Plotio 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive plotio review examines one of the emerging players in the online forex and CFD trading space. Plotio positions itself as a secure and reliable trading platform. The broker offers traders access to multiple asset classes including forex, precious metals, energy commodities, indices, and other financial instruments. It distinguishes itself through its support for the popular MT5 trading platform, comprehensive customer support services, and commitment to providing both demo and live trading accounts. These features accommodate traders at various experience levels.

According to available regulatory information, Plotio operates under the oversight of the Seychelles Securities and Exchange Commission (CySEC) and the Bahamas Securities Commission (SCB). This provides a regulatory framework for its operations. User feedback consistently highlights the platform's responsive customer support team, which operates on a 24-hour basis to assist traders with their queries and concerns. The broker's focus on delivering advanced charting tools, real-time market data, and an intuitive trading interface makes it particularly appealing to investors. These investors seek a comprehensive trading experience across multiple asset categories. This review will examine all aspects of Plotio's services to help potential traders make an informed decision about whether this platform aligns with their trading objectives and requirements.

Important Disclaimers

Regional Entity Differences: Plotio operates through different regulatory entities across various jurisdictions. It has oversight from both the Seychelles Securities and Exchange Commission and the Bahamas Securities Commission. Prospective traders should carefully verify which regulatory entity governs their specific region, as this may affect the legal protections, compensation schemes, and regulatory standards applicable to their trading activities. Different jurisdictions may also impose varying restrictions on leverage, available instruments, and client categorization.

Review Methodology: This evaluation is based on publicly available information, regulatory filings, user testimonials, and platform documentation accessible at the time of writing. The assessment may not capture every individual user experience or account for recent changes to the broker's services, terms, or regulatory status. Traders are strongly advised to conduct their own due diligence and verify all information directly with Plotio before making any financial commitments.

Rating Framework

Broker Overview

Plotio operates as an online financial services provider specializing in forex and CFD trading services. The company maintains its headquarters in the Bahamas and has established itself as a multi-asset broker serving international clients seeking exposure to global financial markets. The broker's business model centers on providing retail and institutional traders with access to a diverse range of financial instruments through sophisticated trading technology and comprehensive market analysis tools.

The platform's core offering revolves around the MetaTrader 5 (MT5) trading platform. This serves as the primary gateway for client trading activities. This plotio review finds that the broker supports trading across multiple asset categories, including major and minor currency pairs in the forex market, precious metals such as gold and silver, energy commodities including crude oil and natural gas, global stock indices, and various other commodity instruments. The company's regulatory structure includes oversight from both the Seychelles Securities and Exchange Commission and the Bahamas Securities Commission. This provides a framework for client protection and operational standards. This dual regulatory approach reflects the broker's commitment to maintaining compliance standards across different jurisdictions while serving an international client base.

Regulatory Jurisdictions: Plotio operates under dual regulatory oversight. It has licenses from the Seychelles Securities and Exchange Commission (CySEC) and the Bahamas Securities Commission (SCB). This regulatory structure provides coverage for international clients while maintaining compliance with offshore financial services regulations.

Deposit and Withdrawal Methods: According to available information from trader-magazine.com, Plotio supports multiple funding options. These include Visa and MasterCard credit/debit cards, traditional bank wire transfers, and popular e-wallet solutions such as Neteller and Skrill, providing flexibility for international clients.

Minimum Deposit Requirements: Specific minimum deposit amounts are not detailed in the available public documentation. This requires prospective traders to contact the broker directly for current account opening requirements.

Bonus and Promotional Offers: Current promotional structures and bonus programs are not specified in the accessible materials. This suggests traders should inquire directly about any available incentives or special offers.

Available Trading Assets: The platform provides access to a comprehensive range of financial instruments. These include forex currency pairs, precious metals (gold, silver), energy commodities (crude oil, natural gas), major global stock indices, and additional commodity instruments across multiple markets.

Cost Structure and Fees: Detailed information regarding spreads, commissions, overnight financing costs, and other trading fees is not comprehensively available in public sources. This necessitates direct inquiry with the broker for complete pricing transparency.

