East Asia Futures Review 1

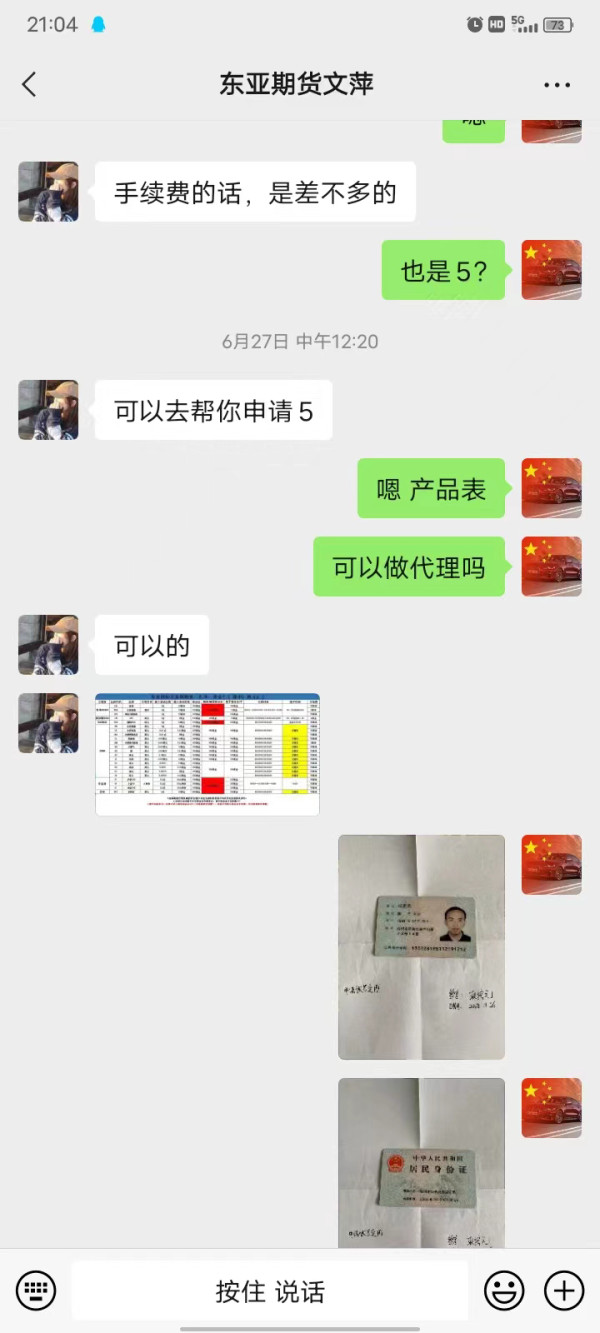

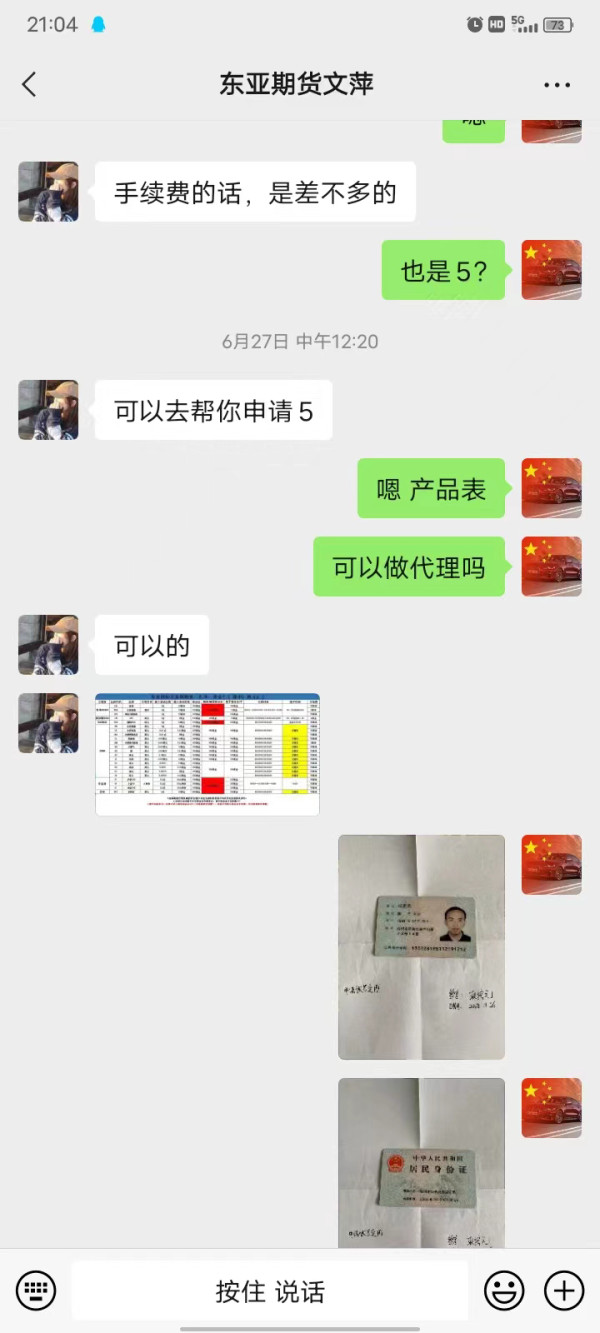

20,000 RMB and earn 40,000 RMB profi. You can only withdraw rprinciple. No one handles the case even I report it.

