OnEquity 2025 Review: Everything You Need to Know

Summary

OnEquity is a new player in forex and CFD trading. The company has built itself as a multi-asset broker that gives traders access to many different instruments like forex, commodities, stocks, and cryptocurrencies. This onequity review shows a broker that draws investors with high leverage up to 1:1000 and clear trading solutions. However, it has some trust issues.

The broker works under rules from several places. It has licenses from one Tier-1 regulator (highly trusted), one Tier-2 regulator (trusted), and one Tier-4 regulator (high risk). OnEquity focuses on giving traders a safe and clear trading space, and it supports popular platforms like MetaTrader 4 and MetaTrader 5.

The platform mainly serves traders who want high leverage and many different assets. It offers customer support in multiple languages for clients around the world. While the broker looks good in terms of platform choices and asset variety, potential clients should think carefully about the regulatory setup and trust scores when deciding.

Important Notice

OnEquity works through companies regulated in different places. Users should know that regulatory protections and legal rules may change a lot depending on where they register. The broker's regulatory status includes oversight from multiple levels of regulatory authorities. This means different levels of protection may apply to different client groups.

This review uses publicly available information, user feedback, and standard industry analysis methods. Readers should do their own research and think about their local regulatory environment before making any trading decisions.

Rating Framework

Broker Overview

OnEquity entered the competitive forex and CFD trading market as a multi-asset broker. The company positioned itself to serve traders who want access to many different financial instruments. According to available information, OnEquity works to provide complete trading access across forex, commodities, stocks, and cryptocurrency markets.

The broker's business model focuses on offering high leverage trading opportunities. Maximum leverage reaches 1:1000, which appeals to traders looking for better market exposure. OnEquity's approach emphasizes easy access through multiple trading platforms and support in many languages, showing a strategy aimed at capturing international market share in the competitive online trading sector.

OnEquity provides trading services through industry-standard MetaTrader 4 and MetaTrader 5 platforms. This ensures traders have access to familiar and strong trading environments. The asset portfolio spans multiple categories including forex pairs, commodity CFDs, stock CFDs, cryptocurrency CFDs, and index CFDs, offering traders ways to diversify within a single trading account. The broker operates under a multi-jurisdictional regulatory framework, with oversight from regulators classified across different trust tiers. This reflects its commitment to maintaining regulatory compliance while expanding its market reach.

Regulatory Jurisdictions: OnEquity operates under a complex regulatory structure with licenses from multiple authorities across different trust tiers. The broker maintains regulatory compliance through one Tier-1 regulator (highly trusted), one Tier-2 regulator (trusted), and one Tier-4 regulator (high risk). This provides varying levels of client protection depending on the specific regulatory entity.