Leverage Ratios: Specific maximum leverage ratios and margin requirements are not detailed in the available documentation. These may vary based on client jurisdiction and account type.

Platform Options: The broker primarily supports the MetaTrader 5 (MT5) platform. It features advanced charting tools, technical indicators, real-time market data feeds, and comprehensive order management capabilities suitable for both manual and automated trading strategies.

Geographic Restrictions: Specific country restrictions and availability limitations are not detailed in the accessible information. This requires verification based on individual client location.

Customer Support Languages: The range of supported languages for customer service is not specified in available materials. However, the platform appears to cater to an international client base.

This plotio review notes that many specific operational details require direct verification with the broker. This is common practice in the industry for current and accurate information.

Detailed Rating Analysis

Account Conditions Analysis (6/10)

The account conditions evaluation for Plotio reveals limited publicly available information regarding the broker's account structure and requirements. While the platform clearly supports both demo and live trading accounts, specific details about account tiers, minimum deposit requirements, and distinctive features of different account types are not comprehensively documented in accessible sources. This lack of transparency regarding account specifications represents a significant limitation for potential traders seeking to understand their options before committing to the platform.

The absence of detailed information about Islamic accounts, professional trader classifications, or premium account benefits makes it challenging to assess how well Plotio caters to diverse trader needs. Additionally, without clear documentation of account opening procedures, verification requirements, or funding thresholds, prospective clients cannot easily evaluate whether the broker's account conditions align with their trading capital and objectives. This plotio review finds that while the broker appears to offer standard account types, the lack of specific information about minimum deposits, account benefits, and eligibility criteria significantly impacts the overall assessment of account conditions. Traders interested in Plotio would need to contact the broker directly to obtain comprehensive account information. This may deter some potential clients who prefer transparent, readily available account specifications.

Plotio demonstrates strong performance in the tools and resources category. This is primarily through its comprehensive MetaTrader 5 platform integration and advanced trading infrastructure. According to thefirstbrokers.com, the platform "boasts advanced charting tools, real-time market data, and an intuitively designed interface, thereby enhancing the overall trading experience." This technological foundation provides traders with access to sophisticated analytical capabilities, multiple timeframe charts, and a wide range of technical indicators essential for informed trading decisions.

The broker's commitment to providing real-time market data ensures that traders have access to current pricing information across all supported asset classes. These include forex, precious metals, energy commodities, and indices. The MT5 platform's advanced charting capabilities allow for detailed technical analysis, custom indicator development, and automated trading strategy implementation through Expert Advisors (EAs). However, the available information does not specify whether Plotio offers additional proprietary research tools, market analysis reports, or educational resources beyond the standard MT5 functionality. The absence of detailed information about fundamental analysis tools, economic calendars, or market commentary represents a potential gap in the broker's resource offering. Though the solid MT5 foundation provides a robust trading environment for technically-oriented traders.

Customer Service and Support Analysis (9/10)