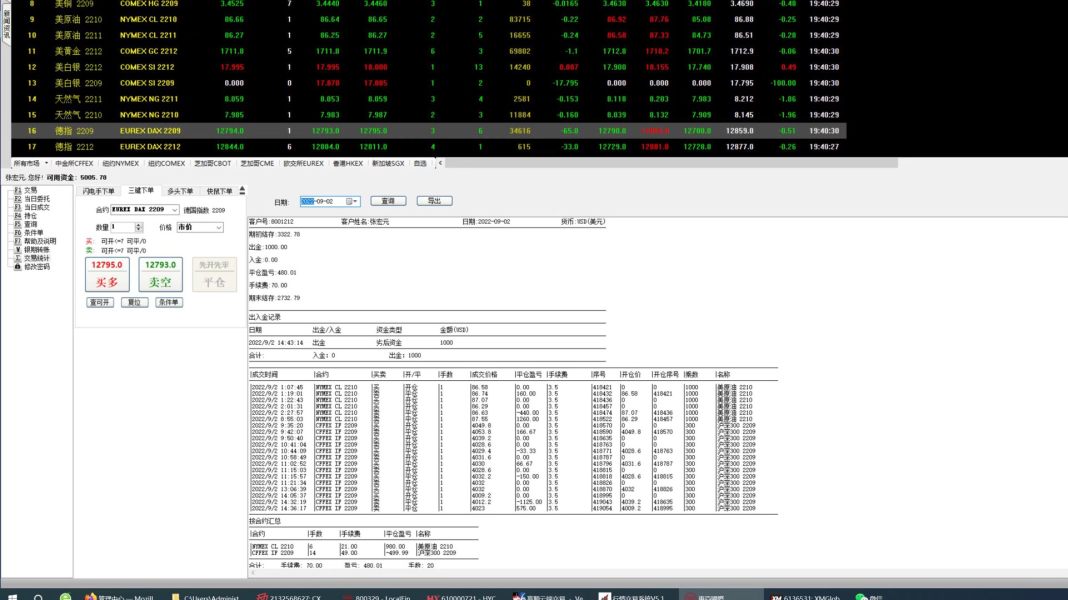

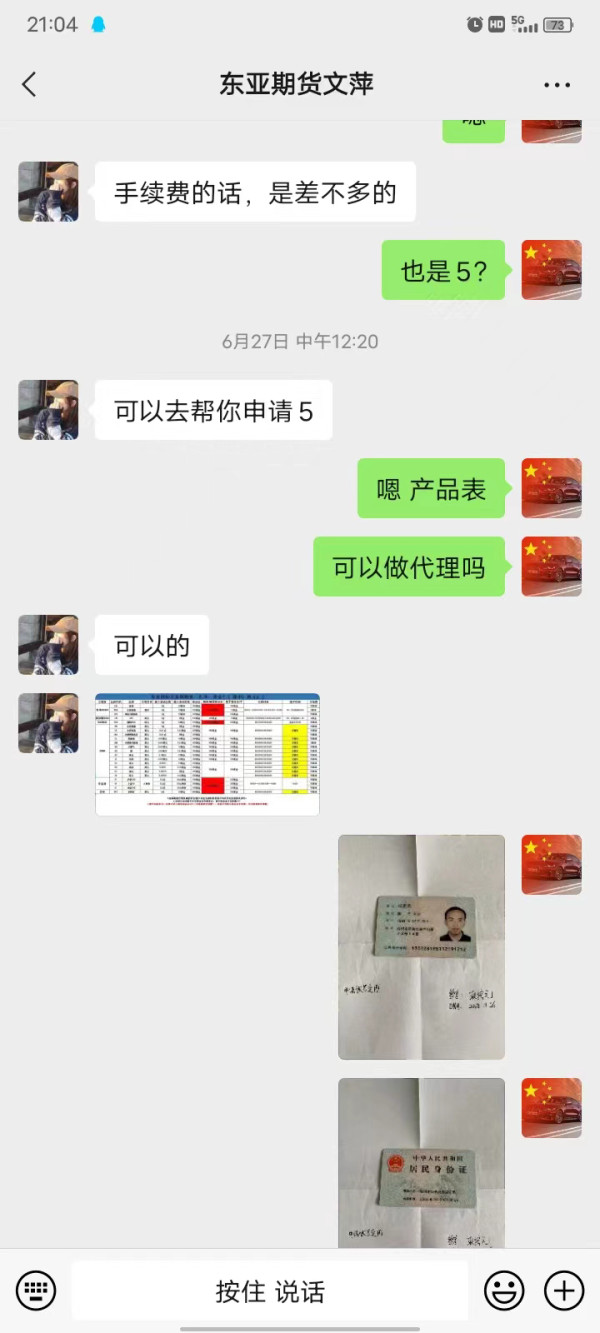

East Asia Futures Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Risk Control

Software Index

20,000 RMB and earn 40,000 RMB profi. You can only withdraw rprinciple. No one handles the case even I report it.

East Asia Futures is a Hong Kong-based futures trading brokerage. It has been operating in the financial markets for 20 years. This east asia futures review examines a company that is regulated by the Securities and Futures Commission of Hong Kong under license number AAE975. The broker provides investors with a regulated trading environment for futures contracts. The broker specializes exclusively in futures trading. It positions itself as a focused service provider in this specific market segment.

The company's primary strength lies in its regulatory transparency and compliance with Hong Kong's stringent financial oversight standards. East Asia Futures caters specifically to investors interested in futures trading. The company offers access to various futures contracts under the supervision of one of Asia's most respected financial regulators. However, our analysis reveals significant information gaps regarding account conditions, trading tools, customer service quality, and detailed fee structures. Potential clients should consider these gaps when evaluating this broker against competitors in the futures trading space.

Investors should be aware that regulatory frameworks and trading conditions may vary across different jurisdictions. This could potentially affect the overall trading experience. The legal and regulatory environment in Hong Kong provides specific protections and requirements. These may differ from those in other regions where investors are based.

This review is based on publicly available regulatory information and company background data obtained from the Securities and Futures Commission of Hong Kong. The analysis does not include user reviews or detailed service evaluations. Comprehensive user feedback data was not available in the source materials. Potential clients are advised to conduct additional due diligence and consider requesting detailed information directly from the broker.

| Dimension | Score | Rating Basis |

|---|---|---|

| Account Conditions | N/A | Specific account conditions not detailed in available information |

| Tools and Resources | N/A | Trading tools and resources not specified in source materials |

| Customer Service and Support | N/A | Customer service information not provided in available data |

| Trading Experience | N/A | Detailed trading experience information not available |

| Trust and Reliability | 9/10 | Strong regulatory oversight by Hong Kong SFC, established 20-year track record |

| User Experience | N/A | User experience details not available in source materials |

East Asia Futures was established 20 years ago. It has built its reputation as a specialized futures trading brokerage based in Hong Kong. The company has focused exclusively on futures trading throughout its two-decade history. This focus allows them to develop expertise in this specific market segment. As a Hong Kong-based entity, East Asia Futures operates within one of Asia's most sophisticated financial regulatory frameworks. The company benefits from the region's established position as a major international financial hub.

