Regarding the legitimacy of GOLDSTONE forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is GOLDSTONE safe?

Pros

Cons

Is GOLDSTONE markets regulated?

The regulatory license is the strongest proof.

ASIC Derivatives Trading License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

Clone FirmLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

S.A.M. FINANCIAL GROUP (AUSTRALIA) PTY LTD

Effective Date:

2009-08-31Email Address of Licensed Institution:

jr@samfingroup.com.auSharing Status:

No SharingWebsite of Licensed Institution:

www.samfingroup.com.auExpiration Time:

2022-10-17Address of Licensed Institution:

ASHURST AUSTRALIA, Level 16, 80 Collins Street South Tower MELBOURNE VIC 3000Phone Number of Licensed Institution:

0280040234Licensed Institution Certified Documents:

Is Goldstone Safe or a Scam?

Introduction

In the ever-evolving landscape of the foreign exchange (forex) market, traders are constantly seeking reliable brokers to facilitate their trading activities. Goldstone, an offshore forex broker, claims to offer a range of trading services. However, with the rising number of fraudulent schemes in the industry, it is crucial for traders to exercise caution and thoroughly evaluate the credibility of brokers like Goldstone. This article aims to investigate whether Goldstone is a safe trading option or if it raises red flags indicating potential scams. Our investigation will be based on a comprehensive analysis of regulatory compliance, company background, trading conditions, customer experiences, and risk assessments.

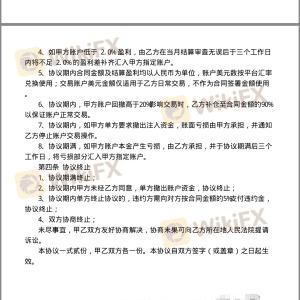

Regulation and Legitimacy

Regulatory oversight is a pivotal factor in determining the safety and legitimacy of forex brokers. A broker's regulatory status often reflects its commitment to industry standards and investor protection. Goldstone claims to be regulated by the Australian Securities and Investments Commission (ASIC); however, investigations reveal that this claim is dubious.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 338674 | Australia | Cloned License |

The presence of a cloned license raises significant concerns about Goldstone's legitimacy. Cloned firms often misrepresent their regulatory status to gain the trust of unsuspecting traders. Furthermore, the lack of a functional official website and reports of withdrawal issues further compound doubts about Goldstone's compliance with regulatory requirements. Traders should be wary of engaging with brokers that exhibit such questionable regulatory practices, as they may lack the necessary protections that regulated brokers provide.

Company Background Investigation

Goldstone's history and ownership structure are essential components in assessing its credibility. While specific details about Goldstone's establishment remain sparse, it is reported to have been in operation for several years, with claims of being registered in the United Kingdom. However, the absence of verifiable information regarding its management team and operational history raises concerns about transparency.

A transparent broker should provide clear information about its ownership, management team, and operational practices. Unfortunately, Goldstone's lack of such disclosures creates an environment of uncertainty and suspicion. Traders are encouraged to conduct thorough research and seek brokers with established reputations and transparent business practices.

Trading Conditions Analysis

Understanding a broker's trading conditions is crucial for traders seeking to maximize their profitability. Goldstone offers forex trading services, but the details regarding its fee structure and trading costs are not readily available. Such opacity can be a warning sign for potential clients.

| Fee Type | Goldstone | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of clarity surrounding trading costs can lead to unexpected expenses, which may negatively impact traders' profitability. Furthermore, reports of withdrawal issues and limited payment methods indicate a potentially unfavorable trading environment. Traders should be cautious when dealing with brokers that do not provide transparent information about their trading conditions.

Client Funds Security

The safety of clients' funds is paramount in the forex trading environment. Goldstone's approach to fund security is a critical aspect to consider. Reports indicate that Goldstone does not adequately segregate client funds, which poses a risk to traders' investments.

Additionally, the absence of investor protection measures and negative balance protection policies raises further concerns about the safety of funds. Traders should prioritize brokers that implement robust security measures to safeguard their investments and provide a safety net in the event of market volatility.

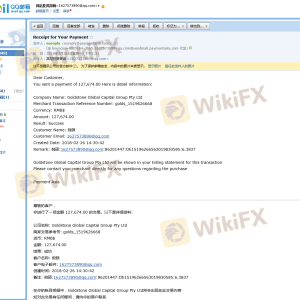

Customer Experience and Complaints

Customer feedback serves as a valuable indicator of a broker's reliability and service quality. Numerous complaints have surfaced regarding Goldstone's inability to facilitate withdrawals, with some clients reporting extended delays and unresponsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Inconsistent |

These complaints highlight a troubling pattern of customer dissatisfaction, which raises questions about Goldstone's commitment to client service. Traders should be wary of brokers with a history of unresolved complaints, as this may indicate deeper operational issues.

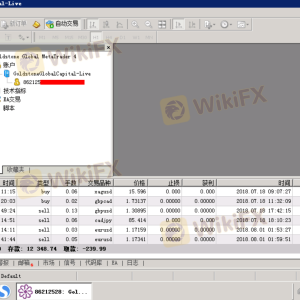

Platform and Trade Execution

The performance of a broker's trading platform is crucial for a seamless trading experience. Goldstone claims to support the popular MetaTrader 4 (MT4) platform; however, the actual execution quality and user experience remain uncertain. Reports of slippage and order rejections could indicate potential manipulation or inefficiencies within the trading system.

Traders should thoroughly assess the platform's stability, responsiveness, and execution quality before committing to a broker. A reliable broker should provide a robust trading platform that enhances the trading experience rather than hinders it.

Risk Assessment

Using Goldstone as a trading platform involves inherent risks that traders must be aware of. The combination of unregulated status, lack of transparency, and numerous complaints contributes to a high-risk environment.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Cloned license and no regulation |

| Fund Security | High | Lack of segregation and protection |

| Customer Support | Medium | Poor response to complaints |

To mitigate these risks, traders are advised to conduct thorough due diligence, consider alternative regulated brokers, and only invest capital they can afford to lose.

Conclusion and Recommendations

In conclusion, the investigation into Goldstone reveals several alarming indicators that suggest it may not be a safe trading option. The presence of a cloned regulatory license, lack of transparency regarding company operations, and numerous complaints about withdrawal issues raise significant red flags.

Traders are strongly advised to exercise caution when considering Goldstone as their forex broker. It is essential to prioritize regulated brokers with a proven track record of reliability and customer satisfaction. Alternatives such as brokers with established regulatory frameworks and positive client feedback should be considered to ensure a safer trading experience.

In summary, is Goldstone safe? The evidence suggests otherwise, and traders should remain vigilant and informed to protect their investments.

Is GOLDSTONE a scam, or is it legit?

The latest exposure and evaluation content of GOLDSTONE brokers.

GOLDSTONE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GOLDSTONE latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.