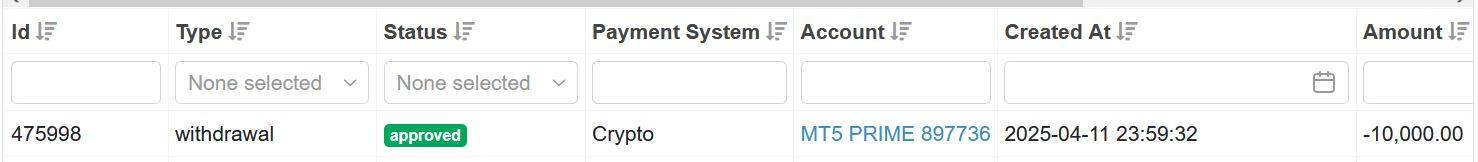

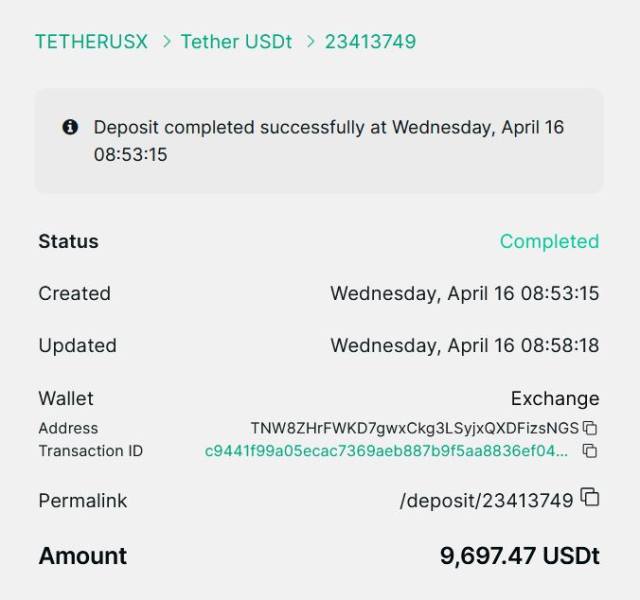

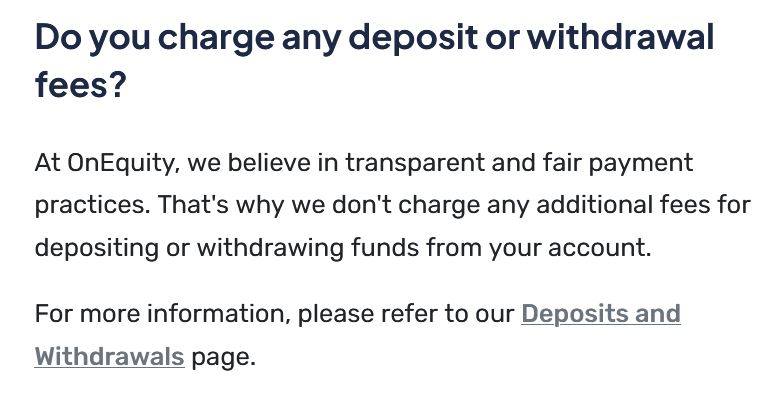

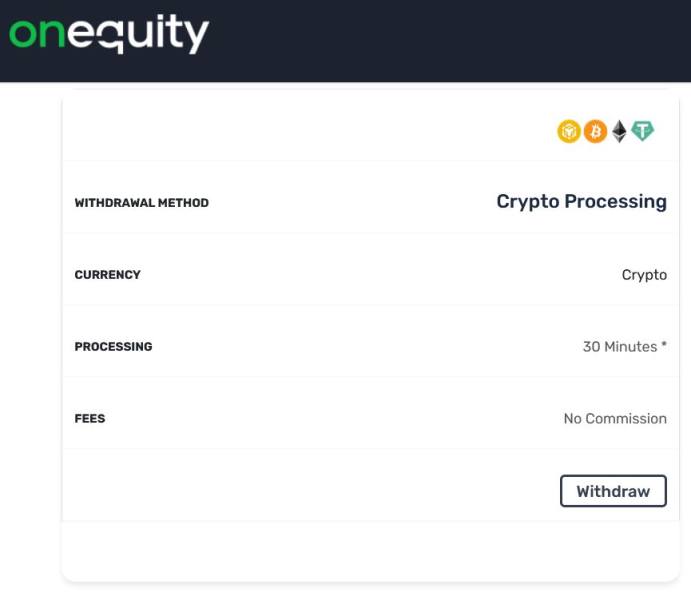

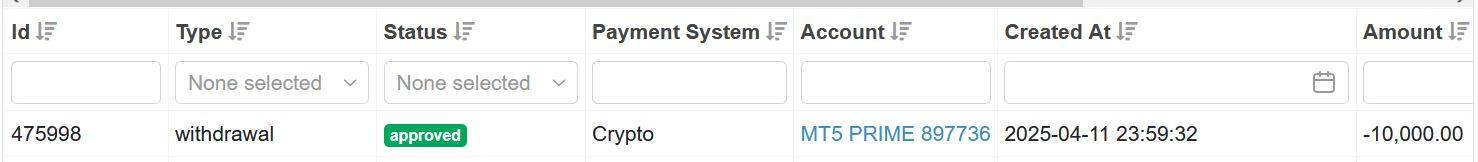

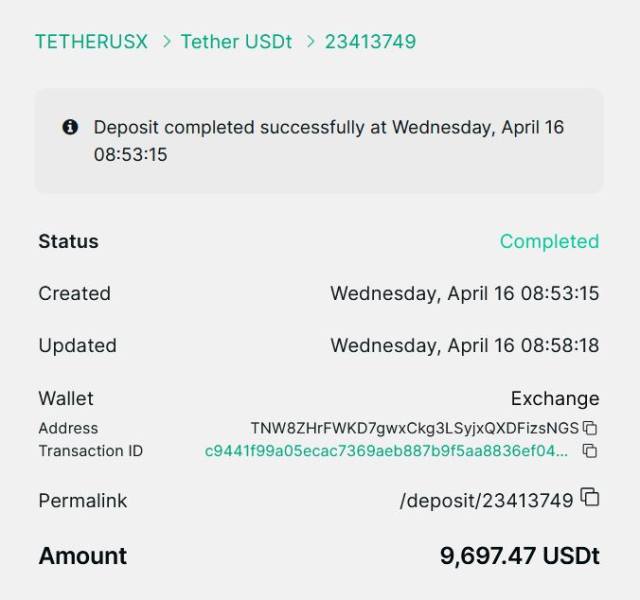

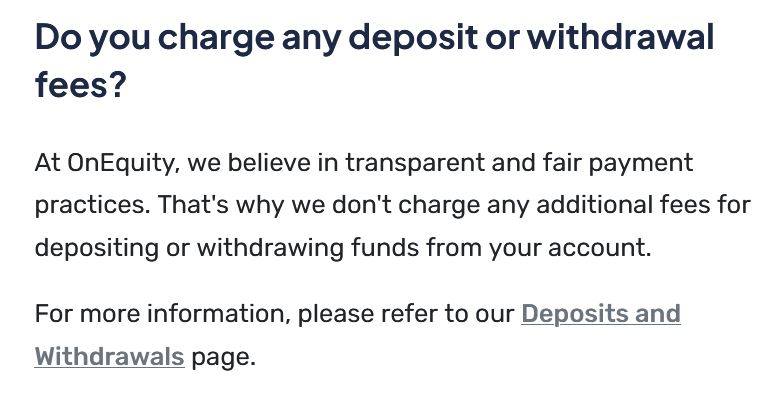