The broker's business model centers entirely on providing futures trading services. This distinguishes it from multi-asset brokers that offer forex, stocks, and other financial instruments. This specialized approach allows East Asia Futures to concentrate its resources and expertise on futures markets. The focus potentially offers more focused service quality for clients specifically interested in futures trading. The company operates under the regulatory supervision of the Securities and Futures Commission of Hong Kong. This commission maintains strict standards for financial service providers and requires regular compliance reporting. This east asia futures review finds that while the broker maintains proper regulatory standing, detailed information about trading platforms, account types, and specific service offerings remains limited in publicly available sources.

Regulatory Jurisdiction: East Asia Futures operates under the regulatory authority of the Securities and Futures Commission of Hong Kong. The company holds license number AAE975. Hong Kong's regulatory framework is recognized internationally for its comprehensive oversight and investor protection measures.

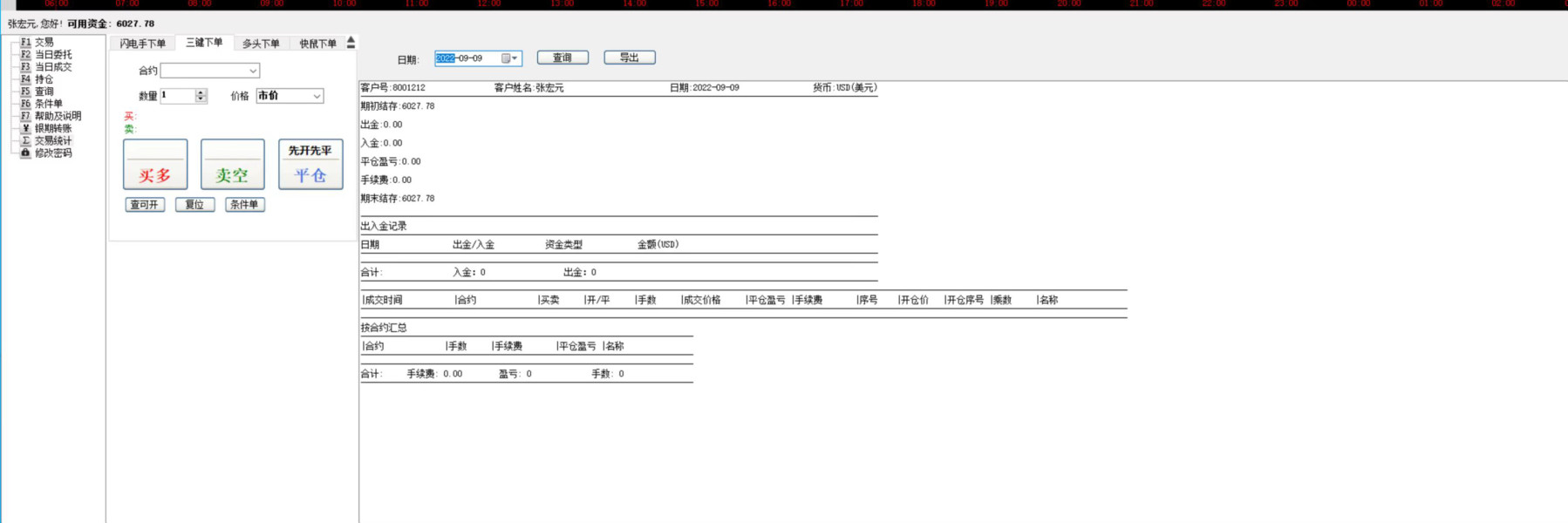

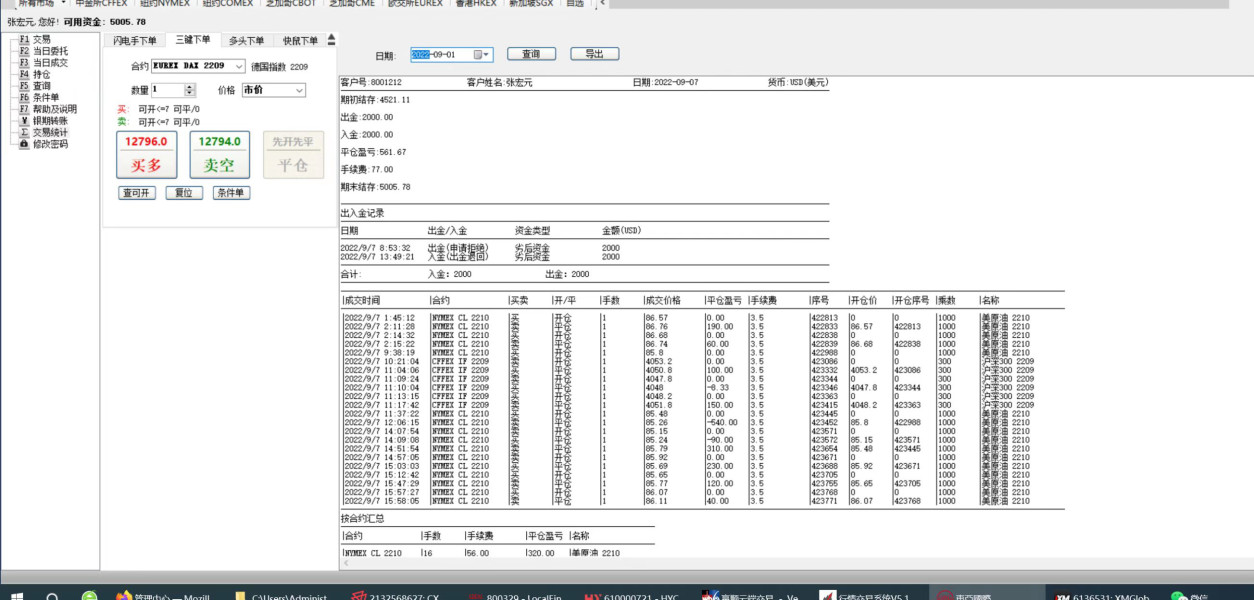

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal methods is not detailed in the available source materials. This represents a significant information gap for potential clients.

Minimum Deposit Requirements: The minimum deposit requirements for opening accounts with East Asia Futures are not specified in the publicly available information.

Bonus and Promotional Offers: Details about any bonus programs or promotional offers are not mentioned in the source materials.

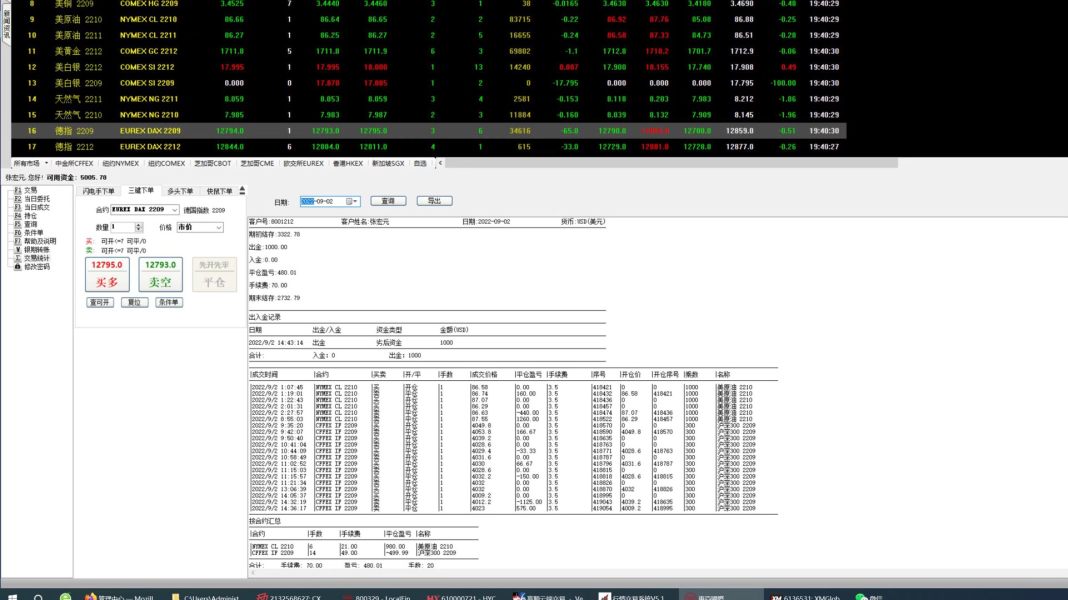

Tradeable Assets: East Asia Futures specializes in futures contracts. However, specific details about the range of available futures markets and instruments are not comprehensively outlined in the available information.

