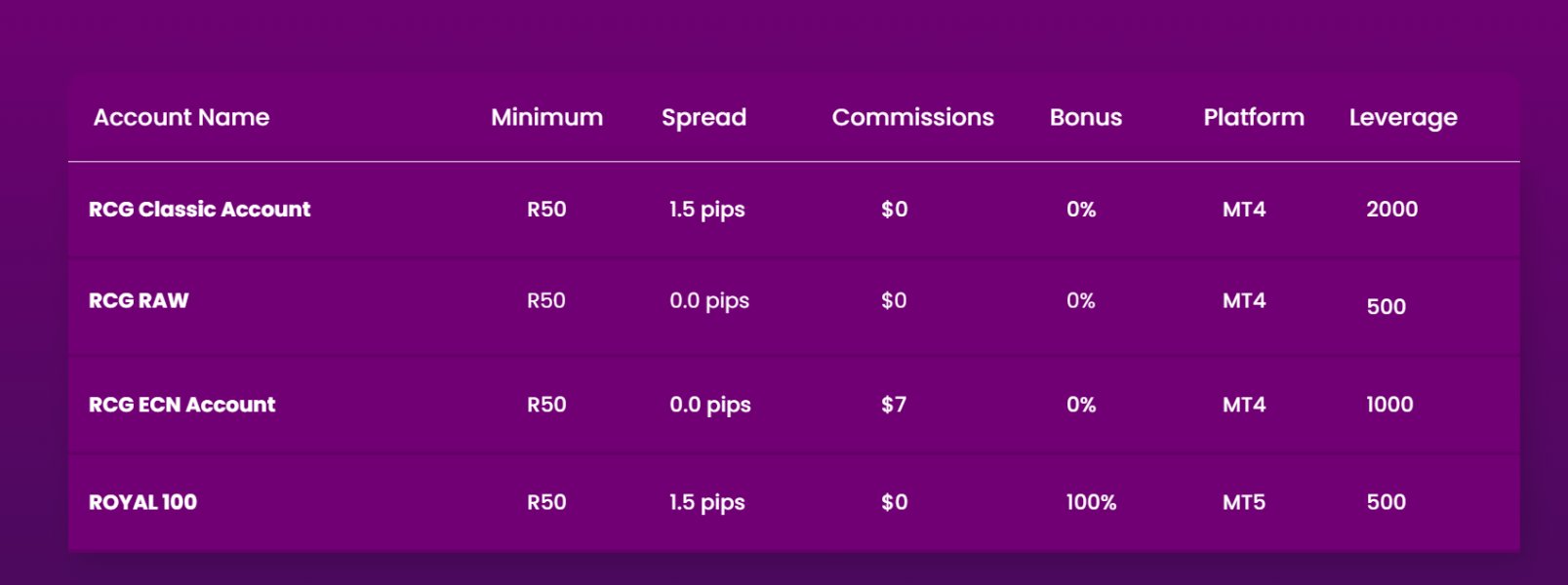

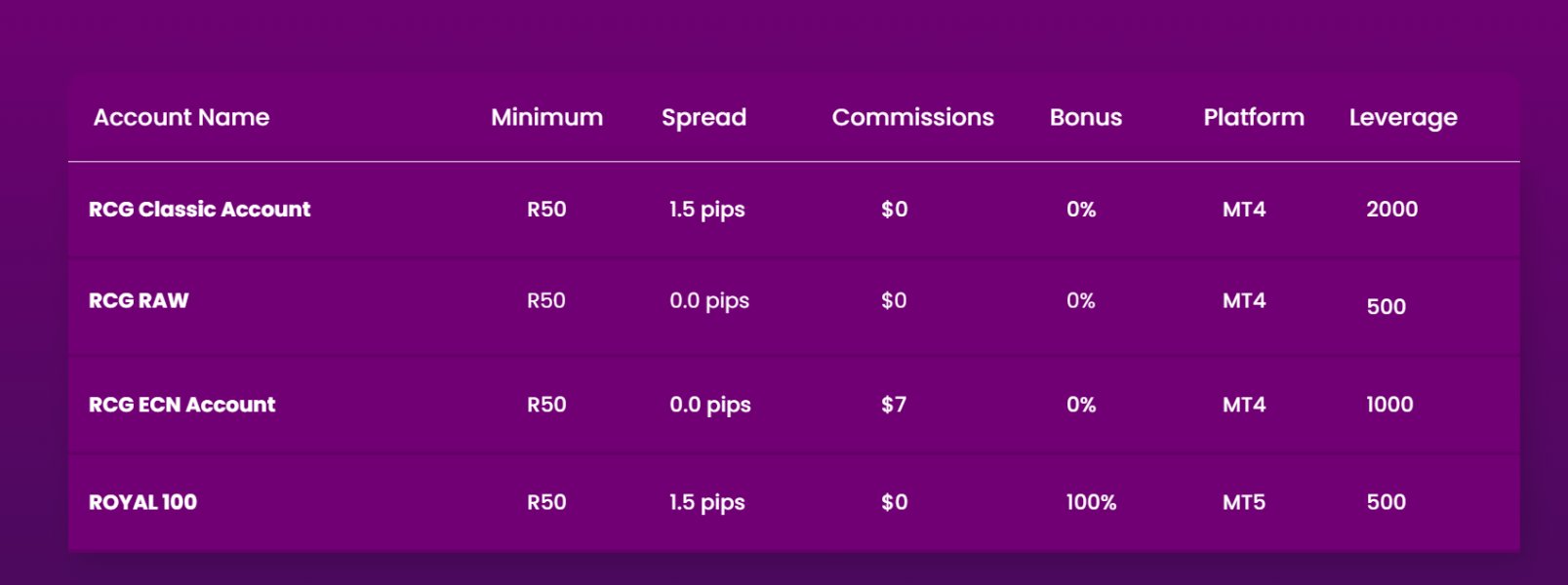

RCG Markets stands out because they offer both MT4 and MT5 trading platforms, support multiple payment methods, and have competitive fee structures. The broker mainly serves traders who want to trade forex and CFDs. They offer six different account types to fit various trading styles and experience levels. With a minimum deposit requirement of R50, RCG Markets makes trading accessible for both new and experienced traders.

RCG Markets shows strong performance in account conditions and user satisfaction based on available information and user feedback. However, some regulatory details need more clarification for potential clients considering their services.

Important Disclaimers

Regulatory Considerations: While RCG Markets operates as a South African-based entity, specific regulatory information and licensing details are not fully detailed in available sources. Potential clients should know that regulatory rules may vary across different regions. It's important to check the broker's regulatory status in your specific area before opening an account.

Review Limitations: This evaluation uses publicly available information, user testimonials, and industry reports accessible at the time of writing. Some detailed operational aspects may not be fully covered due to limited information availability. Traders should strongly consider doing their own research and check multiple sources when making trading decisions.

Rating Framework

Broker Overview

RCG Markets works as a South African-based online trading service provider that focuses on forex and CFD markets. According to [Brokersway reports], the company has positioned itself as a global service provider, offering online trading services to clients worldwide. The broker's business model centers on providing flexible trading solutions through multiple platform options and diverse account structures designed to fit different trader profiles and investment approaches.

The company's operational framework focuses on accessibility and user-friendly trading conditions. By keeping a low minimum deposit threshold and offering various account configurations, RCG Markets targets both entry-level traders seeking to begin their trading journey and experienced investors requiring more sophisticated trading tools. According to [FxReviewTrading sources], the broker has developed a reputation for maintaining competitive market conditions and responsive service delivery.

RCG Markets provides access to MT4 and MT5 trading platforms, supporting both forex and CFD trading across multiple asset classes. The broker's service delivery model focuses on combining traditional trading platform reliability with modern execution standards. While specific regulatory details require verification, available user testimonials suggest the broker maintains operational standards that support sustained client relationships. Some users report successful trading partnerships spanning multiple years.

Regulatory Status: Specific regulatory information for RCG Markets is not fully detailed in available sources. Potential clients should verify regulatory compliance in their jurisdiction before account opening.

