PanBay 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

PanBay, a UK-based broker established in 2017, markets itself with a low-cost trading platform that may attract experienced traders searching for budget-friendly options. However, this enticing prospect is accompanied by pressing issues: a lack of regulatory transparency, particularly highlighted by the revocation of its FCA license, and a history of concerning user complaints. The target audience for PanBay primarily includes seasoned traders willing to engage in higher-risk environments, embracing the chance for substantial returns despite the potential for losses. The trade-offs between the broker's low-cost appeal and significant regulatory risks necessitate thorough scrutiny before engaging with this platform.

⚠️ Important Risk Advisory & Verification Steps

Warning: Trading with PanBay may expose investors to significant risks due to regulatory concerns and a troubling track record of user complaints.

Risk Statement: PanBay is not currently regulated and has faced serious complaints regarding its customer service and withdrawal processes.

Potential Harms: Engaging with PanBay could result in challenges in withdrawing funds, unresponsive customer support, and unregulated trading practices.

Verification Guide

To ensure the broker's legitimacy, follow these verification steps:

- Visit the Regulatory Agency's Website: Always check if the broker is listed on the websites of regulatory bodies, such as the FCA (Financial Conduct Authority), NFA (National Futures Association), or other relevant local authorities.

- Contact Customer Service: Assess the broker's responsiveness by reaching out through available contact methods.

- Examine User Reviews: Look for feedback on trusted review sites to confirm the experiences of others.