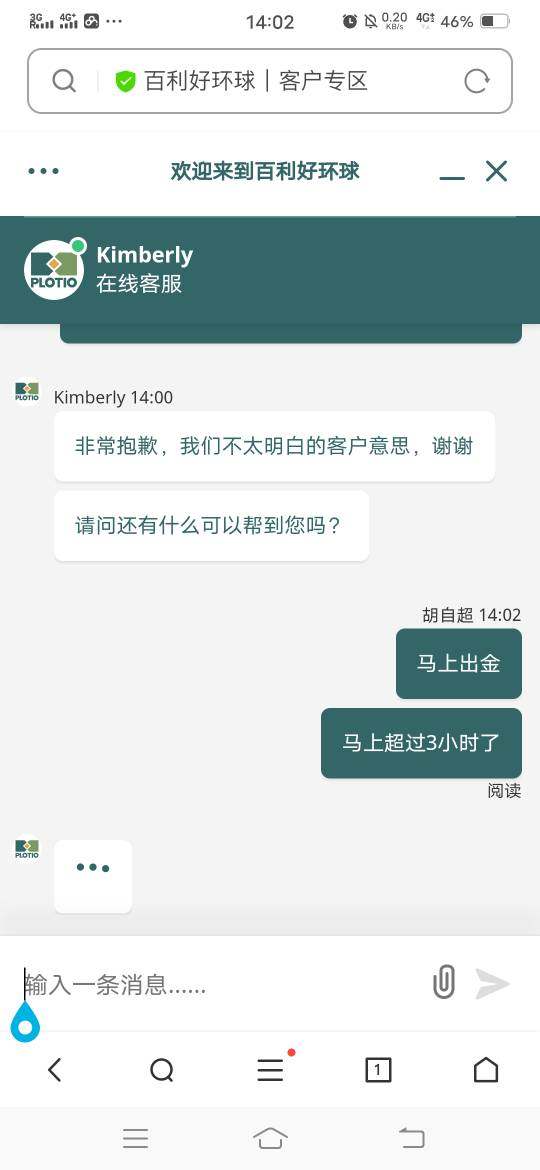

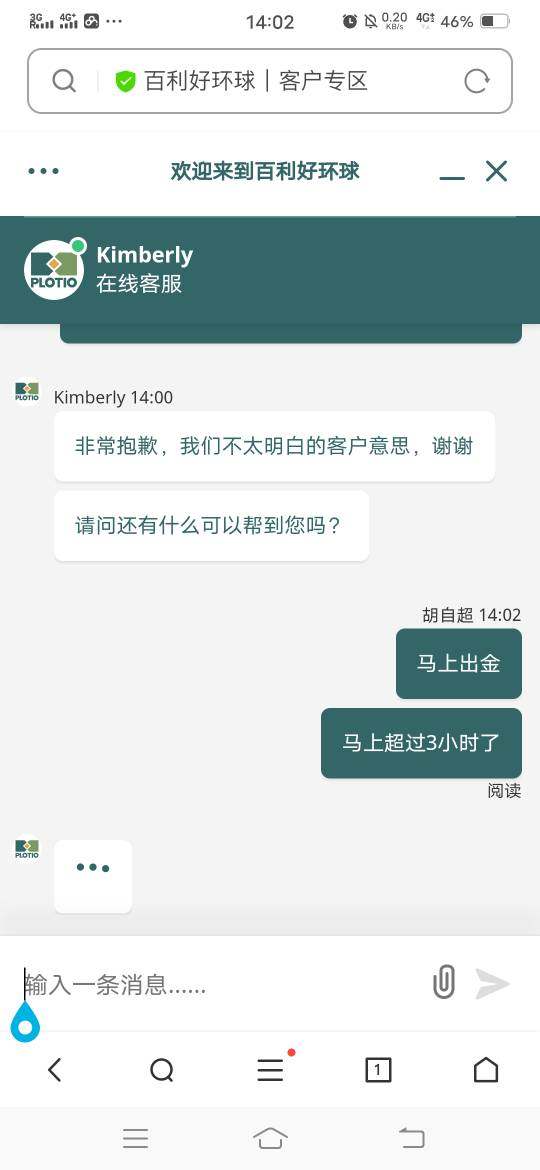

Customer service represents one of Plotio's strongest areas. It has consistently positive feedback regarding the quality and responsiveness of the support team. User testimonials indicate that "the customer support team is friendly and helpful," demonstrating the broker's commitment to maintaining high service standards. The availability of 24-hour customer support ensures that traders across different time zones can access assistance when needed. This is particularly important for a broker serving an international client base.

According to thefirstbrokers.com, "the support team, known for its responsiveness and proficiency, adeptly addresses queries and concerns in a timely manner." This reputation for effective problem resolution suggests that Plotio has invested in training qualified support personnel capable of handling both technical and account-related inquiries. The combination of round-the-clock availability and positive user feedback regarding service quality indicates a well-structured customer support operation. However, the available information does not specify the exact communication channels available (live chat, email, phone), response time guarantees, or multilingual support capabilities. Despite these informational gaps, the consistently positive user feedback and 24-hour availability contribute to a strong customer service rating. Though additional transparency regarding support channels and service level agreements would further enhance the overall assessment.

