Addex 2025 Review: Everything You Need to Know

Executive Summary

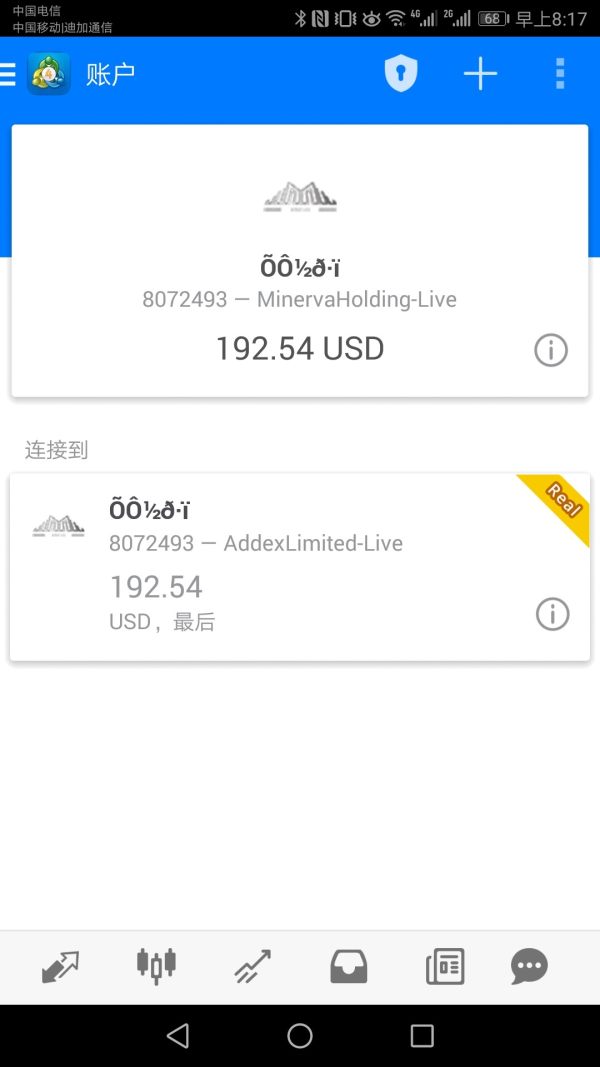

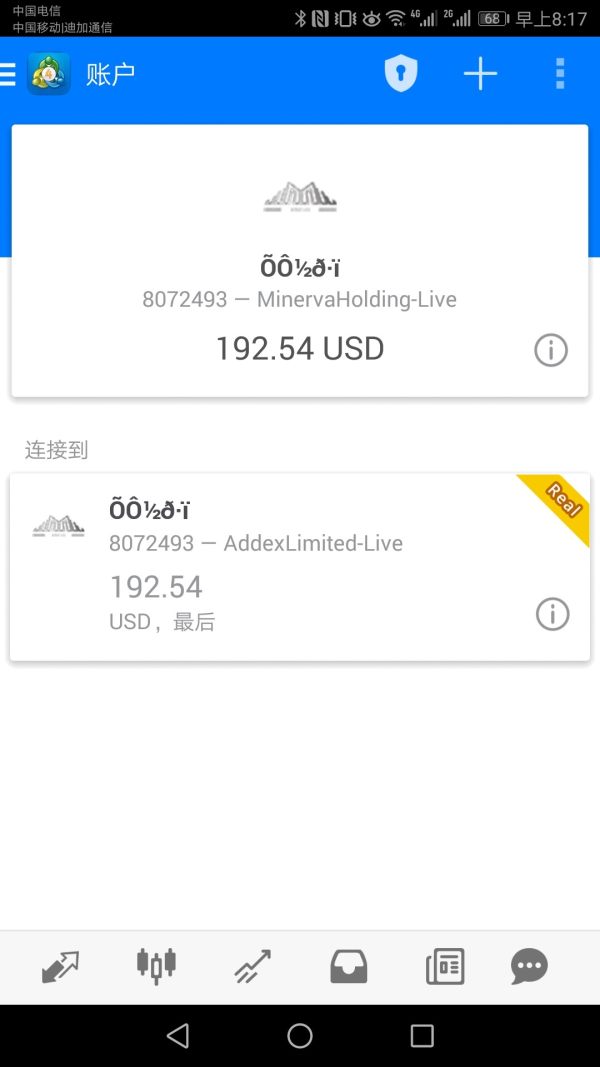

This comprehensive addex review examines a forex broker that presents a mixed profile in the current trading landscape. Addex Forex Broker demonstrates certain positive aspects through user feedback while simultaneously raising concerns due to limited transparency in crucial operational areas. Based on available information from various sources including WikiFX and user review platforms, the broker offers multiple account types designed to accommodate different trading preferences and requirements.

The broker's standout features include three distinct account offerings: Classic Account, Elite Account, and Swap-Free Account. Each account is tailored for specific investor needs. This diversified approach suggests an understanding of varied trader requirements, from conventional trading setups to Islamic-compliant solutions. However, the overall assessment reveals significant information gaps regarding regulatory compliance, detailed fee structures, and comprehensive trading conditions. Potential clients should carefully consider these gaps.

The primary target demographic appears to be traders seeking flexible account options with varying levels of service sophistication. While some users report satisfactory experiences, the lack of detailed regulatory information and transparent operational data necessitates cautious evaluation by prospective clients.

Important Notice

This addex review is compiled based on available public information and user feedback from multiple sources. Due to the limited availability of comprehensive regulatory and operational details, traders should conduct independent verification of the broker's legal compliance status in their respective jurisdictions. Different regional entities may operate under varying regulatory frameworks, and this review may not encompass all aspects of individual trading experiences.

The evaluation methodology relies on user testimonials, available platform information, and industry standard assessment criteria. Prospective clients should verify all trading conditions, fees, and regulatory status directly with the broker before making any financial commitments.

Rating Framework

Broker Overview

Addex operates in the forex brokerage sector. Specific establishment details and comprehensive company background information remain limited in available sources. The relationship between various entities bearing the "Addex" name, including pharmaceutical companies and forex trading services, lacks clear delineation in public information. This ambiguity regarding corporate structure and operational history presents initial concerns for traders seeking transparent broker relationships.

