Regarding the legitimacy of FUTU forex brokers, it provides SFC and WikiBit, (also has a graphic survey regarding security).

Is FUTU safe?

Risk Control

Regulation

Is FUTU markets regulated?

The regulatory license is the strongest proof.

SFC Market Making License (MM)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Futu Securities International (Hong Kong) Limited

Effective Date:

2012-10-04Email Address of Licensed Institution:

cs@futuhk.comSharing Status:

No SharingWebsite of Licensed Institution:

www.futuhk.comExpiration Time:

--Address of Licensed Institution:

34/F, United Centre, No. 95 Queensway, Admiralty, Hong KongPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Futu A Scam?

Introduction

Futu is a Hong Kong-based online brokerage firm that has carved a niche for itself in the competitive forex market. Established in 2012, it has positioned itself as a leading fintech unicorn in Asia, providing a fully digital trading platform known as "Futubull." As the demand for online trading continues to rise, traders are increasingly drawn to platforms like Futu for their innovative services and potential for high returns. However, with the proliferation of online trading platforms, it is crucial for traders to exercise caution and conduct thorough evaluations before engaging with any broker. This article aims to provide an objective analysis of Futu's legitimacy and safety by examining its regulatory status, company background, trading conditions, customer experiences, and risk factors.

To ensure a comprehensive assessment, this investigation is based on a review of various credible sources, including regulatory filings, customer feedback, and expert analyses. The evaluation framework encompasses key aspects such as regulatory compliance, operational transparency, customer service quality, and the overall trading experience.

Regulation and Legitimacy

Regulatory oversight is a fundamental aspect of online trading, as it ensures that brokers adhere to specific standards that protect investors. Futu is regulated by the Securities and Futures Commission (SFC) in Hong Kong, which is known for its stringent regulatory environment. This regulation provides a layer of assurance for traders, as it mandates compliance with various operational standards.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Securities and Futures Commission (SFC) | AZT 137 | Hong Kong | Verified |

The importance of regulatory compliance cannot be overstated. It serves as a safeguard against potential fraud and malpractice. Futu's registration with the SFC indicates that it operates under a framework designed to protect investor interests. Furthermore, the SFC requires brokers to maintain client funds in segregated accounts, thus enhancing the security of investor capital.

Futu has maintained a clean regulatory record, with no significant compliance issues reported. This history of adherence to regulatory standards adds to its credibility. However, potential clients should remain vigilant and conduct their due diligence, as the absence of past issues does not guarantee future compliance.

Company Background Investigation

Futu's history is marked by rapid growth and innovation. Founded in 2012, the company has evolved into one of Asia's top online brokers, leveraging technology to provide advanced trading solutions. Futu is a publicly traded company listed on the NASDAQ, which further enhances its transparency and accountability.

The company's ownership structure is primarily held by its founder and CEO, Leaf Li, along with strategic investors such as Tencent Holdings. This backing from reputable investors lends additional credibility to Futu. The management team is composed of experienced professionals with backgrounds in finance and technology, which is crucial for navigating the complexities of the trading environment.

In terms of transparency, Futu provides detailed information about its services, fees, and operational practices on its website. This level of disclosure is essential for building trust with potential clients. However, the company has faced scrutiny regarding its handling of customer data, particularly in light of China's evolving data privacy laws.

Trading Conditions Analysis

Futu offers a competitive trading environment characterized by a transparent fee structure. The platform provides access to a wide range of financial instruments, including stocks, options, and futures. Importantly, Futu has gained popularity for its zero-commission trading model for certain products, which is appealing to cost-conscious traders.

| Fee Type | Futu | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 0.03% | 0.05% |

| Commission Structure | Zero commission on select trades | Varies widely |

| Overnight Interest Range | 6.8% | 5-10% |

While Futu's fee structure is generally competitive, traders should be aware of any unusual or hidden fees that may apply. For instance, while the platform advertises zero commissions, there may be other costs associated with trading, such as regulatory fees and exchange settlements. It is vital for traders to thoroughly read the terms and conditions to avoid unexpected charges.

