Regarding the legitimacy of HFM forex brokers, it provides CYSEC, FCA, DFSA, FSCA, FSA and WikiBit, (also has a graphic survey regarding security).

Is HFM safe?

Pros

Cons

Is HFM markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM) 18

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

HF Markets (Europe) Ltd

Effective Date:

2012-11-20Email Address of Licensed Institution:

reg@hfmarkets.euSharing Status:

No SharingWebsite of Licensed Institution:

https://www.hfaffiliates.com/eu/en/index.html, www.hfeu.comExpiration Time:

--Address of Licensed Institution:

Spyrou Kyprianou & Papanikoli 84, NIC. SHOPPING CITY ANG. COURT, 6th floor, Flat/Office 601, 6052, Larnaca, CyprusPhone Number of Licensed Institution:

+357 24 400 165Licensed Institution Certified Documents:

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

HF Markets (UK) Limited

Effective Date:

2018-11-14Email Address of Licensed Institution:

compliance@hfmarkets.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

www.hfmarkets.co.ukExpiration Time:

--Address of Licensed Institution:

Bloomsbury Building 10 Bloomsbury Way Holborn London WC1A 2SL UNITED KINGDOMPhone Number of Licensed Institution:

+44 2035199890Licensed Institution Certified Documents:

DFSA Derivatives Trading License (MM)

Dubai Financial Services Authority

Dubai Financial Services Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

HF Markets (DIFC) Limited

Effective Date:

2018-12-12Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Unit OT 20-53, Level 20, Central Park Offices, DIFC, PO Box 507274, Dubai, UAEPhone Number of Licensed Institution:

971 4 318 4777Licensed Institution Certified Documents:

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

HF MARKETS SA (PTY) LTD

Effective Date:

2016-02-09Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

KATHERINE & WEST, SUITE 18, SECOND FLOOR 114 WEST STREET, SANDTON 2021Phone Number of Licensed Institution:

087 288 5495Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

HF Markets (Seychelles) Ltd

Effective Date:

--Email Address of Licensed Institution:

legal@hfm.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.hfm.com/sc/en/Expiration Time:

--Address of Licensed Institution:

Unit C, F28, Eden Plaza, Eden Island, SeychellesPhone Number of Licensed Institution:

+248 4346123Licensed Institution Certified Documents:

Is HFM (HF Markets) A Scam?

Introduction

HFM, formerly known as HotForex, is a multi-asset broker that has positioned itself as a prominent player in the forex trading market since its inception in 2010. With a focus on providing a wide range of trading instruments, including forex, commodities, and cryptocurrencies, HFM has attracted a diverse clientele. However, the forex market is notoriously fraught with risks, and the choice of a broker can significantly impact a trader's success. Therefore, it is crucial for traders to meticulously evaluate the credibility and reliability of any brokerage they consider. This article aims to provide a comprehensive analysis of HFM, examining its regulatory status, company background, trading conditions, customer fund safety, and user experiences. The investigation is based on a variety of sources, including expert reviews, regulatory data, and user feedback, allowing for an objective assessment of HFM's legitimacy.

Regulation and Legitimacy

The regulatory framework under which a broker operates is a key indicator of its legitimacy and reliability. HFM is regulated by several reputable authorities, which enhances its credibility in the eyes of traders. Below is a summary of HFM's regulatory status:

| Regulator | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| FCA | 801701 | United Kingdom | Verified |

| CySEC | 183/12 | Cyprus | Verified |

| DFSA | F004885 | UAE | Verified |

| FSCA | 46632 | South Africa | Verified |

| FSA | SD 015 | Seychelles | Verified |

HFM's regulation by tier-1 authorities like the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC) signifies that it adheres to stringent financial standards and operational guidelines. These regulations provide a level of protection for traders, ensuring that their funds are handled responsibly. Furthermore, HFM maintains a history of compliance with regulatory requirements, which is crucial for building trust with its clients. The presence of multiple regulatory licenses across different jurisdictions indicates HFM's commitment to maintaining high standards in its operations.