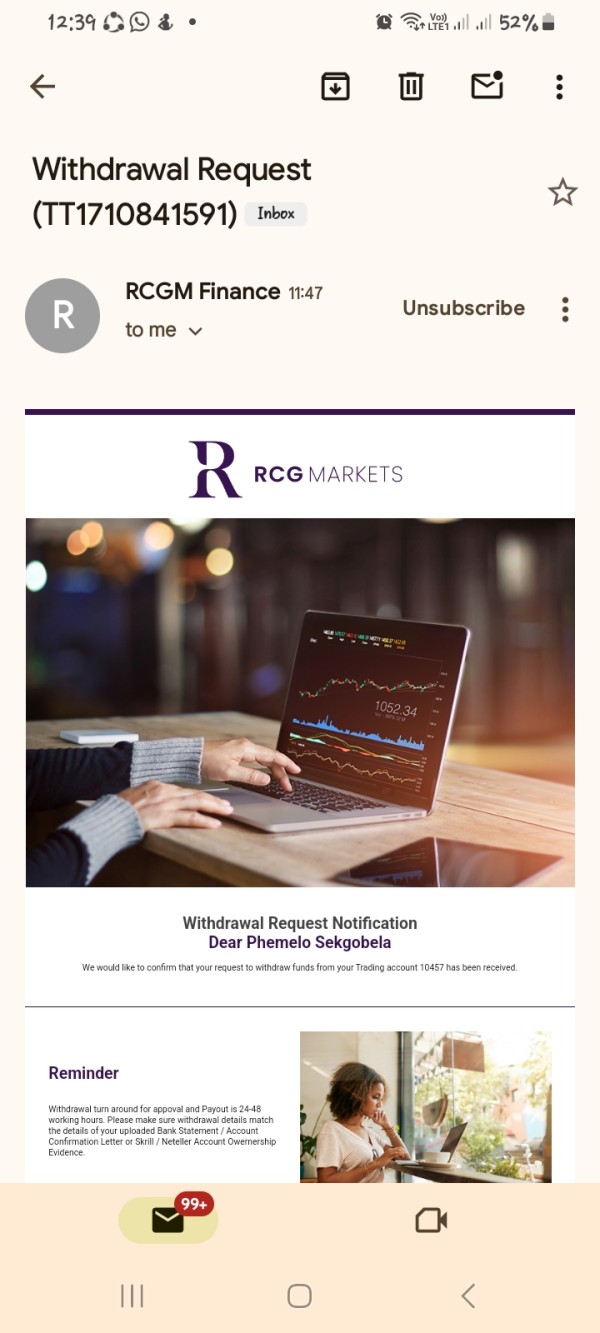

Deposit and Withdrawal Methods: The broker supports multiple payment methods for account funding and withdrawals. However, specific payment processor details are not extensively outlined in current documentation.

Minimum Deposit Requirements: RCG Markets maintains an accessible entry point with a minimum deposit requirement of R50, making it particularly suitable for new traders testing market conditions.

Bonus and Promotional Offers: Current promotional activities and bonus structures are not specifically detailed in available information sources.

Tradeable Assets: The broker provides access to forex and CFD trading instruments. This covers major currency pairs and contract for difference products across various market sectors.

Cost Structure: According to available reports, RCG Markets offers competitive fee arrangements. However, specific spread ranges, commission structures, and overnight financing rates require direct verification with the broker.

Leverage Options: Specific leverage ratios and margin requirements are not detailed in current information sources and should be confirmed during account setup.

Platform Selection: RCG Markets provides both MT4 and MT5 trading platforms. This offers traders choice between the established MT4 interface and the enhanced features of MT5.

Geographic Restrictions: Specific regional limitations and service availability restrictions are not fully outlined in available documentation.

Customer Support Languages: The range of supported languages for customer service is not specifically detailed in current sources.

This rcg markets review shows that while the broker provides essential trading services, some operational details require direct verification with the company for complete accuracy.