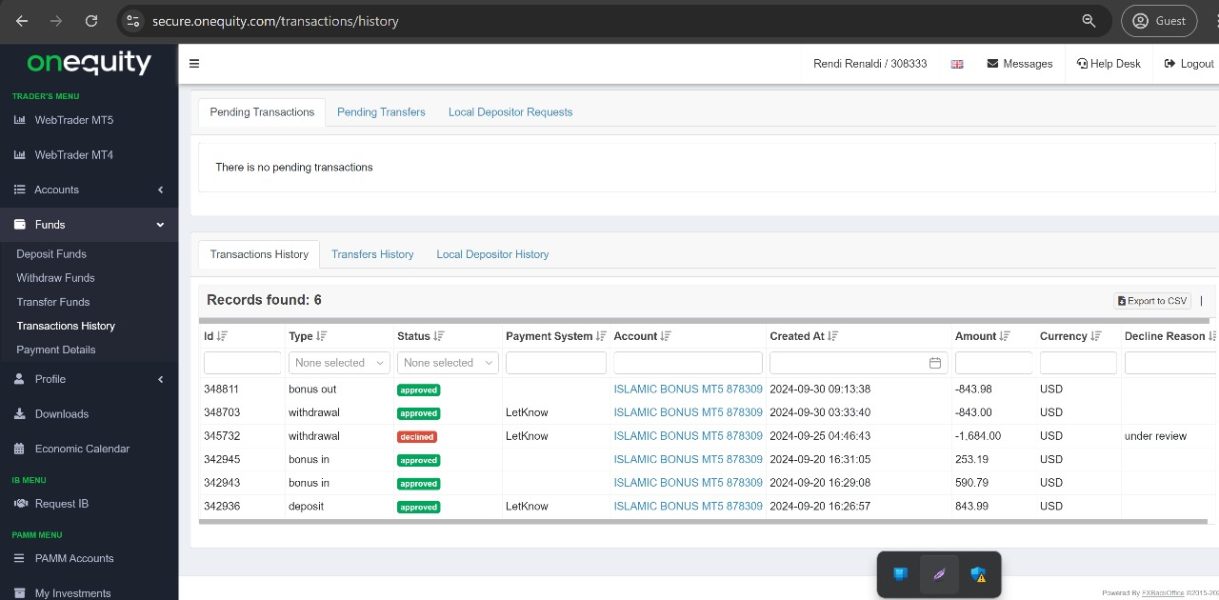

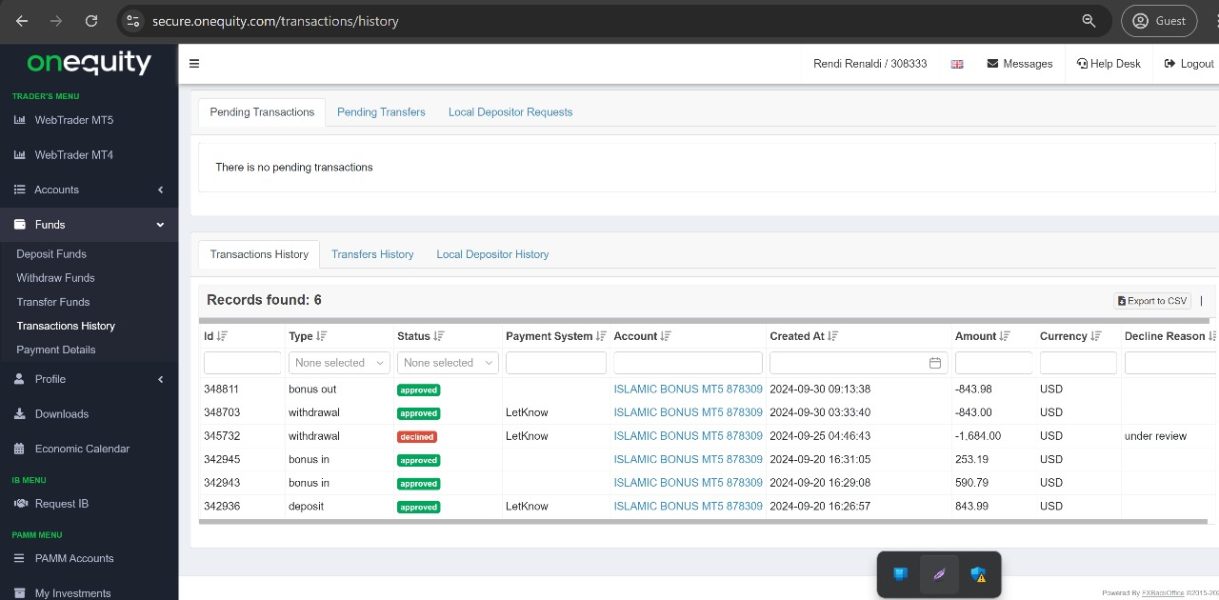

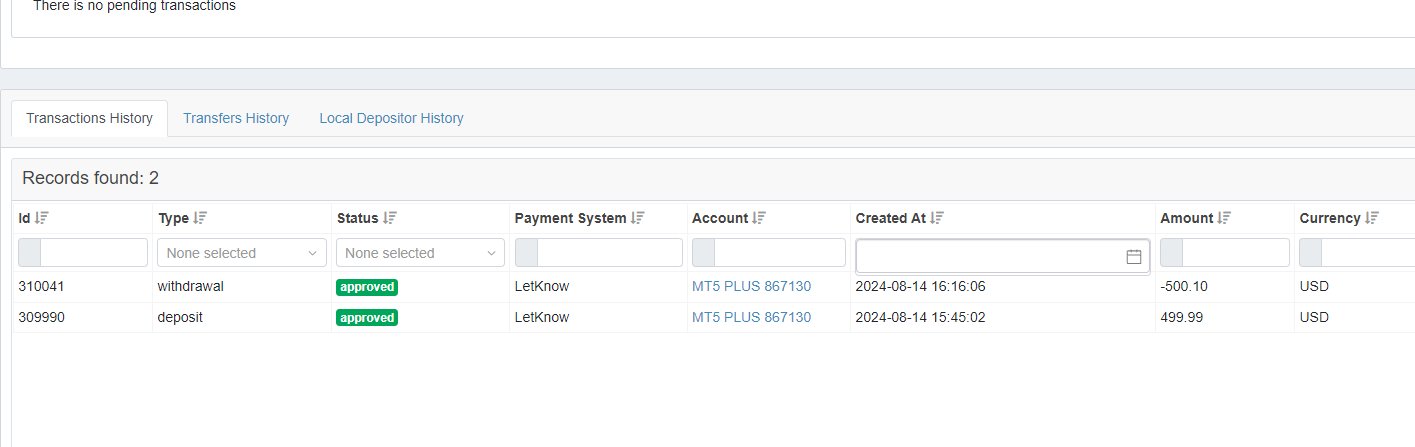

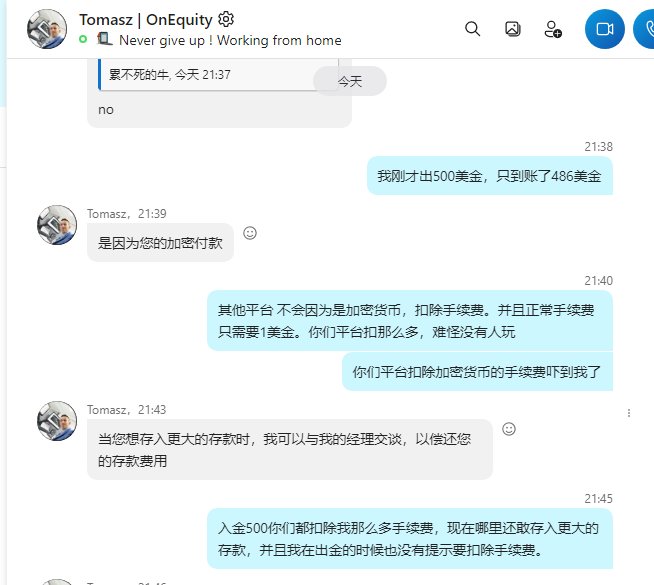

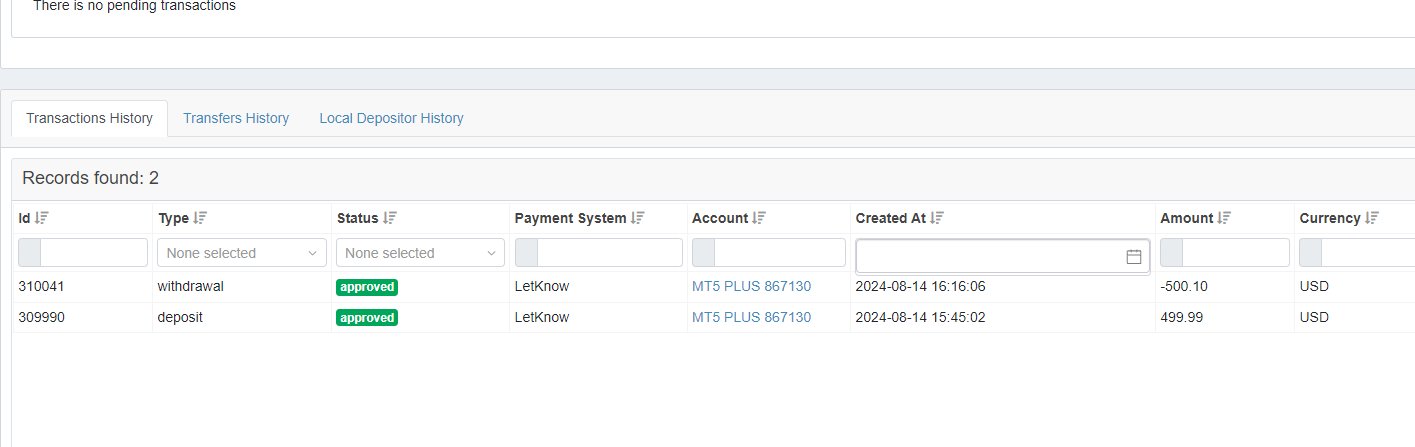

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not detailed in available public information. Potential clients need to contact the broker directly for complete payment processing details.

Minimum Deposit Requirements: Minimum deposit requirements are not specified in publicly available information. This suggests varying account tiers may exist with different entry points for traders.

Bonus and Promotions: Current promotional offerings and bonus structures are not detailed in available information. This indicates that such incentives may be communicated directly to prospective clients during the account opening process.

