Regarding the legitimacy of PFD forex brokers, it provides FMA and WikiBit, (also has a graphic survey regarding security).

Is PFD safe?

Pros

Cons

Is PFD markets regulated?

The regulatory license is the strongest proof.

FMA Derivatives Trading License (MM)

Financial Markets Authority

Financial Markets Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

PACIFIC FINANCIAL DERIVATIVES LIMITED

Effective Date:

2015-02-27Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

http://www.pfd-nz.comExpiration Time:

--Address of Licensed Institution:

12-26 Swanson STreeT, Level 8, Auckland CenTral, Auckland, 1010, New ZealandPhone Number of Licensed Institution:

+64 9 6320110Licensed Institution Certified Documents:

Is PFD Safe or Scam? An In-Depth Review

Introduction

Pacific Financial Derivatives (PFD) is a forex and CFD broker based in New Zealand, established in 1999. Over the years, it has positioned itself as a significant player in the forex market, particularly in the Asia-Pacific region. However, as the forex trading landscape continues to evolve, traders must exercise caution and conduct thorough evaluations of brokers before committing their funds. The potential for scams and unreliable practices in the forex industry necessitates a detailed investigation into the legitimacy and safety of brokers like PFD.

This article aims to provide an objective and comprehensive assessment of PFD, examining its regulatory status, company background, trading conditions, client fund security measures, customer experiences, platform performance, and associated risks. The information presented is derived from various reputable sources, including expert reviews and user feedback, to ensure a balanced perspective.

Regulation and Legitimacy

PFD operates under the regulatory oversight of the Financial Markets Authority (FMA) in New Zealand, a top-tier regulatory body known for its stringent requirements. This regulatory framework is crucial as it ensures that brokers adhere to specific standards designed to protect traders. The following table summarizes PFD's regulatory details:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FMA | FSP 28944 | New Zealand | Verified |

The FMA's oversight is significant as it mandates the segregation of client funds, ensuring that traders' deposits are held in separate accounts from the broker's operational funds. This reduces the risk of misappropriation and enhances investor protection. However, it's worth noting that PFD does not provide negative balance protection, which could expose traders to losses exceeding their account balance. Despite this shortcoming, PFD has maintained a relatively clean regulatory history with no major compliance issues reported.

Company Background Investigation

PFD was founded in 1999 and has a rich history rooted in the financial services sector. The company is 100% owned by a Japanese investor, who has implemented advanced trading technologies and practices from Japan. This ownership structure is indicative of a commitment to professional standards and innovation within the brokerage.

The management team at PFD comprises experienced professionals with extensive backgrounds in trading and financial services. Their expertise contributes to the broker's operational efficiency and strategic direction. However, information regarding the company's full ownership structure and management team is somewhat limited, which may raise questions about transparency.

In terms of information disclosure, PFD provides essential details about its services and trading conditions on its website. However, the lack of extensive educational resources and market analysis tools may pose challenges for novice traders seeking to enhance their trading knowledge. Overall, while PFD demonstrates a solid foundation, the limited transparency in certain areas could warrant further scrutiny.

Trading Conditions Analysis

PFD offers competitive trading conditions, which include a variety of account types tailored to different trader profiles. The fee structure is relatively straightforward, with no minimum deposit requirement for the basic accounts. However, the trading costs can vary significantly based on the account type chosen. Below is a comparative analysis of PFD's core trading costs:

| Cost Type | PFD | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.3 pips | 0.5 - 1.0 pips |

| Commission Model | $1 per side (Pro) | $2 per side |

| Overnight Interest Range | Variable, typically lower than average | Variable |

PFD's spreads are notably competitive, especially for major currency pairs, making it an attractive option for high-frequency traders. However, the commission structure for the Pro accounts may be considered higher than some competitors who offer commission-free trading. Additionally, traders should be aware of potential hidden fees associated with deposits and withdrawals, which can vary depending on the payment method used.

Client Fund Security

The safety of client funds is a paramount concern when selecting a forex broker. PFD implements several measures to ensure the security of traders' funds. Client deposits are held in segregated accounts, which protects them from being used for the broker's operational expenses. This practice is a fundamental requirement set by the FMA.

However, PFD does not offer negative balance protection, which means that traders could potentially incur losses exceeding their account balance during volatile market conditions. This lack of protection is a critical factor that traders should consider when evaluating whether PFD is safe for their trading activities. Historically, there have been no major incidents reported regarding fund misappropriation or insolvency, which adds a layer of confidence for potential clients.