Detailed Rating Analysis

Account Conditions Analysis (8/10)

RCG Markets shows strong performance in account accessibility and variety, offering six different account types designed to fit diverse trading requirements and experience levels. The broker's minimum deposit requirement of R50 represents a very competitive entry point. This makes forex and CFD trading accessible to traders with limited initial capital. This low barrier to entry aligns with modern industry trends toward making trading access easier for everyone.

The variety of account options suggests that RCG Markets has developed its service structure to serve different trader segments. This ranges from beginners requiring basic functionality to experienced traders needing advanced features. According to user feedback, clients have maintained successful trading relationships for extended periods. One testimonial states their three-year experience has been "the best broker ever."

Account opening procedures and verification requirements are not extensively detailed in available sources. However, the positive user retention suggests streamlined onboarding processes. The broker's account structure appears designed to support both short-term trading strategies and longer-term investment approaches. This provides flexibility for different trading styles and risk management preferences.

Compared to industry standards, the R50 minimum deposit requirement positions RCG Markets favorably against competitors who often require significantly higher initial investments. This rcg markets review finds that the account conditions represent a strong value proposition for traders seeking accessible market entry points.

RCG Markets provides access to both MT4 and MT5 trading platforms, offering traders choice between the widely-adopted MT4 interface and the enhanced analytical capabilities of MT5. This dual-platform approach ensures compatibility with various trading strategies and technical analysis requirements. The MT4 platform provides reliable order execution and charting tools, while MT5 offers advanced features including additional timeframes and improved backtesting capabilities.

The broker's platform selection supports automated trading strategies and expert advisor implementation. However, specific details about custom indicator support and third-party tool integration are not extensively documented. The availability of both platforms suggests that RCG Markets recognizes the diverse preferences within the trading community and aims to accommodate both traditional and modern trading approaches.

Research and educational resources are not specifically detailed in available information, representing a potential area for service enhancement. The lack of comprehensive information about market analysis tools, economic calendars, and educational content may impact the overall value proposition for traders seeking integrated learning and analysis resources.

Technical analysis capabilities through the provided platforms appear standard for the industry, with both MT4 and MT5 offering comprehensive charting tools and indicator libraries. However, proprietary research tools and exclusive market insights are not highlighted in current documentation.

Customer Service and Support Analysis (6/10)

Customer service information for RCG Markets is limited in available documentation, making comprehensive evaluation challenging. While user testimonials suggest positive overall experiences, specific details about support channel availability, response times, and service quality metrics are not extensively outlined in current sources.

The lack of detailed customer service information represents a significant gap in evaluating the broker's operational capabilities. Modern traders typically expect multiple contact methods including live chat, email support, and telephone assistance. They also expect comprehensive FAQ resources and technical support documentation.

Response time expectations and service level commitments are not specifically documented, making it difficult to assess whether RCG Markets meets industry standards for customer support responsiveness. The absence of detailed multilingual support information also limits understanding of the broker's global service capabilities.

User feedback suggests satisfactory service delivery, with long-term client relationships indicating adequate problem resolution and ongoing support. However, the lack of specific customer service metrics and detailed support structure information prevents a higher rating in this category.

Trading Experience Analysis (7/10)