Company Background Investigation

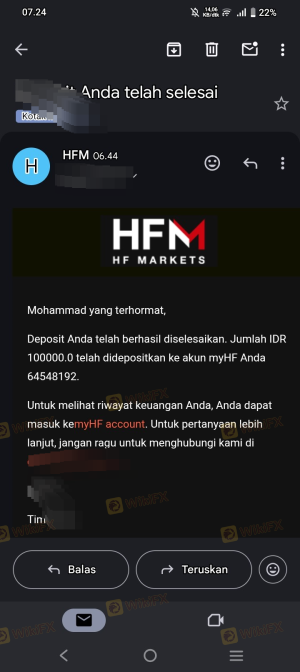

HFM was founded in 2010 and has since grown to establish a significant presence in the global trading market. The company operates under the HF Markets Group, which includes several regulated entities in regions such as the UK, Cyprus, and South Africa. The management team at HFM comprises experienced professionals with backgrounds in finance and trading, contributing to the company's strategic direction and operational efficiency. Transparency is a fundamental aspect of HFM's business model, with the broker providing detailed information about its services, fees, and regulatory status on its website. This level of disclosure is essential for fostering trust among traders and ensuring they have the necessary information to make informed decisions.

Trading Conditions Analysis

HFM offers a variety of trading accounts, catering to different trader needs and preferences. The broker's fee structure is competitive, but it is essential to scrutinize any unusual charges that may apply. Below is a comparison of HFM's core trading costs:

| Cost Type | HFM | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.0 pips | From 1.0 pips |

| Commission Model | $6 per round (Zero Spread Account) | $7 per round |

| Overnight Interest Range | Varies | Varies |

HFM's spreads, particularly on the zero spread account, are among the most competitive in the industry, making it an attractive option for active traders. However, the commission structure may vary depending on the account type, and traders should be aware of any additional fees that may apply, especially for specific trading strategies. Overall, HFM's trading conditions are designed to be favorable for both novice and experienced traders.

Customer Fund Safety

The safety of customer funds is paramount in the forex trading industry. HFM employs several measures to protect client funds, including the use of segregated accounts, which ensures that client funds are kept separate from the company's operational funds. This segregation is crucial in the event of financial difficulties faced by the broker. Additionally, HFM offers negative balance protection, which prevents traders from losing more than their account balance during periods of high market volatility. The broker's commitment to fund security is further supported by its insurance policies, which provide additional coverage for client deposits. However, it is essential for traders to remain vigilant and conduct their due diligence to ensure their funds are secure.

Customer Experience and Complaints

Customer feedback provides valuable insights into the overall reliability of a broker. HFM has received mixed reviews from users, with some praising its trading conditions and customer support, while others have raised concerns about specific issues. Below is a summary of common complaints and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

