Regarding the legitimacy of PLOTIO forex brokers, it provides HKGX, ASIC, SCB and WikiBit, (also has a graphic survey regarding security).

Is PLOTIO safe?

Software Index

Regulation

Is PLOTIO markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

RegulatedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

百利好金業(香港)有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.plotio-gold.comExpiration Time:

--Address of Licensed Institution:

九龍尖沙咀廣東道33號中港城5座16樓03A-04室Phone Number of Licensed Institution:

37550922Licensed Institution Certified Documents:

ASIC Forex Execution License (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

PLOTIO (AU) GLOBAL FINANCIAL PTY LTD

Effective Date: Change Record

2021-10-14Email Address of Licensed Institution:

jzeeyt@gmail.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

10 FITZSIMONS LANE ELTHAM VIC 3095Phone Number of Licensed Institution:

0411118882Licensed Institution Certified Documents:

SCB Derivatives Trading License (MM)

The Securities Commission of The Bahamas

The Securities Commission of The Bahamas

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

Plotio Global Financial Limited

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Capital Union Bank Financial Centre, Western Road, Lyford Cay, Nassau, BahamasPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Plotio Safe or a Scam?

Introduction

Plotio is a relatively new player in the forex trading market, having been established in 2020. It positions itself as a broker offering a variety of financial instruments including forex, commodities, and indices. As the forex market continues to grow, it becomes increasingly essential for traders to carefully evaluate the credibility and reliability of brokers like Plotio. The potential for financial loss is significant, particularly with unregulated brokers, making due diligence a critical component of the trading process. This article aims to provide a comprehensive analysis of Plotio's regulatory status, company background, trading conditions, customer safety measures, and user experiences. The information is derived from various online reviews, regulatory sources, and user feedback to deliver a balanced perspective on whether Plotio is a safe trading platform or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is a key indicator of its legitimacy and safety. Plotio claims to be regulated by the Securities Commission of the Bahamas (SCB), but it is important to scrutinize the quality of this regulation. Offshore regulations, such as those provided by the SCB, often lack the stringent oversight found in more reputable jurisdictions. Below is a summary of Plotios regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SCB | SIA-F 212 | Bahamas | Unverified |

While the existence of a license from an offshore authority might give some semblance of legitimacy, the lack of stringent regulatory oversight raises concerns. Traders should be aware that unregulated or poorly regulated brokers may engage in questionable practices without fear of repercussions. Additionally, there have been multiple complaints against Plotio regarding its operations, which further compounds the concerns about its regulatory environment. The absence of a robust regulatory framework can lead to a higher risk of fraud, making it imperative for traders to tread cautiously.

Company Background Investigation

Plotio operates under the name Plotio Global Financial Limited and is based in Hong Kong. Despite its relatively short history, the company has made claims regarding its commitment to providing quality financial services. However, the lack of transparency surrounding its ownership structure and management team raises red flags. There is minimal publicly available information regarding the backgrounds of the individuals running the company, which is crucial for assessing the broker's reliability.

A broker's transparency is vital in building trust with its clients. Without clear information about who is managing their investments, traders may find themselves in a precarious position. Furthermore, the limited history of Plotio means that it has not yet established a track record of reliability or compliance with industry standards. This lack of historical performance makes it difficult to assess its credibility fully.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience and profitability. Plotio presents a variety of trading costs, including spreads and commissions. However, multiple sources indicate that the broker's fee structure may include hidden fees, which can eat into traders' profits. Below is a comparison of Plotio's trading costs against industry averages:

| Fee Type | Plotio | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable (High) | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies (0.1% - 0.5%) |

| Overnight Interest Range | High | Low to Moderate |

The spread for major currency pairs at Plotio appears to be higher than the industry average, which can be a significant drawback for traders looking to maximize their returns. Furthermore, the vague commission model raises concerns, as traders may not be fully aware of the costs they will incur. Such opacity can lead to unexpected expenses that could deter new traders.