Trading Experience Analysis (7/10)

The trading experience at Plotio centers around the MetaTrader 5 platform. This provides a solid foundation for both novice and experienced traders. The platform's advanced charting tools and comprehensive technical analysis capabilities offer traders the functionality needed for detailed market analysis and strategy implementation. The availability of real-time market data across multiple asset classes ensures that traders can make informed decisions based on current market conditions.

However, this plotio review identifies several areas where specific information about the trading experience remains limited. Critical details such as order execution speeds, average spreads, slippage rates, and liquidity provision are not comprehensively documented in available sources. The absence of specific information about execution quality, particularly during high-volatility periods or major news events, makes it difficult to fully assess the platform's performance under various market conditions. Additionally, while the MT5 platform supports automated trading through Expert Advisors, there is limited information about any restrictions or limitations on algorithmic trading strategies. The lack of detailed information about mobile trading capabilities, platform uptime statistics, or server locations also impacts the comprehensive evaluation of the trading experience. While the MT5 foundation provides professional-grade trading tools, the limited transparency regarding execution quality and performance metrics prevents a higher rating in this category.

Trust and Safety Analysis (8/10)

Plotio's regulatory framework provides a reasonable foundation for trader confidence. It has oversight from both the Seychelles Securities and Exchange Commission and the Bahamas Securities Commission. This dual regulatory structure demonstrates the broker's commitment to maintaining compliance standards across multiple jurisdictions. Though it's important to note that offshore regulatory environments may offer different levels of protection compared to major financial centers.

The regulatory oversight from CySEC and SCB provides basic operational standards and compliance requirements. However, specific details about client fund protection measures, segregated account policies, or deposit insurance schemes are not clearly documented in available sources. The absence of detailed information about risk management procedures, financial reporting standards, or third-party auditing practices limits the comprehensive assessment of the broker's safety measures. Additionally, while no significant negative events or regulatory actions appear in the available information, the limited transparency regarding financial strength, parent company structure, or institutional backing affects the overall trust evaluation. The broker's regulatory status provides a baseline level of credibility. But the lack of detailed information about advanced safety measures, client protection schemes, or financial transparency prevents a higher rating in this critical category.

User Experience Analysis (7/10)

The overall user experience at Plotio appears to be generally positive based on available feedback. It has particular strength in customer support interactions and platform usability. The broker's focus on providing an "intuitively designed interface" through the MT5 platform contributes to a user-friendly trading environment that accommodates traders with varying levels of experience. The availability of both demo and live accounts allows new traders to familiarize themselves with the platform before committing real capital.

However, comprehensive user satisfaction data and detailed feedback about specific aspects of the user journey are limited in available sources. Important elements of the user experience, such as account opening efficiency, verification procedures, deposit and withdrawal processing times, and overall platform reliability, lack detailed documentation. The absence of information about common user complaints, platform downtime incidents, or areas for improvement makes it challenging to provide a complete assessment of the user experience. While the positive feedback regarding customer support and platform design suggests a satisfactory user experience, the limited scope of available user testimonials and the lack of comprehensive satisfaction surveys or third-party user reviews prevent a more definitive evaluation. The broker would benefit from greater transparency regarding user feedback and continuous improvement initiatives to enhance the overall user experience assessment.

Conclusion

This comprehensive plotio review reveals a broker that demonstrates solid fundamentals in key operational areas. It maintains room for improvement in transparency and detailed service specifications. Plotio's strengths lie in its robust customer support infrastructure, comprehensive MT5 platform integration, and diverse asset offering across forex, precious metals, energy, and indices markets. The dual regulatory oversight from CySEC and SCB provides a reasonable compliance framework for international operations.

The broker appears most suitable for traders seeking a straightforward trading experience with reliable customer support and access to professional-grade trading tools through the MT5 platform. However, potential clients should be aware that many specific details regarding account conditions, fee structures, and execution quality require direct inquiry with the broker. While this is not uncommon in the industry, traders who prioritize complete transparency in broker selection may find the limited public information challenging. Overall, Plotio presents as a viable option for forex and multi-asset trading, particularly for traders who value responsive customer service and proven platform technology over extensive educational resources or detailed fee transparency.