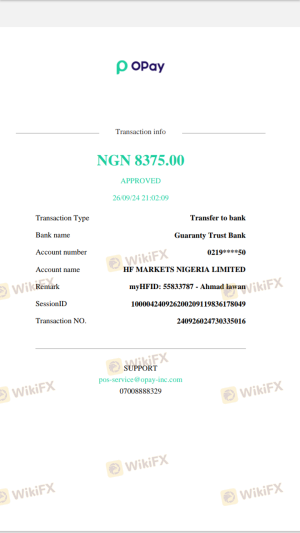

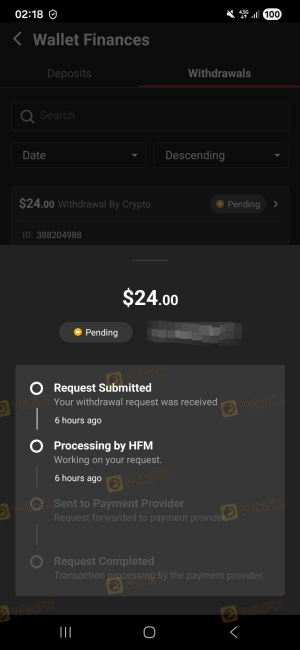

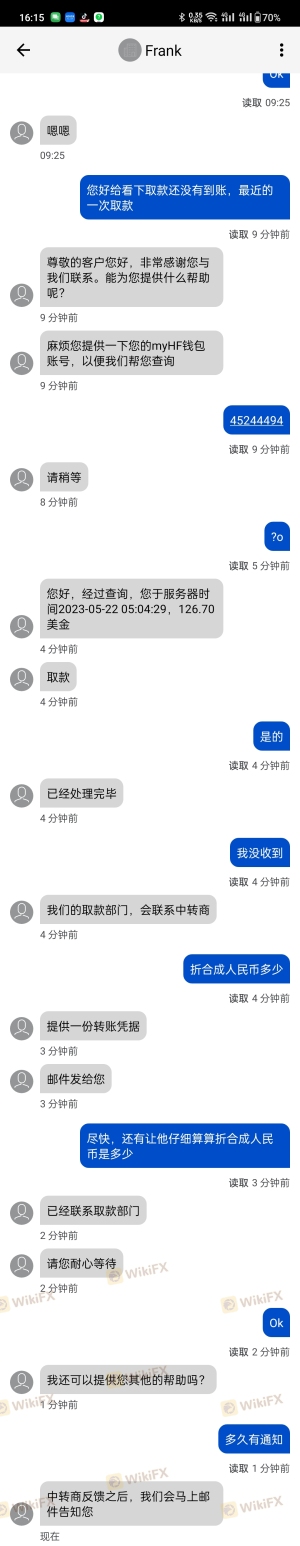

| Withdrawal Delays | Medium | Generally responsive |

| High Spreads during Volatility | High | Investigated on a case-by-case basis |

| Customer Support Response Time | Medium | Improvements noted |

One notable case involved a trader who experienced significant delays in withdrawing funds, raising concerns about HFM's processing times. However, other users reported satisfactory experiences with withdrawals, highlighting the variability in customer experiences. Overall, HFM's response to complaints appears to be adequate, but there is room for improvement, particularly in the area of withdrawal processing times.

Platform and Trade Execution

HFM offers a robust trading platform, primarily utilizing the popular MetaTrader 4 and MetaTrader 5 systems. These platforms are known for their reliability and user-friendly interfaces, providing traders with essential tools for analysis and execution. The execution quality is generally regarded as high, with minimal slippage reported during trading. However, some users have expressed concerns about the potential for platform manipulation, particularly during volatile market conditions. Overall, HFM's platform performance is satisfactory, but traders should remain cautious and monitor execution quality closely.

Risk Assessment

Trading with HFM involves several risks that traders should be aware of. Below is a risk assessment summary:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | Low | Well-regulated by multiple authorities |

| Market Risk | High | High volatility can lead to significant losses |

| Operational Risk | Medium | Potential delays in withdrawals or support response |

To mitigate these risks, traders should implement robust risk management strategies, including the use of stop-loss orders and proper position sizing. Additionally, it is advisable to remain informed about market conditions and regulatory changes that may affect trading.

Conclusion and Recommendations

In conclusion, HFM appears to be a legitimate broker with a solid regulatory framework, competitive trading conditions, and a commitment to customer fund safety. While there are some concerns regarding customer experiences and withdrawal processing times, the overall evidence does not suggest that HFM is a scam. Traders should remain vigilant and conduct their own research before engaging with any broker. For those seeking reliable alternatives, brokers such as IG, OANDA, and Forex.com may offer similar services with varying features. Ultimately, the choice of a broker should align with individual trading goals and risk tolerance.

Is HFM a scam, or is it legit?

The latest exposure and evaluation content of HFM brokers.

HFM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HFM latest industry rating score is 7.07, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.07 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.