Rating Framework

Broker Overview

Company Background and Positioning

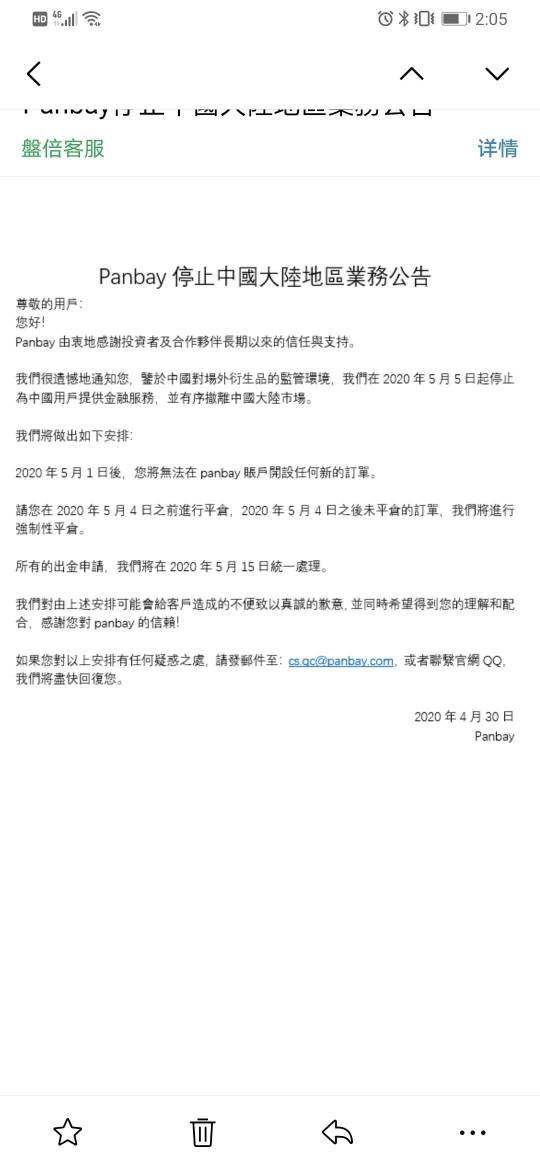

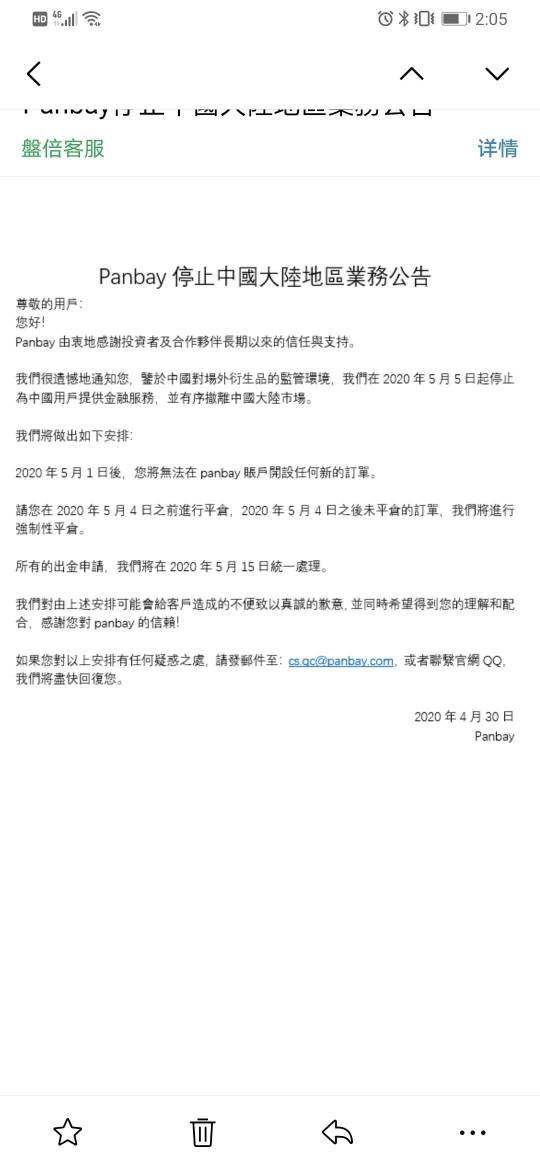

Founded in 2017 and headquartered in the United Kingdom, PanBay has positioned itself as a low-cost broker in the highly competitive forex market. However, the lack of regulatory oversight—following the revocation of its FCA license—casts a shadow over its credibility. Despite being established for several years, traders are cautioned against engaging without understanding the risks associated with its unregulated status.

Core Business Overview

PanBay primarily operates in forex trading, offering various asset classes and trading platforms such as MT5 and MT4. The broker promises low commissions and fees, appealing to cost-conscious traders. Despite claims of regulatory compliance with bodies like the Cayman Islands Monetary Authority (CIMA), its primary license was revoked, raising substantial doubts about its legal standing.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

Investors face considerable uncertainty with PanBay's regulatory status. The broker's low WikiFX score of 1.59/10 indicates a lack of trust among users. Compounding the issue is the revocation of its FCA license, signaling serious regulatory issues and necessitating a cautious approach from potential investors.

User Self-Verification Guide

To check the legitimacy of PanBay, follow this self-verification guide:

- Check the FCA Website: Confirm if the company is on the Financial Conduct Authority's website.

- Review WikiFX Ratings: Visit WikiFX for up-to-date ratings and user reviews.

- Utilize the NFA BASIC Database: Search for PanBay in the NFA's BASIC database to verify the brokers regulatory status.

- Evaluate User Feedback: Assess experiences shared on forums or review sites to gauge the general sentiment about fund safety.

“I had significant issues with fund withdrawals; they would leave my requests unanswered for weeks.” — User feedback on withdrawal difficulties.

Industry Reputation and Summary

The dealer's reputation has dwindled due to issues surrounding fund withdrawals and overall verifiable transparency. Arguably, users should prioritize thorough checks on a broker's background before committing funds. If the background appears murky, as with PanBay, its advisable to tread carefully.

Trading Costs Analysis

Advantages in Commissions

PanBay's commission structure is notably low, attracting many experienced traders seeking to minimize costs. The broker promotes low commission rates, which can be an attractive feature for high-volume traders.

The "Traps" of Non-Trading Fees

However, users have reported high withdrawal fees that undermine the broker's low-cost appeal. For example, one user noted a withdrawal fee of $30 with little warning or explanation regarding the costs associated with fund access.

“I was charged $30 to withdraw my own money, which was a surprise after all the hype about low fees.” — User review expressing frustration over unexpected withdrawal fees.

