Money Ocean FX 2025 Review: Everything You Need to Know

Executive Summary

Money Ocean FX presents itself as an online financial services provider targeting both retail and professional clients worldwide. According to available information, the broker offers trading services in forex and precious metals through the MT5 platform. However, this money ocean fx review reveals significant concerns regarding the broker's transparency and regulatory status.

The broker's most attractive features include leverage up to 1:1000 and spreads starting from 0.0 pips, which may appeal to traders seeking competitive trading conditions. Money Ocean FX claims to provide three different live account types and 24/5 customer support. Despite these offerings, the absence of clear regulatory information and mixed user feedback raises serious questions about the broker's legitimacy and trustworthiness.

Based on available data, Money Ocean FX appears to target traders looking for high leverage and tight spreads, but the lack of regulatory oversight and limited transparency makes it a questionable choice for serious investors. Multiple sources have raised concerns about potential scam activities, making this broker a high-risk option for traders.

Important Notice

Due to the absence of specific regulatory authorities and license numbers in available information, investors should exercise extreme caution when considering Money Ocean FX. Different jurisdictions have varying legal requirements and risk protections, and traders must understand their local regulations before engaging with unregulated brokers.

This review is based on publicly available information and user feedback. However, the lack of comprehensive regulatory background information significantly limits our ability to provide a complete assessment of the broker's legitimacy and safety measures.

Rating Overview

Broker Overview

Money Ocean FX operates as an online financial services provider, though specific founding details and company background information remain unclear in available sources. The broker positions itself as serving both retail and professional clients globally, offering various trading products including forex and precious metals. The company claims to provide reliable and transparent services, though evidence supporting these claims is limited.

The broker's business model centers around providing trading services through the MT5 platform, with a focus on competitive spreads and high leverage ratios. However, the absence of detailed company information, including founding year, management details, and corporate structure, raises questions about the broker's transparency and legitimacy.

According to available information, Money Ocean FX offers trading in forex and precious metals markets. The broker utilizes the MetaTrader 5 platform as its primary trading interface, supporting automated trading capabilities. However, this money ocean fx review must note that specific regulatory oversight information is not mentioned in available sources, which represents a significant concern for potential clients seeking regulated trading environments.

Regulatory Status: Available information does not mention specific regulatory authorities or license numbers, which represents a major red flag for potential investors seeking regulated brokers.

Deposit and Withdrawal Methods: Specific information about available funding methods is not detailed in current sources, leaving potential clients without crucial operational information.

Minimum Deposit Requirements: Current available information does not specify minimum deposit amounts for different account types, making it difficult for traders to plan their initial investments.

Bonus and Promotions: No specific promotional offers or bonus programs are mentioned in available sources, suggesting either absence of such programs or lack of transparent marketing.

Tradable Assets: The broker offers trading in forex and precious metals markets, though the complete range of available instruments is not comprehensively detailed.

Cost Structure: Spreads reportedly start from 0.0 pips, which appears competitive, but commission structures and other trading costs are not specified in available information.

Leverage Ratios: The broker offers leverage up to 1:1000, which is among the higher ratios available in the market, appealing to traders seeking maximum capital efficiency.

Platform Options: Money Ocean FX provides the MT5 trading platform, supporting automated trading capabilities and various trading tools.

Regional Restrictions: Specific geographic limitations or restricted jurisdictions are not mentioned in available sources.

Customer Service Languages: The range of supported languages for customer service is not specified in current information, though this money ocean fx review notes 24/5 support availability.

Comprehensive Rating Analysis

Account Conditions Analysis (Score: 6/10)

Money Ocean FX claims to offer three different live account types, providing some variety for traders with different needs and capital levels. However, the lack of specific information about minimum deposit requirements significantly hampers potential clients' ability to make informed decisions. The absence of detailed commission structures and account-specific features further reduces the transparency that professional traders typically expect.