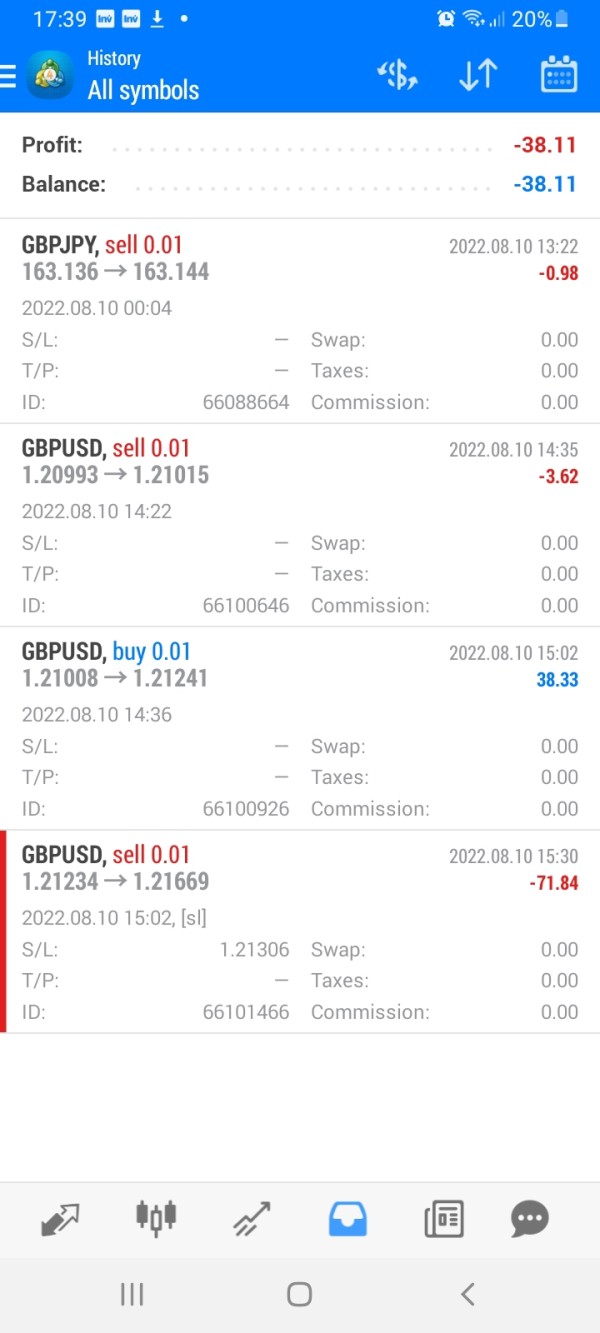

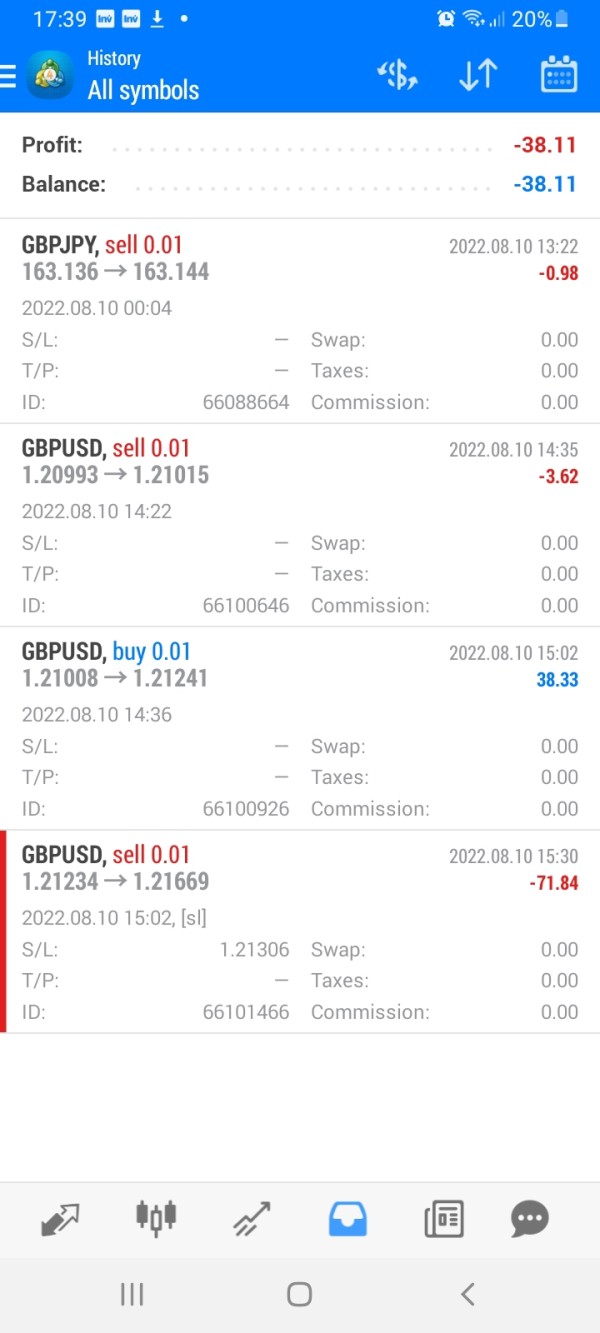

According to available information, RCG Markets provides competitive trading conditions with favorable fee structures, contributing to positive user experiences. The broker's platform stability and execution quality appear satisfactory based on user retention and testimonial feedback. However, specific performance metrics are not detailed in current documentation.