Customer Funds Security

The security of customer funds is a paramount concern for any trading platform. Futu implements several measures to ensure the safety of client deposits. As a regulated entity, it is required to keep client funds in segregated accounts, which protects investors in the event of financial difficulties faced by the broker. Additionally, Futu participates in the Investor Compensation Fund, which provides coverage for eligible clients.

Futu's commitment to safeguarding client assets is further reinforced by its use of advanced encryption technologies to protect sensitive information. However, the broker has faced some scrutiny over its data management practices, particularly in light of recent regulatory changes in China related to data privacy.

Despite these challenges, there have been no significant incidents reported regarding the safety of customer funds at Futu. Nevertheless, traders should remain informed about any changes in regulatory policies that may affect their investments.

Customer Experience and Complaints

Customer feedback is a critical component of evaluating a broker's reliability. Reviews of Futu reveal a mixed bag of experiences. Many users praise the platform for its user-friendly interface and efficient trading execution. However, some customers have reported issues, particularly related to withdrawal delays and customer service responsiveness.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response times |

| Customer Service Issues | Medium | Limited support options |

| Platform Stability | Low | Generally stable |

A notable complaint pattern involves delays in processing withdrawal requests, with some users reporting waits of several days. While Futu does not charge withdrawal fees, the processing times may vary depending on the withdrawal method used.

In terms of customer service, Futu lacks a live chat option, which can hinder timely communication. Users have expressed frustration over the response times when seeking assistance via email. These factors are essential to consider for potential clients, as effective customer support is crucial for resolving issues promptly.

Platform and Trade Execution

Futu's trading platform, Futubull, is designed to provide a seamless trading experience. The platform boasts a range of features, including real-time market data, advanced charting tools, and a community forum for traders to share insights.

In terms of order execution, users generally report a high level of satisfaction, with minimal slippage observed during trades. However, some traders have raised concerns about the platform's stability during peak trading hours, which could potentially lead to missed opportunities.

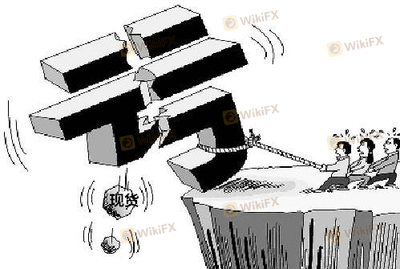

Risk Assessment

Engaging with any trading platform carries inherent risks. Futu presents a mix of both opportunities and challenges for traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Subject to changing regulations |

| Operational Risk | Medium | Potential platform stability issues |

| Market Risk | High | Exposure to market volatility |

To mitigate these risks, traders are advised to implement sound risk management strategies, such as setting stop-loss orders and diversifying their investment portfolios. Additionally, staying updated on regulatory changes and platform updates can help traders navigate potential pitfalls.

Conclusion and Recommendations

In summary, Futu presents a compelling option for traders seeking a modern and innovative trading platform. Its regulatory compliance with the SFC in Hong Kong adds a layer of credibility, and its competitive fee structure is attractive for cost-conscious investors. However, potential clients should be aware of the mixed customer feedback, particularly regarding withdrawal processes and customer service responsiveness.

While there are no significant indicators of fraudulent activity associated with Futu, traders should proceed with caution and conduct their due diligence before investing. For those who may prefer alternatives, brokers such as Interactive Brokers and Moomoo offer competitive features and may provide a more satisfactory customer experience.

Ultimately, the decision to engage with Futu should be based on individual trading needs and risk tolerance. As always, thorough research and careful consideration are essential in the world of online trading.

Is FUTU a scam, or is it legit?

The latest exposure and evaluation content of FUTU brokers.

FUTU Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FUTU latest industry rating score is 7.66, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.66 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.