Regarding the legitimacy of INVESTINGOR forex brokers, it provides FSA and WikiBit, .

Is INVESTINGOR safe?

Risk Control

License

Is INVESTINGOR markets regulated?

The regulatory license is the strongest proof.

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Investingor Ltd

Effective Date:

--Email Address of Licensed Institution:

info@investingor.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.investingor.comExpiration Time:

--Address of Licensed Institution:

CT House, Office 8A, Providence, Mahe, SeychellesPhone Number of Licensed Institution:

+248 4373812Licensed Institution Certified Documents:

Is Investingor A Scam?

Introduction

Investingor is an online forex broker that has emerged in the competitive landscape of foreign exchange trading. Established in Seychelles, this broker aims to cater to both novice and experienced traders by offering a range of financial instruments. However, the forex market is rife with potential pitfalls, and traders must exercise caution when selecting a broker. The importance of thorough evaluation cannot be overstated, as the safety of funds, quality of service, and overall legitimacy of the broker are critical factors that can significantly impact a trader's experience and financial health. This article seeks to provide an objective assessment of Investingor, utilizing information gathered from various reputable sources, including regulatory databases, user reviews, and expert analyses to evaluate its credibility and safety.

Regulation and Legitimacy

Regulation is a vital aspect of any financial service provider, especially in the forex market, where the potential for fraud is significant. Investingor claims to be regulated by the Seychelles Financial Services Authority (FSA), which is known for its relatively lax regulatory environment compared to more stringent jurisdictions like the UK or the US. Below is a summary of Investingor's regulatory status:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Seychelles FSA | SD 135 | Seychelles | Verified |

Despite being licensed, the regulatory framework in Seychelles raises concerns regarding the level of investor protection. The FSA's requirements are minimal, allowing brokers to operate without stringent oversight. For instance, brokers are not mandated to provide negative balance protection or segregated accounts for client funds. This lack of robust regulation can expose traders to higher risks, as many offshore brokers are known to engage in questionable practices. Therefore, while Investingor does hold a license, the quality and reliability of such regulation should be critically assessed.

Company Background Investigation

Investingor was established in 2020 and operates from Seychelles, a popular offshore jurisdiction for many financial services firms. The companys ownership structure and management team are not extensively documented, which raises questions about transparency. A broker's management team plays a crucial role in its operations, and having experienced professionals can significantly enhance a broker's credibility. However, information regarding the backgrounds of Investingor's key personnel is scarce, limiting potential clients' ability to assess the broker's reliability fully.

Furthermore, the companys transparency in disclosing essential information, such as its physical address and contact details, is also lacking. While it provides a contact number and email, the absence of a clearly defined management team or ownership structure could lead to concerns about accountability. A broker's willingness to disclose such information is often indicative of its legitimacy and commitment to customer service.

Trading Conditions Analysis

The trading conditions offered by Investingor are another critical area of concern. The broker presents various account types, with a minimum deposit requirement starting at $50. However, the trading costs associated with these accounts appear to be on the higher side. Below is a comparative overview of Investingor's trading costs:

| Cost Type | Investingor | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.5 pips | 1.0-1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Not Specified | Varies |

The spreads offered by Investingor start at 2.5 pips, which is considerably wider than the industry average, suggesting that trading with this broker may be more expensive than with others. Additionally, the absence of a clearly defined commission structure could lead to unexpected costs for traders. Such high trading costs can erode potential profits, particularly for those employing high-frequency trading strategies.

Customer Funds Safety

The safety of customer funds is paramount in the forex trading realm. Investingor claims to implement certain measures to protect client funds, but the effectiveness of these measures is questionable. The broker does not provide clear information regarding whether it employs segregated accounts to keep client funds separate from its operating capital. Additionally, there is no mention of investor protection schemes that would compensate clients in the event of insolvency or fraud.