Tradeable Assets: OnEquity offers a wide range of tradeable instruments including forex currency pairs, commodity CFDs covering precious metals and energy products, stock CFDs from major global markets, cryptocurrency CFDs for digital asset exposure, and index CFDs representing major market indices worldwide.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not publicly available in reviewed sources. This requires direct inquiry with the broker for complete fee schedules and trading conditions.

Leverage Ratios: The broker offers competitive leverage up to 1:1000. This provides traders with significant market exposure capabilities while requiring appropriate risk management considerations.

Platform Options: Trading is done through MetaTrader 4 and MetaTrader 5 platforms. These offer traders access to advanced charting tools, automated trading capabilities, and complete market analysis features.

Geographic Restrictions: Specific geographic limitations are not detailed in available information. However, regulatory compliance suggests certain jurisdictional restrictions may apply.

Customer Service Languages: OnEquity provides multilingual customer support to accommodate its international client base. Specific language options are not completely listed in reviewed materials.

Detailed Rating Analysis

Account Conditions Analysis (Score: 5/10)

OnEquity's account conditions present a mixed picture for potential traders. While the broker offers access to multiple asset classes and high leverage options, the lack of publicly available information about specific account types, minimum deposit requirements, and detailed fee structures creates uncertainty for prospective clients. This onequity review finds that the absence of transparent pricing information significantly impacts the overall account conditions rating.

The broker's account opening process and specific account features are not well detailed in available public information. This makes it difficult for traders to make informed comparisons with other market participants. The high leverage offering up to 1:1000 represents a positive aspect for traders seeking enhanced market exposure, but this must be balanced against the limited transparency in other account-related areas.

Without clear information about account tiers, special features such as Islamic accounts, or specific trading conditions for different client segments, potential users face challenges in evaluating whether OnEquity's account structure aligns with their trading needs. The broker would benefit from increased transparency in communicating account conditions and requirements to improve client confidence and decision-making processes.

OnEquity demonstrates strength in its platform offerings by providing access to both MetaTrader 4 and MetaTrader 5. These are industry-standard platforms known for their complete trading tools and analytical capabilities. These platforms offer traders access to advanced charting tools, technical indicators, automated trading through Expert Advisors, and mobile trading capabilities.

The broker's multi-asset approach provides traders with diverse trading opportunities across forex, commodities, stocks, cryptocurrencies, and indices. This allows for portfolio diversification within a single trading account. This breadth of available instruments represents a significant advantage for traders seeking exposure to multiple market sectors without maintaining accounts with multiple brokers.

However, specific information about additional research resources, market analysis tools, educational materials, or proprietary trading tools is not detailed in available information. The absence of information about daily market commentary, economic calendars, or educational webinars suggests that traders may need to rely primarily on the standard features provided by the MetaTrader platforms rather than enhanced broker-specific resources.

Customer Service and Support Analysis (Score: 6/10)

OnEquity offers multilingual customer support, indicating a commitment to serving its international client base effectively. This multilingual capability represents a positive aspect for traders from different geographic regions who prefer communication in their native languages. It enhances accessibility and user experience.

However, specific details about customer service channels, availability hours, response times, and service quality metrics are not provided in available information. The absence of information about live chat availability, phone support options, email response times, or dedicated account management services makes it difficult to assess the overall quality and accessibility of customer support services.

User feedback regarding customer service experiences is not detailed in reviewed sources. This prevents a complete evaluation of actual service delivery quality. The broker would benefit from providing more transparent information about its customer support infrastructure, including available contact methods, service hours, and expected response times to help potential clients understand the level of support they can expect.

Trading Experience Analysis (Score: 7/10)

OnEquity's trading experience benefits from its provision of industry-standard MetaTrader platforms. These offer reliable and feature-rich trading environments familiar to most forex and CFD traders. The availability of both MT4 and MT5 provides flexibility for traders with different platform preferences and trading strategies.

The high leverage offering up to 1:1000 enhances trading flexibility for those seeking increased market exposure. The diverse asset portfolio allows for complete market participation across multiple sectors. This combination of high leverage and asset diversity creates opportunities for varied trading strategies and portfolio approaches.