Cost Structure Summary

Traders considering PanBay must weigh the benefits of low commissions against potentially significant non-trading fees. For seasoned investors comfortable with trading costs, the broker's offerings may seem beneficial, but less experienced traders might find unexpected expenses challenging.

PanBay provides several trading platforms, including MT4 and MT5, catering primarily to traders who seek advanced features for forex trading. However, beginners might struggle due to the complexity of available tools and the learning curve associated with these platforms.

The analytic tools and resources offered include essential features for monitoring market movements, though some traders criticize the educational materials as being inadequate for new users.

User feedback suggests that while the platform offers depth, it may not be beginner-friendly, leading to confusion among inexperienced traders.

“The platform is complex, it‘s geared toward those who know what they’re doing.” — A recurring sentiment among new traders.

User Experience Analysis

User Interface and Navigation

PanBays trading interface is generally well-reviewed by users experienced with trading platforms, although newcomers may find its appearance daunting. The broker might benefit from a more intuitive layout to foster positive user engagement.

Trading Execution Quality

Users report inconsistencies in trade execution speeds, especially during high volatility. Experienced users familiar with rapid trading environments note areas needing improvement.

Overall User Sentiment

The amalgamation of potentially positive trading features and the acknowledgment of significant concerns leads to mixed experiences.

“I liked the low costs, but the execution lagged at critical moments.” — Feedback highlighting both positives and negatives.

