Regarding the legitimacy of CI Markets forex brokers, it provides VFSC and WikiBit, .

Is CI Markets safe?

Business

License

Is CI Markets markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

RevokedLicense Type:

Forex Trading License (EP)

Licensed Entity:

CI Markets Limited

Effective Date:

2017-12-19Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is CI Markets Safe or a Scam?

Introduction

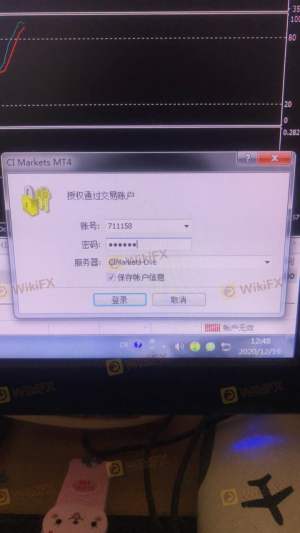

CI Markets is an online forex broker that has positioned itself within the competitive landscape of foreign exchange trading since its establishment in 2017. Based in Vanuatu, CI Markets offers a range of trading services primarily through the popular MetaTrader 4 platform. As the forex market continues to expand, traders must exercise caution and conduct thorough evaluations of brokers to ensure their investments are secure. The importance of this assessment cannot be overstated, as choosing the wrong broker can lead to significant financial losses. In this article, we will investigate whether CI Markets is safe or if it exhibits characteristics of a scam. Our evaluation will be based on regulatory compliance, company background, trading conditions, customer fund security, client experiences, and overall risk assessments.

Regulation and Legitimacy

The regulatory status of a forex broker is critical in determining its legitimacy and safety for traders. CI Markets is registered with the Vanuatu Financial Services Commission (VFSC); however, it is worth noting that its license has been revoked. The implications of such a revocation raise serious concerns about the broker's operational integrity and adherence to regulatory standards. Below is a summary of CI Markets' regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission | 14843 | Vanuatu | Revoked |

The revocation of CI Markets' license suggests that it may no longer meet the necessary regulatory requirements, which is a significant red flag for potential investors. In the world of forex trading, regulatory oversight is paramount as it ensures that brokers adhere to established financial standards, protecting investors from potential fraud or malpractice. The lack of current regulation can expose traders to increased risks, including the possibility of not being able to recover their funds in case of any disputes or insolvency. Therefore, it is crucial for traders to consider these factors when evaluating the question of "Is CI Markets safe?"

Company Background Investigation

CI Markets was founded in 2017 and has since aimed to provide forex trading services to a global clientele. However, the company's brief history raises questions regarding its stability and reliability. Limited information is available about its ownership structure and management team, which can further complicate the assessment of its credibility. Transparency is a vital aspect of any financial institution, and a lack of clear information about the company's operations can be indicative of underlying issues.

The management teams background and professional experience are equally important in evaluating CI Markets. A strong management team with a proven track record in the financial industry can provide reassurance to traders. Unfortunately, the absence of detailed profiles on the key personnel at CI Markets limits the ability to assess their qualifications and expertise. This lack of transparency may contribute to the skepticism surrounding the broker's reliability. Therefore, potential traders should remain cautious and consider the implications of the company's background when determining if "Is CI Markets safe?"

Trading Conditions Analysis

The trading conditions offered by a broker are crucial for traders looking to maximize their investment potential. CI Markets provides access to various trading instruments, including forex pairs, commodities, and CFDs. However, the overall fee structure and trading costs associated with CI Markets warrant careful examination. A transparent and competitive fee structure is essential for traders to make informed decisions.

The following table summarizes the key trading costs associated with CI Markets:

| Fee Type | CI Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable (not specified) | 1.0 - 2.0 pips |

| Commission Model | Not specified | $3 - $7 per lot |

| Overnight Interest Range | High (not specified) | 2% - 5% |

Traders should be particularly wary of any unusually high fees or commissions that could eat into their profits. Moreover, the absence of clear information regarding spreads and commissions raises concerns about transparency. If traders are unable to easily access this information, it may indicate a lack of accountability on the broker's part. As such, potential investors should consider these factors when questioning "Is CI Markets safe?"

Customer Funds Security

The safety of customer funds is a paramount concern for any trader. CI Markets claims to implement measures to ensure the security of client investments, but the specifics of these measures are crucial for evaluating their effectiveness. A reputable broker typically segregates client funds into separate accounts to protect them in case of insolvency. Furthermore, robust investor protection policies, such as negative balance protection, are essential for safeguarding traders' capital.

Despite CI Markets' claims, the lack of detailed information regarding their fund security measures raises concerns. The revocation of their regulatory license further complicates the matter, as it may imply that they are not subject to the same level of scrutiny as regulated brokers. Historical issues with fund security or disputes can also indicate a broker's reliability. Therefore, traders must carefully assess the security protocols in place at CI Markets when asking themselves, "Is CI Markets safe?"

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing the reliability of a forex broker. Reviews and testimonials can provide insight into the experiences of other traders and highlight any recurring issues. In the case of CI Markets, there have been numerous complaints regarding account access, withdrawal difficulties, and poor customer service.

The following table outlines the primary types of complaints received about CI Markets:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Account access issues | High | Slow response |

| Withdrawal problems | Critical | Unresolved |

| Poor customer service | Moderate | Inconsistent |

One notable complaint involved a trader's inability to withdraw funds, which was met with inadequate responses from customer support. Such experiences can significantly impact a trader's perception of a broker's reliability and trustworthiness. Therefore, it is essential to consider the overall customer experience when evaluating "Is CI Markets safe?"

Platform and Execution

The trading platform's performance and execution quality are crucial for traders looking to capitalize on market opportunities. CI Markets utilizes the MetaTrader 4 platform, which is widely recognized for its user-friendly interface and advanced trading features. However, the platform's stability, execution speed, and any signs of manipulation are critical factors to assess.

While CI Markets offers a well-known trading platform, any reports of slippage or rejected orders can raise red flags. Traders should be cautious of brokers that exhibit signs of poor execution or manipulation, as these can lead to significant financial losses. Therefore, it is essential for traders to evaluate the execution quality when determining "Is CI Markets safe?"

Risk Assessment

Traders must be aware of the risks associated with using any forex broker. CI Markets presents a range of risks that potential investors should consider before engaging with the platform. The following table summarizes key risk categories and their respective levels:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | License revoked |

| Fund Security Risk | High | Lack of transparency |

| Customer Service Risk | Medium | Numerous complaints |

To mitigate these risks, traders should conduct thorough research, consider using smaller trade sizes initially, and remain vigilant regarding any unusual activity in their accounts. It is crucial to weigh these risks carefully when questioning "Is CI Markets safe?"

Conclusion and Recommendations

In conclusion, the evidence suggests that CI Markets exhibits several characteristics that warrant caution. The revocation of its regulatory license, coupled with numerous customer complaints and a lack of transparency regarding trading conditions and fund security, raises significant concerns about its safety and reliability. As such, traders should approach this broker with caution and consider alternative options that offer stronger regulatory oversight and a proven track record of customer satisfaction.

For those seeking a reliable trading environment, it may be advisable to explore brokers regulated by reputable authorities, such as the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC). These brokers typically provide enhanced security measures, transparent fee structures, and superior customer support, ensuring a safer trading experience. Ultimately, the question "Is CI Markets safe?" leans toward a negative conclusion, and traders are encouraged to prioritize their financial security by choosing well-regulated and reputable brokers.

Is CI Markets a scam, or is it legit?

The latest exposure and evaluation content of CI Markets brokers.

CI Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CI Markets latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.