Cost Structure: Information regarding spreads, commissions, and other trading costs is not detailed in the source materials. This makes it difficult for potential clients to assess the competitiveness of the broker's pricing.

Leverage Ratios: Specific leverage ratios offered by East Asia Futures are not mentioned in the available information.

Platform Options: Details about trading platforms are not specified in the source materials. This includes whether the broker offers proprietary platforms or third-party solutions.

Geographic Restrictions: Information about geographic restrictions or limitations on client acceptance is not available in the source materials.

Customer Support Languages: The languages supported by customer service are not specified in the available information.

This east asia futures review highlights the need for potential clients to request comprehensive information directly from the broker. Such requests are necessary to fill these information gaps.

The evaluation of East Asia Futures' account conditions faces significant limitations due to the lack of detailed information in available source materials. Typically, futures brokers offer various account types designed to meet different investor needs. These range from basic retail accounts to sophisticated institutional trading arrangements. However, specific details about account types, their respective features, and associated benefits are not outlined in the publicly available information about East Asia Futures.

Minimum deposit requirements are crucial for potential clients to assess accessibility. These requirements are not specified in the source materials. This represents a significant information gap, as minimum deposit levels can vary substantially among futures brokers. They range from relatively modest amounts for retail traders to substantial requirements for professional accounts. The account opening process is also not detailed in available sources. This includes required documentation, verification procedures, and timeline for account activation.

Special account features are not mentioned in the available information. Such features include Islamic-compliant accounts for Muslim traders or specific arrangements for institutional clients. The absence of detailed account condition information makes it challenging for potential clients to evaluate whether East Asia Futures meets their specific trading requirements and financial capabilities. This east asia futures review emphasizes the importance of requesting comprehensive account information directly from the broker before making any commitment.

The assessment of trading tools and resources offered by East Asia Futures is constrained by the limited information available in source materials. Modern futures trading typically requires sophisticated analytical tools, real-time market data, charting capabilities, and risk management features to enable effective decision-making. However, specific details about the trading tools and analytical resources provided by East Asia Futures are not comprehensively outlined in available sources.

Research and analysis resources are essential for informed futures trading decisions. These resources are not detailed in the source materials. Professional futures trading often relies on fundamental analysis, technical indicators, market commentary, and economic calendars to guide trading strategies. The availability and quality of such resources can significantly impact trading success. This makes this information gap particularly notable.

Educational resources are not mentioned in the available information. These include tutorials, webinars, market analysis, and trading guides. These resources are particularly valuable for newer traders or those looking to expand their futures trading knowledge. Automated trading support is also not specified in the source materials. This includes algorithmic trading capabilities or expert advisor functionality.

The lack of detailed information about trading tools and resources makes it difficult to assess how East Asia Futures compares to competitors. This comparison would focus on supporting client trading activities and decision-making processes.

Evaluating the customer service and support quality of East Asia Futures proves challenging due to the absence of detailed information in available source materials. Effective customer support is crucial in futures trading. Rapid market movements and time-sensitive decisions require reliable assistance when technical issues or account questions arise. However, specific details about customer service channels, availability, and quality are not provided in the available information.

Response times for customer inquiries are not specified in the source materials. These can be critical during active trading sessions. The availability of multiple communication channels is not detailed. Such channels include phone support, live chat, email, and potentially dedicated account managers. Service quality metrics are not available in the source materials. These include customer satisfaction ratings or resolution times.

Multilingual support capabilities are not mentioned in the available information. These capabilities are important for international clients. Operating hours for customer support are not specified. This includes whether 24-hour support is available during global futures market hours. The geographical distribution of support teams and local language capabilities remain unclear from available sources.

Without access to user feedback or detailed service descriptions, it is not possible to provide a comprehensive assessment of East Asia Futures' customer service quality. Potential clients should inquire directly about support arrangements and service levels before committing to the broker.

The analysis of trading experience with East Asia Futures faces substantial limitations due to insufficient detail in available source materials. Platform stability and execution speed are critical factors in futures trading. Price movements can be rapid and timing is essential for successful trades. However, specific information about platform performance, uptime statistics, and execution quality is not provided in available sources.