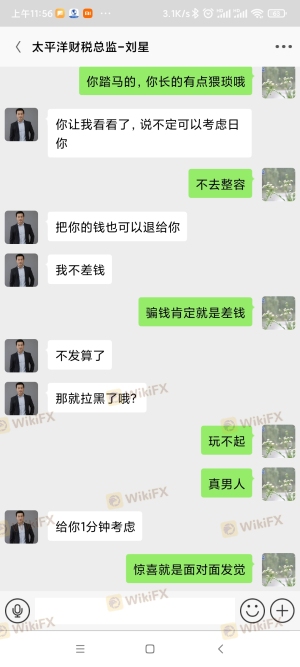

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating a broker's reliability. PFD has garnered mixed reviews from users, with some praising its competitive trading conditions and quick execution speeds, while others have reported issues related to account access and withdrawal processes. The following table summarizes common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow to respond |

| Account Access | Medium | Generally responsive |

| Customer Support | Medium | Varies by agent |

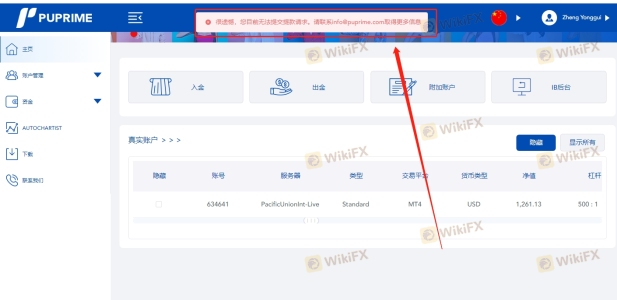

One notable case involved a trader who experienced significant delays in withdrawing funds, which led to frustration and concerns about the broker's reliability. While PFD's customer support team is available via multiple channels, including live chat and email, the quality of responses can vary, which may impact the overall customer experience.

Platform and Trade Execution

PFD utilizes the widely recognized MetaTrader 4 (MT4) platform, which is favored for its user-friendly interface and advanced trading features. The platform supports automated trading through Expert Advisors (EAs), making it suitable for both manual and algorithmic trading strategies. However, some users have reported issues with order execution quality, including slippage during high volatility periods.

The broker's execution model operates on a no-dealing desk (NDD) basis, which generally enhances transparency and fairness in trade execution. Yet, traders should remain vigilant for any signs of manipulation or excessive slippage, particularly during major news releases.

Risk Assessment

Using PFD for trading comes with inherent risks, and it is essential for traders to be aware of these before proceeding. The following risk assessment table summarizes critical risk areas associated with trading with PFD:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Regulated by FMA, but lacks negative balance protection. |

| Fund Security | Medium | Segregated funds, but no compensation scheme. |

| Customer Support | Medium | Mixed reviews on response times and effectiveness. |

To mitigate these risks, traders should implement sound risk management strategies, including setting appropriate stop-loss orders and avoiding excessive leverage. Additionally, conducting regular reviews of the broker's performance and staying informed about market conditions can help reduce exposure to unforeseen risks.

Conclusion and Recommendations

In conclusion, while PFD is regulated by New Zealand's FMA, which provides a level of assurance regarding its legitimacy, there are several factors that potential traders should consider before engaging with the broker. The lack of negative balance protection and mixed customer feedback regarding withdrawal issues raise concerns about the overall safety of trading with PFD.

For experienced traders seeking competitive spreads and fast execution, PFD may present a viable option. However, novice traders or those requiring extensive educational resources and robust customer support might find better alternatives.

If you are considering trading with PFD, it is advisable to conduct thorough research and possibly explore other reputable brokers that offer similar services with enhanced safety measures. Some recommended alternatives include brokers with strong regulatory oversight and comprehensive educational support, such as [Broker A] and [Broker B]. Always ensure that you understand the risks involved in forex trading and choose a broker that aligns with your trading goals and risk tolerance.

Is PFD a scam, or is it legit?

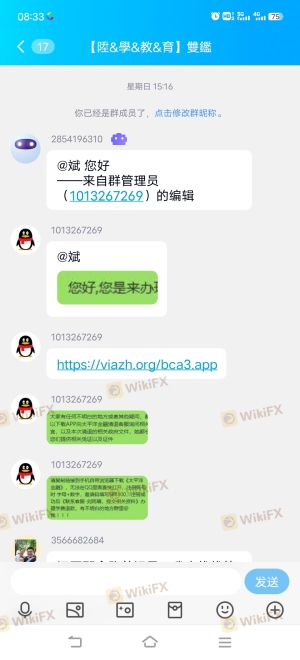

The latest exposure and evaluation content of PFD brokers.

PFD Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PFD latest industry rating score is 6.04, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.04 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.