Order execution quality and platform reliability are suggested to be adequate through user feedback indicating sustained trading relationships. The availability of both MT4 and MT5 platforms provides traders with familiar and reliable trading environments. This supports various trading strategies and analytical approaches.

Trading environment features including spread competitiveness and execution speed are described as favorable. However, specific numerical data and comparative analysis are not provided in available sources. The broker's competitive fee structure suggests attention to cost-effectiveness for active traders.

Mobile trading capabilities and cross-platform synchronization are standard features of the MT4 and MT5 platforms. However, broker-specific mobile app development and enhanced mobile features are not specifically documented. User testimonials suggest overall satisfaction with the trading environment, with one client describing their rcg markets review experience as superior to previous brokers.

Trust and Safety Analysis (5/10)

The trust and safety evaluation for RCG Markets is significantly impacted by the limited availability of specific regulatory information in current documentation. While the broker operates from South Africa, detailed licensing information and regulatory compliance details are not fully outlined. This creates uncertainty about oversight and client protection measures.

Fund safety measures, segregated account policies, and client money protection protocols are not specifically detailed in available sources. This information gap represents a significant concern for potential clients evaluating the broker's safety credentials and risk management practices.

Industry reputation appears positive based on user testimonials and sustained client relationships. However, comprehensive third-party evaluations and regulatory assessments are not extensively available. The lack of detailed transparency information about company management, financial statements, and operational oversight limits confidence in the broker's institutional credibility.

Negative incident handling and dispute resolution procedures are not documented in available sources, making it difficult to assess the broker's approach to client protection and problem resolution. The absence of detailed safety and compliance information significantly impacts the trust rating for this rcg markets review.

User Experience Analysis (7/10)

Overall user satisfaction with RCG Markets appears positive based on available testimonials and client retention indicators. Users report favorable experiences with the broker's services. One long-term client specifically highlights their three-year relationship as exceptionally positive compared to previous broker experiences.

Interface design and platform usability benefit from the standard MT4 and MT5 environments, which provide familiar and reliable trading interfaces for most forex and CFD traders. The platforms' established user interfaces reduce learning curves for experienced traders while providing comprehensive functionality for various trading approaches.

Account registration and verification processes are not specifically detailed in current documentation. However, positive user retention suggests reasonably streamlined onboarding procedures. The low minimum deposit requirement supports accessible account opening for new traders.

