Goldstone 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Goldstone emerges as a broker that offers a range of trading options including forex, commodities, and indices, aiming to attract experienced traders who value competitive trading costs. However, the allure of lower fees comes with considerable caveats. The broker's operability has been significantly hampered by a history of regulatory infractions and withdrawal troubles that have raised alarm bells in the trading community. Aspiring traders must weigh the potential for diverse trading experiences against the substantial risks involved. Notably, novice traders and those risk-averse individuals should reconsider venturing into this broker's waters due to pressing concerns regarding its regulatory stature and customer service shortcomings.

⚠️ Important Risk Advisory & Verification Steps

Risk Statement: Goldstone operates with significant regulatory concerns.

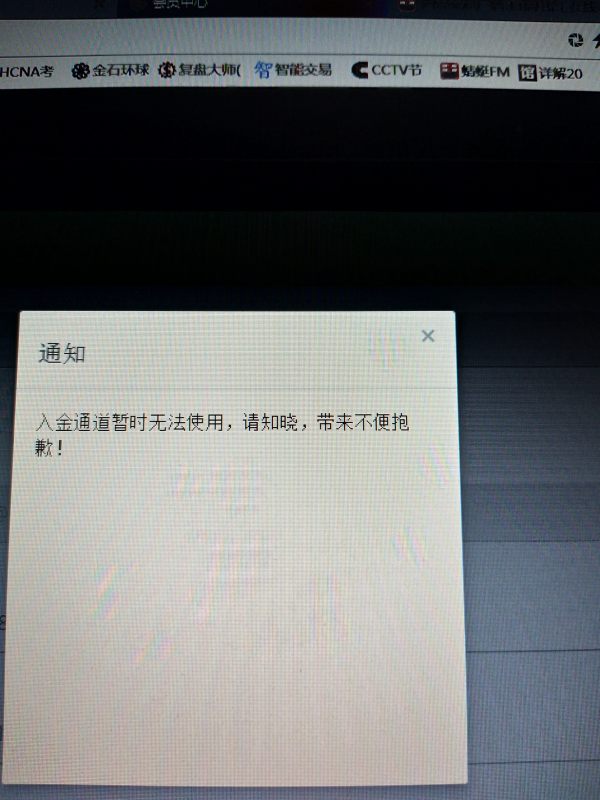

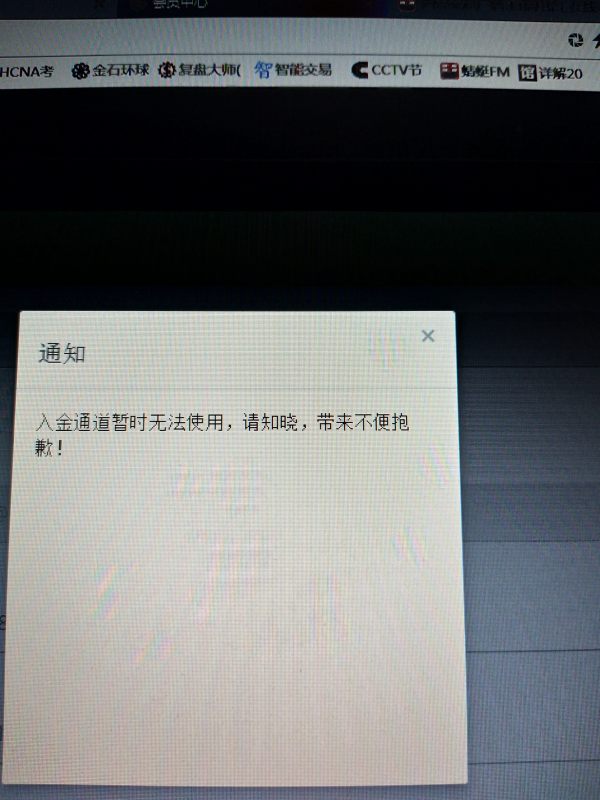

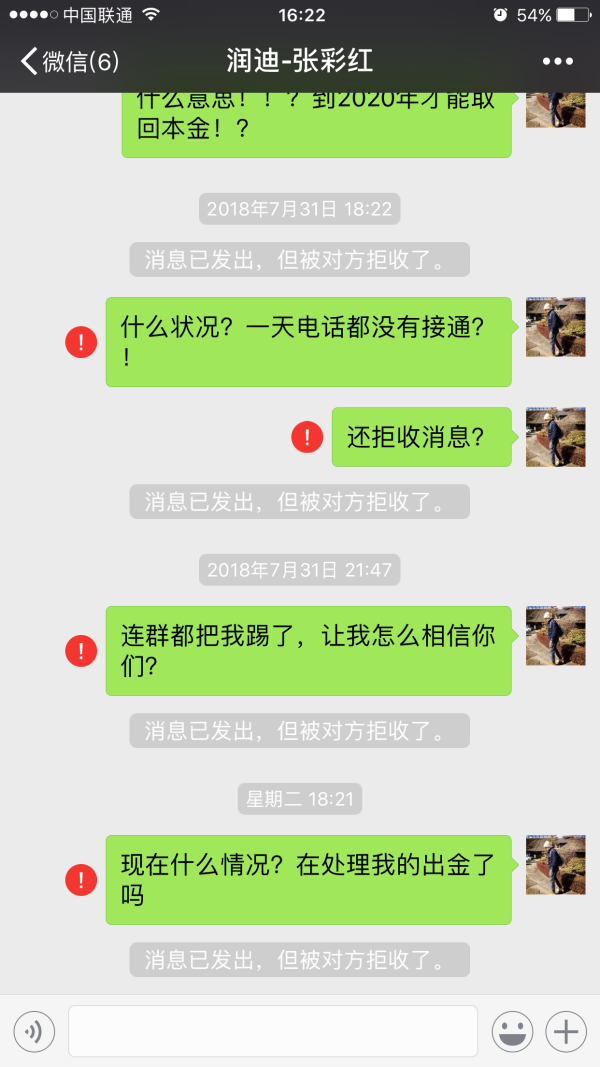

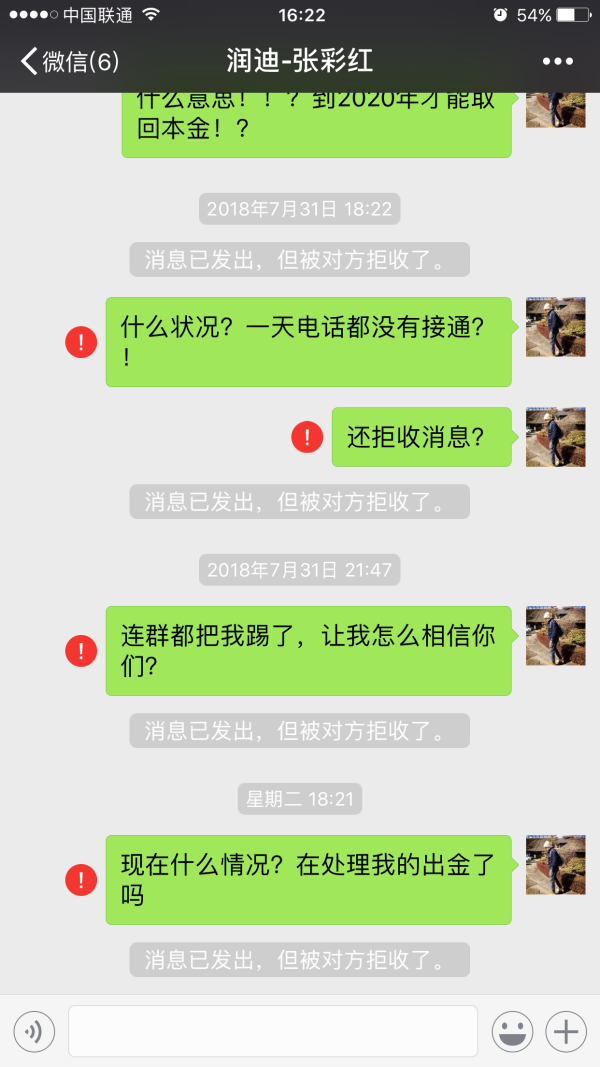

Potential Harms: Investors may face challenges in fund withdrawals, as many users have reported difficulties retrieving their investments.

Self-Verification Steps:

- Check regulatory status on NFA's website.

- Review user experiences on platforms like WikiFX, which highlight the broker's issues.

- Contact customer service for clarity on withdrawal processes, although many have reported unsatisfactory experiences.

