Regarding the legitimacy of onequity forex brokers, it provides FSCA, FSA and WikiBit, .

Is onequity safe?

Pros

Cons

Is onequity markets regulated?

The regulatory license is the strongest proof.

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

ONEQUITY (PTY) LTD

Effective Date: Change Record

2023-12-18Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

1 EDGEMERE ROAD ELFINDALE CAPE TOWN 7945Phone Number of Licensed Institution:

0836473347Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

OnEquity Ltd

Effective Date:

--Email Address of Licensed Institution:

andreas.p@onequity.comSharing Status:

No SharingWebsite of Licensed Institution:

https://onequity.comExpiration Time:

--Address of Licensed Institution:

OST Building, Unit 5, Office 4, Zone 18, Providence, Mahe, Seychelles.Phone Number of Licensed Institution:

+248 372808Licensed Institution Certified Documents:

Is OneQuity A Scam?

Introduction

OneQuity is a relatively new player in the forex and CFD trading arena, having been established in 2022 and headquartered in Seychelles. The broker offers a diverse range of financial instruments, including forex, commodities, indices, stocks, and cryptocurrencies, aiming to cater to both novice and experienced traders. However, the online trading environment can be fraught with risks, and it's crucial for traders to carefully evaluate brokers before committing their funds. This article aims to provide a comprehensive assessment of OneQuity, examining its regulatory status, company background, trading conditions, customer fund security, and user experiences. Our investigation is based on a thorough review of available information, including user feedback and expert analyses from various financial platforms.

Regulation and Legitimacy

The regulatory framework under which a broker operates is a key factor in determining its legitimacy and trustworthiness. OneQuity is regulated by two primary authorities: the Seychelles Financial Services Authority (FSA) and the Financial Sector Conduct Authority (FSCA) in South Africa. While having regulatory oversight is a positive aspect, the quality of that regulation is also critical.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Seychelles FSA | SD 154 | Seychelles | Active |

| FSCA | FSP 53187 | South Africa | Active |

The Seychelles FSA is often considered a tier-3 regulator, which means it has less stringent requirements compared to tier-1 regulators like the FCA in the UK or ASIC in Australia. The FSCA, on the other hand, is regarded as a more robust regulatory body, offering better investor protection and oversight. Despite being regulated, the fact that OneQuity operates under offshore jurisdictions raises concerns about the level of client protection and regulatory enforcement.

Company Background Investigation

OneQuity is owned by Merit Fox Investments Ltd, and its operational history has been relatively short, with its establishment dating back only to 2022. The company is headquartered at CT House, Office 6 C, Providence, Mahe, Seychelles. Transparency in a companys operations is vital for establishing trust, and OneQuity's website provides some information about its ownership and regulatory compliance. However, the lack of extensive historical data and detailed disclosures about its management team may raise red flags for potential investors.

The management team behind OneQuity is not extensively documented in available resources, making it challenging to assess their professional backgrounds and experience in the financial sector. The absence of detailed information can lead to concerns about the company's operational integrity and commitment to ethical trading practices. Furthermore, the companys transparency regarding its business practices and financial health remains limited, which is critical for fostering trust among traders.

Trading Conditions Analysis

OneQuity offers a range of trading accounts, including Plus, Prime, and Elite accounts, each designed for different types of traders. The overall fee structure is competitive, but it is essential to analyze any unusual or problematic fee policies that may affect trading costs.

| Fee Type | OneQuity | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | From 1.5 pips | 1.0 pips |

| Commission Model | None for Plus; $5 for Prime and Elite | Varies |

| Overnight Interest Range | Average | Average |

The Plus account requires a minimum deposit of $25 and offers spreads starting at 1.5 pips, which may not be attractive for scalpers. The Prime account, aimed at more experienced traders, requires a $1,000 deposit and offers tighter spreads at a cost of $5 per lot. The Elite account, which charges a similar commission, requires a significant minimum deposit of $5,000. This tiered structure may deter smaller traders while catering to those with larger capital.

