Regarding the legitimacy of PhillipSecurities forex brokers, it provides FSA and WikiBit, (also has a graphic survey regarding security).

Is PhillipSecurities safe?

Pros

Cons

Is PhillipSecurities markets regulated?

The regulatory license is the strongest proof.

FSA Market Making License (MM)

Financial Services Agency

Financial Services Agency

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

フィリップ証券株式会社

Effective Date:

2007-09-30Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

東京都中央区日本橋兜町4-2Phone Number of Licensed Institution:

03-3666-2101Licensed Institution Certified Documents:

Is Phillip Securities A Scam?

Introduction

Phillip Securities, a well-established brokerage firm, operates within the forex market as part of the larger Phillip Capital Group, which has a significant presence in Southeast Asia and beyond. Founded in 1975, Phillip Securities has developed a reputation for offering a wide range of financial services, including forex trading, stock brokerage, and investment consulting. However, in an industry rife with scams and unreliable brokers, traders must exercise caution when selecting a trading partner. This article aims to provide an objective analysis of Phillip Securities, assessing its credibility and trustworthiness through a structured evaluation framework that includes regulatory compliance, company background, trading conditions, client fund safety, customer experience, platform performance, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a brokerage firm is crucial in determining its safety and reliability. Phillip Securities is regulated by the Financial Services Agency (FSA) in Japan, which imposes stringent requirements on brokers to ensure the protection of client funds and the integrity of trading practices. The following table summarizes the core regulatory information for Phillip Securities:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Services Agency (FSA) | 関東 財務 局長 ( 金 商 ) 第 127 号 | Japan | Verified |

The importance of regulation cannot be overstated; it serves as a safeguard for traders, ensuring that brokers adhere to ethical practices and maintain transparency. Phillip Securities has been operational for several decades, and its long-standing presence in the market suggests a level of stability and compliance with regulatory standards. However, there have been instances of regulatory disclosures, including a warning issued by the FSA in 2012 regarding administrative actions taken against the firm for violations of laws and regulations. This historical compliance issue raises questions about the firm's commitment to adhering to regulatory requirements.

Company Background Investigation

Phillip Securities has a rich history that dates back to its founding in 1975. As a member of the Phillip Capital Group, the firm has expanded its operations across various countries, establishing a global footprint in the financial services industry. The ownership structure of Phillip Securities is transparent, with the company being publicly traded and subject to the scrutiny of regulatory authorities.

The management team at Phillip Securities comprises seasoned professionals with extensive experience in the financial markets. Their backgrounds in finance, investment, and trading contribute to the firm's reputation as a reliable brokerage. However, the level of transparency regarding the firm's operations and decision-making processes could be improved. While the company provides essential information about its services, more detailed disclosures regarding its financial health and operational strategies would enhance its credibility.

Trading Conditions Analysis

The trading conditions offered by Phillip Securities are a critical aspect of its overall value proposition. The firm provides access to a variety of financial instruments, including forex, stocks, and commodities, through its proprietary trading platforms. However, the cost structure associated with trading can significantly impact a trader's profitability. Below is a summary of the key trading costs associated with Phillip Securities:

| Cost Type | Phillip Securities | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.3 - 0.6 pips | 0.2 - 0.5 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | Varies | Varies |

Phillip Securities employs a floating spread model, which can be advantageous during periods of low volatility but may lead to higher costs during market fluctuations. Additionally, the absence of a clear commission structure can create confusion for traders, particularly those new to the forex market. Traders should carefully review the fee schedule and understand how costs are calculated to avoid unexpected expenses.

Client Fund Safety

The safety of client funds is paramount in the brokerage industry. Phillip Securities implements several measures to ensure the security of client deposits. Client funds are held in segregated accounts, separate from the firm's operational funds, which helps protect traders in the event of financial difficulties faced by the brokerage. Furthermore, the firm does not offer negative balance protection, which could expose traders to significant financial risks during periods of high market volatility.

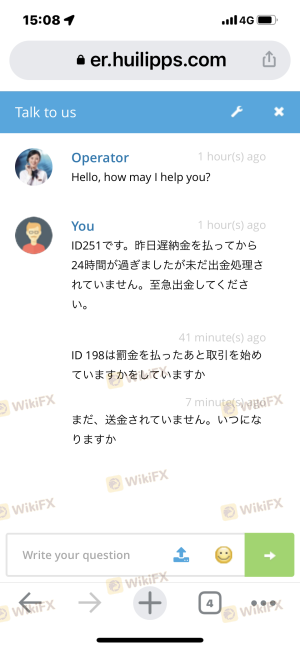

Historically, Phillip Securities has faced challenges regarding fund safety, with reports of client complaints related to withdrawal issues and fund access. While the firm has made efforts to address these concerns, potential clients should remain vigilant and consider the implications of these past issues when deciding to trade with Phillip Securities.

Customer Experience and Complaints

Customer feedback is an essential indicator of a brokerage's reliability. Phillip Securities has received a mix of positive and negative reviews from its clients. Many users praise the firm's trading platform and execution speed, while others express dissatisfaction with customer service and withdrawal processes. The following table summarizes common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response times |

| Customer Service Quality | Medium | Inconsistent support |

| Platform Stability | Low | Generally reliable |

A notable case involved a trader who experienced significant delays in withdrawing funds, leading to frustration and a loss of trust in the firm. While Phillip Securities has made strides in improving its customer service, the inconsistency in support quality remains a concern for many clients.

Platform and Trade Execution

The performance of a trading platform is critical to a trader's success. Phillip Securities offers its proprietary platforms, including POEMS and MT5, which are designed to facilitate seamless trading experiences. However, user experiences vary, with some traders reporting issues related to platform stability and execution quality. The overall quality of order execution, including slippage and rejection rates, is generally acceptable, but traders should remain cautious and monitor their trades closely.

Risk Assessment

Engaging with Phillip Securities carries inherent risks, as with any brokerage. The following risk assessment summarizes key risk areas associated with trading through Phillip Securities:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | Medium | Historical compliance issues |

| Fund Safety | High | Lack of negative balance protection |

| Customer Service | Medium | Mixed reviews on support quality |

To mitigate these risks, traders are advised to conduct thorough research, maintain clear communication with the brokerage, and consider diversifying their trading activities across multiple platforms.

Conclusion and Recommendations

In conclusion, Phillip Securities presents a mixed picture regarding its credibility as a forex broker. While the firm is regulated and has a long-standing presence in the market, historical compliance issues and customer complaints raise valid concerns. Traders should approach this broker with caution and consider their individual trading needs and risk tolerance.

For traders seeking reliable alternatives, consider brokers with a strong regulatory framework, transparent fee structures, and robust customer support. Options such as IG, OANDA, or Forex.com may provide a more secure trading environment for those wary of potential risks associated with Phillip Securities. Ultimately, conducting thorough due diligence is essential for any trader looking to engage in the forex market.

Is PhillipSecurities a scam, or is it legit?

The latest exposure and evaluation content of PhillipSecurities brokers.

PhillipSecurities Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PhillipSecurities latest industry rating score is 8.37, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 8.37 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.