The broker's account opening process details are not clearly outlined in available sources, making it difficult to assess the ease and efficiency of getting started with the platform. Additionally, specialized account options such as Islamic accounts or institutional accounts are not mentioned, which may limit the broker's appeal to diverse trading communities.

When compared to established brokers in the market, Money Ocean FX's lack of detailed account information represents a significant disadvantage. This money ocean fx review must emphasize that serious traders typically require comprehensive account details before committing funds, and the current information gap raises concerns about the broker's professional standards and transparency practices.

The broker provides access to the MetaTrader 5 platform, which is widely recognized as a professional-grade trading interface offering advanced charting tools, technical indicators, and automated trading capabilities. MT5's reputation in the industry provides some credibility to Money Ocean FX's trading infrastructure, assuming proper implementation and maintenance.

Automated trading support is mentioned, which appeals to algorithmic traders and those using expert advisors. However, specific details about the range of supported automated trading features, custom indicator capabilities, or platform customization options are not elaborated in available sources.

Educational resources, market analysis tools, and research materials are not specifically mentioned in current information, which represents a significant gap for traders seeking comprehensive broker support. Modern traders typically expect access to market commentary, economic calendars, and educational content, and the absence of such information raises questions about the broker's commitment to client development and support.

Customer Service Analysis (Score: 6/10)

Money Ocean FX claims to provide 24/5 customer support, which covers most trading hours for global markets. However, specific contact methods, response time commitments, and service quality metrics are not detailed in available information, making it difficult to assess the actual effectiveness of their support system.

The range of supported languages for customer service is not specified, which may limit accessibility for international clients. Professional brokers typically provide multilingual support to serve their global client base effectively, and the absence of such information raises questions about the broker's international service capabilities.

User feedback regarding customer service quality, problem resolution effectiveness, and overall support satisfaction is not available in current sources. Without concrete user experiences and service examples, it's challenging to evaluate whether the claimed 24/5 support translates into meaningful assistance for traders facing issues or requiring guidance.

Trading Experience Analysis (Score: 7/10)

The combination of spreads starting from 0.0 pips and leverage up to 1:1000 creates potentially attractive trading conditions for active traders and scalpers. These competitive parameters suggest that Money Ocean FX is attempting to appeal to cost-conscious traders seeking maximum capital efficiency and minimal trading costs.

However, crucial trading experience factors such as order execution speed, slippage rates, and requote frequency are not addressed in available information. These technical performance metrics significantly impact actual trading results and trader satisfaction, and their absence makes it difficult to assess real-world trading conditions.

Platform stability, server uptime, and mobile trading capabilities are not specifically detailed, though MT5 generally provides robust functionality across devices. The lack of user testimonials or performance data regarding actual trading experiences represents a significant information gap for this money ocean fx review, as real trader feedback typically provides the most valuable insights into platform performance and reliability.

Trust and Safety Analysis (Score: 4/10)

The most significant concern regarding Money Ocean FX is the absence of clear regulatory information and license numbers. Regulatory oversight provides crucial investor protections, including segregated client funds, compensation schemes, and dispute resolution mechanisms. The lack of such information severely undermines the broker's trustworthiness and creates substantial risk for potential clients.

