Is DTC safe?

Pros

Cons

Is DTC Safe or Scam?

Introduction

DTC, a forex broker established in 2018, positions itself as a trading platform primarily catering to traders in the United States. As with any financial service provider, it is crucial for traders to conduct thorough due diligence to assess the legitimacy and reliability of the broker before committing their funds. The forex market is rife with opportunities, but it also harbors risks, particularly from unregulated and potentially fraudulent brokers. This article aims to provide an objective analysis of whether DTC is a safe trading platform or a scam. Our evaluation methodology includes a review of regulatory status, company background, trading conditions, customer experiences, and security measures.

Regulation and Legitimacy

Regulation is a cornerstone of trust in the financial services industry. A broker's regulatory status not only influences its legitimacy but also offers a layer of protection for traders. DTC claims to operate under the regulatory oversight of the Financial Conduct Authority (FCA) in the UK; however, its actual licensing status is questionable. Below is a summary of the core regulatory information available:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 526490 | United Kingdom | Suspicious/Unknown |

The low score of 1.50 out of 10 on WikiFX raises significant concerns about DTC's regulatory compliance. A broker lacking clear regulatory oversight is a red flag, indicating potential risks for investors. The absence of a well-known regulatory framework means that traders may not have access to essential investor protections, such as compensation schemes or formal dispute resolution mechanisms. It is vital to consider the quality of the regulatory body involved, as this can greatly impact the safety of your funds. DTC's claims of regulation must be scrutinized closely, especially given the existence of suspicious clone firms posing as legitimate entities.

Company Background Investigation

DTC's history and ownership structure play a critical role in evaluating its credibility. Founded in 2018, the broker has a relatively short history in the competitive forex market. A deeper investigation reveals limited information about its management team and their professional backgrounds. Transparency is key in the financial sector, and a lack of clear data regarding the company's leadership raises concerns about its accountability and operational integrity.

Furthermore, the absence of a robust corporate governance structure can lead to potential conflicts of interest and mismanagement. This lack of transparency extends to its operational practices, making it difficult for traders to ascertain the broker's reliability. A thorough understanding of a broker's history, including its response to past controversies, is essential for traders looking to protect their investments. Given the limited information available on DTC, traders should exercise caution and consider seeking alternatives with a more established reputation and better transparency.

Trading Conditions Analysis

Understanding the trading conditions offered by DTC is essential for evaluating its overall value proposition. DTC provides a trading platform that utilizes the widely recognized MetaTrader 4 (MT4) software, which is known for its user-friendly interface and extensive features. However, the costs associated with trading on this platform can significantly affect profitability. Below is a comparison of DTC's trading costs against industry averages:

| Cost Type | DTC | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Moderate |

While DTC claims to offer competitive spreads, the absence of a clear commission structure could suggest hidden fees or unfavorable trading conditions. The potential for high overnight interest rates may further deter traders, especially those engaging in longer-term positions. It is crucial for traders to understand the complete fee structure before committing to a broker. The overall trading environment should be transparent and fair, aligning with industry standards to ensure a positive trading experience.

Client Fund Safety

The safety of client funds is paramount when considering a forex broker. DTC's measures for securing client funds should be thoroughly evaluated. A reputable broker typically offers segregated accounts, ensuring that client funds are kept separate from the company's operational funds. This practice protects traders in the event of financial difficulties faced by the broker. Furthermore, mechanisms such as negative balance protection are essential to prevent traders from losing more than their initial investment.

DTC's website lacks comprehensive information regarding its fund security policies, raising concerns about the safety of client deposits. Historical incidents of fund mismanagement or disputes can provide insights into a broker's reliability. As such, potential clients should be wary of any broker that does not clearly outline its security measures. The absence of transparency in this area is a significant indicator that DTC may not be a safe choice for trading.

Customer Experience and Complaints

Analyzing customer feedback is crucial for understanding the overall experience with a broker. DTC has received mixed reviews from users, with common complaints revolving around account management issues and withdrawal difficulties. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

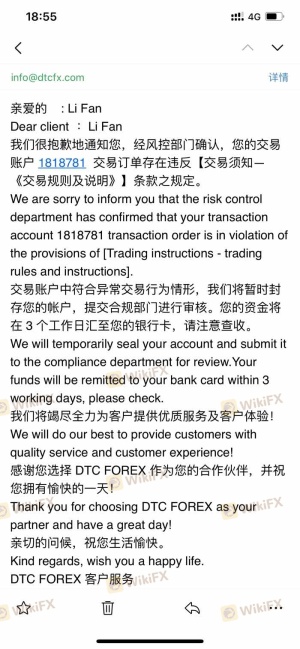

| Account Blocking | High | Poor |

| Withdrawal Delays | High | Poor |

| Lack of Customer Support | Medium | Average |

Several users have reported that their accounts were inexplicably blocked, limiting their ability to withdraw funds. Such practices are often associated with unregulated brokers and indicate a lack of commitment to customer service. The company's slow response to complaints further exacerbates the situation, leading to frustration among clients. Traders should be cautious when considering DTC, as these patterns of complaints suggest that the broker may not prioritize customer satisfaction or trust.

Platform and Execution

The performance and reliability of a trading platform are critical factors for traders. DTC offers the MT4 platform, known for its robust features and customization options. However, the platform's execution quality, including slippage and order rejection rates, must also be considered. Users have reported occasional issues with order execution, which can significantly impact trading outcomes.

It is essential to assess whether there are any signs of platform manipulation, as this can compromise the integrity of trades. A reliable broker should provide a seamless trading experience, ensuring that orders are executed promptly and accurately. Any evidence of platform issues should be taken seriously, as they can indicate deeper operational problems that may affect traders' success.

Risk Assessment

When evaluating the overall risk associated with DTC, several factors must be considered. Below is a risk summary highlighting key areas of concern:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of clear regulation raises concerns. |

| Fund Safety Risk | High | Insufficient information on fund security measures. |

| Customer Service Risk | Medium | Poor response to complaints may lead to unresolved issues. |

Traders should be aware that engaging with a broker like DTC carries inherent risks. To mitigate these risks, it is advisable to only invest amounts that one can afford to lose and to consider diversifying trading activities across more reputable brokers.

Conclusion and Recommendations

In conclusion, the evidence suggests that DTC presents several red flags that warrant caution. The lack of clear regulatory oversight, combined with customer complaints and insufficient transparency regarding fund safety, raises significant concerns about its legitimacy. While DTC may offer some appealing trading conditions, the risks associated with this broker may outweigh the potential benefits.

For traders seeking a safe trading environment, it is advisable to consider alternative brokers with established reputations, robust regulatory frameworks, and positive customer feedback. Brokers such as XYZ and ABC have consistently demonstrated their commitment to client safety and satisfaction. Ultimately, ensuring the safety of your investments should be the top priority when choosing a forex broker.

Is DTC a scam, or is it legit?

The latest exposure and evaluation content of DTC brokers.

DTC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

DTC latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.