Customer Support Analysis

Availability and Response Times

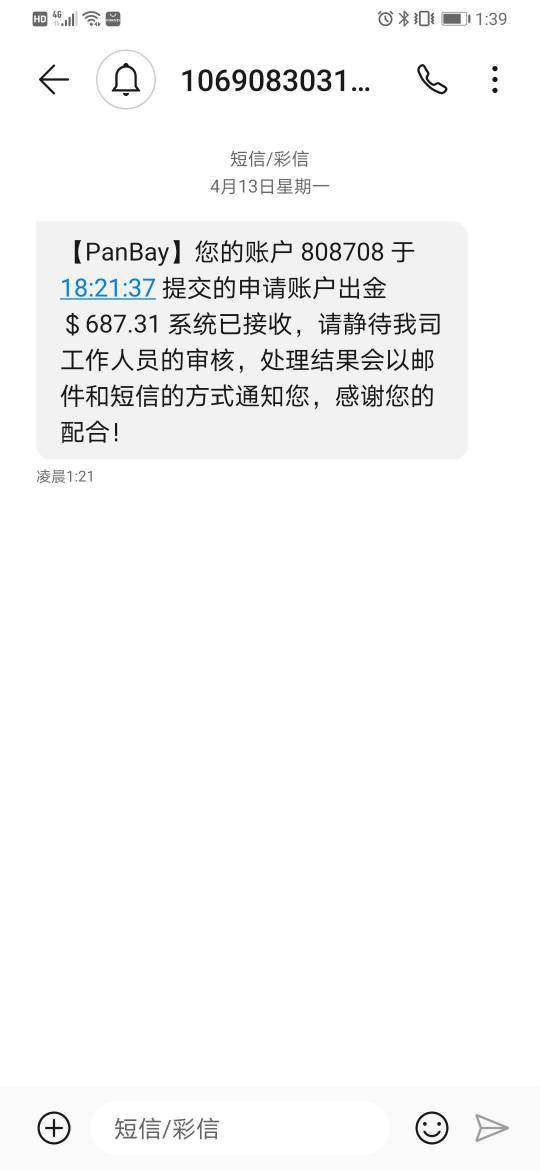

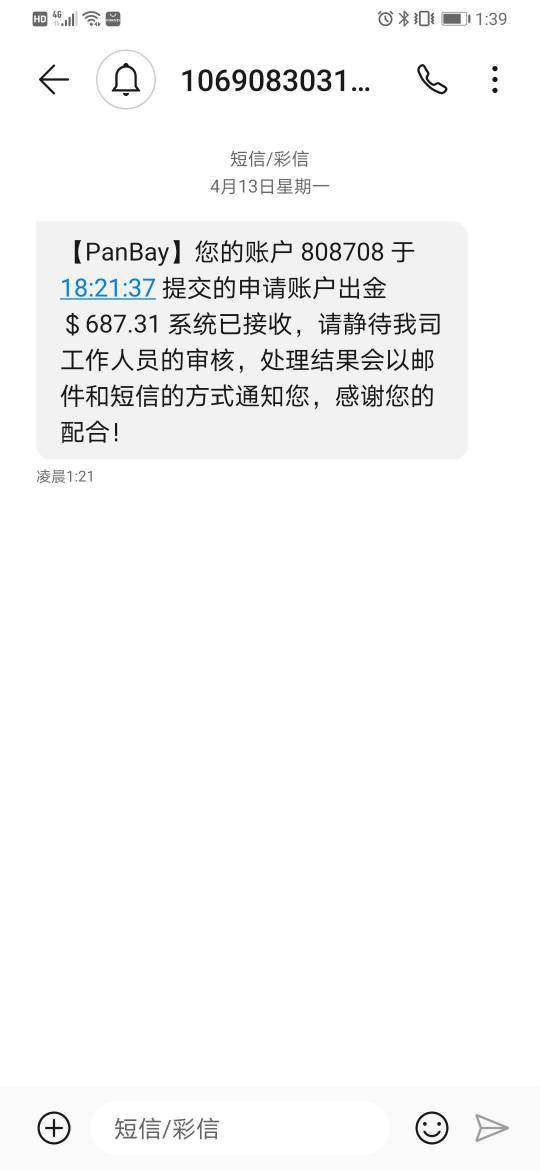

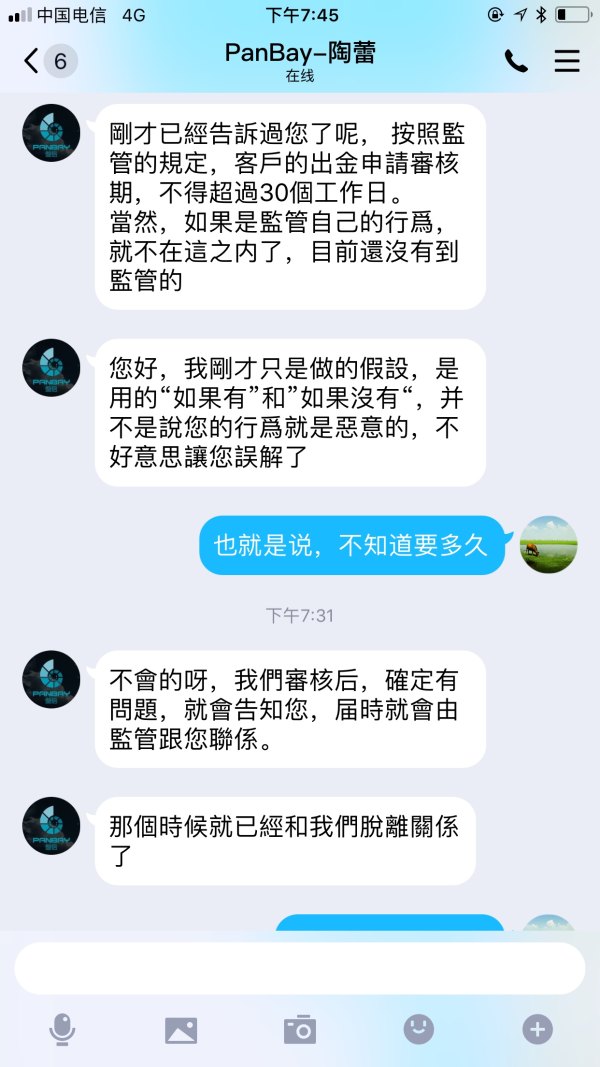

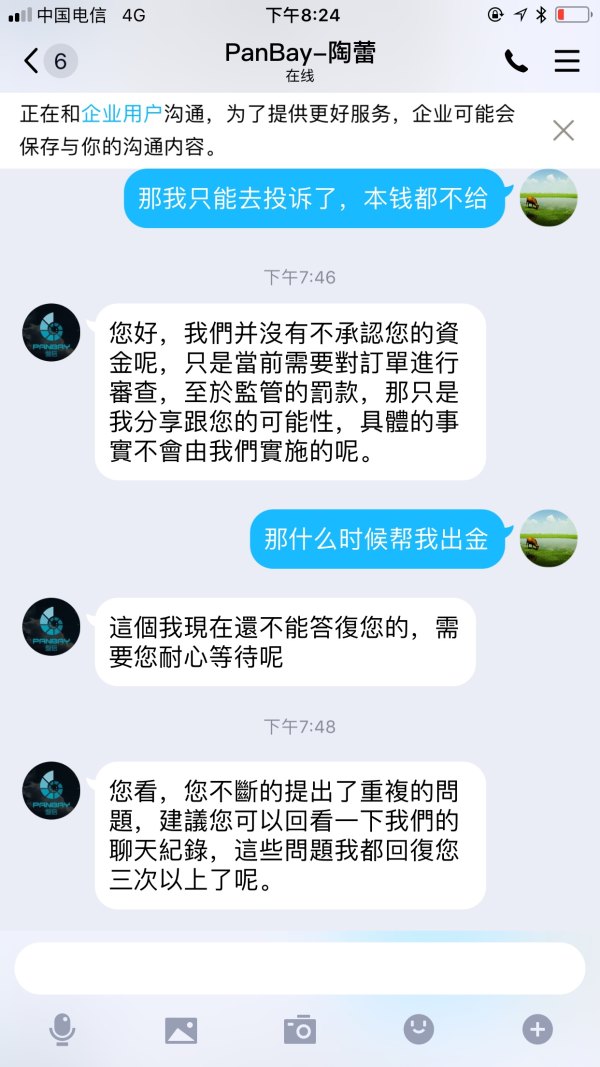

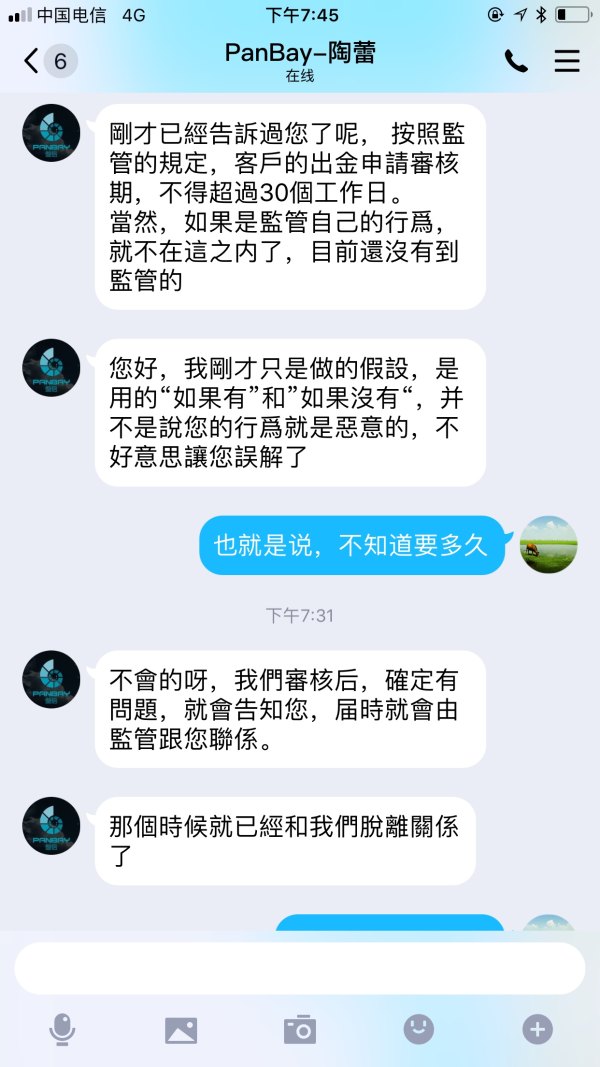

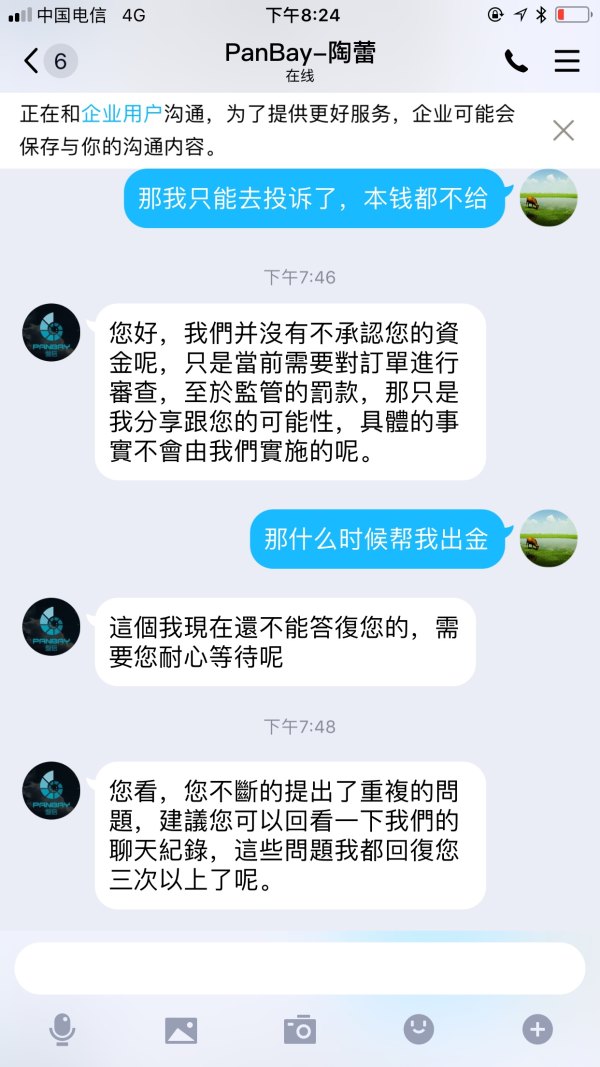

Customer service at PanBay has faced criticism, particularly regarding response times. Multiple user complaints highlight long delays in receiving help with critical issues, especially with fund withdrawals.

“Customer support is slow, and during a withdrawal issue, I felt completely abandoned.” — A common concern voiced by users.

Support Channels

While the broker offers multiple channels, including email, live chat, and phone support, users often find themselves waiting extended periods for assistance.