The broker's business model focuses on providing forex and CFD trading services through multiple account structures. However, detailed information regarding the company's operational methodology, technological infrastructure, and market-making versus ECN approaches is not readily available in current sources. This information gap affects the ability to provide comprehensive operational assessment.

According to available information, Addex offers trading services across various financial instruments. These presumably include major currency pairs and contracts for difference. The platform selection and technological backbone supporting these services require direct verification with the broker, as specific details are not prominently featured in available materials. The absence of clear regulatory jurisdiction information further complicates the assessment of the broker's operational framework and client protection measures.

Regulatory Status: Current available information does not specify the regulatory jurisdictions under which Addex operates. This represents a significant transparency concern for potential clients seeking regulated trading environments.

Deposit and Withdrawal Methods: Specific information regarding accepted payment methods, processing times, and associated fees is not detailed in available sources. This requires direct inquiry with the broker.

Minimum Deposit Requirements: Exact minimum deposit amounts for different account types are not specified in current available materials. This necessitates direct verification.

Promotional Offers: Information regarding welcome bonuses, trading incentives, or promotional campaigns is not available in current sources.

Tradeable Assets: The broker appears to focus on forex and CFD trading. However, the complete range of available instruments, including specific currency pairs, commodities, indices, and other assets, requires confirmation through direct contact.

Cost Structure: Detailed spread information, commission rates, overnight financing charges, and other trading costs are not comprehensively outlined in available materials. This makes cost comparison challenging.

Leverage Ratios: Specific maximum leverage offerings for different account types and instrument categories are not detailed in current sources.

Platform Options: Information regarding trading platform availability, including MetaTrader versions, proprietary platforms, or web-based solutions, is not comprehensively available.

Geographic Restrictions: Details regarding restricted countries or regional limitations are not specified in available materials.

Customer Support Languages: Available customer service languages and support hours are not detailed in current sources.