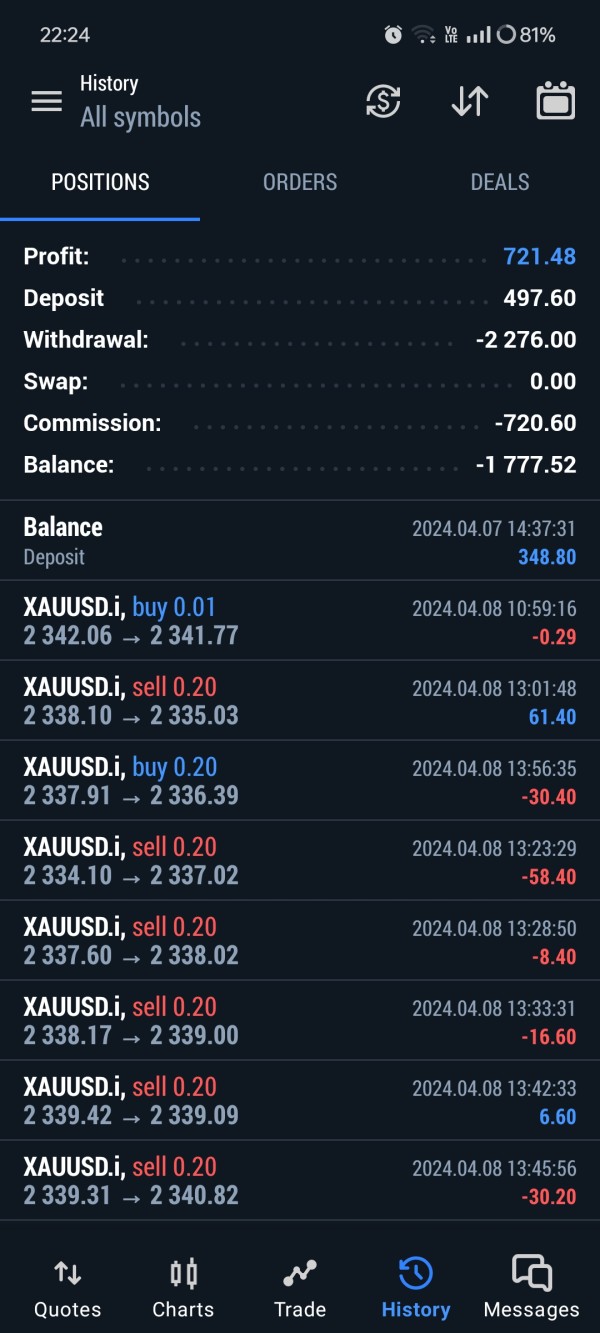

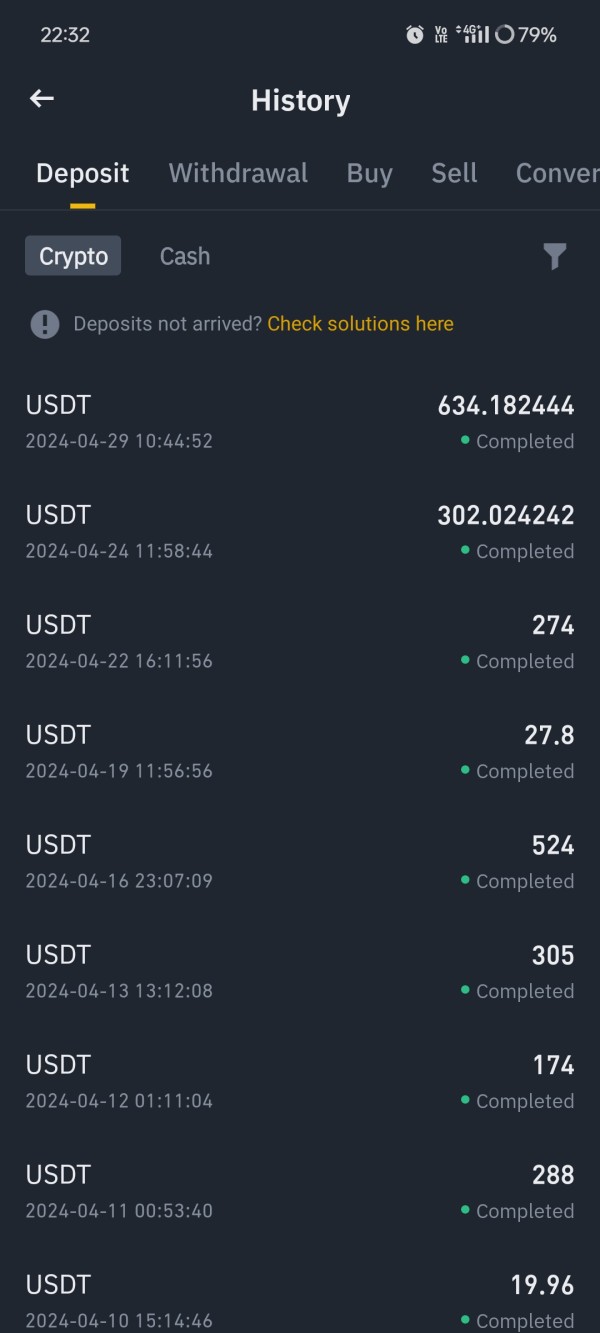

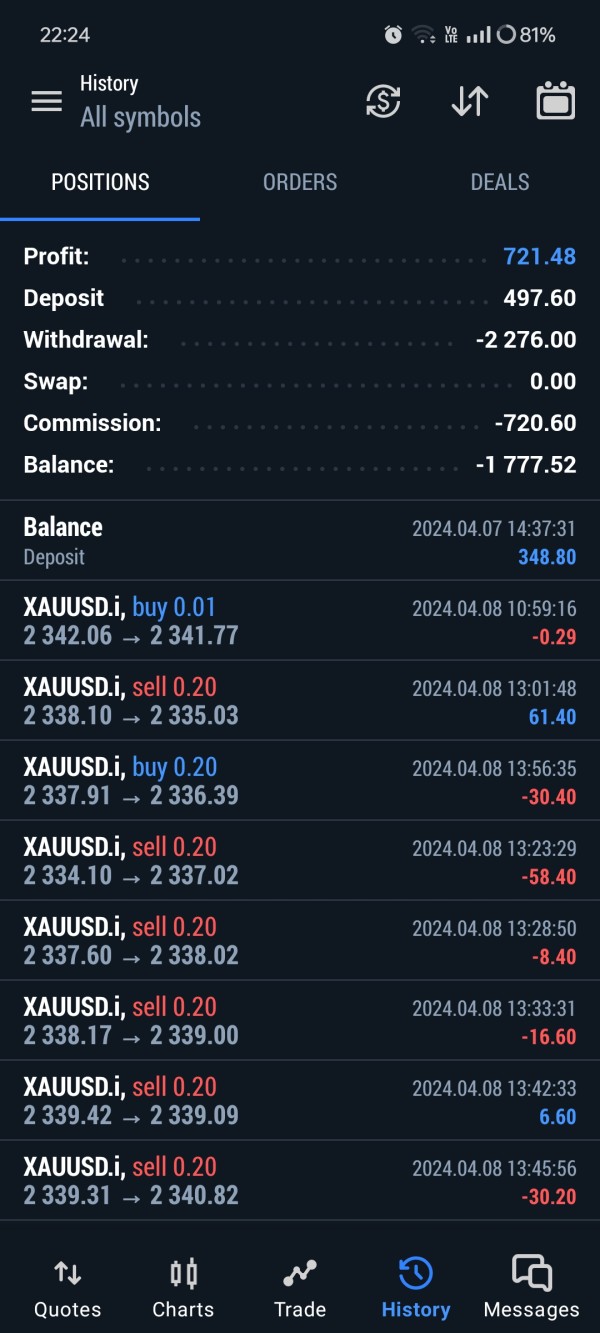

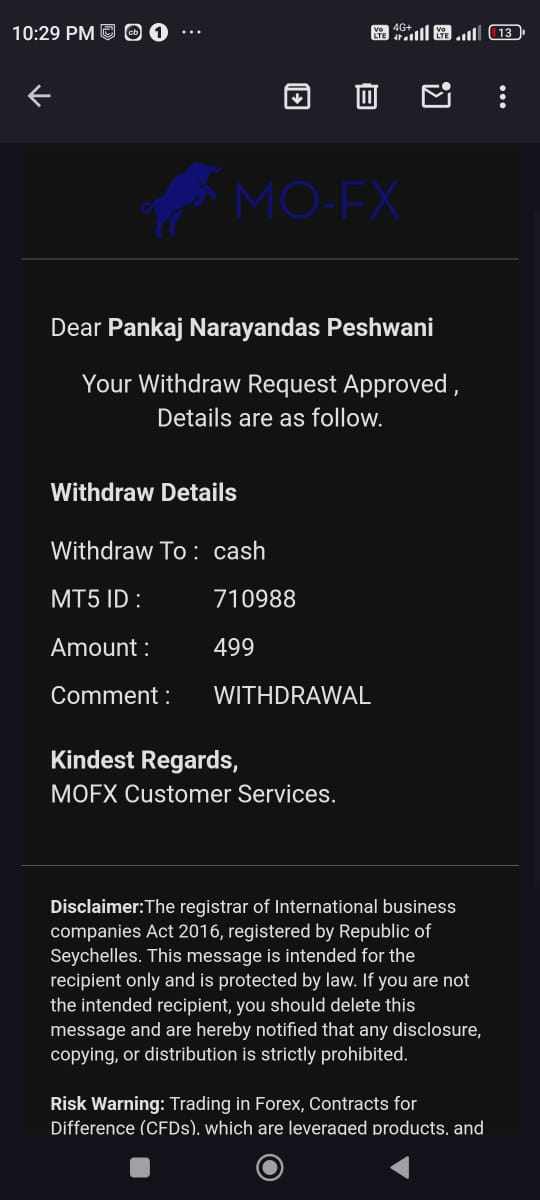

Available sources indicate discussions about potential scam activities, which further damages the broker's reputation and reliability assessment. While these may be unverified claims, the presence of such concerns in online discussions represents a red flag that potential clients must consider seriously.

Client fund security measures, financial reporting transparency, and corporate governance information are not detailed in available sources. Established brokers typically provide comprehensive information about fund segregation, insurance coverage, and financial stability, and the absence of such details raises serious questions about Money Ocean FX's operational standards and client protection measures.

User Experience Analysis (Score: 5/10)