Order execution quality is not detailed in the source materials. This includes fill rates, slippage characteristics, and rejection rates. These factors significantly impact trading outcomes and overall client satisfaction. Platform functionality is not comprehensively described in available information. This includes advanced order types, risk management tools, and analytical capabilities.

Mobile trading experience is not addressed in the source materials. This experience is increasingly important for active traders who need market access while away from their primary trading stations. The quality and functionality of mobile applications or web-based mobile trading solutions remain unclear. Trading environment characteristics are not specified. These include market depth display, real-time quotes, and news integration.

Technical performance data are not available in the source materials. This includes latency measurements, server locations, and infrastructure specifications. Without access to user experiences or detailed platform specifications, providing a comprehensive assessment of the trading experience with East Asia Futures is not possible. This east asia futures review recommends requesting platform demonstrations and detailed technical specifications directly from the broker.

East Asia Futures demonstrates strong regulatory credentials through its supervision by the Securities and Futures Commission of Hong Kong under license number AAE975. The Hong Kong SFC is recognized as one of Asia's most rigorous financial regulators. It maintains comprehensive oversight of licensed entities and enforces strict compliance standards. This regulatory framework provides significant protection for client funds and ensures adherence to professional conduct standards.

The company's 20-year operational history suggests institutional stability and market experience. This indicates sustained business operations through various market cycles. Long-term operation under Hong Kong's regulatory framework demonstrates ongoing compliance with evolving regulatory requirements. It also suggests the broker has successfully navigated changing market conditions over two decades.

However, specific details about client fund protection measures are not detailed in available source materials. Such measures include segregated account arrangements or compensation schemes. Company transparency regarding financial statements, ownership structure, and business operations is not comprehensively outlined in available information. Industry reputation and recognition are not mentioned in source materials. This includes any awards or professional acknowledgments.

Information about how the company has handled any past regulatory issues or market disruptions is not available in the source materials. While the regulatory oversight provides a strong foundation for trust, the limited availability of detailed operational and transparency information represents areas where potential clients may want to seek additional clarification directly from the broker.

Assessing the overall user experience with East Asia Futures is significantly hampered by the absence of user feedback and detailed service descriptions in available source materials. User satisfaction levels provide crucial insights into real-world experiences with the broker's services. These levels are not documented in available sources. Interface design and ease of use can significantly impact trading efficiency and user comfort. These aspects are not described in the source materials.

Registration and verification processes are not detailed in available information. This includes the complexity and time requirements for account opening. These processes can significantly impact the initial user experience and set expectations for ongoing service quality. Fund operation experiences are not specified in source materials. These include deposit and withdrawal procedures, processing times, and any associated challenges.

Common user complaints or recurring issues are not documented in available sources. These would provide valuable insights into potential service limitations. User demographic information is not provided. This information could help potential clients assess whether the broker serves clients with similar profiles and needs. Feedback regarding the broker's strengths and weaknesses from actual users is not available in source materials.

Without access to user reviews, satisfaction surveys, or detailed service descriptions, it is not possible to provide a comprehensive assessment of the user experience with East Asia Futures. Potential clients are advised to seek references or testimonials directly from the broker and consider requesting trial access or demonstrations before making commitments.

This east asia futures review reveals a broker with solid regulatory foundations but significant information transparency challenges. East Asia Futures benefits from strong regulatory oversight by the Hong Kong Securities and Futures Commission. It also demonstrates institutional longevity with its 20-year operational history. However, the lack of detailed information about account conditions, trading tools, customer service arrangements, and user experiences creates substantial evaluation challenges for potential clients.

The broker appears most suitable for investors specifically interested in futures trading who prioritize regulatory compliance. These investors must also be willing to conduct extensive due diligence to fill information gaps. The specialized focus on futures trading may appeal to experienced traders seeking dedicated expertise in this market segment. However, the limited transparency regarding service details, costs, and user experiences suggests that potential clients should carefully compare East Asia Futures against competitors with more comprehensive public information before making decisions.

The primary advantages include strong regulatory oversight and specialized futures trading focus. The main disadvantages involve limited information transparency and absence of user feedback in publicly available sources.

FX Broker Capital Trading Markets Review