This addex review highlights the need for prospective clients to obtain detailed operational information directly from the broker. This is due to limited publicly available comprehensive data.

Account Conditions Analysis

The account structure represents one of Addex's more clearly defined offerings. It features three distinct account types designed to serve different trading preferences and requirements. The Classic Account appears positioned for standard retail traders, while the Elite Account suggests enhanced features for more experienced or higher-volume traders. The Swap-Free Account specifically addresses the needs of Islamic traders who require Sharia-compliant trading conditions.

The availability of a Swap-Free Account demonstrates awareness of diverse religious and cultural trading requirements. This is a positive aspect for brokers serving global markets. However, the specific features, minimum deposit requirements, spread differences, and additional benefits associated with each account type lack detailed public documentation. This information gap makes it difficult for potential clients to make informed decisions about which account type best suits their trading needs.

According to available user feedback, some traders have expressed satisfaction with the account options provided. However, specific details about the account opening process, verification requirements, and time to activation are not comprehensively documented. The absence of detailed fee structures, including potential account maintenance charges, inactivity fees, or upgrade requirements between account types, represents a significant information gap.

The broker's approach to account management, including customer onboarding procedures, documentation requirements, and ongoing account administration, requires direct verification. This addex review emphasizes the importance of obtaining complete account terms and conditions before proceeding with any account opening procedures.

The assessment of trading tools and resources available through Addex faces significant limitations. This is due to insufficient publicly available information. Modern forex trading requires comprehensive analytical tools, real-time market data, economic calendars, and educational resources to support trader decision-making processes. However, current available sources do not provide detailed information about the specific tools and resources offered by this broker.

Professional trading platforms typically include technical analysis indicators, charting capabilities, automated trading support, and market research resources. The absence of detailed information regarding these essential trading components makes it challenging to evaluate the broker's competitive position in the current market. Educational resources, including webinars, trading guides, market analysis, and beginner-friendly materials, are crucial for trader development but are not documented in available sources.

The availability of mobile trading applications, API access for algorithmic trading, and integration with third-party analysis tools represents important considerations for modern traders. However, specific information regarding these technological capabilities is not comprehensively available. Risk management tools, including stop-loss and take-profit order types, trailing stops, and position sizing calculators, are essential features that require verification through direct broker contact.

Market research and analysis resources, including daily market commentary, economic event calendars, and expert insights, contribute significantly to trader success. However, these are not detailed in current available information. This comprehensive information gap regarding tools and resources significantly impacts the overall assessment of the broker's service offering.

Customer Service and Support Analysis

Customer service quality represents a crucial factor in forex broker selection. Yet available information regarding Addex's support capabilities remains limited. Some user feedback suggests positive experiences with customer interaction, though specific details about response times, support channel availability, and problem resolution effectiveness are not comprehensively documented in available sources.

Modern forex brokers typically offer multiple communication channels including live chat, email support, telephone assistance, and comprehensive FAQ sections. The availability and effectiveness of these support mechanisms at Addex require direct verification. Professional customer support should provide assistance in multiple languages, operate during extended hours to accommodate global trading schedules, and demonstrate technical competency in addressing trading-related inquiries.

The quality of customer service often becomes apparent during account opening procedures, deposit and withdrawal processes, and technical issue resolution. User experiences in these areas are not sufficiently documented in available sources to provide comprehensive assessment. Educational support, including guidance for new traders and assistance with platform navigation, represents an important service component that lacks detailed documentation.

Response time expectations, escalation procedures for complex issues, and the availability of dedicated account management for higher-tier clients are important service considerations. These require direct inquiry. The absence of detailed customer service information in this addex review reflects the need for prospective clients to evaluate support quality through direct interaction before committing to trading relationships.

Trading Experience Analysis

The trading experience encompasses platform stability, execution speed, order processing quality, and overall user interface functionality. However, comprehensive user feedback regarding these critical aspects of Addex's service delivery is not sufficiently available in current sources to provide detailed assessment. Platform performance during high-volatility market conditions, order slippage rates, and execution reliability represent crucial factors that require evaluation through direct experience or comprehensive user testimonials.