However, specific information about platform stability, execution speeds, order processing quality, mobile trading experience, and trading environment characteristics is not detailed in available sources. The absence of performance metrics, user experience feedback, or technical specifications makes it challenging to evaluate the actual quality of the trading experience beyond the basic platform and leverage offerings. This onequity review notes that while the foundation appears solid, more detailed performance information would strengthen the evaluation.

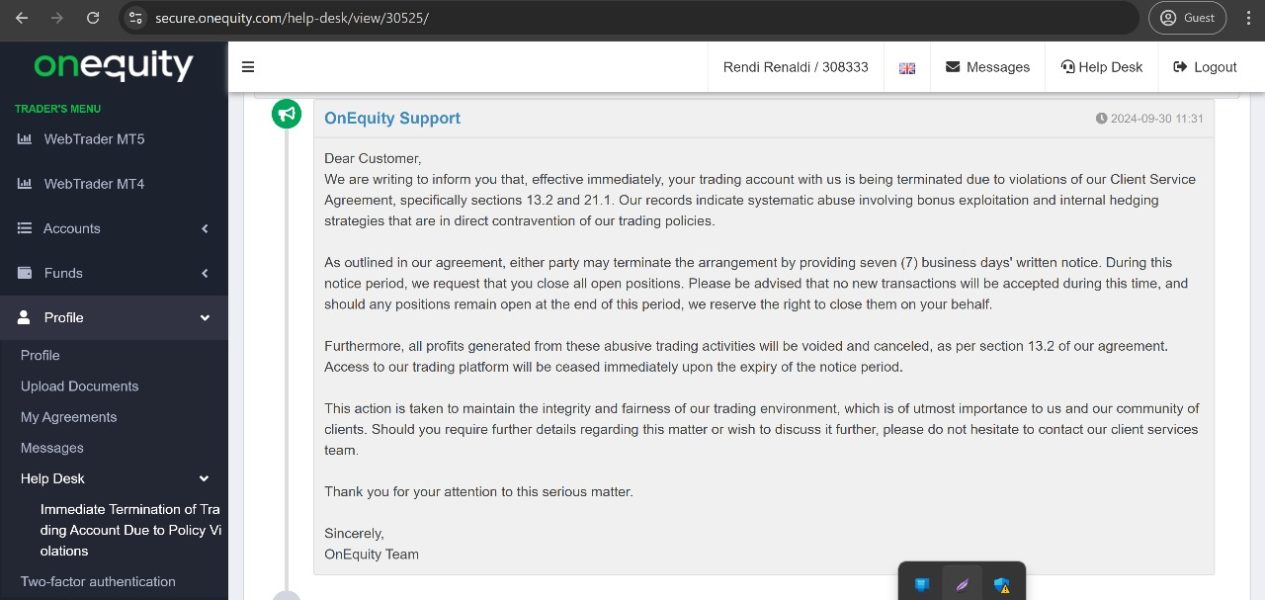

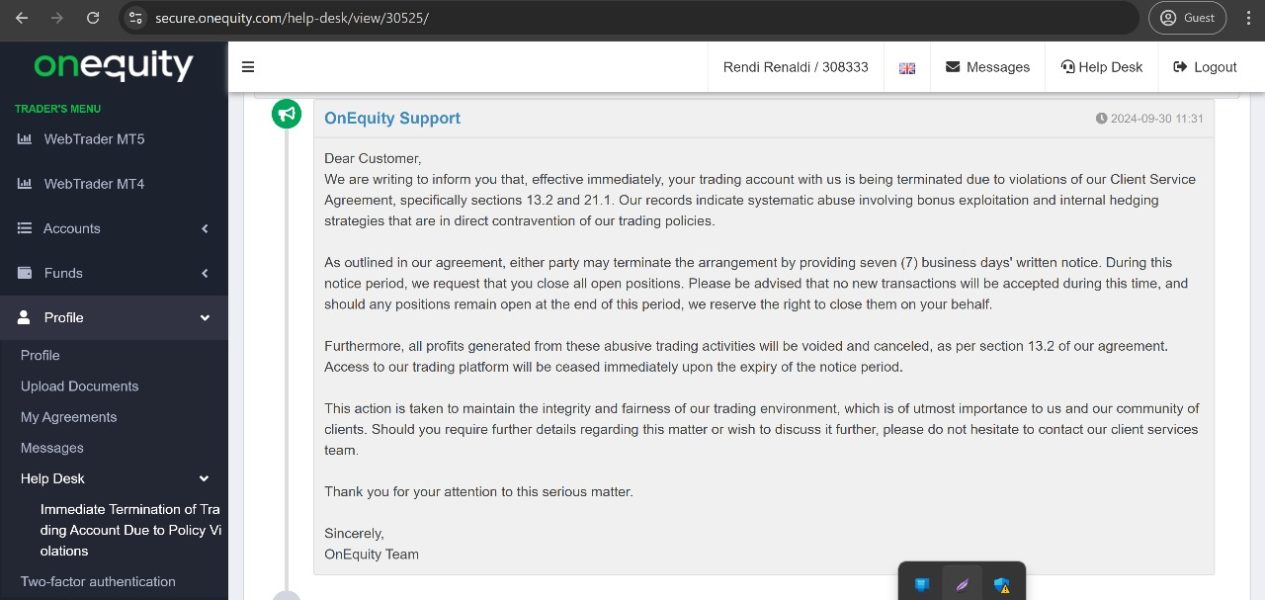

Trust Factor Analysis (Score: 4/10)

OnEquity's trust factor presents significant concerns due to its mixed regulatory profile. While the broker maintains licenses from multiple regulatory authorities, including one Tier-1 regulator (highly trusted) and one Tier-2 regulator (trusted), the presence of a Tier-4 regulator (high risk) in its regulatory structure raises questions about overall client protection standards.

The multi-jurisdictional regulatory approach, while potentially offering broader market access, creates complexity in understanding which regulatory protections apply to specific client segments. Different regulatory tiers provide varying levels of client fund protection, dispute resolution mechanisms, and oversight standards. This makes it challenging for potential clients to assess their specific protection level.

Specific information about client fund segregation, deposit insurance coverage, regulatory compliance history, or third-party auditing is not detailed in available sources. The absence of information about company financial transparency, negative incident handling, or industry reputation assessments further impacts the trust evaluation. Potential clients should carefully investigate the specific regulatory protections applicable to their account before engaging with the broker.

User Experience Analysis (Score: 6/10)

OnEquity's user experience is supported by its provision of familiar MetaTrader platforms. These offer standardized interfaces and functionality that many traders already understand. The multi-asset trading capability within single account structures simplifies portfolio management and reduces the complexity of maintaining multiple broker relationships.