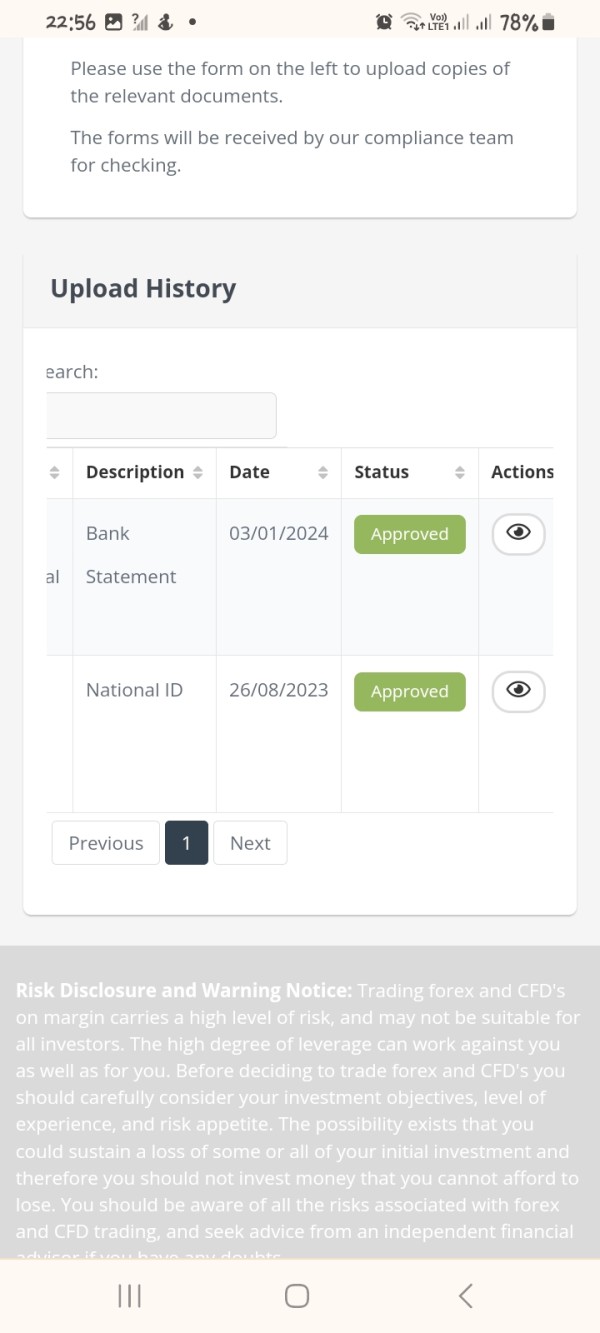

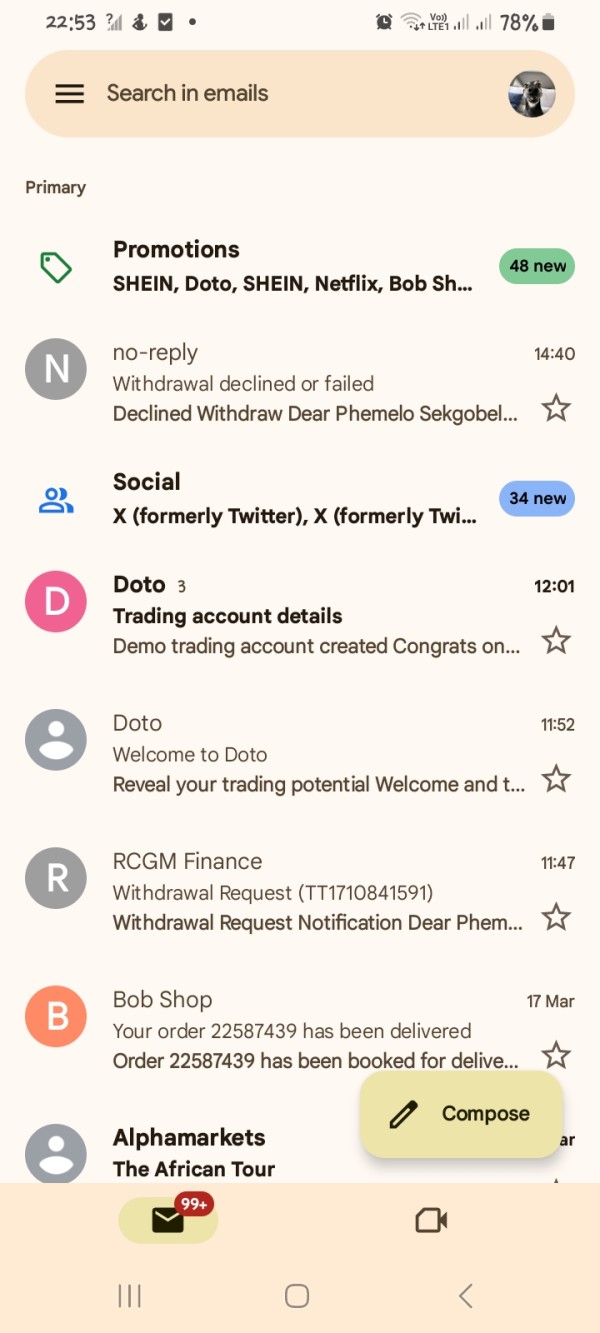

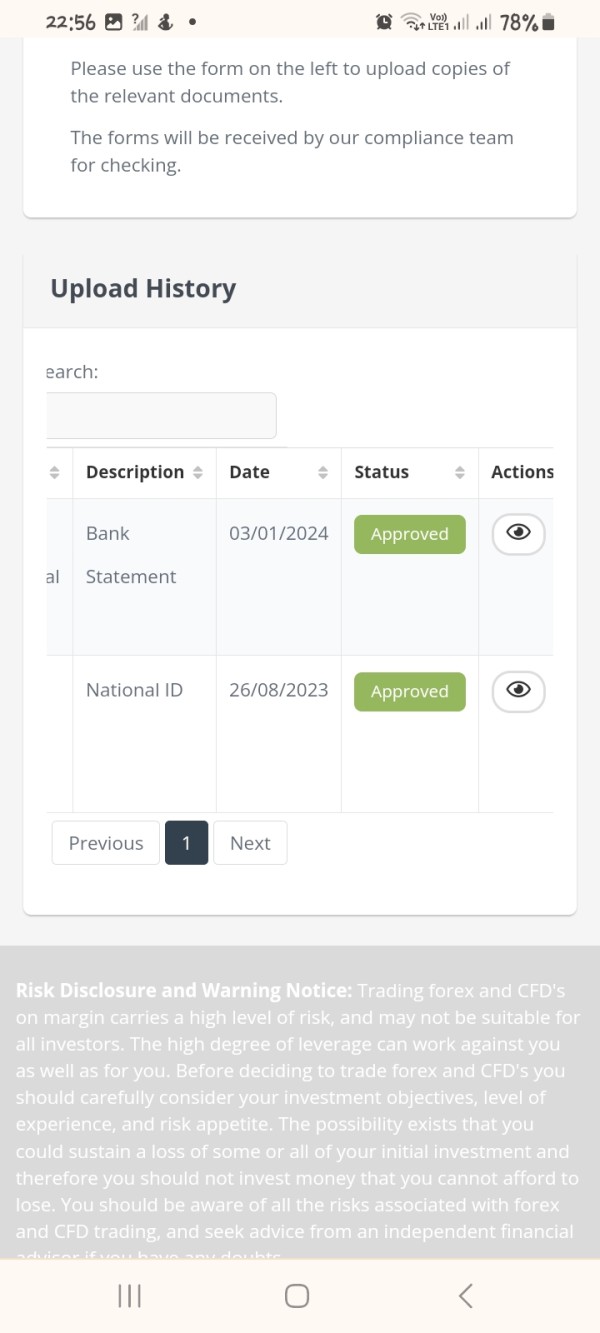

Funding and withdrawal experiences are not extensively documented in available sources, representing an information gap in evaluating operational convenience. The availability of multiple payment methods suggests attention to user convenience. However, specific processing times and fee structures require verification.

Common user complaints and service limitations are not highlighted in available documentation. However, the generally positive testimonial feedback suggests satisfactory service delivery across key operational areas.

Conclusion

Based on this comprehensive rcg markets review, RCG Markets demonstrates solid performance in account accessibility and user satisfaction, making it a viable option for traders seeking competitive trading conditions and platform reliability. The broker's strengths include low minimum deposit requirements, multiple account options, and positive user testimonials spanning extended trading relationships.

However, the limited availability of detailed regulatory information represents a significant consideration for potential clients prioritizing comprehensive oversight and transparency. While user experiences appear positive, the lack of specific compliance and safety documentation may concern traders requiring detailed regulatory assurance.

RCG Markets appears most suitable for traders comfortable with established trading platforms seeking competitive conditions and accessible account requirements. The broker's competitive fee structure and positive user feedback suggest adequate service delivery. However, comprehensive due diligence regarding regulatory status is recommended before account opening.

Strengths: Low minimum deposit, multiple account types, positive user testimonials, competitive trading conditions

Areas for Improvement: Enhanced regulatory transparency, detailed customer service information, comprehensive safety documentation