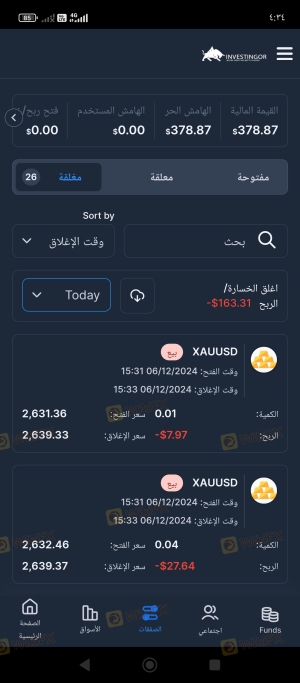

Furthermore, the lack of negative balance protection is concerning. This feature is vital as it prevents traders from losing more than their initial investment, especially when trading with high leverage, which Investingor offers at a maximum of 1:500. Without such protections, traders could face significant financial risks. The absence of documented security incidents or fund safety issues in the broker's history does not necessarily imply a secure environment, as many cases of fraud go unreported.

Customer Experience and Complaints

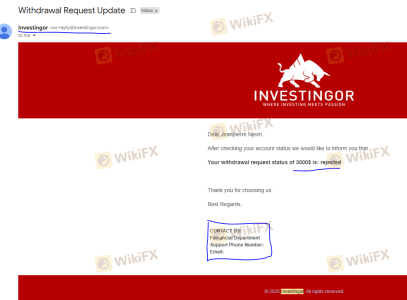

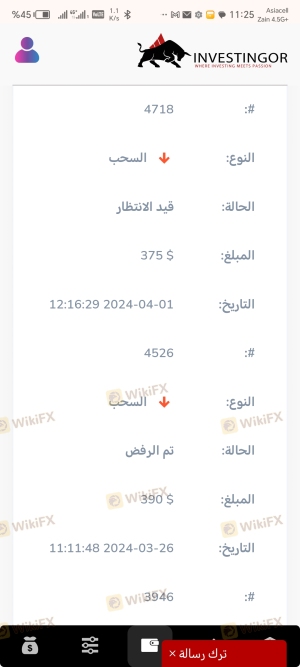

Customer feedback is an essential component of assessing a broker's reliability. Reviews of Investingor reveal a mixed bag of experiences, with many users expressing dissatisfaction regarding the broker's service quality. Common complaints include difficulties in account registration, slow response times from customer support, and challenges in withdrawing funds. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Account Registration Problems | Medium | Inconsistent |

| Customer Support Delay | High | Poor |

One notable case involved a trader who reported being unable to withdraw their funds after multiple requests, leading to frustration and a sense of mistrust towards the broker. Such patterns of complaints can indicate systemic issues within the company's operations and raise red flags for potential clients.

Platform and Trade Execution

The trading platform offered by Investingor is touted as cTrader, which is known for its advanced features and user-friendly interface. However, users have reported difficulties in accessing the platform and executing trades, raising concerns about the broker's reliability. The quality of order execution is crucial, as delays or slippage can significantly impact trading outcomes. Reports of high slippage and rejected orders further exacerbate these concerns, suggesting that traders may not receive the service quality they expect.

Risk Assessment

Engaging with Investingor carries inherent risks that potential clients should be aware of. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Offshore regulation with minimal oversight. |

| Financial Risk | High | High leverage and lack of negative balance protection. |

| Operational Risk | Medium | Customer complaints about service and platform access. |

To mitigate these risks, traders should consider starting with a small investment and thoroughly researching the brokers policies and user experiences. Additionally, opting for brokers with stronger regulatory oversight and better customer service records may provide a safer trading environment.

Conclusion and Recommendations

In conclusion, while Investingor is a regulated broker, the quality of its regulation raises significant concerns about its legitimacy and the safety of client funds. The high trading costs, lack of essential protections, and numerous customer complaints suggest that potential clients should approach this broker with caution.

For traders seeking a reliable forex broker, it may be prudent to consider alternatives that offer stronger regulatory frameworks and better customer service. Brokers regulated by reputable authorities such as the FCA or ASIC may provide a more secure trading environment. Ultimately, thorough research and careful consideration are essential in navigating the complexities of the forex market.

Is INVESTINGOR a scam, or is it legit?

The latest exposure and evaluation content of INVESTINGOR brokers.

INVESTINGOR Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

INVESTINGOR latest industry rating score is 3.82, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 3.82 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.