The multilingual support capability suggests attention to user accessibility for international clients. This potentially improves the overall user experience for non-English speaking traders. The high leverage options provide flexibility for traders seeking enhanced market exposure, contributing to a more complete trading experience.

However, specific information about user interface design quality, account registration and verification processes, fund operation experiences, mobile app functionality, or common user satisfaction metrics is not available in reviewed sources. User feedback regarding platform usability, customer satisfaction levels, or specific user experience challenges is not detailed. This limits the ability to provide a complete user experience assessment. The broker would benefit from publishing user testimonials, satisfaction surveys, or detailed user experience information to support potential client decision-making.

Conclusion

OnEquity presents itself as a multi-asset broker with several appealing features. These include high leverage up to 1:1000, access to popular MetaTrader platforms, and a diverse range of tradeable instruments across forex, commodities, stocks, and cryptocurrencies. The broker's multilingual support and multi-jurisdictional regulatory approach demonstrate efforts to serve an international client base.

However, this onequity review identifies significant areas of concern, particularly regarding transparency and trust factors. The mixed regulatory profile, with the presence of a high-risk tier regulator alongside more trusted authorities, creates uncertainty about client protection standards. The limited availability of detailed information about account conditions, fee structures, and service quality metrics further impacts the overall evaluation.

OnEquity may be suitable for experienced traders who prioritize high leverage access and asset diversity. These traders must also be comfortable navigating the complexities of multi-jurisdictional regulatory frameworks. However, traders seeking maximum transparency and top-tier regulatory protection may want to consider alternatives with clearer regulatory profiles and more complete public information disclosure. Potential clients should conduct thorough due diligence and carefully evaluate the regulatory protections applicable to their specific situation before opening an account.