Ratings Framework

Broker Overview

Company Background and Positioning

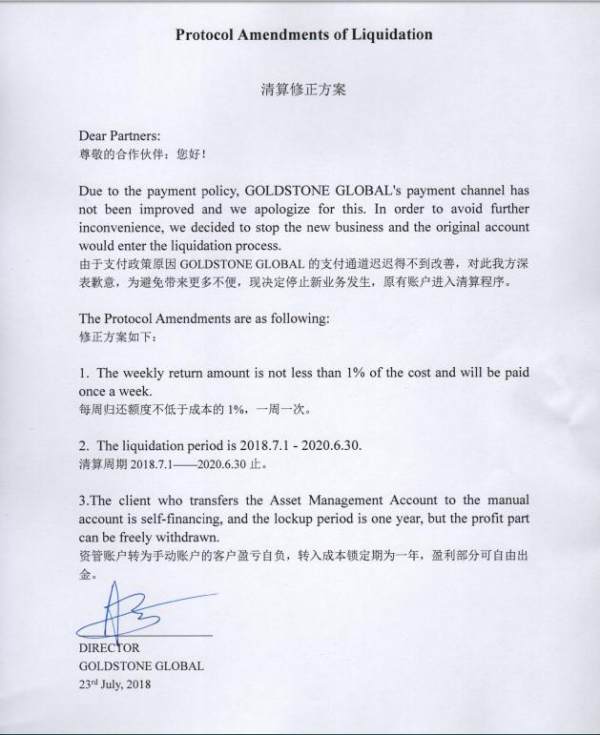

Goldstone, founded a few years ago with a headquarters reportedly located in the United Kingdom, presents itself as a gateway for retail investors looking to explore forex and other financial markets. Operating under the shadow of cloned licenses, its legitimacy is called into question on multiple fronts. The brokers positioning within the trading ecosystem illustrates a focus on providing access to various instruments and trading platforms like MetaTrader 4, often a key attraction for forex traders. Unfortunately, the lack of transparency regarding ownership and accountability raises compliance issues that potential investors should consider seriously.

Core Business Overview

Goldstone claims to provide trading services in forex, commodities, and contracts for difference (CFD) with a focus on cost efficiency and market accessibility. However, the regulatory claims about being licensed by ASIC have been flagged as clones of legitimate firms, raising critical trust issues. Additionally, the broker lacks a properly functional website necessary for seamless navigation and user support, further complicating their business operations.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

Goldstones trustworthiness is severely undermined by its dubious licensing status and multiple reports of withdrawal problems. The void of a genuine regulatory framework poses considerable risks for investors looking for security in their trading endeavors.

Analysis of Regulatory Information Conflicts

An examination of Goldstones compliance reveals that its license claims are dubious, with the Australian Securities and Investments Commission (ASIC) bearing reports of it being a cloned entity with non-verified operational status. This raises inherent doubts regarding investor safety.

User Self-Verification Guide

Check the NFA and ASIC websites for confirmation of regulatory status.

Search for user reviews on trusted platforms like WikiFX to assess community sentiment.

Contact customer service and document your inquiry responses regarding funds withdrawal and operational legitimacy.