Summary of Support Sentiment

Overall, customer support appears to be a weak point, which could significantly impact the experience for traders who may require assistance when it's most needed.

Account Conditions Analysis

Account Types and Flexibility

PanBay provides a couple of different account types aimed at various levels of trading experience, from beginners to advanced traders. However, flexibility in switching between account types may be limited.

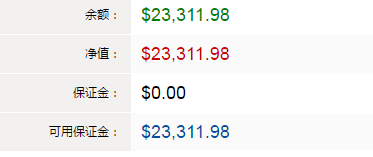

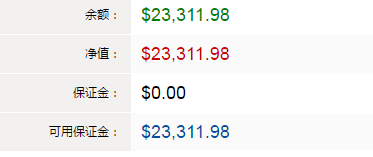

Leverage and Margin Conditions

Traders can access high leverage, up to 1:500, which can be both an opportunity and a risk. Novice traders should exercise caution, as high leverage can lead to significant losses.

Withdrawal Conditions

A lack of clarity regarding withdrawal conditions has raised concerns among users, leading to outright accusations of unfair practices.

“It's nearly impossible to extract your earnings without facing hurdles.” — A users caution about fund withdrawals.

Conclusion

In summary, while PanBay presents a tempting proposition for experienced traders focused on low-cost trading, the absence of regulatory oversight, a troubling user complaint history, and a lack of transparency create substantial risks. The combination of potential rewards and serious concerns make this broker a questionable choice for most investors. Those considering engaging with PanBay should conduct thorough research and be prepared for a trading environment that may not deliver as promised. Potential investors must weigh all aspects carefully before entering into any agreements with this broker.