Customer Funds Safety

The safety of customer funds is a paramount concern for any trader. Plotio claims to implement various safety measures, including segregated accounts for client funds. However, the effectiveness of these measures is questionable given the regulatory environment in which the broker operates. The lack of participation in an investor protection scheme further exacerbates concerns regarding fund safety.

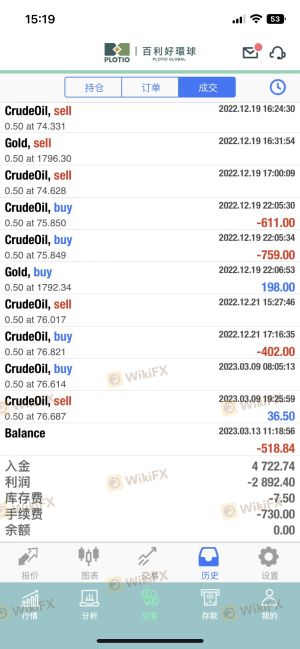

Traders should be aware that if a broker is not subject to rigorous regulatory oversight, there is a risk that their funds could be mismanaged or lost. Additionally, there have been reports of customers facing difficulties when attempting to withdraw their funds, which is a common warning sign of potential fraud. Historical incidents of fund safety issues can significantly impact a broker's reputation, and Plotio is not exempt from this scrutiny.

Customer Experience and Complaints

Customer feedback is invaluable in evaluating a broker's reliability. Numerous reviews and complaints about Plotio have surfaced, indicating a pattern of negative experiences among users. Common issues reported include problems with withdrawals, high-pressure sales tactics, and inadequate customer support. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/No Response |

| High-Pressure Sales | Medium | Inconsistent |

| Poor Customer Support | High | Lacking |

For instance, one user reported being unable to withdraw funds after several requests, highlighting a potential issue with the broker's operational integrity. Another case involved aggressive sales tactics that led to significant financial losses for the trader. Such complaints suggest that Plotio may not prioritize customer satisfaction, which is a critical factor for traders considering where to invest their money.

Platform and Execution

The trading platform used by a broker plays a crucial role in the overall trading experience. Plotio offers its clients access to popular trading platforms; however, user reviews indicate that the platform may not be as stable or efficient as competitors. Issues such as slippage and order rejections have been reported, which can significantly affect trading outcomes.

Traders have expressed concerns about the execution quality on Plotio's platform, with some suggesting that they experienced higher than normal slippage during volatile market conditions. This can be particularly detrimental for traders employing short-term strategies or scalping techniques. If a broker's platform cannot reliably execute trades, it undermines the trader's ability to succeed.

Risk Assessment

Using Plotio as a trading platform carries inherent risks that potential investors should consider. Below is a summary of the key risk areas identified:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of robust oversight. |

| Fund Safety Risk | High | Reports of withdrawal issues. |

| Customer Service Risk | Medium | Inconsistent support responses. |

Traders should be particularly cautious about the regulatory risk associated with Plotio. The lack of stringent oversight can lead to potential fraud or mismanagement of funds. Additionally, the high-risk profile surrounding fund safety is a significant concern, particularly given the complaints regarding withdrawal difficulties.

To mitigate these risks, potential investors are advised to conduct thorough research and consider using well-regulated brokers with a proven track record.

Conclusion and Recommendations

In conclusion, based on the extensive analysis of Plotio's regulatory status, company background, trading conditions, and customer experiences, it is evident that potential traders should exercise caution. The broker's lack of robust regulation, combined with numerous complaints regarding fund safety and customer service, suggests that Plotio may not be a safe option for trading.

For traders seeking reliable alternatives, it is advisable to consider brokers regulated by reputable authorities such as the FCA or ASIC, which offer better protections and transparency. Engaging with well-established brokers can help mitigate the risks associated with trading and enhance the likelihood of a positive trading experience.

Is PLOTIO a scam, or is it legit?

The latest exposure and evaluation content of PLOTIO brokers.

PLOTIO Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PLOTIO latest industry rating score is 8.16, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 8.16 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.