Industry Reputation and Summary

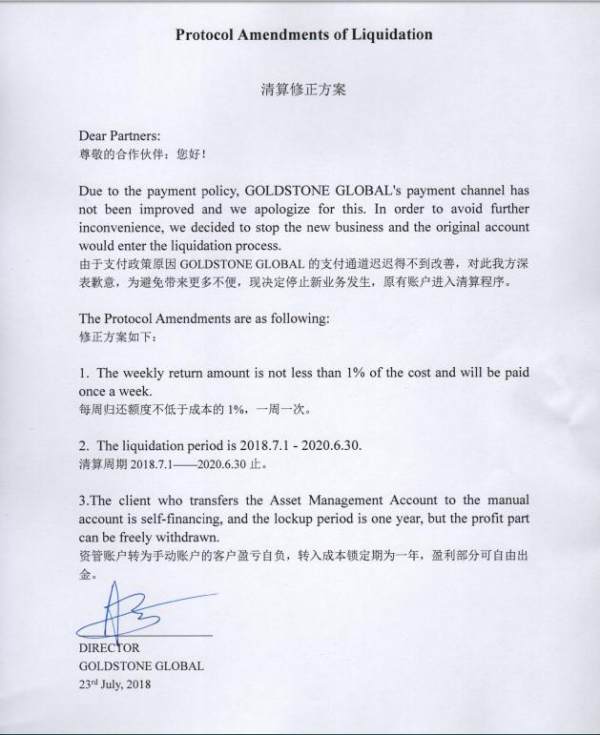

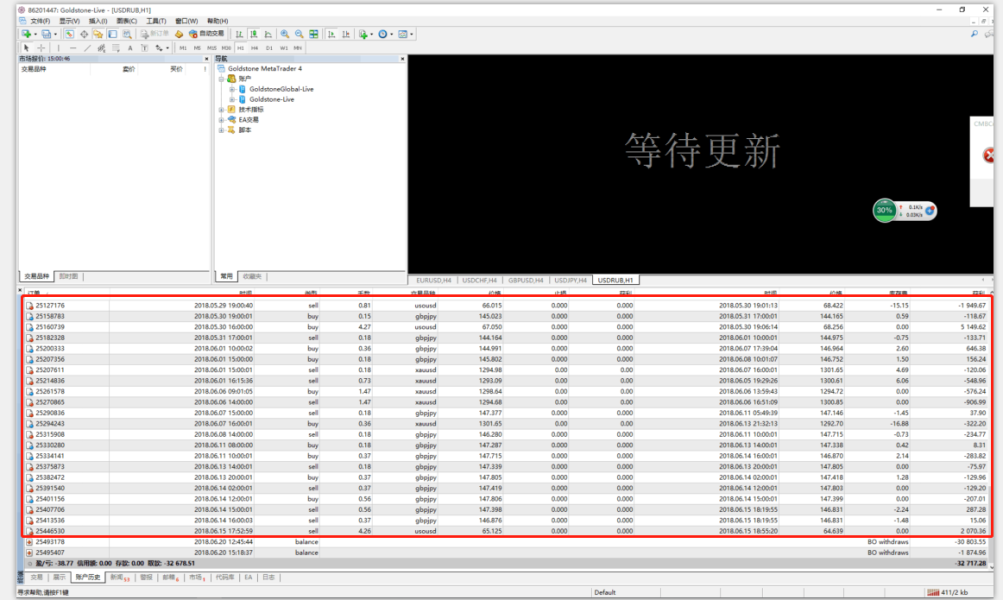

Overall, Goldstone is perceived unfavorably within the trading community, evidenced by numerous user complaints regarding its withdrawal practices. Many testimonials from traders indicate a growing distrust, citing incidents where attempts to withdraw funds were met with delays or outright denials.

Trading Costs Analysis

While Goldstone appears to offer competitive trading costs which could potentially attract a varied clientele, the nuances in their fee structures unveil a more complicated picture.

Advantages in Commissions

Traders may benefit from lower commission rates compared to some competitors, however, comprehensive details on transaction fees are notably absent, leaving room for hidden charges.

The "Traps" of Non-Trading Fees

User complaints frequently mention unexpected non-trading fees that can erode prospective earnings, turning the initially attractive fee structure into a double-edged sword.

Cost Structure Summary

The fluctuating nature of fees means that while experienced traders might navigate these effectively, newer traders may find themselves overwhelmed, leading to disenchantment with the trader fee framework.

Goldstone provides a limited array of trading platforms and tools, which stands in stark contrast with many of its competitors.

Platform Diversity

The broker primarily supports MetaTrader 4, a platform generally regarded as user-friendly for forex trading. However, traders looking for modern trading tools may find the options limited.

Quality of Tools and Resources

Educational resources and trading tools available on the platform are insufficient for both beginners and experienced traders. Users have expressed a need for better user support and more comprehensive trading aids.

Platform Experience Summary

User feedback highlights persistent usability issues with Goldstone's trading platform, stating that many functionally necessary support features are lacking, thereby impairing the overall trading experience.

User Experience Analysis

User experience with Goldstone has been mixed, leading to frustrations particularly around customer support and platform accessibility.

Client Reviews Overview

Users consistently report subpar experiences regarding customer service, characterizing it as unresponsive and lacking in effective communication. Many complaints focus on the unavailability of reliable support channels, hampering users ability to resolve issues.

Overall Sentiment

While some users appreciate the trading opportunities available, the predominant negative feedback regarding customer support greatly overshadows any potential positives, making it a risky choice for prospective clients.

Customer Support Analysis

Customer support is one of Goldstone's most significant weaknesses, with numerous complaints surfacing about unresponsiveness.

Support Availability

Users have noted that although contact via phone and email is possible, the quality of support is lacking, with many experiencing delays in response or complete non-responsiveness.

Overall Support Quality

With no live chat or 24/7 support options, Goldstone presents a glaring deficiency that can be particularly impactful for traders who require immediate assistance during trading hours.

Account Conditions

The terms and conditions associated with accounts at Goldstone have drawn criticism for their stringent nature.

Minimum Deposit Requirements

With a starting deposit requirement of $20 combined with high minimum investments for other account types, Goldstone is not the most accommodating choice for varied traders looking to diversify their portfolios.

Account Type Limitations

Limited account options available may fail to cater to different trading needs, adversely affecting a traders experience depending on their particular strategies or goals.

Conclusion

In summary, while Goldstone presents an enticing variety of trading options, potential investors must confront a disturbing underbelly characterized by regulatory inconsistencies and historical withdrawal issues. The notable risk associated with trading through this broker—including lack of accessibility, user complaints, and inadequate support—outweigh the benefits it may initially seem to offer. For seasoned traders willing to take risks for lower fees, Goldstone may appear attractive. However, for most traders prioritizing security and reliable customer interactions, significant red flags suggest it would be prudent to explore more reputable brokerage alternatives instead.

Keywords

"goldstone review" (mentioned 5 times)