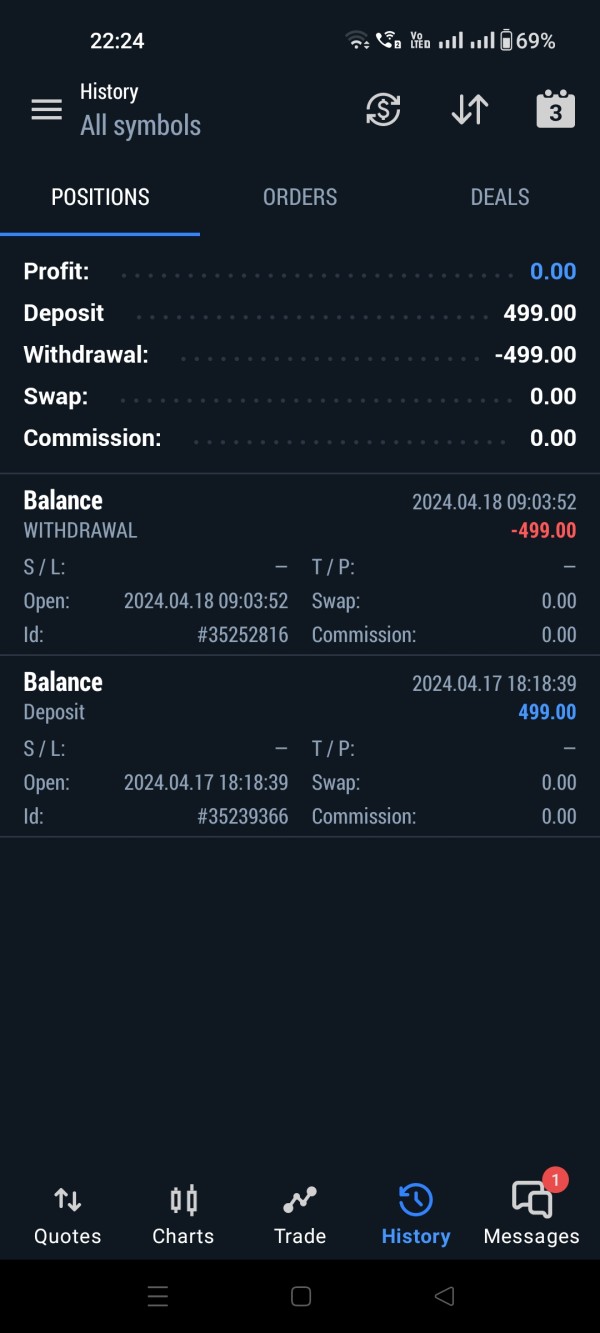

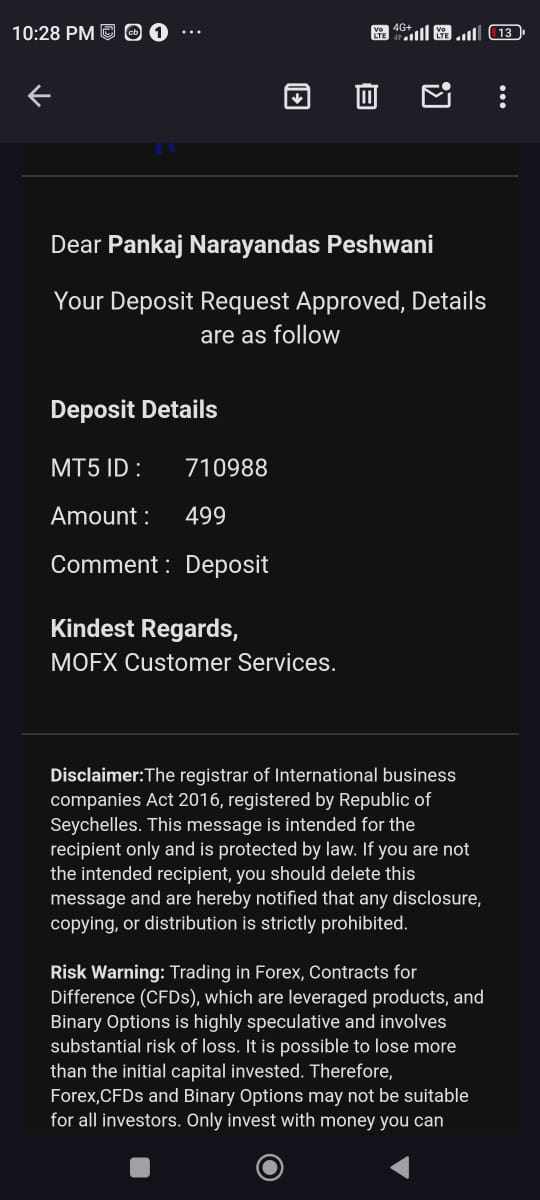

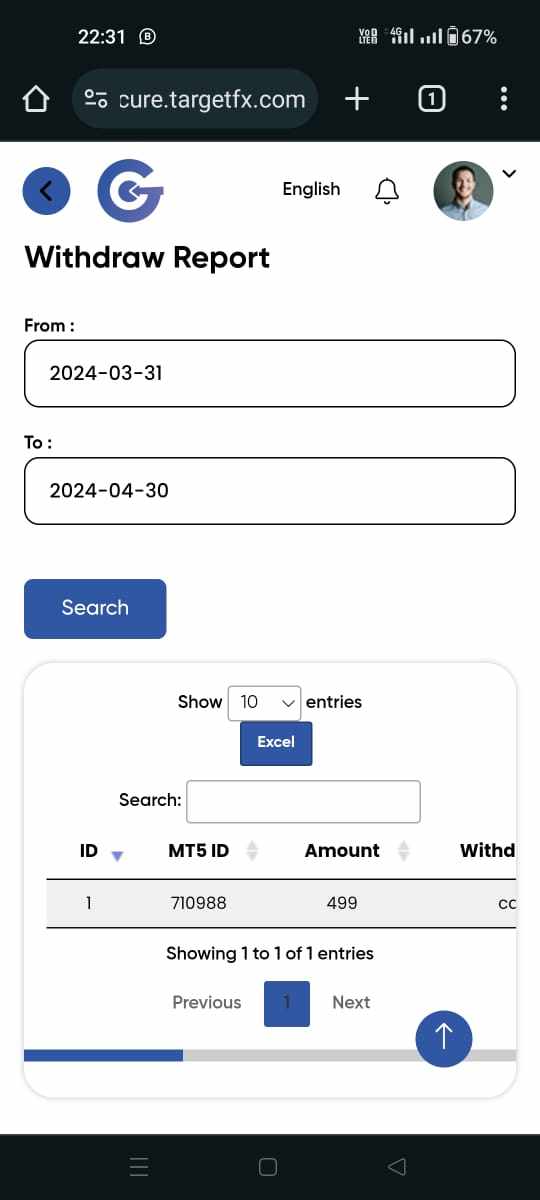

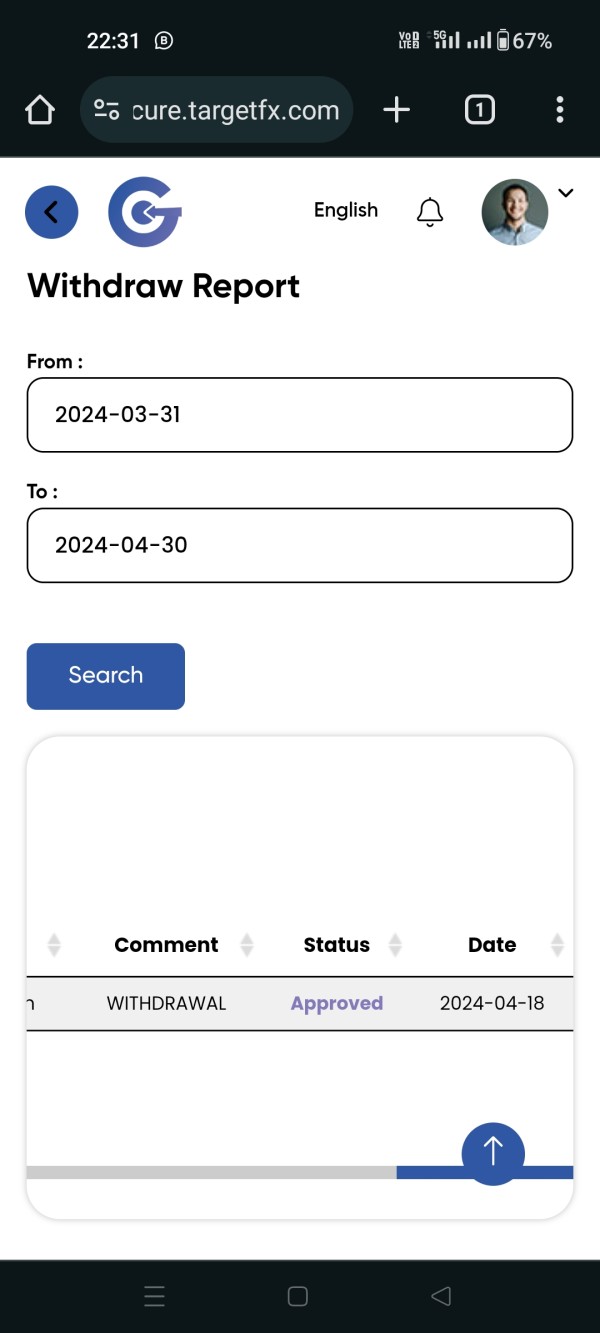

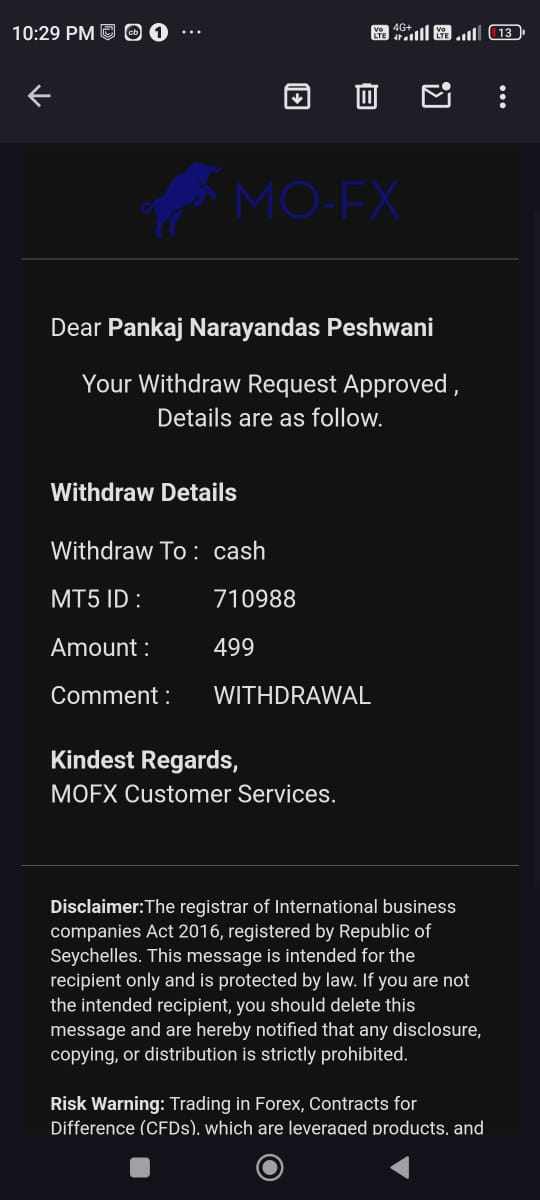

Comprehensive user feedback and satisfaction ratings are not available in current sources, making it challenging to assess overall client satisfaction and platform usability. User reviews and testimonials typically provide crucial insights into real-world broker performance, withdrawal processing, and customer service effectiveness.

The broker's website interface, account management tools, and overall user journey are not detailed in available information. Modern traders expect intuitive platforms, efficient account management, and seamless operational processes, and the absence of such information makes it difficult to evaluate the actual user experience.

Registration and verification processes, funding convenience, and withdrawal efficiency are not specifically addressed, though these factors significantly impact trader satisfaction. The presence of negative discussions in some sources suggests potential issues with user experience, though specific details and resolution outcomes are not provided in current information.

Conclusion

This money ocean fx review reveals a broker offering potentially attractive trading conditions through high leverage and competitive spreads, but significant transparency and regulatory concerns overshadow these benefits. While the MT5 platform and claimed 24/5 support suggest some professional infrastructure, the absence of regulatory oversight and limited user feedback create substantial risks for potential clients.

Money Ocean FX might appeal to traders specifically seeking high leverage ratios and tight spreads, but the lack of regulatory protection makes it unsuitable for risk-averse investors or those prioritizing fund security. The presence of scam-related discussions further compounds trust issues, making thorough due diligence essential for anyone considering this broker.

The primary advantages include competitive trading conditions and platform access, while major disadvantages encompass regulatory uncertainty, limited transparency, and questionable reputation. Traders should carefully consider these factors and potentially explore regulated alternatives that provide better investor protections and transparent operations.