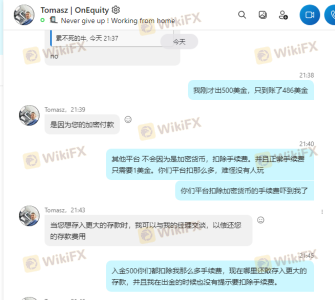

Customer Funds Security

The safety of customer funds is paramount when choosing a broker. OneQuity claims to implement several measures to protect client funds, including segregated accounts and negative balance protection. Segregating client funds from the broker's operational capital helps ensure that traders' funds are not misused for company expenses.

However, OneQuity does not have a compensation scheme in place, which means that in the event of insolvency, clients may not have a safety net to recover their funds. The lack of a robust investor protection framework raises concerns, particularly for traders who may be investing significant amounts of capital.

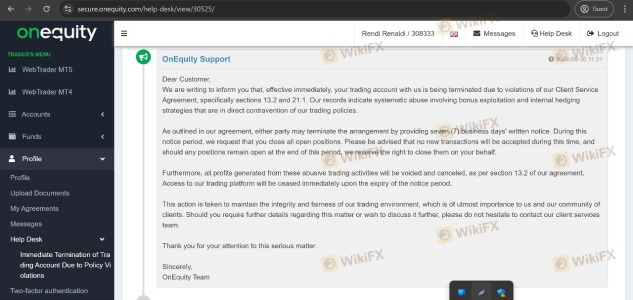

Customer Experience and Complaints

User feedback provides valuable insights into a broker's reliability and the quality of its services. A review of customer experiences with OneQuity reveals a mixed bag, with some users praising the trading conditions and platform functionality, while others have raised concerns about customer support and withdrawal processes.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Customer Support Issues | Medium | Email only, no live chat |

| High Spreads on Plus Account | Medium | Limited explanation |

Common complaints include delays in withdrawal processing and the absence of live chat support, which can be crucial for traders needing immediate assistance. Some users have reported difficulties in accessing their funds, which can be a significant concern for traders.

Platform and Trade Execution

OneQuity offers the well-regarded MetaTrader 4 and MetaTrader 5 platforms, known for their robust functionality and user-friendly interfaces. The platforms provide various features, including automated trading options and advanced charting tools. However, the execution quality, including slippage and order rejection rates, is critical for assessing the overall trading experience.

Many users have reported issues with order execution speed, particularly during volatile market conditions. This can lead to slippage, where trades are executed at different prices than expected, potentially impacting profitability.

Risk Assessment

While OneQuity presents several advantages, it is essential to consider the risks associated with trading through this broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Offshore regulation can lead to limited oversight. |

| Fund Security Risk | Medium | Lack of compensation scheme raises concerns about fund recovery. |

| Execution Risk | Medium | Reports of slow execution and slippage can affect trading performance. |

Traders should approach OneQuity with caution, particularly given its regulatory status and the potential risks involved in trading with high leverage. It is advisable for traders, especially novices, to fully understand these risks and consider whether they align with their trading strategies and risk tolerance.

Conclusion and Recommendations

In conclusion, while OneQuity is not a scam, it operates under regulatory frameworks that may not provide the highest level of investor protection. The broker offers competitive trading conditions, a variety of instruments, and access to popular trading platforms. However, the lack of a compensation scheme, mixed user feedback, and potential issues with execution speed warrant careful consideration.

For traders looking for a reliable broker, it may be prudent to explore alternatives that offer stronger regulatory oversight and better customer support. Brokers regulated by tier-1 authorities, such as the FCA or ASIC, may provide a more secure trading environment.

Ultimately, whether OneQuity is suitable for you depends on your trading experience, risk appetite, and the importance you place on regulatory security and customer support.

Is onequity a scam, or is it legit?

The latest exposure and evaluation content of onequity brokers.

onequity Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

onequity latest industry rating score is 5.75, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.75 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.