Regarding the legitimacy of East Asia Futures forex brokers, it provides SFC and WikiBit, (also has a graphic survey regarding security).

Is East Asia Futures safe?

Risk Control

Software Index

Is East Asia Futures markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

East Asia Futures Limited

Effective Date:

2004-02-02Email Address of Licensed Institution:

accounts@eafutures.com.hkSharing Status:

No SharingWebsite of Licensed Institution:

www.eafutures.com.hkExpiration Time:

--Address of Licensed Institution:

香港中環德輔道中10號東亞銀行大廈9樓Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is East Asia Futures Safe or Scam?

Introduction

East Asia Futures is a brokerage firm based in Hong Kong that positions itself within the competitive landscape of the forex and futures markets. As traders increasingly seek opportunities in global markets, the importance of selecting a reliable broker cannot be overstated. With numerous reports of fraud and mismanagement in the financial sector, traders must exercise caution and conduct thorough due diligence before committing their funds. This article aims to provide a comprehensive assessment of East Asia Futures, exploring its regulatory status, company background, trading conditions, customer experiences, and overall safety. Our investigation draws on multiple sources, including user reviews, regulatory filings, and expert analyses, to deliver a balanced view of whether East Asia Futures is a safe option for traders or a potential scam.

Regulation and Legitimacy

The regulatory framework governing a brokerage is crucial in determining its legitimacy. East Asia Futures claims to be regulated by the Securities and Futures Commission (SFC) of Hong Kong. However, the lack of a clear and robust regulatory environment raises concerns about the broker's reliability. Below is a summary of the regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SFC | AAE 975 | Hong Kong | Verified |

Despite being regulated, the quality of oversight is a significant factor that traders should consider. The SFC has a reputation for stringent compliance, but East Asia Futures has faced scrutiny regarding its operational practices. Historical compliance issues have led to questions about the broker's transparency and accountability. As such, while East Asia Futures may have a regulatory license, the overall safety of trading with them remains questionable.

Company Background Investigation

East Asia Futures Limited was established in 1989, making it one of the older players in the Hong Kong brokerage market. The company has evolved over the years, expanding its services to include various financial instruments, notably futures and options. The ownership structure of East Asia Futures is not entirely transparent, which raises concerns about potential conflicts of interest and the accountability of its management team.

The management team comprises individuals with varying degrees of experience in the financial markets. However, a lack of publicly available information about their qualifications and backgrounds contributes to a perception of opacity. Transparency in business operations is vital for building trust with clients, and East Asia Futures appears to fall short in this regard.

Trading Conditions Analysis

Understanding a broker's trading conditions is essential for evaluating its overall attractiveness. East Asia Futures offers a range of trading instruments, but its fee structure has raised eyebrows among traders. The overall cost of trading can significantly impact profitability, and below is a comparison of key trading costs:

| Fee Type | East Asia Futures | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | None | $5 - $10 per lot |

| Overnight Interest Range | 0.5% - 1.0% | 0.5% - 2.0% |

While the absence of a commission model may seem attractive, the variable spreads can be significantly higher than industry standards, which may lead to increased trading costs. Furthermore, the lack of clarity regarding overnight interest rates can create unexpected expenses for traders. This complexity in the fee structure raises concerns about whether East Asia Futures is truly a cost-effective choice for traders.

Client Fund Safety

The safety of client funds is paramount when choosing a brokerage. East Asia Futures claims to implement various security measures to protect client investments. However, the effectiveness of these measures is often called into question. The firm does not provide clear information about fund segregation practices, which are essential for ensuring that client funds are kept separate from the broker's operational funds.

Moreover, the absence of investor protection schemes raises alarms. In the event of a financial crisis or a broker's insolvency, clients may find themselves without recourse to recover their investments. Historical disputes involving East Asia Futures suggest that clients have experienced difficulties in withdrawing funds, further underscoring the risks associated with trading with this broker. These factors contribute to the growing narrative that East Asia Futures may not be a safe choice for traders.

Customer Experience and Complaints

Customer feedback is a critical indicator of a broker's reliability. Reviews of East Asia Futures reveal a mixed bag of experiences. While some clients report satisfactory trading experiences, many others express frustration over withdrawal issues and lack of responsive customer service. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Average |

| Transparency Concerns | High | Limited |

The prevalence of withdrawal complaints suggests that many clients have faced challenges in accessing their funds, raising concerns about the broker's operational integrity. Additionally, the quality of customer service appears to be lacking, with many users reporting slow response times and inadequate support. These issues contribute to the perception that East Asia Futures may not prioritize customer satisfaction.

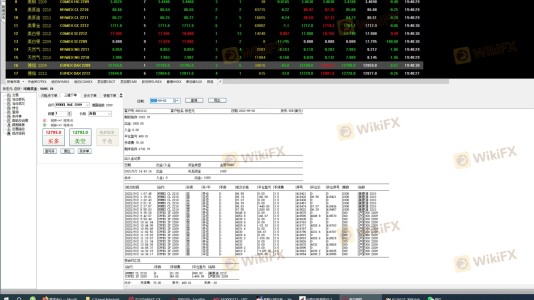

Platform and Trade Execution

The trading platform offered by East Asia Futures is another critical aspect that traders should consider. While the platform is functional, user reviews indicate that it may not be as stable or user-friendly as competitors. Issues such as slippage and order rejections have been reported, which can significantly impact trading outcomes. Traders expect a seamless experience, and any signs of platform manipulation or instability can erode trust in the broker.

Risk Assessment

When assessing the overall risk of trading with East Asia Futures, several factors come into play. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Limited oversight and compliance issues |

| Fund Safety | High | Lack of segregation and investor protection |

| Customer Service | Medium | Inconsistent support and response times |

Given these risks, traders are advised to approach East Asia Futures with caution. Developing a risk mitigation strategy, such as starting with a small investment and closely monitoring trading activities, may help minimize potential losses.

Conclusion and Recommendations

In conclusion, the evidence suggests that East Asia Futures may not be a safe choice for traders. While it operates under a regulatory framework, the lack of transparency, historical compliance issues, and numerous customer complaints raise significant concerns. Traders should be wary of the potential risks associated with this broker, particularly regarding fund safety and withdrawal processes.

For traders seeking reliable alternatives, it is advisable to consider brokers with robust regulatory oversight, transparent fee structures, and strong customer support. Some recommended options include well-established firms with a proven track record in the industry. Ultimately, conducting thorough research and exercising caution is essential for anyone considering trading with East Asia Futures.

Is East Asia Futures a scam, or is it legit?

The latest exposure and evaluation content of East Asia Futures brokers.

East Asia Futures Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

East Asia Futures latest industry rating score is 6.94, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.94 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.