Is Money Ocean Fx safe?

Business

License

Is Money Ocean FX Safe or a Scam?

Introduction

Money Ocean FX positions itself as a global player in the forex market, offering a variety of trading instruments including forex, commodities, and indices. However, the rise of online trading has also led to an increase in fraudulent schemes, making it imperative for traders to thoroughly evaluate the legitimacy of their chosen brokers. With the potential for significant financial loss, understanding whether "Is Money Ocean FX safe?" becomes a critical inquiry for prospective investors. This article aims to provide an objective analysis of Money Ocean FX, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a forex broker is often a key indicator of its legitimacy and safety. For Money Ocean FX, the situation is concerning. Despite claiming to be a licensed entity, it lacks registration with reputable regulatory bodies such as the Cyprus Securities and Exchange Commission (CySEC) or the Financial Conduct Authority (FCA) in the UK. This absence raises significant red flags regarding the broker's operational transparency and accountability.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of regulation means that Money Ocean FX operates without the oversight that protects traders from potential malpractice. Regulatory bodies enforce strict standards for financial practices, ensuring that brokers maintain transparency and accountability. The absence of such oversight suggests that Money Ocean FX may not adhere to industry standards, which is crucial for traders seeking a reliable trading environment.

Company Background Investigation

Money Ocean FX is relatively new to the forex scene, having been established in 2020. The company's ownership structure remains opaque, with little information available regarding its founders or management team. This lack of transparency can be unsettling for potential investors, as knowing the individuals behind a broker can provide insights into its trustworthiness and operational ethos.

The management team's professional background is essential for assessing the broker's credibility. A team with extensive experience in finance and trading can often indicate a higher level of competence and reliability. However, the anonymity surrounding Money Ocean FX's ownership raises concerns about its operational integrity and commitment to ethical trading practices.

Trading Conditions Analysis

When evaluating whether "Is Money Ocean FX safe?", it's crucial to scrutinize the trading conditions it offers. The broker presents itself with competitive spreads and commissions; however, the overall fee structure may not align with industry standards.

| Fee Type | Money Ocean FX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.0 pips | 0.5 - 1.5 pips |

| Commission Model | $6 per trade | $5 - $10 per trade |

| Overnight Interest Range | Varies | Varies |

The commission structure, while competitive, raises questions about the overall cost of trading with Money Ocean FX. Additionally, the broker's claim of offering spreads starting from 0.0 pips could be misleading, as such low spreads are often accompanied by hidden fees or unfavorable trading conditions.

Customer Funds Security

The safety of customer funds is paramount when assessing whether "Is Money Ocean FX safe?". Unfortunately, Money Ocean FX does not provide adequate information regarding its fund security measures. The absence of segregated accounts—where client funds are kept separate from the broker's operational funds—can expose traders to higher risks in the event of financial instability or bankruptcy.

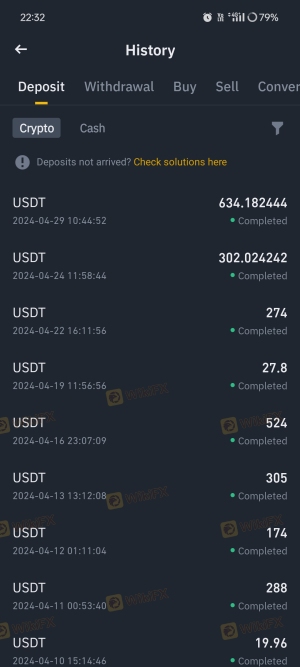

Furthermore, the lack of investor protection mechanisms, such as negative balance protection, further compounds the risk associated with trading through this broker. Historical complaints and issues related to fund withdrawals have also been reported, indicating that traders may face challenges in accessing their funds when needed.

Customer Experience and Complaints

Customer feedback serves as a vital metric for evaluating a broker's reliability. In the case of Money Ocean FX, reviews reveal a pattern of dissatisfaction among users. Common complaints include poor customer support, delayed withdrawals, and a lack of transparency regarding fees and trading conditions.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Transparency | Medium | Inconsistent |

| Customer Support Issues | High | Unresponsive |

One notable case involved a trader who reported significant delays in processing a withdrawal request, which took several weeks to resolve. Such experiences raise concerns about the broker's commitment to customer service and support.

Platform and Trade Execution

The trading platform offered by Money Ocean FX is another critical aspect to consider. While the broker claims to provide a user-friendly trading environment, the quality of execution, including slippage and order rejections, remains uncertain. Traders have reported instances of delayed executions, which can significantly impact trading outcomes.

Additionally, the platform's stability and performance are crucial for a seamless trading experience. If the platform is prone to crashes or technical issues, it can lead to substantial losses for traders, further questioning whether "Is Money Ocean FX safe?".

Risk Assessment

In light of the information gathered, it is essential to conduct a comprehensive risk assessment of trading with Money Ocean FX.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Financial Stability Risk | High | Lack of transparency about ownership and funds security. |

| Customer Support Risk | Medium | Poor response to customer complaints. |

| Platform Reliability Risk | High | Reports of execution issues and platform instability. |

To mitigate these risks, it is advisable for potential traders to conduct thorough research and consider alternative, regulated brokers that offer better protection and customer service.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that "Is Money Ocean FX safe?" is a question that requires serious consideration. The broker's lack of regulation, transparency issues, and customer complaints indicate significant risks for traders. While some may be drawn to its competitive trading conditions, the potential for financial loss is substantial.

For traders seeking a reliable and secure trading environment, it is recommended to consider alternative brokers that are regulated and have a proven track record of customer satisfaction. Brokers such as [insert reputable broker names here] could provide safer trading conditions and better support for traders of all experience levels. Always prioritize due diligence and ensure that your chosen broker aligns with your trading needs and risk tolerance.

Is Money Ocean Fx a scam, or is it legit?

The latest exposure and evaluation content of Money Ocean Fx brokers.

Money Ocean Fx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Money Ocean Fx latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.