Mobile trading capabilities have become essential for modern forex traders. These traders require access to markets and account management functions while away from desktop computers. The quality of mobile applications, including feature completeness, stability, and user interface design, requires verification through direct testing. Web-based platform options provide additional flexibility but must demonstrate reliability and comprehensive functionality.

Order execution methods, including market execution versus instant execution, and the broker's approach to order processing during news events or market gaps, significantly impact trading outcomes. However, specific information regarding Addex's execution methodology and performance statistics is not available in current sources. The availability of advanced order types, partial fills handling, and requote policies requires direct verification.

Platform customization options, including chart settings, indicator availability, and workspace personalization, contribute to trader satisfaction. However, these are not detailed in available materials. This addex review emphasizes the importance of platform testing through demo accounts or small initial deposits to evaluate trading experience quality before significant capital commitment.

Trust and Security Analysis

Trust and security represent fundamental concerns in forex broker selection. Yet Addex's regulatory status and fund protection measures lack comprehensive documentation in available sources. Regulatory oversight provides crucial client protections including segregated fund requirements, deposit insurance, and dispute resolution mechanisms. The absence of clear regulatory information represents a significant concern for traders seeking secure trading environments.

Fund segregation practices, whereby client funds are maintained separately from broker operational capital, provide essential protection against broker insolvency. However, specific information regarding Addex's fund handling procedures and banking relationships is not available in current sources. Professional indemnity insurance, compensation schemes, and other financial protections require verification through direct inquiry.

Corporate transparency, including published financial statements, management team disclosure, and operational history, contributes to trust assessment. However, this is not comprehensively available. Third-party audits, regulatory filings, and industry certifications provide additional credibility indicators that require investigation. The broker's handling of client complaints, dispute resolution procedures, and regulatory compliance history represents important trust factors that lack documentation.

Data security measures, including encryption protocols, account protection features, and privacy policies, are essential in the digital trading environment. However, these are not detailed in available sources. This comprehensive lack of security and trust-related information significantly impacts the overall assessment and necessitates thorough due diligence by prospective clients.

User Experience Analysis

Overall user satisfaction assessment faces limitations due to the mixed nature of available feedback and the absence of comprehensive user experience documentation. Available user comments suggest both positive and neutral experiences, though the sample size and detail level are insufficient for definitive conclusions. The diversity of account types appears to receive positive reception from users who value flexible trading options.

Interface design and platform usability significantly impact trader satisfaction. Yet specific feedback regarding navigation ease, feature accessibility, and learning curve considerations is not comprehensively available. The account registration and verification process, including required documentation, processing times, and user-friendliness, requires evaluation through direct experience.

Deposit and withdrawal experiences, including processing speed, fee transparency, and procedural simplicity, represent crucial user experience factors. These lack detailed documentation in available sources. The availability of account management tools, including real-time reporting, transaction history, and performance analytics, contributes to user satisfaction but requires verification.

Common user complaints and their resolution, upgrade procedures between account types, and ongoing account maintenance experiences are not sufficiently documented to provide comprehensive assessment. The target user profile appears to include traders seeking account variety and flexible trading conditions, though specific user demographics and satisfaction rates require additional investigation. This addex review suggests that prospective clients should carefully evaluate user experience through direct testing and community feedback research.

Conclusion

This comprehensive addex review reveals a forex broker with both positive aspects and significant information gaps that require careful consideration. While the availability of multiple account types demonstrates awareness of diverse trader needs, the lack of detailed regulatory information, transparent fee structures, and comprehensive operational documentation raises important concerns for prospective clients.

The broker appears most suitable for traders who prioritize account flexibility and are willing to conduct thorough due diligence regarding regulatory compliance and trading conditions. However, traders seeking fully transparent, well-documented broker relationships may find the current information availability insufficient for confident decision-making.

The primary advantages include diverse account options and some positive user experiences. The main disadvantages center on limited transparency regarding regulatory status, detailed trading conditions, and comprehensive operational information. Prospective clients should prioritize direct verification of all trading terms, regulatory compliance, and fund protection measures before establishing trading relationships with this broker.